What Led Us to the Troubles in Ferguson?

I’ve spent several years studying the evolution of residential segregation nationwide, motivated in part by convictions that the black-white achievement gap cannot be closed while low-income black children are isolated in segregated schools, that schools cannot be integrated unless neighborhoods are integrated, and that neighborhoods cannot be integrated unless we remedy the public policies that have created and support neighborhood segregation.

When Ferguson, Missouri, erupted in August, I suspected that federal, state and local policy had purposefully segregated St. Louis County, because this had occurred in so many other metropolises. After looking into the history of Ferguson, St. Louis, and the city’s other suburbs, I confirmed these were no different. In The Making of Ferguson: Public Policies at the Root of its Troubles, the Economic Policy Institute has now published a report documenting the basis for this conclusion, and The American Prospect has published a summary in an article in the current issue.

Since a Ferguson policeman shot and killed an unarmed black teenager, we’ve paid considerable attention to that town. If we’ve not been looking closely at our evolving demographic patterns, we were surprised to see ghetto conditions we had come to associate with inner cities now duplicated in almost every respect in a formerly white suburban community: racially segregated neighborhoods with high poverty and unemployment, poor student achievement in overwhelmingly black schools, oppressive policing, abandoned homes, and community powerlessness.

Another Measure of the Staggering Wage Gaps in the United States: Comparing Walton Family Wealth to Typical Households by Race and Ethnicity

Last week, I noted that two recent data releases—the Federal Reserve’s Survey of Consumer Finances and the Forbes 400—painted a stark picture of growing wealth concentration in the U.S. economy. Specifically, I looked at the single largest conglomeration of family financial wealth in the Forbes 400, the combined net worth of the six Walmart heirs, and compared it to that held by typical American families.

If you arrange American families by net worth in ascending order, you would have to aggregate the net worth of the bottom 42.9 percent (52.5 million) of American families to equal the net worth held by the six Waltons. Further, you would need to add together more than 1.7 million American families that all had the median U.S. net worth ($81,200 in 2013) to equal the Walton family holdings.1

In this post, I’ll do the same calculations, but look just at non-white families. It is a stark fact that racial wealth gaps in the U.S. economy are enormous. For example, the median white family had net worth of roughly $142,000 in 2013, while the median net worth of non-white families was just $18,100.

So, arranging non-white families by ascending order of net worth, one would need to aggregate the net worth of the bottom 67.4 percent of non-white families to match the net worth of the Waltons.2 And it would take 7.9 million families that had the median net worth of non-white families to match the Waltons’ wealth.

New Website Contratados.org Brings Transparency Where It’s Lacking: The International Labor Recruitment Industry

For most foreign workers who come to work temporarily in the United States, paying private labor recruitment agencies or individual recruiters (also known as foreign labor contractors or FLCs) in order to find and get a job—as a landscaper, teacher, computer programmer, or almost any other occupation—has become an inescapable part of the process. Recruiters connect workers abroad—who may sometimes be in remote locations and rural villages—with employers in the United States for a fee, which is either collected from the employer, the worker, or both. As the Migration Policy Institute has noted, this cross-border and cross-jurisdiction contracting activity “creates many opportunities for exploitation and abuse.” The UN International Labour Office’s Director-General Guy Ryder has gone further, calling this market “anarchic and in need of proper coordinated regulation.”

The principal reasons that the recruitment market is “anarchic” are its almost total lack of transparency, and the absence of any regulation to ensure fairness and accountability. One result is that migrants can be charged unreasonably high fees to get hired for short-term jobs. The migrants either have to get loans from friends and family, or take out mortgages on their home or land, or borrow the money directly from recruiters at exorbitant interest rates, which leaves the migrant workers heavily indebted.

In most temporary foreign worker programs, workers don’t have the right to switch employers, regardless of whether the employer steals their wages, confiscates their passports, or locks them inside of a factory. Because the employer controls the visa, if the migrant worker decides to quit or escape, he or she becomes instantly deportable. This arrangement leaves workers vulnerable to debt bondage. Countless examples can be cited of abuse and human trafficking perpetrated by recruiters and facilitated by the international labor recruitment system.

Post-recession Decline in Black Women’s Wages is Consistent with Occupational Downgrading

The Bureau of Labor Statistics reported another month of solid job growth in September, bringing this year’s average to over 225,000 jobs per month—the highest average monthly job growth since 1999. As the jobs recovery consistently grinds on, more attention is shifting toward the absence of wage growth in the recovery. Wage stagnation is part of a longer-term trend that has been well-documented in EPI’s research. Last month’s Census Bureau report on income, poverty and health insurance coverage in 2013 provided more evidence of weak wage growth following the recession. In my previous analysis of data from the Census report, I also identified how uneven that growth has been for different groups of women. Median real (ie, inflation-adjusted) annual earnings for African American women working full-time full-year in 2013 were 3.3 percent below the 2009 level, compared to 0.2 percent and 0.5 percent lower for white and Hispanic women, respectively.

Given the magnitude of that disparity, I sought to confirm it using hourly wage data for full-time full-year workers from the CPS ORG files, the data source for EPI’s signature research on wage trends. Based on that analysis, I identified similar racial disparities in women’s hourly wage growth.

Is Corporate America Going to the Poorhouse?

The Financial Times recently reported that the U.S. Chamber of Commerce has spent $30 million to influence the upcoming elections, backing mostly Republicans candidates. The Chamber, upset with the so-called anti-business attitude of the Obama administration, wants a Congress that will cut corporate taxes. This rhetoric suggests that U.S. corporations have become so unprofitable they need tax relief in order to stay in business. So let’s take a look at corporate profitability.

The first figure below shows corporate profits (left axis) and corporate taxes (right axis) as a percent of national income since 1946. Corporate profits have bounced around over the last 68 years between 8 percent of national income and 14 percent. The high point over this period, however, was just last year. Furthermore, corporate profits as a percent of national income have been steadily rising since President Obama took office, though much of that is due to the recovery in corporate profits after the Great Recession. At least before taxes, corporations appear to be doing rather well in terms of profitability.

The figure also shows total taxes on corporate income as a percent of national income. Since 1946, corporate taxes have steadily decreased in relation to national income. In 2013, corporate taxes were at a level below the high point reached in the last Republican administration. The data suggests that corporate taxes have not been keeping up with corporate profitability.

Why is the Obama Administration on the Wrong Side of a Wage and Hour Case?

Integrity Staffing Solutions, which runs a warehouse operation for Amazon, makes employees go through a “security check” at the end of each working day, where they are searched for stolen goods. Even though employees spend 25 minutes being processed—and would be fired if they tried to skip the screening—Integrity doesn’t pay them a penny for their time. The employees sued and won, and the case has gone to the U.S. Supreme Court. Now, the Justice Department and Labor Department have filed a brief that takes the side of the Amazon subcontractor over its employees. This is a shame.

Over the past year, President Obama and Secretary of Labor Tom Perez have seemingly done everything within their power to lift wages and discourage the exploitation of workers. Obama has issued executive orders raising the minimum wage and requiring decent labor practices from federal contractors, Perez has issued a rule covering home-care workers under the minimum wage and overtime rules, and Obama directed Perez to update overtime rules so more salaried employees would have the right to overtime pay. So why are they fighting the employees in this case?

