Joel Klein’s false stories

“Sleight of Hand,” an article in the November-December issue of The American Prospect, describes how federal, state, and local housing policies, including the public housing program, were designed a half-century ago to segregate our major metropolitan areas, and how the residential patterns created by public policy at that time persist to this day.

The article does so by way of describing the childhood of Joel Klein, former New York City schools chancellor and now CEO of a Rupert Murdoch company selling technology and software to public schools. Klein has often used his life story to prove an educational theory—that poor quality teachers are the cause of disadvantaged children’s failures. The life story is that he grew up poor, in public housing, “a kid from the streets” with little interest in education until a high school teacher “saw something that I hadn’t seen in myself.” And this life story, Klein and his allies imply, proves that if only disadvantaged students today had the kind of teacher from whom he had benefited, they too would excel and succeed. Read more

Real hourly wage growth: The last generation

The last generation has been marked by a stark disconnect between productivity growth (up 80 percent between 1973 and 2011) and slow or stunted wage growth. The real hourly wages of the median worker grew less than 4 percent over this span, and real hourly compensation (wages and benefits) grew only 10.7 percent. The graphic at the end of this post parses this dismal wage record by gender, by wage decile, and by business cycle (wage dated updated through 2012, in June 2013).

For all workers, the erosion of real wages was broad and uneven from 1973 through 1995. The upturn of 1995–2000, the latter part of the 1989–2000 business cycle, brought a brief respite of across-the-board wage growth, some of which spilled past 2000 (although the wage growth from 2000–2007 skews much more to higher earners). The current recession and recovery (2007–2012) have brought with them wage losses for most workers.

For men, the pattern is even starker. Real wages begin falling for low-wage men in the mid-1970s, and this spread across all but the highest percentiles through 1979–1989 and through the first half of the 1990s (1989–1995). The late 1990s brings some relief, but this is short-lived: wage growth grinds to a halt in 2000–2007 and then loses ground—for all but highest earners—from 2007–2012.

For women, wage growth has been generally stronger. All wage levels show growth of at least 8 percent over the full 1973–2012 span, although the gains at the top (almost 60 percent for the 90th percentile, more than 70 percent for the 95th) are much more dramatic. Read more

Digging deeper into the BLS data: It was the ‘job creators’ and those in ‘real America’ that led to the job growth

I decided to dig a bit deeper into Bureau of Labor Statistics (BLS) data to gauge the divergence of employment growth in the household survey and the establishment survey in September and recent times. It is, after all, the divergence between these two series in September’s jobs report that generated outrageous charges of BLS economists manipulating the data (the household survey showed employment growth of 873,000 in September, which pushed the unemployment rate down to 7.8 percent from 8.1 percent in spite of a surge of new workers into the labor force).

The BLS, being the highly professional agency that it is, provides documentation on how the two series differ and compares the trends obtained in each series on an apples-to-apples basis (or, as close as they can get it); this information is available when the numbers are released each month. That is impressive, by the way. BLS will also share, on request, a spreadsheet providing the actual adjustments made to reconcile the two series over the last 12-month period (using “not seasonally adjusted” data, which is why they show it for the same month a year apart).

The bottom line is that the household survey has shown comparable employment growth as the payroll survey over the last year and less employment growth than in the payroll survey since the trough in June 2009. That’s pretty strong evidence that the trends in the household survey are not spectacular or implausible Read more

Robert Samuelson is drinking Mitt Romney’s tax cut Kool-Aid

Wednesday night, Republican presidential nominee Mitt Romney added to the myriad of promises that make up his part-exceptionally detailed, part-mystery meat tax agenda—promising that none of his tax cuts would add to the deficit, that the middle class would see a tax break, and that upper-income households would see no tax break. Yesterday, I explained at length why these pledges, coupled with his specific tax cutting plans that cannot be written off, are mathematically impossible. Romney’s tax plan didn’t add up before Wednesday night, and it’s now further into the realm of fantasy. But the Washington Post’s Robert Samuelson didn’t get the memo; instead he’s drinking Romney’s tax cut Kool-Aid.

