A Trump attack on government, flying largely under the radar: Trump wants to help corporations suspected of violating the law

Health inspections of cruise ships, to reduce the spread of infections. A recall of flammable infant sleepwear. An order to clean up contaminated soil or water. This work of the federal government often lets us take for granted the safety of the food we eat, the clothes we put on our kids, and even our collective ability to fight new illnesses like the coronavirus.

We can’t take it for granted anymore. An obscure agency that most Americans have never heard of has issued a request for information that one-sidedly solicits input about how government is a problem, with the transparent goal of creating more roadblocks to government enforcement of environmental, consumer protection, labor, and other regulations. Right-wing groups are already mobilizing a campaign in response, prompting scores of comments expressing fervent yet vague support for the president. Many more comments are surely in the works, by corporations offering more polished and pointed explanations of their need to operate unfettered. The Trump administration has made clear its intent to do their bidding and more, but we don’t have to make it easy. Think tanks, public interest lawyers, community and advocacy organizations, and the general public can and should weigh in, to protect the government’s basic ability to protect our shared well-being.

At the hub of the agencies that report to the president is the Office of Management and Budget (OMB), which sets rules across the federal government for what agencies do and how they behave. In late January, the OMB issued a highly unorthodox request that assumes agencies behave unfairly, and asks how to make agency actions friendlier to alleged lawbreakers. It’s a clear invitation to corporate wrongdoers to provide anecdotes masquerading as evidence. The OMB’s head characterized the request as a means to end “bureaucratic bullying.” They’ve already decreed that agencies must repeal two rules for every new one they issue, no matter the harm to the public; this request is another effort to hamstring the government’s ability to pursue corporate wrongdoing.

The OMB’s request strangely floats importing criminal due process concepts into the civil administrative context. It asks whether there should be an “initial presumption of innocence,” for example, and whether investigated parties should be able “to require an agency to ‘show cause’ to continue an investigation.” But we are talking about corporations under civil investigation based on potential harm to broad swaths of people. If a business is suspected of polluting a playground, do we really want to slow down investigation and enforcement? Most of us would prefer swift government action in such circumstances.Read more

Amid COVID-19 outbreak, the workers who need paid sick days the most have the least

The United States is unprepared for the COVID-19 pandemic given that many workers throughout the economy will have financial difficulty in following the CDC’s recommendations to stay home and seek medical care if they think they’ve become infected. Millions of U.S. workers and their families don’t have access to health insurance, and only 30% of the lowest-paid workers have the ability to earn paid sick days—workers who typically have lots of contact with the public and aren’t able to work from home.

There are deficiencies in paid sick days coverage per sector, particularly among those workers with a lot of public exposure. Figure A displays access to paid sick leave by sector. Information and financial activities have the highest rates of coverage at 95% and 91%, respectively. Education and health services, manufacturing, and professional and business services have lower rates of coverage, but still maintain at least three-quarters of workers with access. Trade, transportation, and utilities comes in at 72%, but there are significant differences within that sector ranging from utilities at 95% down to retail trade at 64% (not shown). Over half of private-sector workers in leisure and hospitality do not have access to paid sick days. Within that sector, 55% of workers in accommodation and food services do not have access to paid sick days (not shown).

Workers face stark differences in access to paid sick days, depending on what sector they work in: Share of private-sector workers with access to paid sick days, by sector, 2019

| Sector | Share of workers who with paid sick leave |

|---|---|

| Information | 95% |

| Financial activities | 91% |

| Education and health services | 84% |

| Manufacturing | 79% |

| Professional and business services | 76% |

| Trade, transportation, and utilities | 72% |

| Other services | 59% |

| Construction | 58% |

| Leisure and hospitality | 48% |

Source: U.S. Bureau of Labor Statistics, National Compensation Survey 2019.

Of the public health concerns in the workforce related to COVID-19, two loom large: those who work with the elderly, because of how dangerous the virus is for that population, and those who work with food, because of the transmission of illness. Research shows that more paid sick days is related to reduced flu rates. There is no reason to believe contagion of COVID-19 will be any different. When over half of workers in food services and related occupations do not have access to paid sick days, the illness may spread more quickly.

What exacerbates the lack of paid sick days among these workers is that their jobs are already not easily transferable to working from home. On average, about 29% of all workers can work from home. And, not surprisingly, workers in sectors where they are more likely to have paid sick days are also more likely to be able to work from home. Over 50% of workers in information, financial activities, and professional and business services can work from home. However, only about 9% of workers in leisure and hospitality are able to work from home.

Many of the 73% of workers with access to paid sick days will not have enough days banked to be able to take off for the course of the illness to take care of themselves or a family member. COVID-19’s incubation period could be as long as 14 days, and little is known about how long it could take to recover once symptoms take hold. Figure B displays the amount of paid sick days workers have access to at different lengths of service. Paid sick days increase by years of service, but even after 20 years, only 25% of private-sector workers are offered at least 10 days of paid sick days a year.

The small sliver of green shows that a very small share (only about 4%) of workers—regardless of their length of service—have access to more than 14 paid sick days. That’s just under three weeks for a five-day-a-week worker, assuming they have that many days at their disposal at the time when illness strikes. The vast majority of workers, over three-quarters of all workers, have nine days or less of paid sick time. This clearly shows that even among workers with access to some amount of paid sick days, the amounts are likely to be insufficient.

Sufficient paid sick days provisions in the case of COVID-19 are scarce: Share of workers with access to paid sick days by number of days and length of service

| Access to more than 14 sick days | Access to 10–14 sick days | Access to 5–9 sick days | Access to less than 5 sick days | |

|---|---|---|---|---|

| After one year of service | 3 % | 18% | 54% | 25% |

| After five years of service | 4 | 19 | 54 | 24 |

| After 10 years of service | 4 | 19 | 54 | 23 |

| After 20 years of service | 4 | 19 | 54 | 23 |

Source: U.S. Bureau of Labor Statistics, National Compensation Survey 2019

Getting serious about the economic response to COVID-19

With the stock market plummeting and hysteria around COVID-19 (commonly known as the coronavirus) escalating, it is time to get serious about the economic policy response. Policymakers and the public will need help in distinguishing between smart responses and those that are just ideological opportunism, such as calls for cuts in taxes and regulations, for example.

Simply put, smart responses must be tailored to the type of recession the outbreak could cause if policymakers don’t act.

The three key elements of a potential COVID-19 recession are:

- If it comes, it will come fast.

- It will hit lower-wage workers first and hardest.

- It will impose even faster and larger costs on state and local governments than recessions normally do.

Each one of these should be targeted directly.

Any economic relief package should come online quickly, it should be even more targeted to help lower-wage workers than usual, and it should rapidly boost state and local government capacity on both the public health and economic fronts. Below I sketch out why these characteristics of the COVID-19 slowdown are likely, and what a tailored response to each would be.

First, if the COVID-19 outbreak slows the economy, it could happen very rapidly. This is quite different, for example, than the onset of the Great Recession. That recession was caused by the bursting of the home price bubble, which essentially began in mid-2006. From that point on the recession was near-inevitable, but it took literally years to gather steam. As the Great Recession loomed, the key characteristics policymakers should have demanded of any proposed stimulus package should have been: effective, large, and sustained. Fiscal policymakers decisively failed on the last point, and dwindling fiscal support hampered recovery for years.

A COVID-19 driven recession would be quite different in that it would hit quickly. The spread of the disease has been quite rapid in each country it has affected. Further, the public health response to maintain “social distancing” to thwart its spread tends to take effect rapidly as well. Even before the reported cases in the U.S. have reached large numbers, the news are full of cascading cancellations of business and entertainment gatherings. We are almost certainly already feeling the economic effects of the COVID-19 slowdown—it just has not appeared in economic statistics yet (since these statistics tend to appear with a small lag).Read more

Even HBO’s John Oliver didn’t provide the full context on ‘Medicare for All’ and jobs

There’s a lot of rhetoric out there right now about how providing “Medicare for All” (M4A) could destroy the economy or lead to ruinous tax increases. But one bright spot was HBO host John Oliver’s monologue on the plan that went viral last month.

Oliver took a characteristically in-depth look at the issues and was largely positive about how M4A could help a “badly broken” health care system given the millions of people who are uninsured and underinsured. Crucially, he noted that we’re going to pay for health care one way or the other, and M4A largely doesn’t add to the costs we pay (indeed, it could well reduce them significantly in the long run), instead it just changes how we pay these costs—substituting taxes for premiums.

Oliver provided a comprehensive accounting of the benefits of the health care proposal, but he also raised some possible pitfalls, including the jobs that could be lost given the elimination of the private health insurance industry. The problem is he quoted a 1.8 million job-loss figure that’s been widely circulated but is widely misleading when presented without context, as I explain in my new analysis of M4A’s impact on the labor market.

What to watch on jobs day: Expected future impact of COVID-19

As COVID-19—commonly known as the coronavirus—continues to spread throughout the world, it is likely to have a direct impact on the United States through the health and well-being of our population. It is also likely to have an impact on economic activity, as workers stop working to care for themselves or their families, and people generally reduce social spending. I’ll be watching this in tomorrow’s job report from the Bureau of Labor Statistics, and keeping an eye on it in the coming months. The first order of business, however, is to make sure that workers can follow the Centers for Disease Control and Prevention (CDC)’s recommendations to stay home and seek medical care—if they are lucky enough to have paid sick days and health insurance. While there are still very few reported cases in the United States, it is expected to spread and the effects may be far-reaching.

In terms of the economy, there has already been an impact on the manufacturing sector as inputs from China are delayed because of temporary factory closures. The Federal Reserve has cut interest rates in expectation of further economic disruptions. Many employers are making contingencies for workers to telecommute rather than risk illness. Unfortunately, this isn’t an option for millions of workers in direct service professions across the economy. Another likely side effect of the pandemic is a pull-back on social consumption. Either because people become sick themselves or are avoiding public spaces, there will likely be a drop in certain types of spending across the economy.Read more

Low-wage workers saw the biggest wage growth in states that increased their minimum wage between 2018 and 2019

Twenty-three states and the District of Columbia raised their minimum wage in 2019 through legislation, referendum, or because the minimum wage was indexed to inflation in those states. Low-wage workers in these states saw much faster wage growth than low-wage workers in states that did not increase their minimum wage between 2018 and 2019, as shown in EPI’s latest State of Working America Wages report. This blog post dives a bit deeper by dispelling some tempting explanations for what might be happening, such as stronger across-the-board wage growth in those states (didn’t happen) or employment losses (not borne out in the data).

Figure A shows in green the states with minimum wage increases that occurred through legislation or referendum in 2019, while states in blue had automatic increases resulting from indexing the minimum wage to inflation. Workers in states that increased their minimum wage between 2018 and 2019 account for about 55% of the U.S. workforce. The nominal minimum wage increases ranged from $0.05 (0.5%) in Alaska to $1.00 (9.1%−10.0%) in California, Massachusetts, and Maine.

