What to watch on jobs day: Expected future impact of COVID-19

As COVID-19—commonly known as the coronavirus—continues to spread throughout the world, it is likely to have a direct impact on the United States through the health and well-being of our population. It is also likely to have an impact on economic activity, as workers stop working to care for themselves or their families, and people generally reduce social spending. I’ll be watching this in tomorrow’s job report from the Bureau of Labor Statistics, and keeping an eye on it in the coming months. The first order of business, however, is to make sure that workers can follow the Centers for Disease Control and Prevention (CDC)’s recommendations to stay home and seek medical care—if they are lucky enough to have paid sick days and health insurance. While there are still very few reported cases in the United States, it is expected to spread and the effects may be far-reaching.

In terms of the economy, there has already been an impact on the manufacturing sector as inputs from China are delayed because of temporary factory closures. The Federal Reserve has cut interest rates in expectation of further economic disruptions. Many employers are making contingencies for workers to telecommute rather than risk illness. Unfortunately, this isn’t an option for millions of workers in direct service professions across the economy. Another likely side effect of the pandemic is a pull-back on social consumption. Either because people become sick themselves or are avoiding public spaces, there will likely be a drop in certain types of spending across the economy.

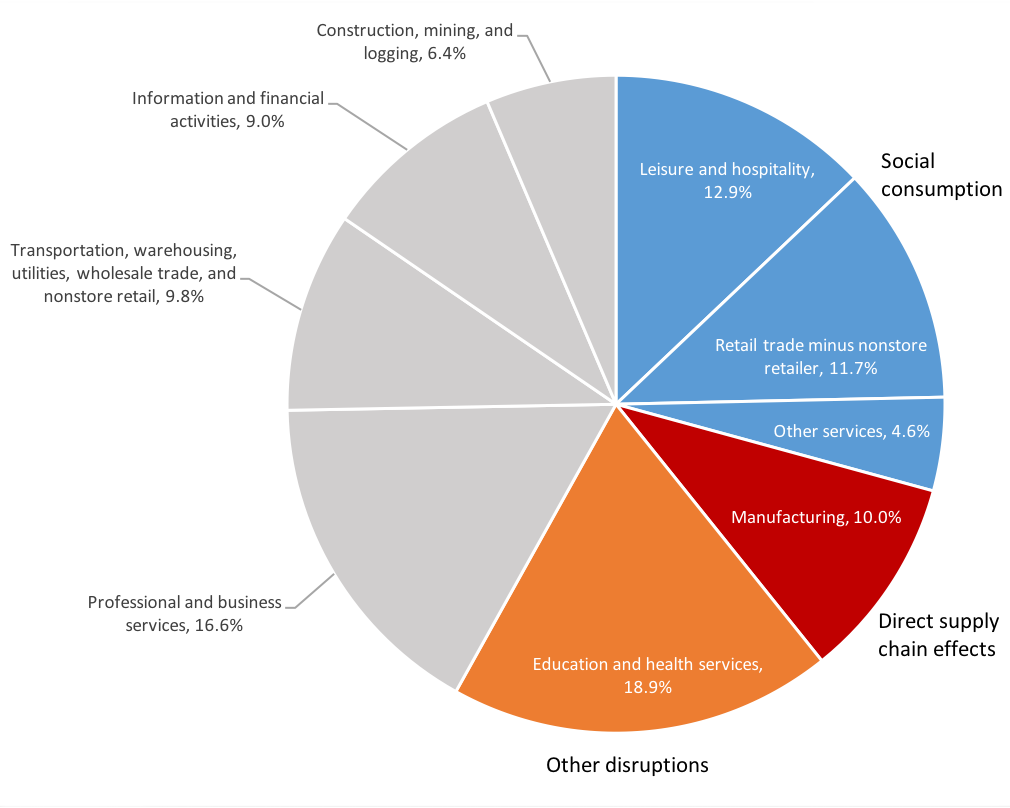

Figure A takes a top-down look at the economy and shares of private-sector employment for various sectors. Manufacturing makes up 10% of private-sector employment and may report some losses in Friday’s jobs report as inputs to production are delayed. The delay in inputs will likely impact construction as well. But, what about the reduction in social spending? Retail trade—minus nonstore retailers—represents 11.7% of private-sector employment. Leisure and hospitality—of which food services and drinking places are a major part—will likely experience a downturn. This sector represents 12.9% of overall employment. Other services—such as personal care services—represent 4.6% of the private-sector labor force. All three sectors combined represent over one-fourth (29.2%) of private-sector employment. If consumption drops as it is expected to, employment in these sectors may experience short-term but serious losses.

Education and health services are likely to be impacted as well. If schools close temporarily, students will have to stay home and parents will be even more strapped to continue working through that period. Health services—which alone makes up about one-eighth of private-sector employment—will be pressed to provide health care to all who need it.

While I’ll be watching upcoming job reports to look for signs of COVID-19 in the employment data, policymakers can act now to mitigate harm and plan for the future.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.