Essentially, Samuelson is giving greater weight to vague promises—promises that don’t add up, mind you—than to the very detailed plan Romney has laid out for cutting individual and corporate income taxes and eliminating the individual and corporate Alternative Minimum Taxes, estate tax, and Affordable Care Act taxes, among other tax cuts. In doing so, he unjustifiably criticizes President Obama for Read more

Transporting black men to good jobs

On Sept. 26, the Economic Policy Institute sponsored a Congressional Briefing on how transportation infrastructure, transportation jobs, and public transit can provide good jobs for black men. This is a brief summary and discussion of key points of the presentations. Links to presentation materials can be found at the end of this post.

African American men have the highest unemployment rate by race and gender. So far in 2012, the black male unemployment rate has averaged 15 percent. This is the overall national rate, but in some metropolitan areas the black male unemployment rate has been even higher.

The figure shows the average metropolitan unemployment rates for non-Hispanic black and white males since the technical end of the recession in June 2009. From July 2009 to May 2012, in many of the nation’s largest metro areas, the black male unemployment rate has averaged close to or above 20 percent. Much needs to be done to end the “economic depression” black men are facing. Transportation investments provide one promising avenue for improving the employment situation of black men. Read more

Who has the better solution to the 300,000 teacher gap?

When asked about the role of government in the first presidential debate on Wednesday, both candidates touched on the importance of teachers, revealing what they would try to do to address the loss of teachers over the last several years due to recession-induced state and local budget shortfalls.

President Obama:

“But what I’ve also said is let’s hire another hundred thousand math and science teachers … and hard-pressed states right now can’t all do that. In fact, we’ve seen layoffs of hundreds of thousands of teachers over the last several years, and Governor Romney doesn’t think we need more teachers. I do, because I think that that is the kind of investment where the federal government can help.”

Mitt Romney:

“Well, first, I love great schools. Massachusetts, our schools are ranked number one of all 50 states. And the key to great schools: great teachers. So I reject the idea that I don’t believe in great teachers or more teachers. Every school district, every state should make that decision on their own.”

Romney’s comment that school districts and states should make their own decision on whether to hire teachers ignores the fact that budget shortfalls over the last four years due to a loss of revenues caused by the recession have meant school districts have been forced to lay off teachers. It’s hard to imagine this is a choice any state or school district actually wanted to make. Read more

‘Generational’ accusations are nearly always wrong

Jim Tankersley really strikes out in his column yesterday. He levels the charge that the Baby Boom generation has somehow put the nation into unsustainable debt and calls them, only half-jokingly, “parasites.”

As a member of Generation X, I used to enjoy some good-ol’ hating on the Baby Boomers, but it turns out that such generational finger-pointing is really silly. The prime exhibit offered in defense of the parasite charge is a comparison between federal debt as a share of GDP in 1965 and 2012. It’s 37.9 percent in 1965 and 74.2 percent in 2012 so, voila! Parasites!

Here’s a similar chart. Look closely at what happened between 1965 and 2007—debt held by the public is lower in 2007 than 1965. So, the charge must be somehow that the Baby Boomers’ mooching in the past five years is the real culprit, right?

Or, more likely, some very large economic event happened between 2007 and 2012 that caused Federal borrowing to rise. What could that have been? Oh yeah, the Great Recession.

And this one is hard to hang on the entire Baby Boom generation.

As a general rule, if you find yourself blaming large macroeconomic trends on the moral failings of entire generations … you are surely barking up the wrong tree.

The outrageous attack on BLS

Apparently, Jack Welch, former chairman and CEO of General Electric, is accusing the Bureau of Labor Statistics of manipulating the jobs report to help President Obama. Others seem to be adding their voices to this slanderous lie. It is simply outrageous to make such a claim and echoes the worrying general distrust of facts that seems to have swept segments of our nation. The BLS employment report draws on two surveys, one (the establishment survey) of 141,000 businesses and government agencies and the other (the household survey) of 60,000 households. The household survey is done by the Census Bureau on behalf of BLS. It’s important to note that large single-month divergences between the employment numbers in these two surveys (like the divergence in September) are just not that rare. EPI’s Elise Gould has a great paper on the differences between these two surveys.