The minimum wage increased in 23 states and the District of Columbia in 2019: States with minimum wage increases in 2019, by type of increase

| State | Abbreviation | Category |

|---|---|---|

| Alaska | AK | Indexed |

| Alabama | AL | No change |

| Arkansas | AR | Legislated or ballot measure |

| Arizona | AZ | Legislated or ballot measure |

| California | CA | Legislated or ballot measure |

| Colorado | CO | Legislated or ballot measure |

| Connecticut | CT | Legislated or ballot measure |

| District of Columbia | DC | Legislated or ballot measure |

| Delaware | DE | Legislated or ballot measure |

| Florida | FL | Indexed |

| Georgia | GA | No change |

| Hawaii | HI | No change |

| Iowa | IA | No change |

| Idaho | ID | No change |

| Illinois | IL | No change |

| Indiana | IN | No change |

| Kansas | KS | No change |

| Kentucky | KY | No change |

| Louisiana | LA | No change |

| Massachusetts | MA | Legislated or ballot measure |

| Maryland | MD | Legislated or ballot measure |

| Maine | ME | Legislated or ballot measure |

| Michigan | MI | Legislated or ballot measure |

| Minnesota | MN | Indexed |

| Missouri | MO | Legislated or ballot measure |

| Mississippi | MS | No change |

| Montana | MT | Indexed |

| North Carolina | NC | No change |

| North Dakota | ND | No change |

| Nebraska | NE | No change |

| New Hampshire | NH | No change |

| New Jersey | NJ | Legislated or ballot measure |

| New Mexico | NM | No change |

| Nevada | NV | No change |

| New York | NY | Legislated or ballot measure |

| Ohio | OH | Indexed |

| Oklahoma | OK | No change |

| Oregon | OR | Legislated or ballot measure |

| Pennsylvania | PA | No change |

| Rhode Island | RI | Legislated or ballot measure |

| South Carolina | SC | No change |

| South Dakota | SD | Indexed |

| Tennessee | TN | No change |

| Texas | TX | No change |

| Utah | UT | No change |

| Virginia | VA | No change |

| Vermont | VT | Indexed |

| Washington | WA | Legislated or ballot measure |

| Wisconsin | WI | No change |

| West Virginia | WV | No change |

| Wyoming | WY | No change |

Notes: Minimum wage increases passed through either legislation or ballot measure took effect on January 1, 2019, in Arkansas, Arizona, California, Colorado, Delaware, Maine, Massachusetts, Michigan, Missouri, New York, Rhode Island, and Washington. Alaska, Florida, Minnesota, Montana, New Jersey, Ohio, South Dakota, and Vermont increased their minimum wages in 2019 because of indexing to inflation. New Jersey, Oregon, and Washington, D.C., legislated minimum wage increases that took effect on July 1, 2019. Note that Connecticut legislated a minimum wage increase that took effect on October 1, 2019. This sample considers all changes after January 2018 and before December 2019; therefore, Maryland is included even though the legislated minimum wage increase for Maryland took effect on July 1, 2018. Note that after indexing to inflation on January 1, 2019, New Jersey legislated a minimum wage increase on July 1, 2019; therefore, New Jersey appears twice in these lists.

Source: EPI analysis of state minimum wage laws. See EPI’s minimum wage tracker for the most current state-level minimum wage information.

Figure B compares 10th-percentile wage growth in states with minimum wage increases compared with those without increases. Growth at the 10th percentile in states without minimum wage increases was much slower (0.9%) than in states with any kind of minimum wage increase (4.1%). This result holds true for both men and women. The 10th-percentile men’s wage grew 3.6% in states with minimum wage increases, compared with 0.7% growth in states without any minimum wage increases, while women’s 10th-percentile wages grew 2.8% in states with minimum wage increases and 1.4% in states without.

Wage growth at the bottom was strongest in states with minimum wage increases in 2019: 10th-percentile wage growth, by presence of 2019 state minimum wage increase and by gender, 2018–2019

| States with minimum wage increases | States without minimum wage increases | |

|---|---|---|

| Overall | 4.1% | 0.9% |

| Men | 3.6% | 0.7% |

| Women | 2.8% | 1.4% |

Notes: Minimum wage increases passed through either legislation or ballot measure took effect on January 1, 2019, in Arkansas, Arizona, California, Colorado, Delaware, Maine, Massachusetts, Michigan, Missouri, New York, Rhode Island, and Washington. Alaska, Florida, Minnesota, Montana, New Jersey, Ohio, South Dakota, and Vermont increased their minimum wages in 2019 because of indexing to inflation. New Jersey, Oregon, and Washington, D.C., legislated minimum wage increases that took effect on July 1, 2019. Note that Connecticut legislated a minimum wage increase that took effect on October 1, 2019. This sample considers all changes after January 2018 and before December 2019; therefore, Maryland is included even though the legislated minimum wage increase for Maryland took effect on July 1, 2018. Note that after indexing to inflation on January 1, 2019, New Jersey legislated a minimum wage increase on July 1, 2019; therefore, New Jersey appears twice in these lists.

Sources: Author’s analysis of EPI Current Population Survey Extracts, Version 1.0 (2020), https://microdata.epi.org, and EPI analysis of state minimum wage laws. See EPI’s minimum wage tracker for the most current state-level minimum wage information.

Economic policy and COVID-19—Mitigate harm and plan for the future: A list of considerations for policymakers

The direct cost that COVID-19 inflicts on human health is obviously its most important effect on society. But this direct cost can be worsened by flawed economic and policy structures. And the indirect damage the disease causes through economic ripple effects could be large, so policymakers should do everything they can to minimize them.

Past decisions that have weakened our economic policy infrastructure will hamper our response to COVID-19; this is already baked into the cake. But there are some short-run ameliorative actions we can take that might help, and there are long-run policy changes that will aid our response to future epidemics.

In technical economic terms, COVID-19 combines potential supply shocks with sector-specific demand shocks. Basically, supply shocks hamper our ability to produce goods and services, and demand shocks are sharp cutbacks in spending from households, businesses, or governments. Below I provide a list for policymakers of what could/should be considered to deal with some of these.

The supply shocks come from disrupted global value chains, as, for example, Chinese production of inputs used by U.S. manufacturing and construction firms are not delivered on time because Chinese factories have temporarily closed. In countries where schools are shut down for long periods of time, a shock to labor supply can occur as working parents have to stay home to care for kids.

The potential sector-specific demand shock is to businesses where consumption is largely social—done with other people around. Think bars, restaurants, grocery stores, and malls. As people avoid social contact to minimize disease transmission, this leads to less activity in these sectors.

These effects mean it will be hard indeed for policymakers to spare the economy any pain from this.

There’s very little that can be done about the supply-side shocks—particularly in the short run. Demand-side shocks are generally easier to address with policy (in theory—policymakers still often fumble the ball in this regard), but the specific nature of the demand shocks associated with COVID-19 make them slightly harder to address. Simply giving households more money won’t boost consumption much in the sectors likely to be affected—the pullback in consumption is not driven by income constraints, but due to concerns over catching the illness.

EPI President Thea Lee testifies before the House Committee on Ways and Means on U.S.–China Trade and Competition (Video)

On February 26, EPI President Thea Lee testified before the House Committee on Ways and Means on the impact of the imbalanced U.S.–China economic relationship on U.S. jobs, wages, businesses, and long-term growth.

In her testimony, Lee discussed the history of U.S. trade policy toward China, problems with Trump’s “phase one” deal with China, and fundamental flaws in the U.S.–China economic relationship. According to new EPI research, the growing U.S.–China trade deficit was responsible for the loss of 3.7 million U.S. jobs between 2001 and 2018. These job losses are spread across all 50 states and the District of Columbia—and every congressional district in America.

Watch her testimony:

Lack of paid sick days and large numbers of uninsured increase risks of spreading the coronavirus

COVID-19—commonly known as the coronavirus—is now a potential threat for the United States and we all “need to be preparing for significant disruption of our lives,” warned the Centers for Disease Control and Prevention (CDC) this week.

Unfortunately, preparing for the “significant disruption” will be economically unimaginable for one group of Americans—the millions of people in the United States who do not have access to paid sick days or have health insurance with a regular health care provider.

The CDC released very clear instructions to help prevent the spread of respiratory diseases, including staying home when you are sick. Not everyone has that option.

Overall, just under three-quarters (73%) of private-sector workers in the United States have the ability to earn paid sick time at work. And, as shown in Figure A, below, access to paid sick days is vastly unequal. The highest-wage workers are more than three times as likely to have access to paid sick leave as the lowest-paid workers. Whereas 93% of the highest-wage workers had access to paid sick days, only 30% of the lowest-paid workers are able to earn sick days. In this way, access to paid sick days increases with wages among workers, disproportionately denying workers at the bottom this important security. And low-wage workers are more likely to be found in occupations where they have contact with the public—think early care and education workers, home health aides, restaurant workers, and food processors. When workers or their family members are sick, they shouldn’t have to decide between staying home from work to care for themselves or their dependents and paying rent or putting food on the table. But that is the situation our policymakers have put workers in.

Black-white wage gaps are worse today than in 2000

This week, my colleagues hosted a discussion on the policies that the 2020 presidential candidates should focus on in order to help black workers in the economy. One of the challenges that the presidential candidates should discuss is how to reduce the black–white wage gap—which has stubbornly persisted over the last four decades. Black-white wage gaps are large and have gotten worse in the last 20 years.

The latest findings on wage growth as documented in EPI’s State of Working America Wages 2019 report indicate wages in general are slowly improving with the growing economy, but wage inequality has grown and wage gaps have persisted, and in some cases, worsened. In this post, I will highlight the worsening black-white wage gap and look at it from multiple dimensions. Since 2000, by any way it’s measured, the wage gap between black and white workers has grown significantly.

The figure below compares wages for black and white workers over the last 19 years, highlighting the gaps in wages in 2000, the last time the economy was closest to full employment, 2007, the last business cycle peak before the Great Recession, and 2019, the latest data available. Against these benchmarks, I illustrated the growth in the average gap, the gap for low-, middle-, and high-wage workers, the gap for workers with a high school diploma, a college degree, and an advanced degree, and a regression-adjusted wage gap (controlling for age, gender, education, and region).

Black–white wage gaps widen across multiple measures: Black–white wages gaps at different points in the wage distribution, by education, and regression-based, 2000, 2007, and 2019

| 2000 | 2007 | 2019 | |

|---|---|---|---|

| Average | 21.8% | 23.5% | 26.5% |

| 10th percentile | 6.2% | 8.7% | 9.0% |

| Median | 20.8% | 22.3% | 24.4% |

| 95th percentile | 28.0% | 28.3% | 34.7% |

| High school | 15.3% | 17.4% | 18.3% |

| College | 17.2% | 19.2% | 22.5% |

| Advanced degree | 12.5% | 16.7% | 17.6% |

| Regression-based | 10.2% | 12.2% | 14.9% |

Notes: Sample based on all workers ages 16 and older. The xth-percentile wage is the wage at which x% of wage earners earn less and (100-x)% earn more. Educational attainment is based on mutually exclusive categories: e.g., high school is high school only, etc. Similar results are found for those with less than high school or some college. The regression-adjusted black–white wage gap controls for education, age, gender, and region.

Source: Author’s analysis of EPI Current Population Survey Extracts, Version 1.0 (2020), https://microdata.epi.org.

The black–white wage gap is smallest at the bottom of the wage distribution, where the minimum wage serves as a wage floor. The largest black–white wage gap as well as the one with the most growth since the Great Recession, is found at the top of the wage distribution, explained in part by the pulling away of top earners generally as well as continued occupational segregation, the disproportionate likelihood for white workers to occupy positions in the highest-wage professions.

It’s clear from the figure that education is not a panacea for closing these wage gaps. Again, this should not be shocking, as increased equality of educational access—as laudable a goal as it is—has been shown to have only small effects on class-based wage inequality, and racial wealth gaps have been almost entirely unmoved by a narrowing of the black–white college attainment gap, as demonstrated by William Darity Jr. and others.

Black workers can’t simply educate their way out of the gap. Across various levels of education, a significant black–white wage gap remains. Even black workers with an advanced degree experience a significant wage gap compared with their white counterparts. And after controlling for age, gender, education, and region, black workers are paid 14.9% less than white workers.

While the wage gaps differ depending on measure, what is obvious from the trends displayed is that the gaps widened in the full business cycle 2000–2007 and continued to grow in the Great Recession and its aftermath. Even though the black unemployment rate has fallen precipitously over the last several years, wage growth has remained particularly weak for black workers.