It doesn’t look like a matter of legal principle to me. Certainly, the application of the Portal to Portal Act, which frees employers from the obligation to pay for certain preliminary and postliminary activities such as traveling to the work site or changing from a uniform into civilian clothes, isn’t obvious in this case. The court of appeals found that the search for stolen property was integral and necessary to the business operation of the warehouse, and that seems right to me. If the screening isn’t “integral and necessary” to the business operation, why would the employer fire employees who skip it? If making employees remove work clothes and shower after work to remove toxins has to be compensated (and the Supreme Court has said that it does), why isn’t making them remove belts and shoes and other clothing to prevent theft? (Cases finding that making employees—and everyone else—go through airport security screenings aren’t analogous because the employees are only being required to do what everyone has to do. It isn’t integral and necessary to the business operation, it’s a general requirement of federal law.)

So if it’s a close legal question, why didn’t the Obama administration side with the workers and ask the Supreme Court to uphold the Court of Appeals decision in their favor? I’m afraid it’s because the federal government is doing the same thing as Integrity, and doesn’t want to be sued. The brief of the United States includes a “Statement of Interest” explaining why it wanted to file a friend of the court brief. Here’s what it says, in part:

“The United States also employs many employees who are covered by the FLSA, 29 U.S.C. 203(e)(2)(A), and requires physical-security checks in many settings. The United States accordingly has a substantial interest in the resolution of the question presented.”

In other words, as an employer, the government wants to be able to get away without paying its own workers for their time. This is wrong.

The Ridiculousness of a “Liberal Endgame” on Fiscal Policy

Last night, the American Enterprise Institute’s Jim Pethokoukis, with whom I occasionally agree on matters of fiscal policy, took to Twitter to “clarify” the fiscal implications of many progressive priorities.

Basically, Pethokoukis is arguing that federal spending levels as high as some (slightly-caricatured version of) progressives have called for would require a broad-based tax hike on all Americans.

There’s plenty to dislike about this claim, but the most important issue is that no progressives I know are arguing for a specific federal spending level for all occasions. Instead, we want federal spending levels that are consistent with our policy priorities. So, for example, in times of weak aggregate demand, spending should temporarily rise to finance safety net programs, aid to state and local governments, and public investments to put people back to work. When the economy gets going again and we are near full employment, federal spending should then pull back. Over the longer run, spending levels should be sufficient to preserve the social insurance programs we have (which are not particularly generous), as well as finance needed public investments, vital safety net programs, and the efficient running of government. (So no phony savings like slashing the budget of the IRS.)

The liberal end game is 30% of GDP spending, financed by a VAT and other taxes.

— James Pethokoukis (@JimPethokoukis) October 6, 2014

Labor Market Weakness Is Still not due to Workers Lacking the Right Skills

The figure below shows the number of unemployed workers and the number of job openings by industry. This figure is useful for diagnosing what’s behind our sustained high unemployment. If our current elevated unemployment were due to skills shortages or mismatches, we would expect to find some sectors where there are more unemployed workers than job openings, and some where there are more job openings than unemployed workers. What we find, however, is that unemployed workers dramatically outnumber job openings across the board. There are between 1.1 and 6.5 times as many unemployed workers as job openings in every industry. In other words, even in the industry with the most favorable ratio of unemployed workers to job openings (health care and social assistance), there are still about 10 percent more unemployed workers than job openings. This demonstrates that the main problem in the labor market is a broad-based lack of demand for workers—not, as is often claimed, available workers lacking the skills needed for the sectors with job openings.

Unemployed and job openings, by industry (in millions)

| Industry | Unemployed | Job openings |

|---|---|---|

| Professional and business services | 1.151667 | 0.792083 |

| Health care and social assistance | 0.719667 | 0.665667 |

| Retail trade | 1.179833 | 0.473667 |

| Accommodation and food services | 0.975167 | 0.544 |

| Government | 0.734333 | 0.421333 |

| Finance and insurance | 0.27225 | 0.216333 |

| Durable goods manufacturing | 0.518667 | 0.174417 |

| Other services | 0.40575 | 0.143417 |

| Wholesale trade | 0.171167 | 0.145917 |

| Transportation, warehousing, and utilities | 0.38375 | 0.157833 |

| Information | 0.163667 | 0.103083 |

| Construction | 0.815333 | 0.126167 |

| Nondurable goods manufacturing | 0.343667 | 0.10575 |

| Educational services | 0.23275 | 0.073333 |

| Real estate and rental and leasing | 0.126 | 0.052 |

| Arts, entertainment, and recreation | 0.226167 | 0.074583 |

| Mining and logging | 0.05425 | 0.026833 |

Note: Because the data are not seasonally adjusted, these are 12-month averages, September 2013–August 2014.

Source: EPI analysis of data from the Job Openings and Labor Turnover Survey and the Current Population Survey

Job Seekers Outnumber Jobs by 2-to-1

In August, the total number of job openings was 4.8 million, up from a revised 4.6 million in July. In August, there were 9.6 million job seekers (unemployment data are from the Current Population Survey), meaning that there were 2.0 times as many job seekers as job openings. Put another way, job seekers so outnumbered job openings that about half of the unemployed were not going to find a job in August no matter what they did. In a labor market with strong job opportunities, there would be roughly as many job openings as job seekers.

The decline of the job seekers to job openings ratio to 2.0 continues the overall downward trend since the high of 6.8 to 1 in July 2009 (see Figure A). The ratio has steadily declined, falling by about 1.0 over the last year.

While this is clearly a move in the right direction, the 9.6 million unemployed workers understate how many job openings will be needed when a robust jobs recovery finally begins, due to the existence of 5.9 million would-be workers (in August) who are currently not in the labor market, but who would be if job opportunities were strong. Many of these “missing workers” will become job seekers when we enter a robust jobs recovery, so job openings will be needed for them, too.