BLS is a highly professional agency with dozens of people involved in the tabulation and analysis of these data. The idea that the data are manipulated is just completely implausible. Moreover, the data trends reported are clearly in line with previous monthly reports and other economic indicators (such as GDP). Read more

What we read today

Here’s some of the thought-provoking content that EPI’s research team enjoyed reading today:

- “Footnoting the [presidential] debate!” (Wonkblog)

- “Women Still Missing From Medicine’s Top Ranks” (New York Times)

- “Ex-Clinton staffer backs [Charlie] Bass: [Erskine] Bowles says GOP rep has ‘the guts’” (Concord (NH) Monitor)

Even more mathematically impossible tax promises

Last night, Republican presidential nominee Mitt Romney made news by substantially “etch-a-sketching” the tax policy he had been running on since the GOP primaries began. In making up policy on the fly, he promised that his tax cuts would be entirely revenue-neutral, that he would cut taxes on the middle class, and that he would not cut taxes on high-income earners. Taken together with his specific tax cutting plans, these pledges violate basic rules of arithmetic.

Early on in the debate, Romney disputed President Obama’s claim that the former governor’s central economic plan was a $5 trillion tax cut on top of extending the Bush-era tax cuts:

“First of all, I don’t have a $5 trillion tax cut. I don’t have a tax cut of a scale that you’re talking about. My view is that we ought to provide tax relief to people in the middle class. But I’m not going to reduce the share of taxes paid by high-income people.”

I’ve gone over these numbers before, but it’s worth a quick refresher about the broad thrust of what’s wrong with this claim: Romney is hugely specific about just how he’ll cut taxes (mostly for high-income earners) but refuses to specify any real-world offset though the “base-broadening” that he’s promising. Read more

Obama too quiet on job creation track record

Jobs were, not surprisingly, a big topic in last night’s presidential debate. President Obama, however, did not seize the opportunity to discuss his administration’s job creation record and substantive job creation proposals—in particular the American Jobs Act (AJA), which would provide a quantifiably substantial economic boost but has largely been stonewalled by the House of Representatives for more than a year.

Those who watched the debate saw Republican presidential nominee Mitt Romney ding Obama on some of the trends that my colleagues here at EPI are constantly analyzing: A) a high unemployment rate (though he misspoke and said it was rising—it’s not); B) millions of unemployed workers (though he overstated by saying 23 million are unemployed—12.5 million were unemployed in August; Romney was likely conflating unemployment with the number of people underemployed); and C) insufficient job creation measures (something I wouldn’t disagree with, though Romney’s budget proposals would have the opposite effect of creating jobs in the near-term). And despite this last point on his budget’s employment impacts, Romney promised, again unsurprisingly, that as president he would Read more