As always, it’s important to remember the historical and social contexts for differences in black and white labor market experiences and labor market outcomes (see Razza). Workers’ ability to claim higher wages rests on a host of social, political, and institutional factors outside of their control. The systematic social deprivation and economic disadvantage is maintained and reinforced by those with economic and political power. Furthermore, occupational segregation plays a significant role in these gaps, for both black men and black women. And, black women, in particularly, can face larger wages gaps with white men than the sum of their parts, meaning the black women face a double wage penalty for their race and gender. The trends in black–white wage gaps found here are supported by other important research that shows that black-white wage gaps expanded with rising inequality from 1979 to 2015.

Given a long history of excluding black Americans from social and political institutions that boost wage growth, the stubbornness of racial wage gaps is less surprising. However, the fact that they are getting worse is troubling. The good news is that policy can make a difference.

We see in the figure that the minimum wage keeps the lowest-wage black workers from even lower wages. In states that increased in the minimum wage between 2018 and 2019, low-wage workers saw stronger wage growth than in states that had no increase in their minimum wage in that period. Raising the federal minimum wage would disproportionately benefit black workers because they are overrepresented among low-wage workers and are less likely to live in states or localities that have passed a minimum wage that is higher than the current federal minimum.

Aside from strengthening and enforcing labor standards such as the minimum wage, making it easier for workers to form unions can narrow the black–white wage gap. Black workers are more likely to be in a union than white and get a bigger wage boost to being in a union than white. Therefore, unions can help shrink the black–white wage gap. Related, research has shown that the decline of unionization led to an expansion of the black–white wage gap.

Using all fiscal and monetary policy levers to achieve and maintain high-pressure labor markets can improve relative labor market outcomes for black workers, including participation in the labor force and work hours as well as wage growth. The U.S. certainly saw this stronger across the board growth in the tight labor market of the late 1990s.

In 2019, black wages exceeded their 2000 and 2007 levels across the wage distribution for the first time in this recovery. I’m hopeful that as the economy continues to move toward genuine full employment, black workers will see their wages rise. But it will take more than a couple of years of a full-employment economy to close racial wage gaps and compensate for years of lower wages, lower incomes, and lower wealth.

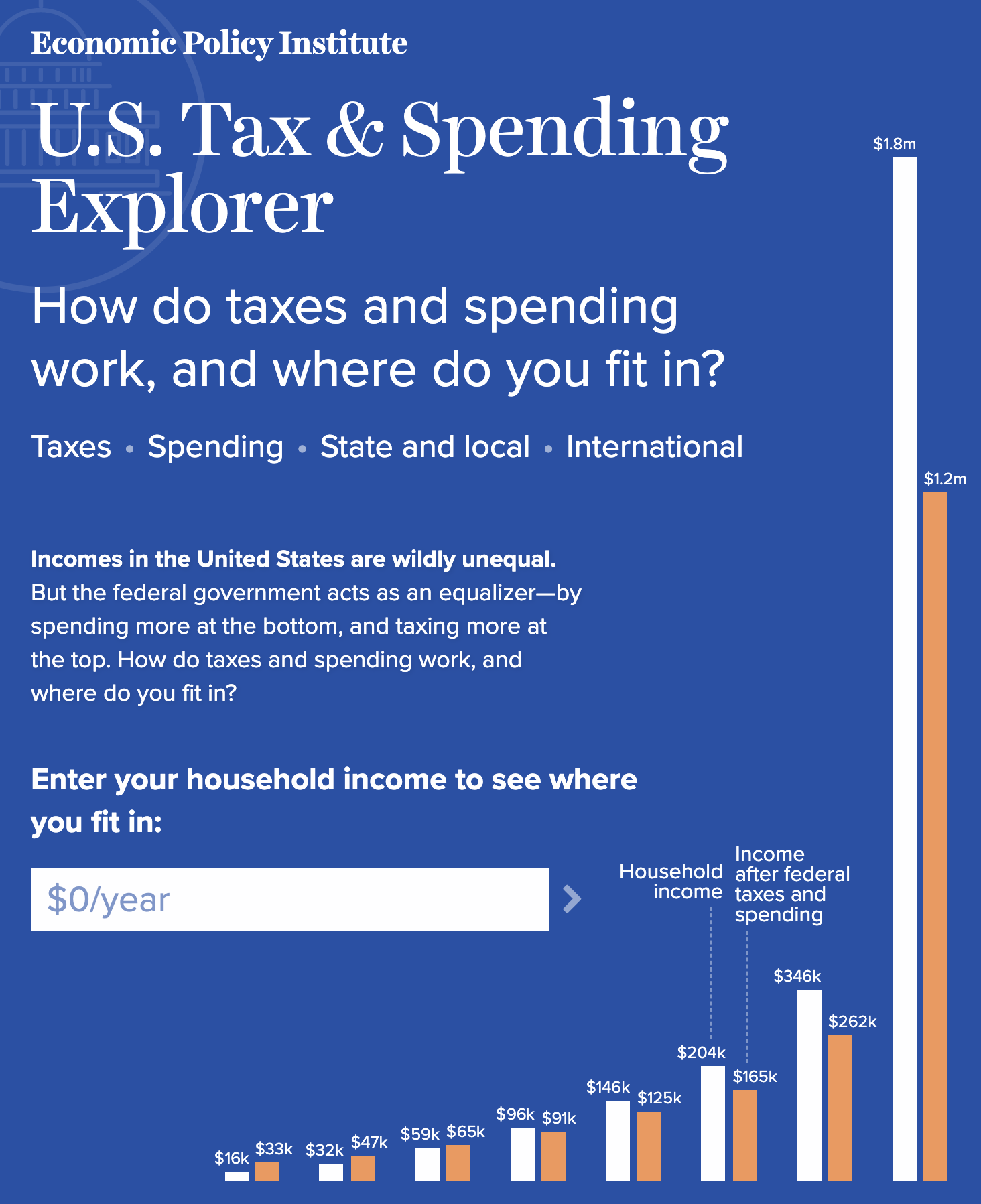

The U.S. federal tax and spending system is the biggest tool to combat inequality, but it could do much more

Last week, we launched the U.S. Tax & Spending Explorer on the EPI website. It’s an interactive web feature designed to shed light on how the government (mostly the federal government) raises and spends money and how changes in taxes and spending over time either increase or decrease income inequality.

There’s enough granular detail in the feature that everybody might have different takeaways from visiting it. But here’s what strikes me looking at this data:

- Together, taxes and spending significantly reduce inequality at any given point in time relative to a world with a much smaller federal footprint. That’s the good news. The bad news is that since 1979 the inequality-reducing effect of taxes and spending hasn’t grown that much—but inequality has grown, a lot. We should use the proven inequality-fighting lever of a larger tax and spending system to combat the inequality that has risen so fast in recent decades.

Medicare4All C-Span discussion sheds light on its impact

Economic Policy Institute’s Director of Research Josh Bivens and American Enterprise Institute’s Jospeh Antos addressed the issue of Medicare for All, and the larger role health care policy is playing in Campaign 2020 on C-Span’s Washington Journal Saturday.

The United States needs movement forward on healthcare that makes it accessible and affordable, said Bivens during the discussion.

“I think there’s a real hunger out there for something for health reform,” he explained. “Health care is something that Americans worry about the most, not just their health but would means for financial security and that worry is well-placed. We have a uniquely dysfunctional health care system.

“We spend on a per capita basis about $10,000 per person, we have some great health systems in the world, number one in terms of health outcomes as France and the Netherlands who spend literally half of what we spend. One of the reasons why a single-payer plan would be expensive is because we still have 27 million uninsured people and 60 million underinsured people. So, yeah, it would be more expensive to give health care to people who need it, but that’s the virtue of a fundamental reform. Keeping costs down by keeping people excluded, seems to me as not the way to go.”

Bivens is the author of a soon-to-be released paper on the impact of fundamental health care reform, including Medicare for All, on wages and job quality.

Sign up here for EPI’s newsletter so you don’t miss the report’s release, or any other essential labor research, analysis and trends from EPI’s research team.

The Trump budget doesn’t spare seniors

President Trump’s proposed 2021 budget claims to help the “most vulnerable populations,” including seniors. But vulnerable older Americans are among those who would be most hurt if this draconian budget were ever enacted.

The budget would slash Medicaid and non-defense discretionary spending, eliminating or drastically shrinking programs targeted at low-income people, including programs benefiting seniors, such as the Low Income Home Energy Assistance Program. At first glance, the administration appears to spare middle-class seniors, a group with high voter turnout that tends to support the president and his party. Despite the president’s hints that Social Security and Medicare will be on the chopping block after the election, the budget would spare retirement benefits (except those for federal employees) and claims to achieve Medicare savings only by eliminating “excessive spending and distortionary payment incentives” while “preserv[ing] benefits and access to care.”

Some Medicare provisions in the president’s budget, such as site-neutral payments across different types of facilities, address genuine problems in how Medicare is administered. But the nearly half trillion in proposed savings from Medicare over 10 years includes provisions that would indirectly affect Medicare beneficiaries’ access to care, such as reducing payments to partially cover unpaid medical bills for Medicare beneficiaries. Since unlimited out-of-pocket expenses are a major cause of bankruptcy for older Americans in poor health, reducing these reimbursements would cause some providers to avoid treating Medicare patients who have expensive conditions and limited resources—and would surely lead to hospital and clinic closures in underserved areas. Middle-class seniors and providers who treat them wouldn’t be spared, since lower-middle-class seniors ineligible for Medicaid are those most likely to spend a high share of their income on health care. The problem of uncompensated care would be compounded by the administration’s attempts to roll back Medicaid expansion under the Affordable Care Act (ACA), which has helped hospitals treating low-income and uninsured patients in expansion states.

Top five Valentine’s Day gifts ideas for U.S. workers: Nothing spells ‘romance’ like a fair wage and quality jobs

That’s why we decided to sum up what we think are the top five Valentine’s Day gifts ideas for working people across the country.

Power through collective action!

Our economy is out of balance. Corporations and CEOs hold too much power and wealth, and working people know it. Workers are mobilizing, organizing, protesting, and striking at a level not seen in decades, and they are winning pay raises and other real change by using their collective voices.

But, the fact is, it is still too difficult for working people to form a union at their workplace when they want to. The law gives employers too much power and puts too many roadblocks in the way of workers trying to organize a union. The Protecting the Right to Organize (PRO) Act will go a long way toward restoring workers’ right to join together to bargain for better wages and working conditions by streamlining the process when workers form a union, ensuring that they are successful in negotiating a first agreement, and holding employers accountable when they violate labor law. The U.S. Senate should join the House of Representatives and pass the PRO Act in order to restore power to working people.