The job-seekers ratio, December 2000–August 2014

| Month | Unemployed job seekers per job opening |

|---|---|

| Dec-2000 | 1.1 |

| Jan-2001 | 1.1 |

| Feb-2001 | 1.3 |

| Mar-2001 | 1.3 |

| Apr-2001 | 1.3 |

| May-2001 | 1.4 |

| Jun-2001 | 1.5 |

| Jul-2001 | 1.5 |

| Aug-2001 | 1.7 |

| Sep-2001 | 1.8 |

| Oct-2001 | 2.1 |

| Nov-2001 | 2.3 |

| Dec-2001 | 2.3 |

| Jan-2002 | 2.3 |

| Feb-2002 | 2.4 |

| Mar-2002 | 2.3 |

| Apr-2002 | 2.6 |

| May-2002 | 2.4 |

| Jun-2002 | 2.5 |

| Jul-2002 | 2.5 |

| Aug-2002 | 2.4 |

| Sep-2002 | 2.5 |

| Oct-2002 | 2.4 |

| Nov-2002 | 2.4 |

| Dec-2002 | 2.8 |

| Jan-2003 | 2.3 |

| Feb-2003 | 2.5 |

| Mar-2003 | 2.8 |

| Apr-2003 | 2.8 |

| May-2003 | 2.8 |

| Jun-2003 | 2.8 |

| Jul-2003 | 2.8 |

| Aug-2003 | 2.7 |

| Sep-2003 | 2.9 |

| Oct-2003 | 2.7 |

| Nov-2003 | 2.6 |

| Dec-2003 | 2.5 |

| Jan-2004 | 2.5 |

| Feb-2004 | 2.4 |

| Mar-2004 | 2.5 |

| Apr-2004 | 2.4 |

| May-2004 | 2.2 |

| Jun-2004 | 2.4 |

| Jul-2004 | 2.1 |

| Aug-2004 | 2.2 |

| Sep-2004 | 2.1 |

| Oct-2004 | 2.1 |

| Nov-2004 | 2.3 |

| Dec-2004 | 2.1 |

| Jan-2005 | 2.2 |

| Feb-2005 | 2.1 |

| Mar-2005 | 2.0 |

| Apr-2005 | 1.9 |

| May-2005 | 2.0 |

| Jun-2005 | 1.9 |

| Jul-2005 | 1.8 |

| Aug-2005 | 1.8 |

| Sep-2005 | 1.8 |

| Oct-2005 | 1.8 |

| Nov-2005 | 1.7 |

| Dec-2005 | 1.7 |

| Jan-2006 | 1.7 |

| Feb-2006 | 1.7 |

| Mar-2006 | 1.6 |

| Apr-2006 | 1.6 |

| May-2006 | 1.6 |

| Jun-2006 | 1.6 |

| Jul-2006 | 1.8 |

| Aug-2006 | 1.6 |

| Sep-2006 | 1.5 |

| Oct-2006 | 1.5 |

| Nov-2006 | 1.5 |

| Dec-2006 | 1.5 |

| Jan-2007 | 1.6 |

| Feb-2007 | 1.5 |

| Mar-2007 | 1.4 |

| Apr-2007 | 1.5 |

| May-2007 | 1.5 |

| Jun-2007 | 1.5 |

| Jul-2007 | 1.6 |

| Aug-2007 | 1.6 |

| Sep-2007 | 1.6 |

| Oct-2007 | 1.7 |

| Nov-2007 | 1.7 |

| Dec-2007 | 1.8 |

| Jan-2008 | 1.8 |

| Feb-2008 | 1.9 |

| Mar-2008 | 1.9 |

| Apr-2008 | 2.0 |

| May-2008 | 2.1 |

| Jun-2008 | 2.3 |

| Jul-2008 | 2.4 |

| Aug-2008 | 2.6 |

| Sep-2008 | 3.0 |

| Oct-2008 | 3.1 |

| Nov-2008 | 3.4 |

| Dec-2008 | 3.7 |

| Jan-2009 | 4.4 |

| Feb-2009 | 4.6 |

| Mar-2009 | 5.4 |

| Apr-2009 | 6.1 |

| May-2009 | 6.0 |

| Jun-2009 | 6.2 |

| Jul-2009 | 6.8 |

| Aug-2009 | 6.5 |

| Sep-2009 | 6.2 |

| Oct-2009 | 6.5 |

| Nov-2009 | 6.3 |

| Dec-2009 | 6.1 |

| Jan-2010 | 5.5 |

| Feb-2010 | 6.0 |

| Mar-2010 | 5.8 |

| Apr-2010 | 5.0 |

| May-2010 | 5.1 |

| Jun-2010 | 5.3 |

| Jul-2010 | 5.0 |

| Aug-2010 | 5.0 |

| Sep-2010 | 5.2 |

| Oct-2010 | 4.8 |

| Nov-2010 | 4.9 |

| Dec-2010 | 5.0 |

| Jan-2011 | 4.8 |

| Feb-2011 | 4.6 |

| Mar-2011 | 4.4 |

| Apr-2011 | 4.5 |

| May-2011 | 4.5 |

| Jun-2011 | 4.3 |

| Jul-2011 | 4.0 |

| Aug-2011 | 4.3 |

| Sep-2011 | 3.9 |

| Oct-2011 | 4.0 |

| Nov-2011 | 4.2 |

| Dec-2011 | 3.7 |

| Jan-2012 | 3.5 |

| Feb-2012 | 3.7 |

| Mar-2012 | 3.3 |

| Apr-2012 | 3.5 |

| May-2012 | 3.4 |

| Jun-2012 | 3.3 |

| Jul-2012 | 3.5 |

| Aug-2012 | 3.4 |

| Sep-2012 | 3.4 |

| Oct-2012 | 3.2 |

| Nov-2012 | 3.2 |

| Dec-2012 | 3.4 |

| Jan-2013 | 3.3 |

| Feb-2013 | 3.0 |

| Mar-2013 | 3.0 |

| Apr-2013 | 3.1 |

| May-2013 | 3.0 |

| Jun-2013 | 3.0 |

| Jul-2013 | 3.0 |

| Aug-2013 | 2.9 |

| Sep-2013 | 2.8 |

| Oct-2013 | 2.8 |

| Nov-2013 | 2.6 |

| Dec-2013 | 2.6 |

| Jan-2014 | 2.6 |

| Feb-2014 | 2.5 |

| Mar-2014 | 2.5 |

| Apr-2014 | 2.2 |

| May-2014 | 2.1 |

| Jun-2014 | 2.0 |

| Jul-2014 | 2.1 |

| Aug-2014 | 2.0 |

Note: Shaded areas denote recessions.

Source: EPI analysis of Bureau of Labor Statistics Job Openings and Labor Turnover Survey and Current Population Survey

Even further, a job opening when the labor market is weak often does not mean the same thing as a job opening when the labor market is strong. There is a wide range of “recruitment intensity” with which a company can deal with a job opening. For example, if a company is trying hard to fill an opening, it may increase the compensation package and/or scale back the required qualifications. Conversely, if it is not trying very hard, it may hike up the required qualifications and/or offer a meager compensation package. Perhaps unsurprisingly, research shows that recruitment intensity is cyclical; it tends to be stronger when the labor market is strong, and weaker when the labor market is weak. This means that when a job opening goes unfilled when the labor market is weak, as it is today, companies may very well be holding out for an overly qualified candidate at a cheap price.

Job Openings Are Up, but the Hires Rate Is Down

The August Job Openings and Labor Turnover Survey (JOLTS) data release this morning from the Bureau of Labor Statistics showed mixed results. While the job openings rose, the hires rate fell. Layoffs continue to trend downwards, while the quits rate remained flat—it’s been flat now since February.

The figure below shows the hires rate, the quits rate, and the layoffs rate. The first thing to note is that layoffs, which shot up during the recession, recovered quickly once the recession officially ended. Layoffs have been at prerecession levels for more than three years. This makes sense—the economy is in a recovery and businesses are no longer shedding workers at an elevated rate. And the continued trend downward in August is a good sign.

But for a full recovery in the labor market to occur, two key things need to happen: Layoffs need to come down, and hiring needs to pick up. Hiring is the side of that equation that, while generally improving, has not yet come close to a full recovery. The hires rate remains well below its prerecession level.

Another piece of the puzzle is voluntary quits (shown by the quits rate in the figure below). A larger number of people voluntarily quitting their job indicates a labor market in which hiring is prevalent and workers are able to leave jobs that are not right for them, and find new ones. The voluntary quits rate, which has been flat for the last seven months, is also nowhere near a full recovery. There are 14 percent percent fewer voluntary quits each month than there were before the recession began, and the quits rate is the same as it was last October. Low voluntary quits indicate that there are a large number of workers who are locked into jobs who would leave if they could.