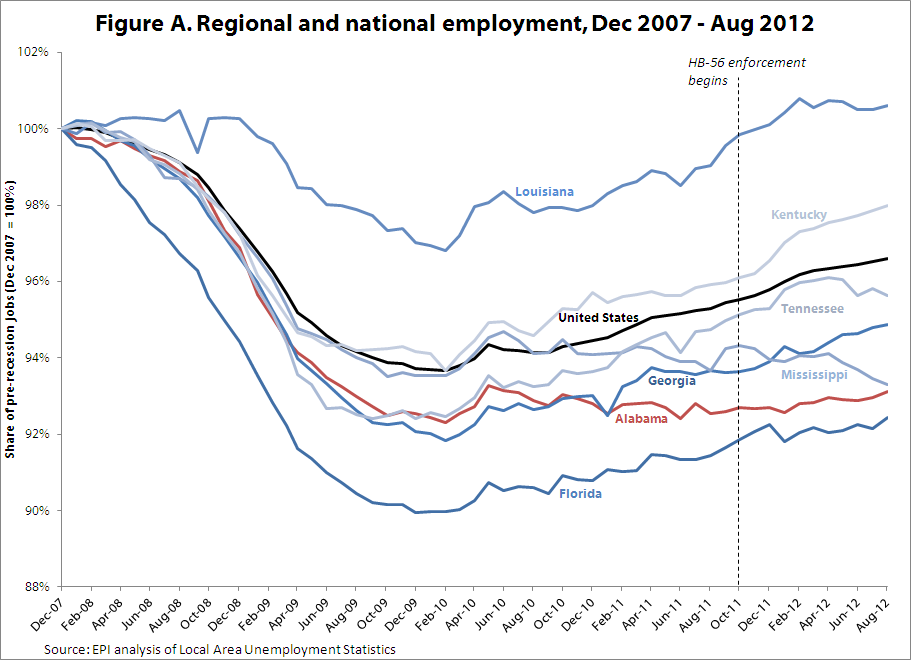

Checking Alabama’s ‘status’: HB 56 no cure for a sick labor market

The evidence continues to mount that HB-56, Alabama’s extreme anti-immigrant law, is anything but the economic cure-all that proponents claimed it would be. In fact, the economic data suggest that the law is only exacerbating the state’s stagnating economy and setting Alabama up for even greater trouble down the road.

As Figure A shows, Alabama’s employment levels have essentially flat-lined since the end of the recession. HB-56, the law that would allegedly “free up jobs for other Alabama workers” and “put thousands of native Alabamians back in the work force” has done nothing to jump-start job growth. Table 1 shows the change in employment from Sept. 2011, the month before the law went into effect, to Aug. 2012. With the exception of Mississippi, which lost employment, Alabama had the slowest job growth in the region over the period—less than half the rate of job growth for the nation as a whole.

The payroll tax cut is likely to expire—let’s replace it with better stimulus

Annie Lowrey’s recent piece in the New York Times on the likely year’s end expiration of the 2 percentage-point employee-side payroll tax cut has sparked a welcomed broadening of the discourse over the so-called “fiscal cliff.” The punditry’s discussion of expiring provisions and pending spending cuts has, for months, been overly and narrowly focused on the looming sequestration cuts and expiration of the Bush-era tax cuts while ignoring the single largest pending fiscal headwind: expiration of the remaining ad hoc stimulus.

In our recent paper on the coming fiscal obstacle course (the “fiscal cliff” is a truly terrible metaphor as it implies a binary policy choice), my colleague Josh Bivens and I estimate that—should they all lapse—expiration of the payroll tax cut, emergency unemployment insurance, and recent expansions of refundable tax credits would shave 1.4 percentage points from real GDP growth in 2013 and lower employment by more than 1.6 million jobs, relative to full extension. This is not to suggest that the remaining ad hoc stimulus necessarily be continued in its existing form—the fiscal obstacle course represents an opportunity to fundamentally reorient fiscal policy to be Read more

No debate here, just facts on the presidential candidates’ economic policies

Tonight, President Obama and Republican nominee Mitt Romney will square off in Denver in the first presidential debate. In preparation, we’ve compiled some of our most relevant analyses of the economy and economic policy from the past few months:

BUDGET

- The so-called “fiscal cliff” isn’t one piece of take-it-or-leave-it legislation; rather, it’s a series of separable tax and spending provisions. Our experts identify which ones should be allowed to phase out (and perhaps be replaced by fiscal support that would more efficiently support economic recovery).

- States are facing $55 billion in budget shortfalls this year, and Romney’s proposed spending cap would decimate budgets further.

- Despite what Romney’s budget plan says, economic growth will come nowhere close to offsetting his proposed tax cuts for the wealthy.

- Would Romney or Obama do more to promote job growth in the near term? We analyze the macroeconomic impacts of both their budget proposals.

- Extending all of the Bush-era tax cuts will provide a massive windfall for the top 1 percent of households.

HEALTH CARE

- Obama’s Patient Protection and Affordable Care Act has increased employer-sponsored health insurance and dependent ESI coverage for young adults—even in a poor labor market.