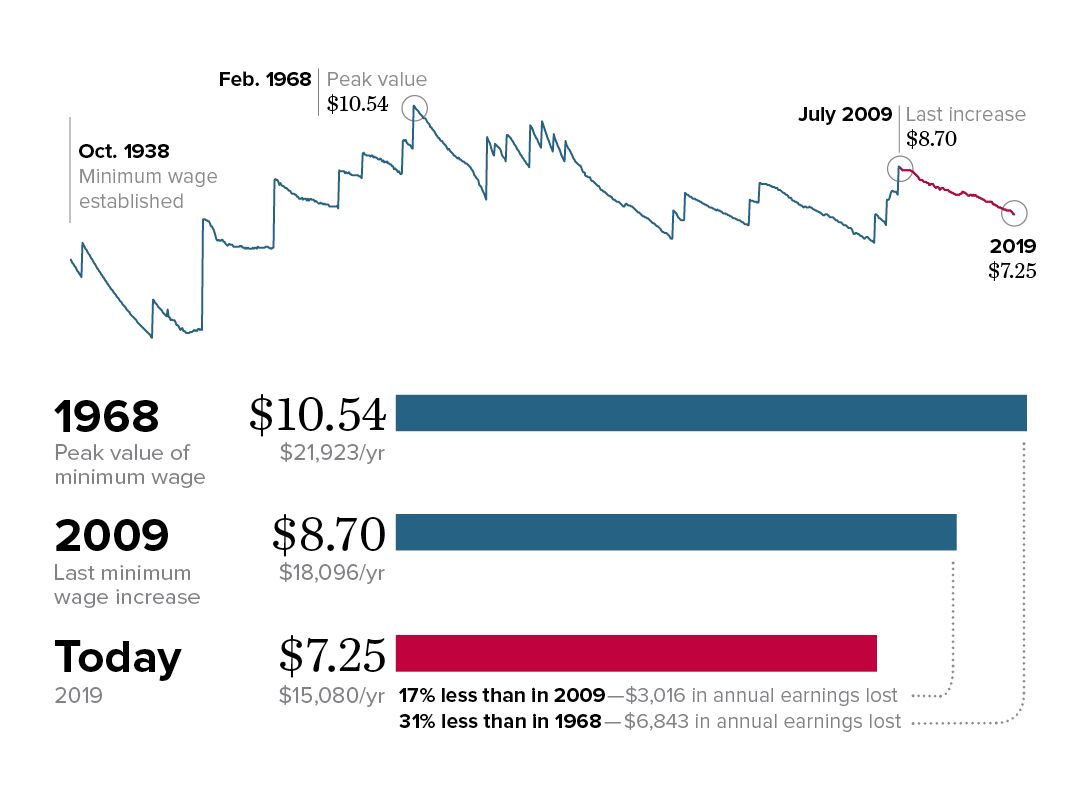

Affording bread…and roses

The real (inflation-adjusted) minimum wage is now roughly 30 percent lower than it was in 1968, and it has been more than 10 years since congress raised the minimum wage—the longest stretch in history. To end this shameful streak, it is incumbent upon the Senate to take up and pass the Raise the Wage Act immediately. Raising the federal minimum wage to $15 by 2025 would lift wages for 33.5 million workers across the country—more than one-fifth of the wage-earning workforce. The increase would boost total annual wages for these low-wage workers by $92.5 billion, lifting annual earnings for the average affected year-round worker by $2,800. Recent survey data have shown that 74% of U.S. workers live paycheck to paycheck. Policymakers should give working people the ability to make ends meet—but also the ability to treat themselves occasionally.

Failure to raise the federal minimum wage has taken thousands of dollars out of the pockets of minimum wage workers: The real value of the minimum wage (adjusted for inflation) is 17% less than 10 years ago and 31% less than in 1968

Note: All values are in June 2019 dollars, adjusted using the CPI-U-RS.

Source: Adapted from Figure C in David Cooper, Elise Gould, and Ben Zipperer, Low-Wage Workers Are Suffering from a Decline in the Real Value of the Federal Minimum Wage, Economic Policy Institute, August 2019).

Source: Adapted from Figure C in David Cooper, Elise Gould, and Ben Zipperer, Low-Wage Workers Are Suffering from a Decline in the Real Value of the Federal Minimum Wage, Economic Policy Institute, August 2019). The figure reflects EPI analysis of historical minimum wage data in the Fair Labor Standards Act and amendments.

Pay workers for their hours worked, or give them their time back

The U.S. Department of Labor announced in September its final overtime rule, which will set the salary threshold under which salaried workers are automatically entitled to overtime pay to $35,568 a year. The rule leaves behind millions of workers who would have received overtime protections under the much stronger rule, published in 2016, that Trump administration chose to abandon. A stronger overtime protection would pay more workers for working more than 40 hours a week, or allow them extra time with their families.

Seven states have already taken steps to raise the overtime threshold, but without further action, it’s estimated that 8.2 million workers who would have benefited from the 2016 rule will be left behind by the Trump administration’s rule, including 3.2 million workers who would have gotten new overtime protections under the 2016 rule and 5.0 million who would have gotten strengthened overtime protections under the 2016 rule. States should follow suit and extend the overtime protections so workers don’t continue to lose out on their hard-earned wages.

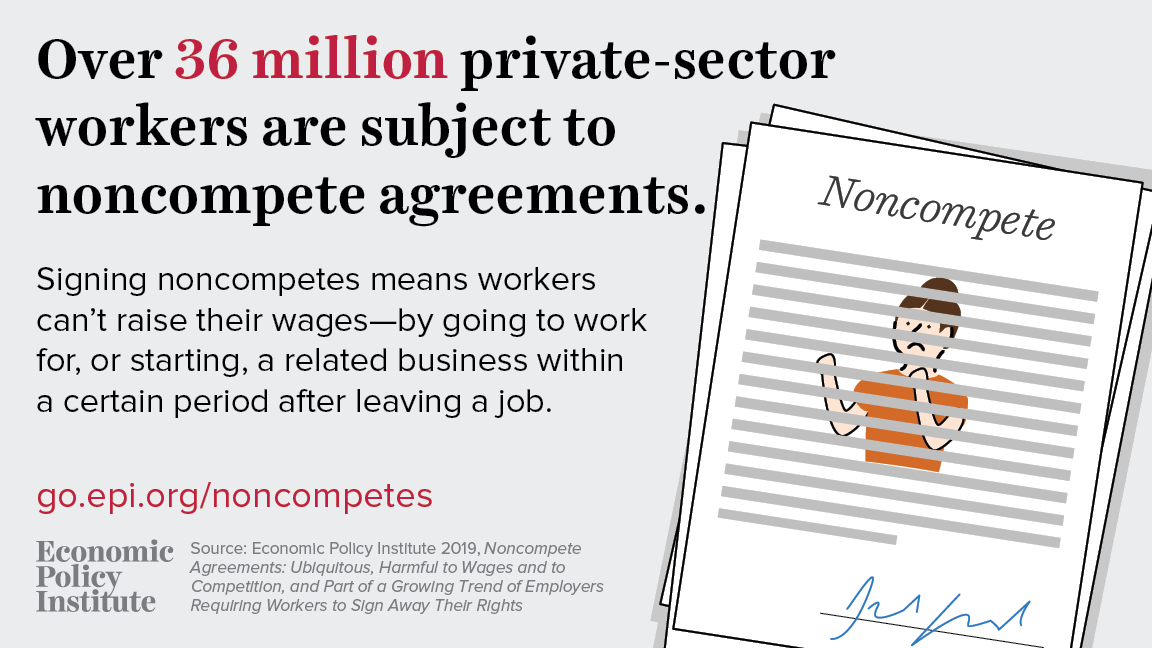

Let your workers move on

At least 36 million workers—27.8% of the private-sector workforce—are required to enter noncompete agreements. Noncompete agreements are employment provisions that ban workers at one company from going to work for, or starting, a competing business within a certain period of time after leaving a job. Establishments with high pay or high levels of education among workers are more likely to use noncompetes, but noncompetes agreements are also common in workplaces with low pay and low levels of education. More than a quarter (29.0%) of private-sector workers with an average hourly wage below $13.00 require noncompetes for all their workers. Noncompetes are part of a disturbing trend of employers requiring workers to sign away their rights. Noncompetes may be contributing to weak wage growth, given that changing jobs is how workers often get a raise. And given that noncompetes limit the ability of individuals to start businesses or take other jobs, it also is not difficult to see that noncompetes may be contributing to the declines in dynamism in the U.S. labor market. Congress should pass the bipartisan legislation, the Workforce Mobility Act of 2019, to prohibit noncompete agreements.

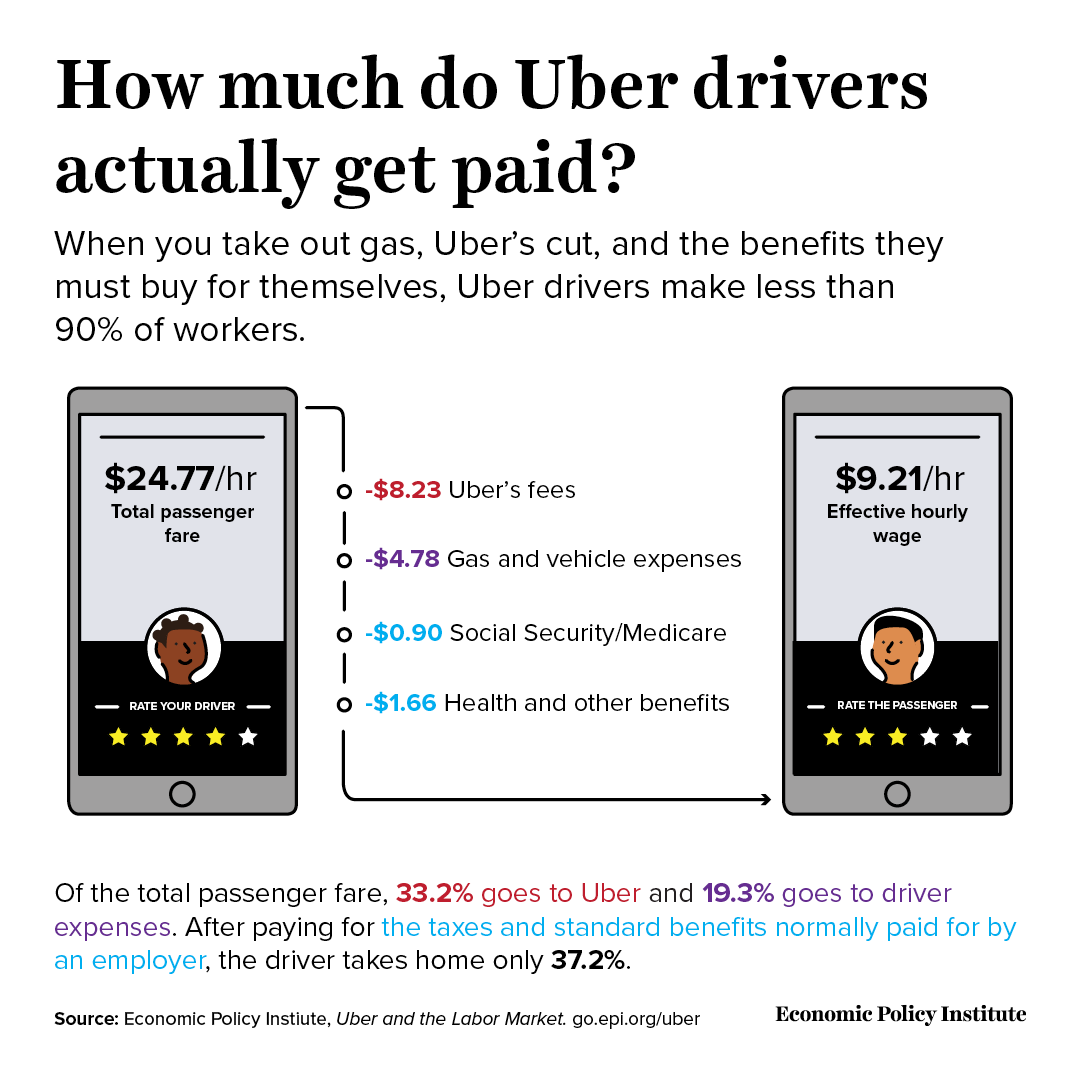

Labor protections for Uber drivers shuttling around Valentine’s couples

The General Counsel of the National Labor Relations Board recently released a memo claiming that Uber drivers are independent contractors, not employees of Uber. The reality is that these drivers have very little entrepreneurial freedom: Drivers can’t raise revenues because they can’t control prices or expand their customer base through marketing. Unlike a typical enterprise, Uber drivers do not build earnings as they get more experience. Uber drivers are not able to choose their customers—drivers are penalized for rejecting or not accepting trips. And after accounting for Uber’s commissions and fees and vehicle expenses, and taking into account the cost of a modest package of health insurance and other benefits equivalent to those earned by W-2 workers, Uber drivers earn the equivalent of $9.21 in hourly wages—less than what is earned by 90% of all other wage and salary earners, and below the minimum wage in 13 of the 20 major urban markets where Uber operates.