Hires, quits, and layoff rates, December 2000–August 2014

| Month | Hires rate | Layoffs rate | Quits rate |

|---|---|---|---|

| Dec-2000 | 4.1% | 1.4% | 2.3% |

| Jan-2001 | 4.4% | 1.6% | 2.6% |

| Feb-2001 | 4.1% | 1.4% | 2.5% |

| Mar-2001 | 4.2% | 1.6% | 2.4% |

| Apr-2001 | 4.0% | 1.5% | 2.4% |

| May-2001 | 4.0% | 1.5% | 2.4% |

| Jun-2001 | 3.8% | 1.5% | 2.3% |

| Jul-2001 | 3.9% | 1.5% | 2.2% |

| Aug-2001 | 3.8% | 1.4% | 2.1% |

| Sep-2001 | 3.8% | 1.6% | 2.1% |

| Oct-2001 | 3.8% | 1.7% | 2.2% |

| Nov-2001 | 3.7% | 1.6% | 2.0% |

| Dec-2001 | 3.7% | 1.4% | 2.0% |

| Jan-2002 | 3.7% | 1.4% | 2.2% |

| Feb-2002 | 3.7% | 1.5% | 2.0% |

| Mar-2002 | 3.5% | 1.4% | 1.9% |

| Apr-2002 | 3.8% | 1.5% | 2.1% |

| May-2002 | 3.8% | 1.5% | 2.1% |

| Jun-2002 | 3.7% | 1.4% | 2.0% |

| Jul-2002 | 3.8% | 1.5% | 2.1% |

| Aug-2002 | 3.7% | 1.4% | 2.0% |

| Sep-2002 | 3.7% | 1.4% | 2.0% |

| Oct-2002 | 3.7% | 1.4% | 2.0% |

| Nov-2002 | 3.8% | 1.5% | 1.9% |

| Dec-2002 | 3.8% | 1.5% | 2.0% |

| Jan-2003 | 3.8% | 1.5% | 1.9% |

| Feb-2003 | 3.6% | 1.5% | 1.9% |

| Mar-2003 | 3.4% | 1.4% | 1.9% |

| Apr-2003 | 3.6% | 1.6% | 1.8% |

| May-2003 | 3.5% | 1.5% | 1.8% |

| Jun-2003 | 3.7% | 1.6% | 1.8% |

| Jul-2003 | 3.6% | 1.6% | 1.8% |

| Aug-2003 | 3.6% | 1.5% | 1.8% |

| Sep-2003 | 3.7% | 1.5% | 1.9% |

| Oct-2003 | 3.8% | 1.4% | 1.9% |

| Nov-2003 | 3.6% | 1.4% | 1.9% |

| Dec-2003 | 3.8% | 1.5% | 1.9% |

| Jan-2004 | 3.7% | 1.5% | 1.9% |

| Feb-2004 | 3.6% | 1.4% | 1.9% |

| Mar-2004 | 3.9% | 1.4% | 2.0% |

| Apr-2004 | 3.9% | 1.5% | 2.0% |

| May-2004 | 3.8% | 1.4% | 1.9% |

| Jun-2004 | 3.8% | 1.4% | 2.0% |

| Jul-2004 | 3.7% | 1.4% | 2.0% |

| Aug-2004 | 3.9% | 1.5% | 2.0% |

| Sep-2004 | 3.8% | 1.4% | 2.0% |

| Oct-2004 | 3.9% | 1.4% | 2.0% |

| Nov-2004 | 3.9% | 1.5% | 2.1% |

| Dec-2004 | 4.0% | 1.5% | 2.1% |

| Jan-2005 | 3.9% | 1.4% | 2.1% |

| Feb-2005 | 3.9% | 1.4% | 2.0% |

| Mar-2005 | 3.9% | 1.5% | 2.1% |

| Apr-2005 | 4.0% | 1.4% | 2.1% |

| May-2005 | 3.9% | 1.4% | 2.1% |

| Jun-2005 | 3.9% | 1.5% | 2.1% |

| Jul-2005 | 3.9% | 1.4% | 2.0% |

| Aug-2005 | 4.0% | 1.4% | 2.2% |

| Sep-2005 | 4.0% | 1.4% | 2.3% |

| Oct-2005 | 3.8% | 1.3% | 2.2% |

| Nov-2005 | 3.9% | 1.2% | 2.2% |

| Dec-2005 | 3.7% | 1.3% | 2.1% |

| Jan-2006 | 3.9% | 1.3% | 2.1% |

| Feb-2006 | 3.9% | 1.3% | 2.2% |

| Mar-2006 | 3.9% | 1.2% | 2.2% |

| Apr-2006 | 3.8% | 1.3% | 2.1% |

| May-2006 | 4.0% | 1.4% | 2.2% |

| Jun-2006 | 3.9% | 1.2% | 2.2% |

| Jul-2006 | 3.9% | 1.3% | 2.2% |

| Aug-2006 | 3.8% | 1.2% | 2.2% |

| Sep-2006 | 3.8% | 1.3% | 2.1% |

| Oct-2006 | 3.8% | 1.3% | 2.1% |

| Nov-2006 | 4.0% | 1.3% | 2.3% |

| Dec-2006 | 3.8% | 1.3% | 2.2% |

| Jan-2007 | 3.8% | 1.2% | 2.2% |

| Feb-2007 | 3.8% | 1.3% | 2.2% |

| Mar-2007 | 3.8% | 1.3% | 2.2% |

| Apr-2007 | 3.7% | 1.3% | 2.1% |

| May-2007 | 3.8% | 1.3% | 2.2% |

| Jun-2007 | 3.8% | 1.3% | 2.0% |

| Jul-2007 | 3.7% | 1.3% | 2.1% |

| Aug-2007 | 3.7% | 1.3% | 2.1% |

| Sep-2007 | 3.7% | 1.5% | 1.9% |

| Oct-2007 | 3.8% | 1.4% | 2.1% |

| Nov-2007 | 3.7% | 1.4% | 2.0% |

| Dec-2007 | 3.6% | 1.3% | 2.0% |

| Jan-2008 | 3.5% | 1.3% | 2.0% |

| Feb-2008 | 3.5% | 1.4% | 2.0% |

| Mar-2008 | 3.4% | 1.3% | 1.9% |

| Apr-2008 | 3.5% | 1.3% | 2.1% |

| May-2008 | 3.3% | 1.3% | 1.9% |

| Jun-2008 | 3.5% | 1.5% | 1.9% |

| Jul-2008 | 3.3% | 1.4% | 1.8% |

| Aug-2008 | 3.3% | 1.6% | 1.7% |

| Sep-2008 | 3.1% | 1.4% | 1.8% |

| Oct-2008 | 3.3% | 1.6% | 1.8% |

| Nov-2008 | 2.9% | 1.6% | 1.5% |

| Dec-2008 | 3.2% | 1.8% | 1.6% |

| Jan-2009 | 3.1% | 1.9% | 1.5% |

| Feb-2009 | 3.0% | 1.9% | 1.5% |

| Mar-2009 | 2.8% | 1.8% | 1.4% |

| Apr-2009 | 2.9% | 2.0% | 1.3% |

| May-2009 | 2.8% | 1.6% | 1.3% |

| Jun-2009 | 2.8% | 1.6% | 1.3% |

| Jul-2009 | 2.9% | 1.7% | 1.3% |

| Aug-2009 | 2.9% | 1.6% | 1.3% |

| Sep-2009 | 3.0% | 1.6% | 1.3% |

| Oct-2009 | 2.9% | 1.5% | 1.3% |

| Nov-2009 | 3.1% | 1.4% | 1.4% |

| Dec-2009 | 2.9% | 1.5% | 1.3% |

| Jan-2010 | 3.0% | 1.4% | 1.3% |

| Feb-2010 | 2.9% | 1.4% | 1.3% |

| Mar-2010 | 3.2% | 1.4% | 1.4% |

| Apr-2010 | 3.1% | 1.3% | 1.5% |

| May-2010 | 3.4% | 1.3% | 1.4% |