- Paul Ryan, Romney’s running mate, has proposed a Medicare voucher that will shift around 11 percent of costs to seniors in 2023 (and even more in later years).

JOBS

- The economy would have added another million jobs in 2012 if Congress had fully enacted Obama’s American Jobs Act.

- More than three years after the end of the Great Recession, public-sector job loss resulting from state and local austerity continues to be a major drag on the recovery.

- The labor market’s struggles have meant declining wages and fewer opportunities for young graduates. Graduating in a bad economy also means long-lasting economic consequences for the Class of 2012.

What we read today

Here’s some of the thought-provoking content that EPI’s research team enjoyed reading today:

- “Leaders at Work on Plan to Avert Mandatory Cuts” (New York Times)

- “The Policy Priorities and Issue Preferences of Asian Americans and Pacific Islanders” (National Asian American Survey)

- “Paul Ryan Was Never a Moderate on Social Security” (Huffington Post)

- “Congress just let the farm bill expire. It’s not the end of the world … yet” (Washington Post)

- “If Congress Goes Over the Fiscal Cliff Your Taxes Will Likely Go Up” (TaxVox)

Capping federal spending at 20 percent of GDP would decimate state budgets

My colleagues Josh Bivens and Andrew Fieldhouse recently released a report finding that Republican presidential nominee Mitt Romney’s budget plan would reduce employment by between 550,000 and 1.9 million jobs over the next two years relative to current policy, depending on whether his tax cut is deficit-financed or fully paid for with base-broadening. This job loss is overwhelmingly fueled by his proposal to cap federal spending at 20 percent of GDP.

But the impact of any fiscal plan goes beyond the job impact—after all, a little over 17 percent of non-interest federal spending flows directly to states (e.g., matching funds for Medicaid and unemployment insurance), and with a half trillion dollars in cumulative shortfalls that states have faced in the last few years and another $55 billion in shortfalls faced this year, states would have difficulty handling another blow to their budgets. So how would Romney’s proposed spending cap affect state budgets?

To make this calculation, I started with the U.S. Census Bureau’s Annual Survey of State Government Finances, which shows total expenditures and federal transfers to state governments, each by state. I then applied the Read more

What we read today

Here’s some of the thought-provoking content that EPI’s research team enjoyed reading today:

- “The Real Referendum” (New York Times)

- “Obamanomics: A Counterhistory” (New York Times)

- “I am a job creator: A manifesto for the entitled” (Washington Post)

- “Payroll Tax Cut Is Unlikely to Survive Into Next Year” (New York Times)

Barry Commoner, visionary environmentalist, teacher and activist dies at 95

Barry Commoner, path-breaking scientist and social activist, passed away yesterday at the age of 95. I was fortunate enough to work for Barry in the late 1970s as a research assistant on two of his books, The Poverty of Power (1976) and The Politics of Energy (1979). Commoner, a botanist and biologist, was a founder of the environmental movement, along with peers such as Rachel Carson (The Silent Spring, 1962) and Margaret Meade. He believed that scientists have an obligation to share scientific information with the general public to enable them to participate in public debate on scientific issues. His work on the effects of nuclear fallout, documented through the collection of baby teeth and reinforced by a petition signed by 11,201 scientists worldwide, provided the scientific foundation for the adoption of the Nuclear Test Ban Treaty of 1963.

Commoner also helped establish the roots of today’s BlueGreen Alliance of labor and environmentalists. He first began working with Tony Mazzocchi, a longtime leader of the Oil, Chemical and Atomic Workers in the 1950s, who collected baby teeth from the children of members of his Long Island local union. Commoner’s work showed the connections between the environmental crisis and social and economic issues such as “poverty, injustice, public health, national security and war,” and that the roots of the environmental crisis lay in excessive corporate power and flawed systems of production. He argued that only by changing those systems—for example, by replacing nuclear power, coal and oil with renewable energy—could the root causes of our environmental problems be eliminated. Not coincidentally, these same policies would create millions of new domestic jobs, reducing pollution, inequality and our trade deficit simultaneously. As Commoner established in The Closing Circle (1971), the first of his “four laws of ecology” was, “Everything is connected to everything else.” Indeed.