Recently, AB5 went into effect in California, a set of protections aimed at combatting the misclassification of workers as independent contractors, helping ensure that California’s employees have access to basic labor and employment protections denied to independent contractors including: minimum wage and overtime protections, paid sick days and family leave, workers’ compensation benefits, and unemployment insurance benefits. Policymakers across the country should take notice and provide similar protections to workers in their states.

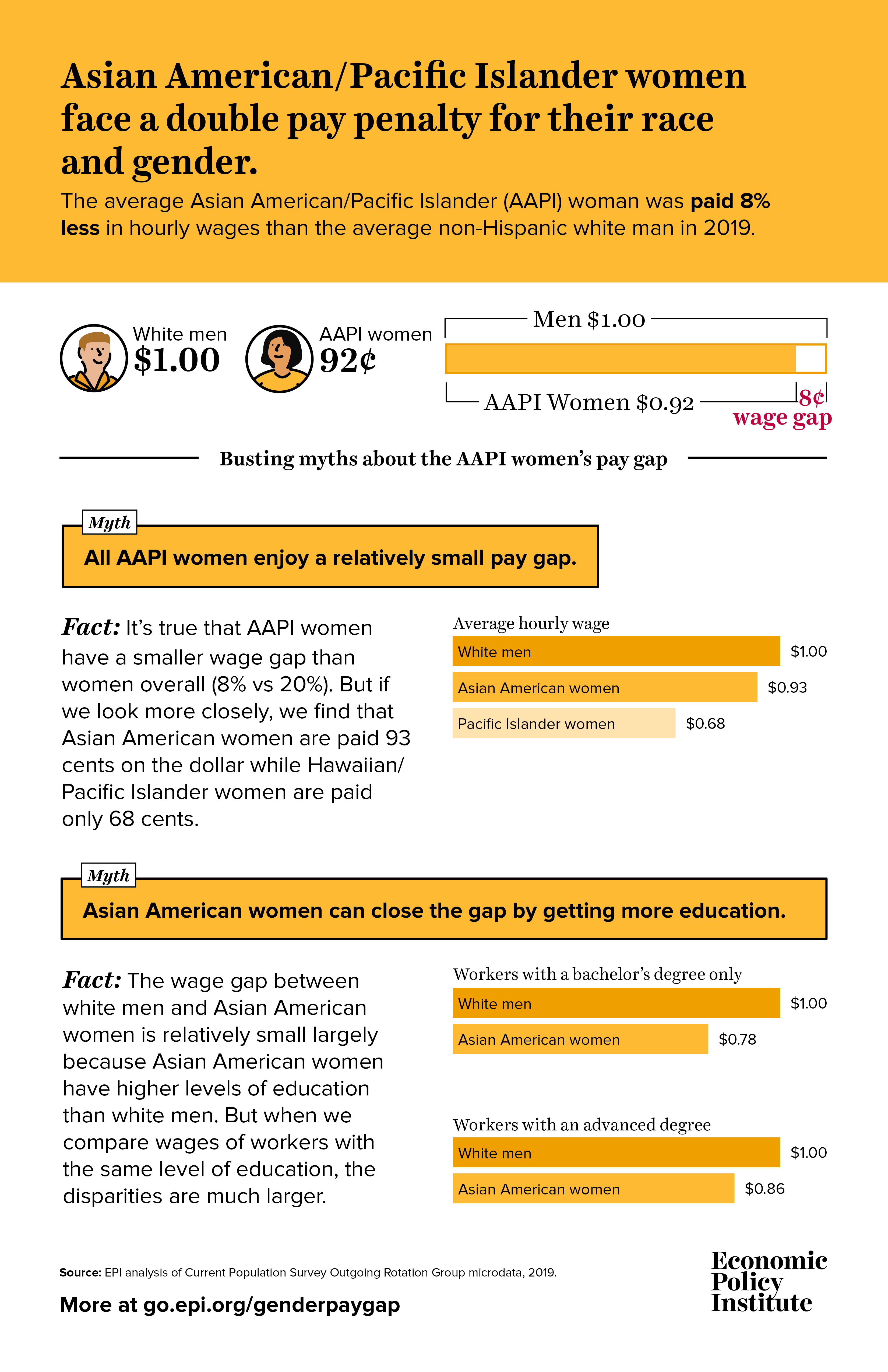

AAPI women face a double pay penalty for race and gender

Asian American/Pacific Islander (AAPI) Equal Pay Day is February 11. It marks the number of days into 2020 that AAPI women have to work to make the same amount as their white male counterparts were paid in 2019. Put another way, the average AAPI woman needs to work almost an extra month and a half to make up for the shortfall in annual earnings relative to the average non-Hispanic white man.

The infographic below takes a closer look at the data to debunk commonly held myths about the AAPI women’s pay gap. Specifically, all AAPI women do not face a relatively small pay gap—Asian American women are paid 93 cents on the dollar, while Hawaiian/Pacific Islander women are paid only 68 cents.

Further, Asian American women can’t just educate their way out of the pay gap. Asian American women have higher levels of education than white men, and when comparing wages of workers with the same level of education, the disparities are much larger. Asian American women with a bachelor’s degree only are paid 22% less than their white male counterparts and those with an advanced degree are paid 14% less.

Declining trade balances disguise continued growth in the non-oil trade deficit

The overall goods and services trade deficit declined 1.7% ($10.9 billion) in 2019, while the total deficit in goods trade fell 2.4% ($21.4 billion). However, the U.S. trade deficit in non-oil goods, which is dominated by trade in manufactured products, increased 1.8% in 2019. Aside from petroleum, trade was a net drag on the economy in 2019 and on manufacturing, in particular.

The small decline in overall U.S. trade deficits follows an 18.3% increase in the goods trade deficit in the first two years of the Trump administration. Taken altogether, the U.S. goods trade deficit increased $116.2 billion (15.5%) in the first three years of the Trump Administration. It has proven neither quick nor easy to reduce the growing U.S. goods trade deficit.

The petroleum products deficit decreased 72.6% in 2019, masking the 1.8% increase in the non-oil goods trade deficit within the overall 2.4% decline in the U.S. goods trade balance. The fracking revolution has resulted in a significant reduction in oil imports (13.9%) and a small increase in petroleum exports (2.8%).

Recent changes in petroleum trade yield this shocking factoid: The United States became a net exporter of petroleum products for the last four months of 2019. This reflects a key element of Trump’s trade “strategy” to export liquefied natural gas (LNG) to the rest of the world, which comes at a steep cost. This will drive up U.S. prices for natural gas and oil, despite the fact that low energy prices were a key element of the mini-recovery in US manufacturing exports. Increased LNG exports will hurt U.S. consumers by increasing fuel costs, heightening risks of transport and catastrophic port explosions, and exacerbating global warming and air pollution levels in the country as a whole.

What to watch on jobs day: Large downward revisions in employment expected

On Friday, the Bureau of Labor Statistics (BLS) will revise nonfarm payroll employment, hours, and earnings data to reflect the annual benchmark process in the establishment survey. Each year, the BLS benchmarks total nonfarm payroll employment to state unemployment insurance tax records. In August 2019, BLS released preliminary benchmark revisions to payroll employment for April 2018 through March 2019, but revisions don’t get officially incorporated into the historical numbers until the final revisions are released. While revisions in most years tend to be relatively small, this year’s preliminary revisions came in much higher. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2019 total nonfarm employment of -501,000. This means that between April 2018 and March of 2019, there were a half million fewer jobs created than initially reported. Over the last ten years, preliminary revisions averaged about -92,000, so -501,000 is very large in comparison. And, usually the difference between the preliminary revisions and the final revisions is plus or minus 40,000. Therefore, it’s likely tomorrow’s final revisions will also be around 500,000 fewer jobs in that period.

The revisions will also provide details on changes in the initial payroll employment estimates by sector. For instance, in the preliminary release, the revisions were located primarily in “leisure and hospitality”, “professional and business services”, and “retail trade” with downward revisions of -175,000, -163,000, and -146,400, respectively. On Friday, the historical data will reflect the final benchmarks overall and by sector.

Tracking trends in nominal wage growth

Turning to nominal wage growth, the most important economic indicator to watch in 2020, last month there was a large drop for production/nonsupervisory workers. The figure below charts year-over-year changes in private-sector nominal average hourly earnings for “all nonfarm employees” as well as “production/nonsupervisory workers.” After remaining consistently higher than “all nonfarm” for nearly a year and at or above 3.4% for much of that time, it fell to 3.0% in December, its lowest point since September 2018. This begs the question of whether this is simply a blip and production/nonsupervisory workers will continue to pull away or if the separation in growth rates between the two over the last year was mostly statistical noise.

At this point in the recovery—with unemployment at or below 4.0% for 22 months—wage growth remains lower than expected. As employment growth consistently remains higher than working-age population growth, more and more workers are pulled into the labor force and finding jobs. As this slack gets absorbed, workers should be getting scarcer and scarcer. Therefore, employers would typically have to pay more to attract and retain the workers they want. After increasing in 2018, wage growth for all nonfarm employees has slowed for much of 2019 and remains below target levels.

Nominal wage growth has been far below target in the recovery: Year-over-year change in private-sector nominal average hourly earnings, 2007–2019