| Jun-2010 | 3.1% | 1.5% | 1.5% |

| Jul-2010 | 3.2% | 1.6% | 1.4% |

| Aug-2010 | 3.0% | 1.4% | 1.4% |

| Sep-2010 | 3.1% | 1.4% | 1.4% |

| Oct-2010 | 3.1% | 1.3% | 1.4% |

| Nov-2010 | 3.2% | 1.4% | 1.4% |

| Dec-2010 | 3.2% | 1.4% | 1.5% |

| Jan-2011 | 3.0% | 1.3% | 1.4% |

| Feb-2011 | 3.1% | 1.3% | 1.4% |

| Mar-2011 | 3.2% | 1.3% | 1.5% |

| Apr-2011 | 3.2% | 1.3% | 1.5% |

| May-2011 | 3.1% | 1.3% | 1.5% |

| Jun-2011 | 3.3% | 1.4% | 1.5% |

| Jul-2011 | 3.1% | 1.3% | 1.5% |

| Aug-2011 | 3.2% | 1.3% | 1.5% |

| Sep-2011 | 3.3% | 1.3% | 1.5% |

| Oct-2011 | 3.2% | 1.3% | 1.5% |

| Nov-2011 | 3.2% | 1.3% | 1.5% |

| Dec-2011 | 3.2% | 1.3% | 1.5% |

| Jan-2012 | 3.2% | 1.2% | 1.5% |

| Feb-2012 | 3.3% | 1.3% | 1.6% |

| Mar-2012 | 3.3% | 1.2% | 1.6% |

| Apr-2012 | 3.2% | 1.4% | 1.6% |

| May-2012 | 3.3% | 1.4% | 1.6% |

| Jun-2012 | 3.2% | 1.3% | 1.6% |

| Jul-2012 | 3.2% | 1.2% | 1.6% |

| Aug-2012 | 3.3% | 1.4% | 1.6% |

| Sep-2012 | 3.1% | 1.3% | 1.4% |

| Oct-2012 | 3.2% | 1.3% | 1.5% |

| Nov-2012 | 3.3% | 1.3% | 1.6% |

| Dec-2012 | 3.2% | 1.2% | 1.6% |

| Jan-2013 | 3.2% | 1.2% | 1.7% |

| Feb-2013 | 3.4% | 1.2% | 1.7% |

| Mar-2013 | 3.2% | 1.3% | 1.6% |

| Apr-2013 | 3.3% | 1.3% | 1.6% |

| May-2013 | 3.3% | 1.3% | 1.6% |

| Jun-2013 | 3.2% | 1.2% | 1.6% |

| Jul-2013 | 3.3% | 1.2% | 1.7% |

| Aug-2013 | 3.4% | 1.2% | 1.7% |

| Sep-2013 | 3.4% | 1.3% | 1.7% |

| Oct-2013 | 3.3% | 1.1% | 1.8% |

| Nov-2013 | 3.3% | 1.1% | 1.8% |

| Dec-2013 | 3.3% | 1.2% | 1.8% |

| Jan-2014 | 3.3% | 1.2% | 1.7% |

| Feb-2014 | 3.4% | 1.2% | 1.8% |

| Mar-2014 | 3.4% | 1.2% | 1.8% |

| Apr-2014 | 3.5% | 1.2% | 1.8% |

| May-2014 | 3.4% | 1.2% | 1.8% |

| Jun-2014 | 3.5% | 1.2% | 1.8% |

| Jul-2014 | 3.6% | 1.2% | 1.8% |

| Aug-2014 | 3.3% | 1.1% | 1.8% |

Note: Shaded areas denote recessions. The hires rate is the number of hires during the entire month as a percent of total employment. The layoff rate is the number of layoffs and discharges during the entire month as a percent of total employment. The quits rate is the number of quits during the entire month as a percent of total employment.

Source: EPI analysis of Bureau of Labor Statistics Job Openings and Labor Turnover Survey

How Do U.S. Retirees Compare with Those in Other Countries?

In Monday’s Wall Street Journal, Andrew Biggs and Sylvester Schieber cited these statistics from the Organisation for Economic Co-operation and Development (OECD):

“Despite a supposedly stingy Social Security program and ineffective retirement-savings vehicles, the average U.S. retiree has an income equal to 92% of the average American income, handily outpacing the Scandinavian countries (81%), Germany (85%), Belgium (77%) and many others.”

Meanwhile, in its Global AgeWatch Index released Tuesday, HelpAge International ranked the United States #8 among the best countries to grow old in, ahead of France (#18) but trailing Norway, Sweden, Switzerland, Canada, Germany, Netherlands, and Iceland (#1-7). Afghanistan (#96) was in last place.

It’s not hard to imagine how wealthy countries like Norway and the United States outrank poor and war-torn countries like Afghanistan. But the relative ranking of the wealthy countries comes as a surprise. How did the United States and other English-speaking countries like the United Kingdom and Australia, not known for their generous social insurance programs or employee benefits, come close to the Nordic cradle-to-grave welfare states and handily beat out France, with its famously generous pensions and high-quality affordable healthcare? Are older Americans really living in a retiree paradise?

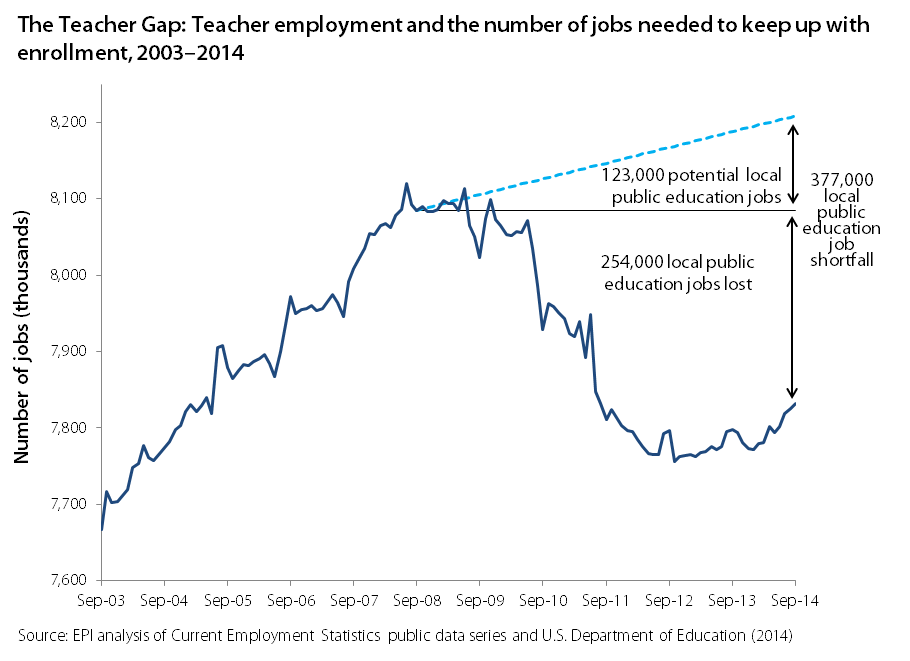

Strong Jobs Numbers for Teachers in September, but Large Jobs Gap Remains

In September, public-sector employment increased by 12,000, with the majority of that growth coming from local government education—an increase of 6,700 jobs. Local government education is largely jobs in public K-12 education (the majority of which are teachers, but also teacher aides, librarians, guidance counselors, administrators, support staff, etc.).