What we read today

As you head into your weekend, here’s some of the thought-provoking content that EPI’s research team came across today:

- Plan Selection in Medicare Part D: Evidence from Administrative Data (National Bureau of Economic Research)

- Will pension plans stage a comeback? (Investment News)

- Shocked by the [NFL] refs? Where’ve you been the last 30 years? (Philly.com)

- No, NFL Owners Didn’t ‘Lose’ The Lockout Battle With Referees (Think Progress)

Another right-wing attack on public workers

How does government pay compare with that in the private sector? The answer is pretty much what you’d expect: Wages and salaries are lower, but benefits are better. Overall compensation is, if anything, slightly lower, though this varies by class of worker; less educated workers are better paid in the public sector and more educated workers are better paid in the private sector. This again is not surprising when you consider that less educated workers in the private sector often earn poverty wages with no health benefits and government employers have little incentive to shift costs onto Medicaid and other government programs.

But anti-government ideologues have deep pockets, so a minor industry has sprung up trying to show that government workers are overpaid. The latest report in this genre comes from Citizens Against Government Waste, and is typical of its kind. The research was done by an outfit called John Dunham and Associates, a.k.a. guerrillaeconomics.com. It shows many of the tell-tale signs of shoddy research:

1. Anecdotal evidence. Somewhere, there’s a government worker making an obscene amount of money and abusing the system. But focusing too much on specific examples is a sure sign they aren’t representative. The CAGW report claims the average San Diego firefighter makes more than $180,000 per yearRead more

Romney heavily exploits tax loopholes while slamming others for not paying income taxes

A Bloomberg article from yesterday highlighted the fact that a trust set up by Mitt Romney to benefit his children and grandchildren relied heavily on tax loopholes for maximum returns. Romney was able to avoid gift and estate taxes by relying on a vehicle known as an “intentionally defective grantor trust,” or IDGT, which tax planners sometimes refer to as “I Dig It.” This type of trusts allow donors to gift unlimited amounts to their children and grandchildren free of gift or estate taxes (the top gift tax rate is scheduled to return to 55 percent in 2013, after being cut significantly by President George W. Bush). The value of the Romney family trust is not counted, according to the article, as part of the $250 million that Romney’s campaign cites as his net worth.

Tax avoidance such as this relies heavily on the preferential treatment of capital gains in the tax code. As the article highlights, when a trust such as the one set up by Romney sells assets at a profit, the donors are able to pay relatively low capital gains rates on behalf of the trust. A Tax Policy Center report earlier this year that looked at the distributional effects of tax expenditures found that “relative to the population as whole, high-income taxpayers would lose the most from eliminating special rates for capital gains and dividends.” Romney and his running mate Paul Ryan have ruled out closing this costly and lopsided loophole Read more

Multipliers, yet again

In a recent paper assessing the likely impact of President Obama and Mitt Romney’s budget plans if they became law, we applied standard macroeconomic multipliers to estimates of each plan’s fiscal impulse.

As always, the very term “multipliers” brings out critics, and the ones we used for this study (and have used often in the past)—those from Moody’s Economy.com—seem to bring out even more. This is all very odd.

We often use the Moody’s multipliers because they’re transparent and slightly more detailed than many others that have been published. But, what drives our results in determining whose budget plans provide a bigger economic boost is simply the relative ranking of these multipliers; specifically the estimate that tax cuts (particularly for high-income households) provide less dollar-for-dollar economic support than do spending increases. This is not controversial at all. Both the Congressional Budget Office and the Council of Economic Advisers make similar relative judgments (see the tables here), and the general view that government purchases’ multipliers will lie above tax multipliers during economic circumstances like the present is buttressed by a number of academic papers in recent yearsRead more

Share of households owning stocks declined over the last decade

The recently released State of Working America, 12th Edition, documents in a variety of ways how the last decade in the United States has been a lost decade for all but the very well-off. One manifestation of this lost decade is the decline in the share of households owning stocks.