| Date | All nonfarm employees | Production/nonsupervisory workers |

|---|---|---|

| Mar-2007 | 3.44% | 4.11% |

| Apr-2007 | 3.08% | 3.79% |

| May-2007 | 3.48% | 4.14% |

| Jun-2007 | 3.56% | 4.19% |

| Jul-2007 | 3.25% | 4.05% |

| Aug-2007 | 3.35% | 3.98% |

| Sep-2007 | 3.14% | 4.09% |

| Oct-2007 | 3.08% | 3.78% |

| Nov-2007 | 3.07% | 3.83% |

| Dec-2007 | 2.97% | 3.81% |

| Jan-2008 | 2.91% | 3.80% |

| Feb-2008 | 2.80% | 3.79% |

| Mar-2008 | 3.04% | 3.83% |

| Apr-2008 | 2.84% | 3.76% |

| May-2008 | 3.07% | 3.69% |

| Jun-2008 | 2.77% | 3.56% |

| Jul-2008 | 3.05% | 3.67% |

| Aug-2008 | 3.33% | 3.89% |

| Sep-2008 | 3.23% | 3.64% |

| Oct-2008 | 3.27% | 3.81% |

| Nov-2008 | 3.60% | 3.91% |

| Dec-2008 | 3.59% | 3.90% |

| Jan-2009 | 3.63% | 3.72% |

| Feb-2009 | 3.43% | 3.65% |

| Mar-2009 | 3.28% | 3.47% |

| Apr-2009 | 3.42% | 3.35% |

| May-2009 | 2.93% | 3.06% |

| Jun-2009 | 2.83% | 2.88% |

| Jul-2009 | 2.69% | 2.71% |

| Aug-2009 | 2.44% | 2.70% |

| Sep-2009 | 2.44% | 2.75% |

| Oct-2009 | 2.53% | 2.68% |

| Nov-2009 | 2.19% | 2.67% |

| Dec-2009 | 1.91% | 2.50% |

| Jan-2010 | 2.05% | 2.66% |

| Feb-2010 | 2.09% | 2.55% |

| Mar-2010 | 1.81% | 2.27% |

| Apr-2010 | 1.76% | 2.38% |

| May-2010 | 1.90% | 2.59% |

| Jun-2010 | 1.76% | 2.53% |

| Jul-2010 | 1.85% | 2.42% |

| Aug-2010 | 1.75% | 2.36% |

| Sep-2010 | 1.84% | 2.19% |

| Oct-2010 | 1.93% | 2.45% |

| Nov-2010 | 1.65% | 2.13% |

| Dec-2010 | 1.79% | 2.02% |

| Jan-2011 | 1.92% | 2.28% |

| Feb-2011 | 1.87% | 2.06% |

| Mar-2011 | 1.87% | 2.06% |

| Apr-2011 | 1.91% | 2.16% |

| May-2011 | 2.04% | 2.10% |

| Jun-2011 | 2.13% | 2.05% |

| Jul-2011 | 2.30% | 2.26% |

| Aug-2011 | 1.99% | 1.94% |

| Sep-2011 | 1.94% | 1.99% |

| Oct-2011 | 2.07% | 1.88% |

| Nov-2011 | 2.02% | 1.82% |

| Dec-2011 | 1.98% | 1.77% |

| Jan-2012 | 1.71% | 1.35% |

| Feb-2012 | 1.79% | 1.45% |

| Mar-2012 | 2.10% | 1.76% |

| Apr-2012 | 2.09% | 1.65% |

| May-2012 | 1.78% | 1.39% |

| Jun-2012 | 2.00% | 1.54% |

| Jul-2012 | 1.77% | 1.44% |

| Aug-2012 | 1.86% | 1.33% |

| Sep-2012 | 2.03% | 1.54% |

| Oct-2012 | 1.51% | 1.18% |

| Nov-2012 | 1.90% | 1.43% |

| Dec-2012 | 2.24% | 1.69% |

| Jan-2013 | 2.24% | 1.84% |

| Feb-2013 | 2.15% | 2.04% |

| Mar-2013 | 1.93% | 1.88% |

| Apr-2013 | 2.05% | 1.83% |

| May-2013 | 2.14% | 1.93% |

| Jun-2013 | 2.13% | 2.03% |

| Jul-2013 | 2.00% | 1.97% |

| Aug-2013 | 2.26% | 2.23% |

| Sep-2013 | 2.04% | 2.22% |

| Oct-2013 | 2.25% | 2.32% |

| Nov-2013 | 2.24% | 2.37% |

| Dec-2013 | 1.85% | 2.21% |

| Jan-2014 | 1.89% | 2.31% |

| Feb-2014 | 2.27% | 2.55% |

| Mar-2014 | 2.10% | 2.30% |

| Apr-2014 | 1.93% | 2.29% |

| May-2014 | 2.09% | 2.44% |

| Jun-2014 | 1.96% | 2.24% |

| Jul-2014 | 2.04% | 2.33% |

| Aug-2014 | 2.16% | 2.43% |

| Sep-2014 | 2.08% | 2.22% |

| Oct-2014 | 2.03% | 2.27% |

| Nov-2014 | 2.03% | 2.22% |

| Dec-2014 | 1.99% | 1.92% |

| Jan-2015 | 2.19% | 2.01% |

| Feb-2015 | 1.93% | 1.66% |

| Mar-2015 | 2.22% | 1.95% |

| Apr-2015 | 2.26% | 2.00% |

| May-2015 | 2.34% | 2.14% |

| Jun-2015 | 2.25% | 2.14% |

| Jul-2015 | 2.17% | 2.04% |

| Aug-2015 | 2.20% | 1.98% |

| Sep-2015 | 2.28% | 2.08% |

| Oct-2015 | 2.52% | 2.37% |

| Nov-2015 | 2.43% | 2.12% |

| Dec-2015 | 2.47% | 2.51% |

| Jan-2016 | 2.55% | 2.40% |

| Feb-2016 | 2.42% | 2.50% |

| Mar-2016 | 2.45% | 2.49% |

| Apr-2016 | 2.61% | 2.58% |

| May-2016 | 2.40% | 2.33% |

| Jun-2016 | 2.60% | 2.48% |

| Jul-2016 | 2.76% | 2.62% |

| Aug-2016 | 2.55% | 2.51% |

| Sep-2016 | 2.63% | 2.46% |

| Oct-2016 | 2.66% | 2.41% |

| Nov-2016 | 2.61% | 2.50% |

| Dec-2016 | 2.65% | 2.50% |

| Jan-2017 | 2.40% | 2.39% |

| Feb-2017 | 2.72% | 2.34% |

| Mar-2017 | 2.55% | 2.29% |

| Apr-2017 | 2.47% | 2.24% |

| May-2017 | 2.54% | 2.33% |

| Jun-2017 | 2.50% | 2.32% |

| Jul-2017 | 2.57% | 2.32% |

| Aug-2017 | 2.57% | 2.31% |

| Sep-2017 | 2.83% | 2.59% |

| Oct-2017 | 2.32% | 2.16% |

| Nov-2017 | 2.47% | 2.35% |

| Dec-2017 | 2.74% | 2.48% |

| Jan-2018 | 2.81% | 2.47% |

| Feb-2018 | 2.57% | 2.47% |

| Mar-2018 | 2.80% | 2.74% |

| Apr-2018 | 2.79% | 2.78% |

| May-2018 | 2.94% | 2.91% |

| Jun-2018 | 2.93% | 2.91% |

| Jul-2018 | 2.85% | 2.85% |

| Aug-2018 | 3.18% | 3.12% |

| Sep-2018 | 2.98% | 3.02% |

| Oct-2018 | 3.32% | 3.25% |

| Nov-2018 | 3.31% | 3.37% |

| Dec-2018 | 3.34% | 3.50% |

| Jan-2019 | 3.18% | 3.35% |

| Feb-2019 | 3.40% | 3.44% |

| Mar-2019 | 3.24% | 3.38% |

| Apr-2019 | 3.16% | 3.33% |

| May-2019 | 3.08% | 3.36% |

| Jun-2019 | 3.18% | 3.35% |

| Jul-2019 | 3.25% | 3.52% |

| Aug-2019 | 3.23% | 3.51% |

| Sep-2019 | 3.00% | 3.54% |

| Oct-2019 | 3.11% | 3.62% |

| Nov-2019 | 3.14% | 3.39% |

| Dec-2019 | 2.87% | 3.03% |

* Nominal wage growth consistent with the Federal Reserve Board’s 2 percent inflation target, 1.5 percent productivity growth, and a stable labor share of income

Source: EPI analysis of Bureau of Labor Statistics Current Employment Statistics public data series

On Friday, the BLS will also be employing new population controls in the Current Population Survey (CPS) starting in January 2020. Unlike the establishment survey, these changes to the CPS are not updated historically so caution should be exercised when making comparisons with data for December 2019 or earlier periods. The BLS is also making some changes to their methodology in terms of providing new seasonally adjusted series for measures of labor market underutilization as well as beginning to include both those in opposite-sex and same-sex marriages in estimates of married persons.

The new benchmarks to the establishment survey as well as revisions to the household survey will provide much fodder for thought on Friday morning. And, wage growth continues to be the most important indicator to watch as it lags behind overall improvements in the labor market.

Trump’s ‘blue-collar boom’ is likely a dud

In his State of the Union address tonight, President Trump plans to extol the “blue-collar boom” in the economy along with his purported “great American comeback.” He’ll claim this based on two recent signature trade deals—the United States-Mexico-Canada Agreement (USMCA) and a “phase one” deal with China. Unfortunately, both agreements will likely to lead to more outsourcing and job loss for U.S. workers, and the facts just don’t support Trump’s claims about the broader economy.

Trump comes from a world that has ardently championed globalization, like many of his predecessors. However, that approach has decimated U.S. manufacturing over the past 20 years, eliminating nearly 5 million good factory jobs as shown in Figure A, below. Nearly 90,000 U.S. factories have been lost as well.

U.S. manufacturing employment, January 1970–December 2019 (millions of jobs)