While this is clearly a positive sign, unfortunately, the number of teachers and related education staffers fell dramatically in the recession and has failed to get anywhere near its pre-recession level, let alone the level that would be required to keep up with the expanding student population. The figure below breaks down the teacher gap. The dark blue line illustrates the level of teacher employment. While the most recent positive trend is obvious, the longer term losses are also readily apparently.

Along with dismal trends in public sector employment in general, about a quarter million public education jobs were lost in the great recession and its aftermath. If we add to that the number of public education jobs that should have been added simply to keep up with growing enrollment, then we are currently experiencing a 377,000 job shortfall in local public education. The costs of a significant teacher gap are measurable: larger class sizes, fewer teacher aides, fewer extracurricular activities, and changes to the curriculum.

The Unemployment Rate Fails to Take into Account Missing Workers

Let’s put the pieces of the puzzle together. The unemployment rate fell in September by 0.2 percent points, from 6.1 to 5.9 percent. There was also a decrease in the sheer number of unemployed people—down 329,000 from August. On its face, this sounds like good news.

At the same time, the employment-to-population ratio has remained 59.0 percent for four months running. If the unemployment rate dropped and the employment-to-population ratio remained the same, the missing part of the puzzle is the labor force participation rate. In September, the labor force participation rate dropped to 62.7 percent. The last time the labor force participation rate was this low was February 1978. And, the biggest drop in labor force participation was among prime-age workers, 25-54 years old.

Over the last year, the labor force participation rate fell 0.5 percentage points. Therefore, it’s not surprising that missing workers—potential workers who are neither working nor actively seeking work due to the weak labor market—are at an all-time-high of 6.3 million. The vast majority of them (3.4 million) are 25 to 54 years old.

To put the official unemployment rate in perspective, the figure below shows the actual unemployment rate and the unemployment rate if the missing workers were in the labor force looking for work and thus counted as unemployed. The unemployment rate including the missing workers sits at 9.6 percent, the same rate for the last four months. Perhaps, this is a better indication of the slack in the labor market and the reason why wage growth has remained so sluggish even with a falling unemployment rate.

The unemployment rate is vastly understating weakness in today's labor market: Unemployment rate, actual and if missing workers* were looking for work, January 2006–November 2014