First, it’s useful to point out that even with the “401(k) revolution,” a surprisingly small share of households ever held any significant amount of stocks. As the figure shows, at its peak in 2001, just more than half (51.9 percent) of U.S. households held any stock, including stocks held in retirement plans like 401(k)s. Furthermore, many of that 51.9 percent held very small amounts—just over a third (37.8 percent) had total stock holdings of $10,000 or more. (Read this snapshot for more on the “democratization of the stock market” that never actually happened.) And even those modest shares have since lost ground. By 2010, less than half (46.9 percent) of all households had any stock holdings, and less than a third (31.1 percent) had stock holdings of $10,000 or more.

The strong rebound in stocks since 2009 amidst persistently high unemployment highlights the disconnect between Wall Street’s financial markets and most people. The stock market simply has little or no direct financial importance to the majority of U.S. households. Since 1989, the top fifth of households consistently held about 90 percent of stock wealth, leaving approximately 10 percent for the bottom four-fifths of households. If you want to assess how the economy is performing for most households in this country, don’t look to the stock market, look to the labor market, and measures of job opportunities like employment and wage growth.

Which candidate’s plans are more Keynesian?

Unemployment remains far too high, and the culprit is clearly deficient spending in the economy. Yet, a full-throated call for aggressive Keynesian remedies for this (i.e., something like another Recovery Act) is far from the top-shelf item on the agenda. Instead, most policy attention in the race centers on which candidate would more rapidly reduce projected budget deficits—a policy maneuver that, in the next couple of years, would be all but guaranteed to lead to higher unemployment rates. This move away from a defense of Keynesian cures for high unemployment started a long time ago and has codified by the 112th Congress (Jan. 2011–present), when federal budget policies pivoted sharply toward austerity.

Republicans have clearly led the charge away from Keynesianism, vociferously decrying the increase in budget deficits since the Great Recession began and demanding a dollar of spending cuts for every dollar increase in the statutory debt ceiling. Democrats have (generally) been more ambivalent—calling for (and passing) some fiscal support while often rhetorically privileging deficit reduction over other policy goals. Given this partisan pattern, it’s somewhat unexpected to hear some commentators speculate that a Mitt Romney administration Read more

Pension report misses obvious causes of underfunding

Yet another right-wing organization is attacking public employees and their pay. This time, it’s Citizens Against Government Waste, a corporate front for tobacco companies, defense contractors, Microsoft, and anyone interested in contracting out government services. Today, they issued a report card at the National Press Club that purports to grade states on public employee pay and argued that overpayments are the cause of unfunded pension liabilities.

These claims are bunk, and study after study has rebutted similar claims. If anything, public-sector workers, most of whom have college degrees or higher, are somewhat underpaid compared to comparable private-sector workers. EPI collected a series of such reports in Jan. 2011, but this has also been the finding of research from the Center for Retirement Research at Boston College, the National Institute on Retirement Security, and the Center for Economic and Policy Research.

The CAGW paper also addresses public employee pension plans. Why are these plans underfunded? The biggest single reason is the stock market collapse of 2007–09. Read more

A ‘lost decade’ for nearly every state

EPI’s recently released The State of Working America, 12th edition, explains in detail how the past 10 years have been a “lost decade” of income growth for the bulk of American families. How has this played out at the state level? Last week’s release of the American Community Survey (ACS) provides excellent data with which to see these trends by state.

According to the ACS, from 2000 to 2011, real median household income—i.e., adjusted for inflation—declined in 41 out of 50 states across the U.S. Figure A illustrates this change. The dark blue bars represent 2011 median household income values. The grey sections show what household income was in each state in 2000. (The light blue sections are the rare instances of median income growth.)