| Date | Manufacturing employment (millions of jobs) |

|---|---|

| 1970-01-01 | 18.424 |

| 1970-02-01 | 18.361 |

| 1970-03-01 | 18.36 |

| 1970-04-01 | 18.207 |

| 1970-05-01 | 18.029 |

| 1970-06-01 | 17.93 |

| 1970-07-01 | 17.877 |

| 1970-08-01 | 17.779 |

| 1970-09-01 | 17.692 |

| 1970-10-01 | 17.173 |

| 1970-11-01 | 17.024 |

| 1970-12-01 | 17.309 |

| 1971-01-01 | 17.28 |

| 1971-02-01 | 17.216 |

| 1971-03-01 | 17.154 |

| 1971-04-01 | 17.149 |

| 1971-05-01 | 17.225 |

| 1971-06-01 | 17.139 |

| 1971-07-01 | 17.126 |

| 1971-08-01 | 17.115 |

| 1971-09-01 | 17.154 |

| 1971-10-01 | 17.126 |

| 1971-11-01 | 17.166 |

| 1971-12-01 | 17.202 |

| 1972-01-01 | 17.283 |

| 1972-02-01 | 17.361 |

| 1972-03-01 | 17.447 |

| 1972-04-01 | 17.508 |

| 1972-05-01 | 17.602 |

| 1972-06-01 | 17.641 |

| 1972-07-01 | 17.556 |

| 1972-08-01 | 17.741 |

| 1972-09-01 | 17.774 |

| 1972-10-01 | 17.893 |

| 1972-11-01 | 18.005 |

| 1972-12-01 | 18.158 |

| 1973-01-01 | 18.276 |

| 1973-02-01 | 18.41 |

| 1973-03-01 | 18.493 |

| 1973-04-01 | 18.53 |

| 1973-05-01 | 18.564 |

| 1973-06-01 | 18.606 |

| 1973-07-01 | 18.598 |

| 1973-08-01 | 18.629 |

| 1973-09-01 | 18.609 |

| 1973-10-01 | 18.702 |

| 1973-11-01 | 18.773 |

| 1973-12-01 | 18.82 |

| 1974-01-01 | 18.788 |

| 1974-02-01 | 18.727 |

| 1974-03-01 | 18.7 |

| 1974-04-01 | 18.702 |

| 1974-05-01 | 18.688 |

| 1974-06-01 | 18.69 |

| 1974-07-01 | 18.656 |

| 1974-08-01 | 18.57 |

| 1974-09-01 | 18.492 |

| 1974-10-01 | 18.364 |

| 1974-11-01 | 18.077 |

| 1974-12-01 | 17.693 |

| 1975-01-01 | 17.344 |

| 1975-02-01 | 17.004 |

| 1975-03-01 | 16.853 |

| 1975-04-01 | 16.759 |

| 1975-05-01 | 16.746 |

| 1975-06-01 | 16.69 |

| 1975-07-01 | 16.678 |

| 1975-08-01 | 16.824 |

| 1975-09-01 | 16.904 |

| 1975-10-01 | 16.984 |

| 1975-11-01 | 17.025 |

| 1975-12-01 | 17.14 |

| 1976-01-01 | 17.287 |

| 1976-02-01 | 17.384 |

| 1976-03-01 | 17.47 |

| 1976-04-01 | 17.541 |

| 1976-05-01 | 17.513 |

| 1976-06-01 | 17.521 |

| 1976-07-01 | 17.524 |

| 1976-08-01 | 17.596 |

| 1976-09-01 | 17.665 |

| 1976-10-01 | 17.548 |

| 1976-11-01 | 17.682 |

| 1976-12-01 | 17.719 |

| 1977-01-01 | 17.803 |

| 1977-02-01 | 17.843 |

| 1977-03-01 | 17.941 |

| 1977-04-01 | 18.024 |

| 1977-05-01 | 18.107 |

| 1977-06-01 | 18.192 |

| 1977-07-01 | 18.259 |

| 1977-08-01 | 18.276 |

| 1977-09-01 | 18.334 |

| 1977-10-01 | 18.356 |

| 1977-11-01 | 18.419 |

| 1977-12-01 | 18.531 |

| 1978-01-01 | 18.593 |

| 1978-02-01 | 18.639 |

| 1978-03-01 | 18.699 |

| 1978-04-01 | 18.772 |

| 1978-05-01 | 18.848 |

| 1978-06-01 | 18.919 |

| 1978-07-01 | 18.951 |

| 1978-08-01 | 19.006 |

| 1978-09-01 | 19.068 |

| 1978-10-01 | 19.142 |

| 1978-11-01 | 19.257 |

| 1978-12-01 | 19.334 |

| 1979-01-01 | 19.388 |

| 1979-02-01 | 19.409 |

| 1979-03-01 | 19.453 |

| 1979-04-01 | 19.45 |

| 1979-05-01 | 19.509 |

| 1979-06-01 | 19.553 |

| 1979-07-01 | 19.531 |

| 1979-08-01 | 19.406 |

| 1979-09-01 | 19.442 |

| 1979-10-01 | 19.39 |

| 1979-11-01 | 19.299 |

| 1979-12-01 | 19.301 |

| 1980-01-01 | 19.282 |

| 1980-02-01 | 19.219 |

| 1980-03-01 | 19.217 |

| 1980-04-01 | 18.973 |

| 1980-05-01 | 18.726 |

| 1980-06-01 | 18.49 |

| 1980-07-01 | 18.276 |

| 1980-08-01 | 18.414 |

| 1980-09-01 | 18.445 |

| 1980-10-01 | 18.506 |

| 1980-11-01 | 18.601 |

| 1980-12-01 | 18.64 |

| 1981-01-01 | 18.639 |

| 1981-02-01 | 18.613 |

| 1981-03-01 | 18.647 |

| 1981-04-01 | 18.711 |

| 1981-05-01 | 18.766 |

| 1981-06-01 | 18.789 |

| 1981-07-01 | 18.785 |

| 1981-08-01 | 18.748 |

| 1981-09-01 | 18.712 |

| 1981-10-01 | 18.566 |

| 1981-11-01 | 18.409 |

| 1981-12-01 | 18.223 |

| 1982-01-01 | 18.047 |

| 1982-02-01 | 17.981 |

| 1982-03-01 | 17.857 |

| 1982-04-01 | 17.683 |

| 1982-05-01 | 17.588 |

| 1982-06-01 | 17.43 |

| 1982-07-01 | 17.278 |

| 1982-08-01 | 17.16 |

| 1982-09-01 | 17.074 |

| 1982-10-01 | 16.853 |

| 1982-11-01 | 16.722 |

| 1982-12-01 | 16.69 |

| 1983-01-01 | 16.705 |

| 1983-02-01 | 16.706 |

| 1983-03-01 | 16.711 |

| 1983-04-01 | 16.794 |

| 1983-05-01 | 16.885 |

| 1983-06-01 | 16.96 |

| 1983-07-01 | 17.059 |

| 1983-08-01 | 17.118 |

| 1983-09-01 | 17.255 |

| 1983-10-01 | 17.367 |

| 1983-11-01 | 17.479 |

| 1983-12-01 | 17.551 |

| 1984-01-01 | 17.63 |

| 1984-02-01 | 17.728 |

| 1984-03-01 | 17.806 |

| 1984-04-01 | 17.872 |

| 1984-05-01 | 17.916 |

| 1984-06-01 | 17.967 |

| 1984-07-01 | 18.013 |

| 1984-08-01 | 18.034 |

| 1984-09-01 | 18.019 |

| 1984-10-01 | 18.024 |

| 1984-11-01 | 18.016 |

| 1984-12-01 | 18.023 |

| 1985-01-01 | 18.009 |

| 1985-02-01 | 17.966 |

| 1985-03-01 | 17.939 |

| 1985-04-01 | 17.886 |

| 1985-05-01 | 17.855 |

| 1985-06-01 | 17.819 |

| 1985-07-01 | 17.776 |

| 1985-08-01 | 17.756 |

| 1985-09-01 | 17.718 |

| 1985-10-01 | 17.708 |

| 1985-11-01 | 17.697 |

| 1985-12-01 | 17.693 |

| 1986-01-01 | 17.686 |

| 1986-02-01 | 17.663 |

| 1986-03-01 | 17.624 |

| 1986-04-01 | 17.616 |

| 1986-05-01 | 17.593 |

| 1986-06-01 | 17.53 |

| 1986-07-01 | 17.497 |

| 1986-08-01 | 17.489 |

| 1986-09-01 | 17.498 |

| 1986-10-01 | 17.477 |

| 1986-11-01 | 17.472 |

| 1986-12-01 | 17.478 |

| 1987-01-01 | 17.465 |

| 1987-02-01 | 17.499 |

| 1987-03-01 | 17.507 |

| 1987-04-01 | 17.525 |

| 1987-05-01 | 17.542 |

| 1987-06-01 | 17.537 |

| 1987-07-01 | 17.593 |

| 1987-08-01 | 17.63 |

| 1987-09-01 | 17.691 |

| 1987-10-01 | 17.729 |

| 1987-11-01 | 17.775 |

| 1987-12-01 | 17.809 |

| 1988-01-01 | 17.79 |

| 1988-02-01 | 17.823 |

| 1988-03-01 | 17.844 |

| 1988-04-01 | 17.874 |

| 1988-05-01 | 17.892 |

| 1988-06-01 | 17.916 |

| 1988-07-01 | 17.926 |

| 1988-08-01 | 17.891 |

| 1988-09-01 | 17.914 |

| 1988-10-01 | 17.966 |

| 1988-11-01 | 18.003 |

| 1988-12-01 | 18.025 |

| 1989-01-01 | 18.057 |

| 1989-02-01 | 18.055 |

| 1989-03-01 | 18.06 |

| 1989-04-01 | 18.055 |

| 1989-05-01 | 18.04 |

| 1989-06-01 | 18.013 |

| 1989-07-01 | 17.98 |

| 1989-08-01 | 17.964 |

| 1989-09-01 | 17.922 |

| 1989-10-01 | 17.895 |

| 1989-11-01 | 17.886 |

| 1989-12-01 | 17.881 |

| 1990-01-01 | 17.797 |

| 1990-02-01 | 17.893 |

| 1990-03-01 | 17.868 |

| 1990-04-01 | 17.845 |

| 1990-05-01 | 17.797 |

| 1990-06-01 | 17.776 |

| 1990-07-01 | 17.704 |

| 1990-08-01 | 17.649 |

| 1990-09-01 | 17.609 |

| 1990-10-01 | 17.577 |

| 1990-11-01 | 17.428 |

| 1990-12-01 | 17.395 |

| 1991-01-01 | 17.33 |

| 1991-02-01 | 17.211 |

| 1991-03-01 | 17.14 |

| 1991-04-01 | 17.093 |

| 1991-05-01 | 17.07 |

| 1991-06-01 | 17.044 |

| 1991-07-01 | 17.015 |

| 1991-08-01 | 17.025 |

| 1991-09-01 | 17.01 |

| 1991-10-01 | 16.999 |

| 1991-11-01 | 16.961 |

| 1991-12-01 | 16.916 |

| 1992-01-01 | 16.839 |

| 1992-02-01 | 16.829 |

| 1992-03-01 | 16.805 |

| 1992-04-01 | 16.831 |

| 1992-05-01 | 16.835 |

| 1992-06-01 | 16.826 |

| 1992-07-01 | 16.819 |

| 1992-08-01 | 16.783 |

| 1992-09-01 | 16.761 |

| 1992-10-01 | 16.751 |

| 1992-11-01 | 16.758 |

| 1992-12-01 | 16.769 |

| 1993-01-01 | 16.791 |

| 1993-02-01 | 16.805 |

| 1993-03-01 | 16.795 |

| 1993-04-01 | 16.772 |

| 1993-05-01 | 16.766 |

| 1993-06-01 | 16.742 |

| 1993-07-01 | 16.739 |

| 1993-08-01 | 16.741 |

| 1993-09-01 | 16.769 |

| 1993-10-01 | 16.778 |

| 1993-11-01 | 16.8 |

| 1993-12-01 | 16.815 |

| 1994-01-01 | 16.855 |

| 1994-02-01 | 16.862 |

| 1994-03-01 | 16.897 |

| 1994-04-01 | 16.933 |

| 1994-05-01 | 16.962 |

| 1994-06-01 | 17.01 |

| 1994-07-01 | 17.026 |

| 1994-08-01 | 17.081 |

| 1994-09-01 | 17.115 |

| 1994-10-01 | 17.144 |

| 1994-11-01 | 17.186 |

| 1994-12-01 | 17.217 |

| 1995-01-01 | 17.262 |

| 1995-02-01 | 17.265 |

| 1995-03-01 | 17.263 |

| 1995-04-01 | 17.278 |

| 1995-05-01 | 17.259 |

| 1995-06-01 | 17.247 |

| 1995-07-01 | 17.218 |

| 1995-08-01 | 17.24 |

| 1995-09-01 | 17.247 |

| 1995-10-01 | 17.216 |

| 1995-11-01 | 17.209 |

| 1995-12-01 | 17.231 |

| 1996-01-01 | 17.208 |

| 1996-02-01 | 17.229 |

| 1996-03-01 | 17.193 |

| 1996-04-01 | 17.204 |

| 1996-05-01 | 17.222 |

| 1996-06-01 | 17.226 |

| 1996-07-01 | 17.223 |

| 1996-08-01 | 17.255 |

| 1996-09-01 | 17.252 |

| 1996-10-01 | 17.268 |

| 1996-11-01 | 17.277 |

| 1996-12-01 | 17.284 |

| 1997-01-01 | 17.297 |

| 1997-02-01 | 17.316 |

| 1997-03-01 | 17.34 |

| 1997-04-01 | 17.349 |

| 1997-05-01 | 17.362 |

| 1997-06-01 | 17.387 |

| 1997-07-01 | 17.389 |

| 1997-08-01 | 17.452 |

| 1997-09-01 | 17.465 |

| 1997-10-01 | 17.513 |

| 1997-11-01 | 17.556 |

| 1997-12-01 | 17.588 |

| 1998-01-01 | 17.619 |

| 1998-02-01 | 17.627 |

| 1998-03-01 | 17.637 |

| 1998-04-01 | 17.637 |

| 1998-05-01 | 17.624 |

| 1998-06-01 | 17.608 |

| 1998-07-01 | 17.422 |

| 1998-08-01 | 17.563 |

| 1998-09-01 | 17.557 |

| 1998-10-01 | 17.512 |

| 1998-11-01 | 17.465 |

| 1998-12-01 | 17.449 |

| 1999-01-01 | 17.427 |

| 1999-02-01 | 17.395 |

| 1999-03-01 | 17.368 |

| 1999-04-01 | 17.344 |

| 1999-05-01 | 17.333 |

| 1999-06-01 | 17.295 |

| 1999-07-01 | 17.308 |