| Date | Actual | If missing workers were looking for work |

|---|---|---|

| 2006-01-01 | 4.7% | 5.0% |

| 2006-02-01 | 4.8% | 4.8% |

| 2006-03-01 | 4.7% | 4.8% |

| 2006-04-01 | 4.7% | 4.9% |

| 2006-05-01 | 4.6% | 4.8% |

| 2006-06-01 | 4.6% | 4.7% |

| 2006-07-01 | 4.7% | 4.8% |

| 2006-08-01 | 4.7% | 4.6% |

| 2006-09-01 | 4.5% | 4.6% |

| 2006-10-01 | 4.4% | 4.4% |

| 2006-11-01 | 4.5% | 4.4% |

| 2006-12-01 | 4.4% | 4.1% |

| 2007-01-01 | 4.6% | 4.4% |

| 2007-02-01 | 4.5% | 4.4% |

| 2007-03-01 | 4.4% | 4.3% |

| 2007-04-01 | 4.5% | 4.9% |

| 2007-05-01 | 4.4% | 4.8% |

| 2007-06-01 | 4.6% | 4.8% |

| 2007-07-01 | 4.7% | 4.9% |

| 2007-08-01 | 4.6% | 5.1% |

| 2007-09-01 | 4.7% | 4.9% |

| 2007-10-01 | 4.7% | 5.2% |

| 2007-11-01 | 4.7% | 4.9% |

| 2007-12-01 | 5.0% | 5.1% |

| 2008-01-01 | 5.0% | 4.8% |

| 2008-02-01 | 4.9% | 5.0% |

| 2008-03-01 | 5.1% | 5.1% |

| 2008-04-01 | 5.0% | 5.2% |

| 2008-05-01 | 5.4% | 5.4% |

| 2008-06-01 | 5.6% | 5.6% |

| 2008-07-01 | 5.8% | 5.7% |

| 2008-08-01 | 6.1% | 6.0% |

| 2008-09-01 | 6.1% | 6.3% |

| 2008-10-01 | 6.5% | 6.5% |

| 2008-11-01 | 6.8% | 7.1% |

| 2008-12-01 | 7.3% | 7.5% |

| 2009-01-01 | 7.8% | 8.2% |

| 2009-02-01 | 8.3% | 8.7% |

| 2009-03-01 | 8.7% | 9.3% |

| 2009-04-01 | 9.0% | 9.4% |

| 2009-05-01 | 9.4% | 9.7% |

| 2009-06-01 | 9.5% | 9.9% |

| 2009-07-01 | 9.5% | 10.1% |

| 2009-08-01 | 9.6% | 10.4% |

| 2009-09-01 | 9.8% | 10.9% |

| 2009-10-01 | 10.0% | 11.3% |

| 2009-11-01 | 9.9% | 11.2% |

| 2009-12-01 | 9.9% | 11.7% |

| 2010-01-01 | 9.7% | 11.3% |

| 2010-02-01 | 9.8% | 11.4% |

| 2010-03-01 | 9.9% | 11.3% |

| 2010-04-01 | 9.9% | 11.0% |

| 2010-05-01 | 9.6% | 11.1% |

| 2010-06-01 | 9.4% | 11.1% |

| 2010-07-01 | 9.5% | 11.3% |

| 2010-08-01 | 9.5% | 11.1% |

| 2010-09-01 | 9.5% | 11.3% |

| 2010-10-01 | 9.5% | 11.5% |

| 2010-11-01 | 9.8% | 11.7% |

| 2010-12-01 | 9.4% | 11.6% |

| 2011-01-01 | 9.1% | 11.4% |

| 2011-02-01 | 9.0% | 11.4% |

| 2011-03-01 | 9.0% | 11.3% |

| 2011-04-01 | 9.1% | 11.4% |

| 2011-05-01 | 9.0% | 11.4% |

| 2011-06-01 | 9.1% | 11.5% |

| 2011-07-11 | 9.0% | 11.7% |

| 2011-08-20 | 9.0% | 11.4% |

| 2011-09-01 | 9.0% | 11.3% |

| 2011-10-11 | 8.8% | 11.2% |

| 2011-11-20 | 8.6% | 11.0% |

| 2011-12-30 | 8.5% | 11.0% |

| 2012-01-12 | 8.2% | 10.8% |

| 2012-02-12 | 8.3% | 10.7% |

| 2012-03-12 | 8.2% | 10.7% |

| 2012-04-12 | 8.2% | 10.9% |

| 2012-05-12 | 8.2% | 10.6% |

| 2012-06-12 | 8.2% | 10.5% |

| 2012-07-12 | 8.2% | 10.8% |

| 2012-08-12 | 8.1% | 10.8% |

| 2012-09-12 | 7.8% | 10.4% |

| 2012-10-12 | 7.8% | 10.0% |

| 2012-11-12 | 7.8% | 10.3% |

| 2012-12-12 | 7.9% | 10.3% |

| 2013-01-12 | 7.9% | 10.4% |

| 2013-02-12 | 7.7% | 10.5% |

| 2013-03-12 | 7.5% | 10.6% |

| 2013-04-12 | 7.5% | 10.5% |

| 2013-05-12 | 7.5% | 10.3% |

| 2013-06-12 | 7.5% | 10.3% |

| 2013-07-12 | 7.3% | 10.2% |

| 2013-08-12 | 7.2% | 10.3% |

| 2013-09-12 | 7.2% | 10.3% |

| 2013-10-12 | 7.2% | 10.7% |

| 2013-11-12 | 7.0% | 10.3% |

| 2013-12-12 | 6.7% | 10.2% |

| 2014-01-12 | 6.6% | 10.0% |

| 2014-02-12 | 6.7% | 10.0 |

| 2014-03-12 | 6.7% | 9.8% |

| 2014-04-12 | 6.3% | 9.9% |

| 2014-05-12 | 6.3% | 9.7% |

| 2014-06-12 | 6.1% | 9.6% |

| 2014-07-12 | 6.2% | 9.6% |

| 2014-08-12 | 6.1% | 9.6% |

| 2014-09-12 | 5.9% | 9.6% |

| 2014-10-12 | 5.8% | 9.1% |

| 2014-11-12 | 5.8% | 9.2% |

* Potential workers who, due to weak job opportunities, are neither employed nor actively seeking work

Source: EPI analysis of Mitra Toossi, “Labor Force Projections to 2016: More Workers in Their Golden Years,” Bureau of Labor Statistics Monthly Labor Review, November 2007; and Current Population Survey public data series

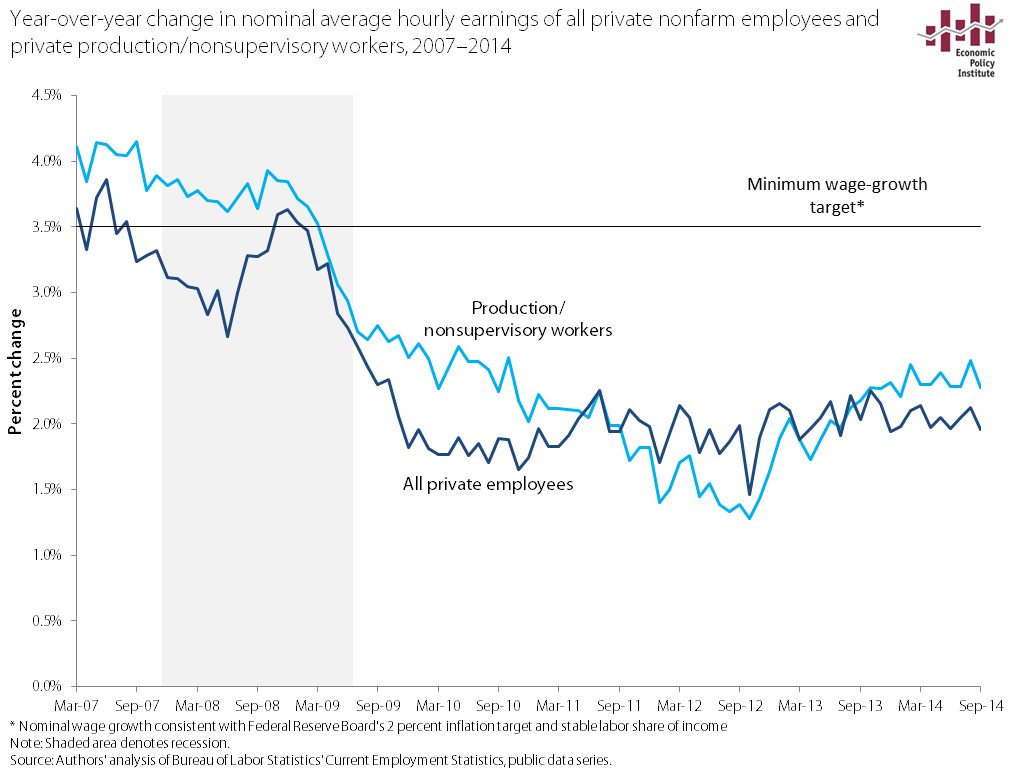

Wage Growth Continues to be Sluggish

While the BLS reported positive overall jobs numbers for September, one notable downside of this morning’s release is that wages grew not at all in the last month. Average hourly earnings of all employees on nonfarm payrolls were little changed (a one cent decline) and average hourly earnings of production and nonsupervisory employees on private nonfarm payrolls saw zero growth. That said, I’d caution reading too much into one month’s numbers because monthly changes can be volatile and longer term trends are more indicative of the overall health of the economy. The fact is that wage growth for both series has been hovering just above 2 percent over the last year.

As shown in the figure below, wage growth is far below the 3.5 percent rate consistent with the Federal Reserve Board’s inflation target of 2 percent. It’s clear that Fed policymakers should abandon notions of slowing the economy. (For a longer analysis of what to watch for in upcoming months on wage growth, see this explainer.)

Walton Family Net Worth is a Case Study Why Growing Wealth Concentration Isn’t Just an Academic Worry

Earlier this year, economist Thomas Piketty caused a stir with a book arguing that the future in advanced economies could see a relentless concentration of wealth among a small sliver of families, whose fortunes would increasingly dwarf those of the typical citizen. The last couple of weeks have seen the release of a couple of key barometers of wealth inequality in America, and combining them, it’s easy to see that this hypothesis of ever-concentrating wealth seems likely indeed. In the past month, the Federal Reserve released its triennial Survey of Consumer Finance (SCF) for 2013, while Forbes magazine released their annual list of the 400 wealthiest Americans.

The SFC is the most comprehensive and high-quality measure of Americans’ wealth up and down the distribution. It makes a special effort to sample very high wealth American households, but actually explicitly excludes listed members of the Forbes 400 (for reasons of confidentiality). The Forbes 400, as is well known, puts a dollar value on the net worth of the 400 wealthiest Americans. There is plenty of material in these releases to assess the current state of wealth inequality in America.

Take one example, that we’ve calculated before: comparing the family wealth of six of the wealthiest members of the Walton family (reported at just under $145 billion in 2013) with the number of American families that you could add together and still have their net worth come in less than the 6 Walton heirs: 52.5 million, or 42.9 percent of American families.

Some have objected to this statistic on the grounds that the negative net worth families (11.5 percent of all American families) somehow shouldn’t count in this calculation. So, try another statistic: how many families that held the median wealth would you need to add together to equal the holdings of the six Walton heirs: more than 1.7 million. The median wealthholder in the United States, remember, has more wealth than half of all American families and less wealth than half (around $81,200 in 2013).

So, what this statistic means is that you’d essentially need a large city’s worth of these typical American families to equal the wealth of the six Walton heirs. And this number has grown steadily over time, as the figure below shows. The falling wealth of the median family (driven largely by the housing bubble burst) and the steadily rising wealth at the very top—including the Walton heirs—have combined to make the gap between them larger and larger over time.

Myths and Facts about Corporate Taxes, Part 1: Do American Corporations Pay the Highest Taxes in the World?

It’s become conventional wisdom that American corporate tax rates are the highest in the developed world, leaving American businesses at a competitive disadvantage—and that the only solution is fundamental tax reform (a phrase used by both Republicans and Democrats). Just yesterday, the Washington Post reported offhandedly that U.S. businesses “currently labor under the highest corporate tax rate in the developed world.” The fact is there are a lot of myths about the corporate tax code—myths that are repeated by corporations that stand to benefit from them. So, let’s look at the facts.