As the figure shows, household incomes rose in only a handful of states in the west-north-central region where the shale gas boom has been driving growth, and in the region surrounding Washington, D.C (which some attribute, in part, to growth in the lobbying industry). Of the 41 states where household incomes fell, 13 states had declines greater than 10 percent, with Michigan (-18.9 percent), Georgia (-14.7 percent), and Mississippi (-13.7 percent) experiencing the largest declines.Read more

Obama’s budget policies would be better for growth than Romney’s

The most pressing economic challenges facing the United States remain stubbornly high unemployment and underemployment rates, a legacy of the Great Recession that began at the end of 2007 and from which the labor market has yet to fully—or even largely—recover. In today’s liquidity trap environment, and with further depreciation of the dollar seemingly unlikely, economic growth and employment overwhelmingly hinge on fiscal policy in the near term.

Both President Obama and Republican presidential nominee Mitt Romney contend that they have plans to accelerate job creation, but their two approaches are diametrically opposed. Relative to current budget policies, Obama is essentially proposing to temporarily increase federal spending and give tax credits for employers expanding payrolls to boost employment (i.e., the American Jobs Act, or AJA, provisions that have stalled in the House of Representatives) and raise taxes on upper-income households. Romney is proposing to cut both federal spending and taxes—overwhelmingly for upper-income households—by capping federal outlays at 20 percent of gross domestic product (GDP) while reducing corporate income and individual income tax rates, as well as repealing the estate and alternative minimum taxes (AMT) in entirety. Timothy Noah prognosticates in The New Republic that, “If any of Romney’s tax stimulus remained [after possible “base-broadening” and legislative sausage-making], it would be erased by cuts in government spending. … At this point it’s fair to conclude Romney’s machinations would actually be worsening the economy.” Read more

Social Security, Medicare and life expectancy

Two new studies find that unemployment at older ages may shorten life and that the gap in life expectancy between less and more educated workers is widening. Though neither result may seem surprising, the first is at odds with some previous research, while the second reinforces earlier findings but provides shocking new statistics—notably the fact that the least educated white women have seen their life expectancy at birth fall by five years since 1990, as highlighted in a recent New York Times article.

A seminal paper by Christopher J. Ruhm (2000) found that recessions were associated with lower mortality rates, a counterintuitive result confirmed by later studies. Ann Huff Stevens et al. (2011) identified a possible reason: Reduced employment opportunities in the broader labor market appeared to leave nursing homes better staffed, explaining why the pro-cyclical mortality effect was concentrated among seniors.

In other words, while higher unemployment may be associated with lower mortality, this doesn’t necessarily mean working is bad for your health. Later research focusing on workers who lost their jobs (as opposed to economy-wide unemployment rates) found Read more

Rare conservative-progressive agreement: Corporate capture of the government is a bad thing

Ross Douthat, a very conservative New York Times columnist, rarely writes anything—even a sentence—that I agree with. So I was surprised to find myself nodding my head as he pointed out the danger of having a capital region so much richer than the rest of the country that policymakers lose touch with the lives of the people their decisions affect.

Douthat writes that seven of the 10 richest counties in America are in the Washington, D.C. region and that Fairfax, Loudoun and Arlington Counties, all in Northern Virginia, have higher median incomes than every other county in the United States.

To his credit, Douthat does not use this as an opportunity to bash federal employees. Instead, he correctly points out that the big growth in numbers and incomes has come from the private-sector firms that feed off the federal government:

“Whence comes this wealth? Mostly from Washington’s one major industry: the federal government. Not from direct federal employment, which has risen only modestly of late, but from the growing armies of lobbyists and lawyers, contractors and consultants, who make their living advising and influencing and facilitating the public sector’s work.”

Douthat tries to make the concentration of wealth in the capital region into a case for Romney’s electionRead more

What we read today

Here’s some of the thought-provoking content that EPI’s research team came across today:

- “About the 47 Percent Who Don’t Pay Federal Income Tax: Mitt, Meet Andrea” (Tax Vox)

- “Five Myths About the 47 Percent” (Tax Vox)

- “Labor’s Declining Share of Income and Rising Inequality” (Federal Reserve Bank of Cleveland)

- “Obama vs. Romney on China” (Center for American Progress Action Fund’s Adam Hersh via CNN.com)

- “Small Business and the Expiration of the 2001 Tax Rate Reductions: Economic Issues” (Congressional Research Service)