| 1999-08-01 | 17.287 |

| 1999-09-01 | 17.281 |

| 1999-10-01 | 17.272 |

| 1999-11-01 | 17.282 |

| 1999-12-01 | 17.28 |

| 2000-01-01 | 17.284 |

| 2000-02-01 | 17.285 |

| 2000-03-01 | 17.302 |

| 2000-04-01 | 17.298 |

| 2000-05-01 | 17.279 |

| 2000-06-01 | 17.296 |

| 2000-07-01 | 17.322 |

| 2000-08-01 | 17.287 |

| 2000-09-01 | 17.23 |

| 2000-10-01 | 17.217 |

| 2000-11-01 | 17.202 |

| 2000-12-01 | 17.181 |

| 2001-01-01 | 17.104 |

| 2001-02-01 | 17.028 |

| 2001-03-01 | 16.938 |

| 2001-04-01 | 16.802 |

| 2001-05-01 | 16.661 |

| 2001-06-01 | 16.515 |

| 2001-07-01 | 16.382 |

| 2001-08-01 | 16.232 |

| 2001-09-01 | 16.117 |

| 2001-10-01 | 15.972 |

| 2001-11-01 | 15.825 |

| 2001-12-01 | 15.711 |

| 2002-01-01 | 15.587 |

| 2002-02-01 | 15.515 |

| 2002-03-01 | 15.443 |

| 2002-04-01 | 15.392 |

| 2002-05-01 | 15.337 |

| 2002-06-01 | 15.298 |

| 2002-07-01 | 15.256 |

| 2002-08-01 | 15.171 |

| 2002-09-01 | 15.119 |

| 2002-10-01 | 15.06 |

| 2002-11-01 | 14.992 |

| 2002-12-01 | 14.912 |

| 2003-01-01 | 14.866 |

| 2003-02-01 | 14.781 |

| 2003-03-01 | 14.721 |

| 2003-04-01 | 14.609 |

| 2003-05-01 | 14.557 |

| 2003-06-01 | 14.493 |

| 2003-07-01 | 14.402 |

| 2003-08-01 | 14.376 |

| 2003-09-01 | 14.347 |

| 2003-10-01 | 14.334 |

| 2003-11-01 | 14.316 |

| 2003-12-01 | 14.3 |

| 2004-01-01 | 14.29 |

| 2004-02-01 | 14.279 |

| 2004-03-01 | 14.287 |

| 2004-04-01 | 14.315 |

| 2004-05-01 | 14.342 |

| 2004-06-01 | 14.332 |

| 2004-07-01 | 14.33 |

| 2004-08-01 | 14.345 |

| 2004-09-01 | 14.331 |

| 2004-10-01 | 14.332 |

| 2004-11-01 | 14.307 |

| 2004-12-01 | 14.287 |

| 2005-01-01 | 14.257 |

| 2005-02-01 | 14.273 |

| 2005-03-01 | 14.269 |

| 2005-04-01 | 14.25 |

| 2005-05-01 | 14.256 |

| 2005-06-01 | 14.227 |

| 2005-07-01 | 14.226 |

| 2005-08-01 | 14.203 |

| 2005-09-01 | 14.175 |

| 2005-10-01 | 14.192 |

| 2005-11-01 | 14.187 |

| 2005-12-01 | 14.193 |

| 2006-01-01 | 14.21 |

| 2006-02-01 | 14.209 |

| 2006-03-01 | 14.214 |

| 2006-04-01 | 14.226 |

| 2006-05-01 | 14.203 |

| 2006-06-01 | 14.213 |

| 2006-07-01 | 14.188 |

| 2006-08-01 | 14.159 |

| 2006-09-01 | 14.125 |

| 2006-10-01 | 14.075 |

| 2006-11-01 | 14.041 |

| 2006-12-01 | 14.015 |

| 2007-01-01 | 14.008 |

| 2007-02-01 | 13.997 |

| 2007-03-01 | 13.97 |

| 2007-04-01 | 13.945 |

| 2007-05-01 | 13.929 |

| 2007-06-01 | 13.911 |

| 2007-07-01 | 13.889 |

| 2007-08-01 | 13.828 |

| 2007-09-01 | 13.79 |

| 2007-10-01 | 13.764 |

| 2007-11-01 | 13.757 |

| 2007-12-01 | 13.746 |

| 2008-01-01 | 13.725 |

| 2008-02-01 | 13.696 |

| 2008-03-01 | 13.659 |

| 2008-04-01 | 13.599 |

| 2008-05-01 | 13.564 |

| 2008-06-01 | 13.504 |

| 2008-07-01 | 13.43 |

| 2008-08-01 | 13.358 |

| 2008-09-01 | 13.275 |

| 2008-10-01 | 13.147 |

| 2008-11-01 | 13.034 |

| 2008-12-01 | 12.85 |

| 2009-01-01 | 12.561 |

| 2009-02-01 | 12.38 |

| 2009-03-01 | 12.208 |

| 2009-04-01 | 12.03 |

| 2009-05-01 | 11.862 |

| 2009-06-01 | 11.726 |

| 2009-07-01 | 11.668 |

| 2009-08-01 | 11.626 |

| 2009-09-01 | 11.591 |

| 2009-10-01 | 11.538 |

| 2009-11-01 | 11.509 |

| 2009-12-01 | 11.475 |

| 2010-01-01 | 11.46 |

| 2010-02-01 | 11.453 |

| 2010-03-01 | 11.453 |

| 2010-04-01 | 11.489 |

| 2010-05-01 | 11.525 |

| 2010-06-01 | 11.545 |

| 2010-07-01 | 11.561 |

| 2010-08-01 | 11.553 |

| 2010-09-01 | 11.563 |

| 2010-10-01 | 11.562 |

| 2010-11-01 | 11.585 |

| 2010-12-01 | 11.595 |

| 2011-01-01 | 11.618 |

| 2011-02-01 | 11.653 |

| 2011-03-01 | 11.67 |

| 2011-04-01 | 11.7 |

| 2011-05-01 | 11.712 |

| 2011-06-01 | 11.724 |

| 2011-07-01 | 11.742 |

| 2011-08-01 | 11.766 |

| 2011-09-01 | 11.771 |

| 2011-10-01 | 11.776 |

| 2011-11-01 | 11.774 |

| 2011-12-01 | 11.799 |

| 2012-01-01 | 11.834 |

| 2012-02-01 | 11.857 |

| 2012-03-01 | 11.899 |

| 2012-04-01 | 11.916 |

| 2012-05-01 | 11.93 |

| 2012-06-01 | 11.941 |

| 2012-07-01 | 11.965 |

| 2012-08-01 | 11.961 |

| 2012-09-01 | 11.948 |

| 2012-10-01 | 11.951 |

| 2012-11-01 | 11.947 |

| 2012-12-01 | 11.961 |

| 2013-01-01 | 11.98 |

| 2013-02-01 | 12.002 |

| 2013-03-01 | 12.006 |

| 2013-04-01 | 12.006 |

| 2013-05-01 | 12.007 |

| 2013-06-01 | 12.005 |

| 2013-07-01 | 11.983 |

| 2013-08-01 | 12.011 |

| 2013-09-01 | 12.022 |

| 2013-10-01 | 12.04 |

| 2013-11-01 | 12.072 |

| 2013-12-01 | 12.086 |

| 2014-01-01 | 12.102 |

| 2014-02-01 | 12.122 |

| 2014-03-01 | 12.131 |

| 2014-04-01 | 12.142 |

| 2014-05-01 | 12.154 |

| 2014-06-01 | 12.177 |

| 2014-07-01 | 12.191 |

| 2014-08-01 | 12.205 |

| 2014-09-01 | 12.214 |

| 2014-10-01 | 12.237 |

| 2014-11-01 | 12.282 |

| 2014-12-01 | 12.301 |

| 2015-01-01 | 12.295 |

| 2015-02-01 | 12.303 |

| 2015-03-01 | 12.311 |

| 2015-04-01 | 12.317 |

| 2015-05-01 | 12.334 |

| 2015-06-01 | 12.338 |

| 2015-07-01 | 12.357 |

| 2015-08-01 | 12.343 |

| 2015-09-01 | 12.35 |

| 2015-10-01 | 12.361 |

| 2015-11-01 | 12.357 |

| 2015-12-01 | 12.362 |

| 2016-01-01 | 12.384 |

| 2016-02-01 | 12.369 |

| 2016-03-01 | 12.344 |

| 2016-04-01 | 12.351 |

| 2016-05-01 | 12.333 |

| 2016-06-01 | 12.353 |

| 2016-07-01 | 12.37 |

| 2016-08-01 | 12.347 |

| 2016-09-01 | 12.344 |

| 2016-10-01 | 12.341 |

| 2016-11-01 | 12.341 |

| 2016-12-01 | 12.355 |

| 2017-01-01 | 12.368 |

| 2017-02-01 | 12.386 |

| 2017-03-01 | 12.395 |

| 2017-04-01 | 12.403 |

| 2017-05-01 | 12.405 |

| 2017-06-01 | 12.42 |

| 2017-07-01 | 12.417 |

| 2017-08-01 | 12.459 |

| 2017-09-01 | 12.467 |

| 2017-10-01 | 12.487 |

| 2017-11-01 | 12.517 |

| 2017-12-01 | 12.545 |

| 2018-01-01 | 12.561 |

| 2018-02-01 | 12.592 |

| 2018-03-01 | 12.612 |

| 2018-04-01 | 12.634 |

| 2018-05-01 | 12.655 |

| 2018-06-01 | 12.687 |

| 2018-07-01 | 12.707 |

| 2018-08-01 | 12.715 |

| 2018-09-01 | 12.733 |

| 2018-10-01 | 12.762 |

| 2018-11-01 | 12.789 |

| 2018-12-01 | 12.809 |

| 2019-01-01 | 12.826 |

| 2019-02-01 | 12.834 |

| 2019-03-01 | 12.831 |

| 2019-04-01 | 12.834 |

| 2019-05-01 | 12.836 |

| 2019-06-01 | 12.846 |

| 2019-07-01 | 12.85 |

| 2019-08-01 | 12.852 |

| 2019-09-01 | 12.854 |

| 2019-10-01 | 12.809 |

| 2019-11-01 | 12.867 |

| 2019-12-01 | 12.855 |

Source: EPI analysis of Bureau of Labor Statistics 2020 Manufacturing Employment data series [CES3000000001].

Trump has not brought these jobs back, nor will his present policies change the status quo. Globalization, and China trade in particular, have also hurt countless communities throughout the country, especially in the upper Midwest, mid-Atlantic, and Northeast regions. The nation has lost a generation of skilled manufacturing workers, many of whom have dropped out of the labor force and never returned. All of this globalized trade has reduced the wages of roughly 100 million Americans, all non-college educated workers, by roughly $2,000 per year.

In addition, more than half of the U.S. manufacturing jobs lost in the past two decades were due to the growing trade deficit with China, which eliminated 3.7 million U.S. jobs, including 2.8 million manufacturing jobs, between 2001 and 2018. In fact, the United States lost 700,000 jobs to China in the first two years of the Trump administration, as shown in our recent report. The phase one trade deal will not bring those jobs back, either.

As investment continues to decline, the Trump tax cuts remain nothing but a handout to the rich

President Trump is likely to tout the benefits of the 2017 Tax Cuts and Jobs Act (TCJA) during his annual State of the Union Address. The centerpiece of the TCJA was a corporate rate cut that proponents claimed would eventually trickle down to workers’ wages—boosting the average American household’s wages by $4,000. We pointed out at the time that there was a lot wrong about this economic theory in practice. Even so, key to the theory is that investment would surge after the tax cuts were enacted. And without a substantial uptick in investment, the typical worker has no chance of benefiting from the TCJA’s corporate rate cuts. Instead, investment has cratered since the TCJA passed. In fact, last week’s GDP data showed that for the first time since the Great Recession, investment has declined for three straight quarters. Given that boosting business investment was the primary stated goal of the TCJA, this seems like an unambiguous policy failure for working people, benefiting only the rich and corporations.

No evidence the TCJA is working as advertised: Year-over-year change in real, nonresidential fixed investment, 2003Q1–2019Q4

| Quarter | Real, nonresidential fixed investment |

|---|---|

| 2003Q1 | -2.3% |

| 2003Q2 | 1.6% |

| 2003Q3 | 4.0% |

| 2003Q4 | 6.8% |

| 2004Q1 | 5.2% |

| 2004Q2 | 4.9% |

| 2004Q3 | 5.7% |

| 2004Q4 | 6.5% |

| 2005Q1 | 9.2% |

| 2005Q2 | 8.2% |

| 2005Q3 | 7.4% |

| 2005Q4 | 6.1% |

| 2006Q1 | 8.0% |

| 2006Q2 | 8.2% |

| 2006Q3 | 7.8% |

| 2006Q4 | 8.1% |

| 2007Q1 | 6.5% |

| 2007Q2 | 7.0% |

| 2007Q3 | 6.8% |

| 2007Q4 | 7.3% |

| 2008Q1 | 5.8% |