Myth: American corporations pay more in taxes than their competitors in any other country.

Fact: Any claim that the United States has the highest corporate tax rate in the world should be accompanied by a clarification that the rate American companies actually pay, on average, is comparable to what their foreign competitors pay.

Yes, the tax rates on the books (the “statutory” rates) in the United States are high relative to our international peers, but the U.S. corporate tax code has become so riddled with loopholes—and American corporations so adept at exploiting them—that the total amount of taxes actually paid by U.S. corporations (the “effective” corporate tax rate) is far less.

The Government Accountability Office found that large, profitable American corporations pay an effective rate of less than 13 percent in U.S. federal taxes; when state and foreign taxes are included, the rate only increases to 17 percent—a far cry from the statutory 39 percent. Meanwhile, the Congressional Research Service found that the effective rate here is nearly identical to the weighted average of corporate taxes in the world’s other most developed economies. (EPI’s Thomas Hungerford found the same thing.)

What to Watch on Jobs Day: Nominal Wages, Teacher Gap, and Upward Revisions

Tomorrow, the Bureau of Labor Statistics will release the September numbers on employment, unemployment, and nominal wages. While the report contains a host of data, there are three particular numbers I’m going to be watching closely.

First, the overall employment numbers from the payroll survey were lower than expected last month. Consensus estimates had projected job growth of about 230,000, but they came in at only 142,000. The consensus so far for September is again in the low 200,000s. So, two key things to watch: whether there are any upward revisions to the August employment numbers and whether the September numbers come in below consensus two months in a row. Last month, I suggested that slow job growth should make those arguing that policymakers need to worry about an overheating economy and inflationary pressures reconsider. Tomorrow, we will get some more information that can inform the question of whether we are at a new lower trend, which I hope not, or whether last month was a blip in a jobs picture that has otherwise been consistent for much of this year.

Second, with kids heading back to the classroom, it’s worth re-examining the teacher gap—the gap between actual local public education employment and what is needed to keep up with growth in the student population. During the recession, thousands of local public education jobs were lost, and those losses continued deep into the official economic recovery (as did public sector jobs in general). The costs of a significant teacher gap are measurable: larger class sizes, fewer teacher aides, fewer extracurricular activities, and changes to the curriculum. And, in sheer numbers, the teacher gap can explain a non-trivial part of the overall jobs gap. On Friday, I will compare where jobs in public education should be, using the precession ratio, student population growth, and the most recent jobs numbers.

Third, I’ll continue to track nominal wages. Last month, Josh Bivens and I explained how very far we are from the kind of wage growth that would suggest that the Federal Reserve can put the brakes on the economy. On Friday, we will put the latest nominal wage trends in perspective, both historically and against target level wage growth. These numbers on nominal wage growth are likely to be the single most important indicator in coming months driving Federal Reserve decisions.

What’s Up (or Down) With the Boomers’ Retirement Savings?!

The recent release of the Federal Reserve’s triennial Survey of Consumer Finances has many retirement researchers scratching their heads. As expected, GenXers’ savings (shaded blue lines in Figure 1) benefited from the rebound in stock prices and the economic recovery. Meanwhile, Silent Generation retirees (dashed red and yellow lines) saw a surprisingly large bounce in retirement savings. But Baby Boomers (solid purple, black and green lines) who were approaching retirement when the housing bubble burst saw weak gains or even losses between 2010 and 2013. Those who were born between 1949 and 1954, for example, saw a decline in mean retirement account savings from $176,000 in 2010 to $167,000 in 2013 (values are in 2013 dollars rounded to the nearest $1,000). This is far below the $199,000 their predecessors—older Boomers born between 1943 and 1948—had accumulated at the same age in 2007.

It’s not news that the Boomers’ retirement savings took a hit during the downturn. What’s more surprising is that they have fared so poorly in the recovery compared to younger workers and retirees. One explanation is simply that the Boomers, unlike older retirees, were hit by both the stock and labor market downturns and didn’t benefit as much from the subsequent rebound in stock prices as younger workers who were heavily invested in stocks through target date funds.

Mean retirement account balances by birth cohort , 1989–2013

| 1931–1936 | 1937–1942 | 1943–1948 | 1949–1954 | 1955–1960 | 1961–1966 | 1967–1972 | 1973–1978 | |

|---|---|---|---|---|---|---|---|---|

| 1989 | $56,383 | $44,937 | $30,369 | $27,428 | $7,419 | |||

| 1992 | $68,060 | $75,678 | $44,749 | $22,920 | $12,552 | $7,176 | ||

| 1995 | $64,254 | $90,781 | $75,262 | $50,090 | $22,642 | $16,480 | ||

| 1998 | $113,886 | $114,908 | $91,373 | $64,166 | $48,084 | $29,458 | $11,059 | |

| 2001 | $124,634 | $162,156 | $155,809 | $91,203 | $75,722 | $40,706 | $18,841 | |

| 2004 | $111,834 | $149,322 | $158,827 | $128,848 | $81,818 | $54,205 | $27,100 | $11,640 |

| 2007 | $109,709 | $164,654 | $199,218 | $161,187 | $114,482 | $69,036 | $41,928 | $18,436 |

| 2010 | $80,091 | $138,102 | $209,317 | $175,697 | $138,713 | $85,454 | $48,472 | $25,864 |

| 2013 | $88,944 | $168,828 | $214,277 | $166,597 | $154,630 | $103,838 | $75,433 | $46,593 |

Source: EPI's analysis of the Federal Reserve's Survey of Consumer Finance

TIP: For apples-to-apples comparisons, look at how successive 6-year birth cohorts fared at 6-year intervals (2013, 2007, and 2001), ignoring intervening surveys.

LA Hotel Workers Win $15.37 Minimum Wage: a New Day for Labor in the United States?

The Los Angeles City Council’s vote to raise the minimum wage for hotel workers is another herald of big changes coming in the way the United States deals with low wages and inequality. The Council voted 12 to 3 to raise the minimum wage for workers at large hotels to $15.37 an hour by 2017, which is more than the national median wage for women ($15.10 in 2013). Mayor Eric Garcetti will sign the bill after it receives a confirming second vote next week.

The LA County AFL-CIO, UNITE HERE Local 11 (the LA area union of hospitality workers), and the Los Angeles Alliance for a New Economy, which led the campaign, don’t intend to rest on their laurels and will push for an across-the-board minimum wage increase to $13.25 an hour, far above the national minimum wage of $7.25 an hour. Mayor Garcetti strongly supports that bill, too.

As in Seattle, where a union-led coalition won a $15 minimum wage, the people of Los Angeles realize that many businesses will not share revenues fairly with their workers unless they are required to do so. Even businesses that want to pay their employees a living wage feel constrained by their competitors: How can they compete with a competitor paying its workers $5.00 an hour less? The only way to break through these constraints is to reset labor standards to a level that provides a decent living. As Franklin Roosevelt said when he first sent minimum wage legislation to Congress in 1933: “No business which depends for existence on paying less than living wages to its workers has any right to continue in this country… By living wages, I mean more than a bare subsistence level. I mean the wages of decent living.”

Now It’s Explicit: Fighting Inflation Is a War to Ensure That Real Wages for the Vast Majority Never Grow

Remember that episode of The West Wing when Josh Lyman announced a secret plan to fight inflation? That was great. Turns out that Dallas Federal Reserve Bank President Richard Fisher has a secret paper telling us how to fight inflation: stop progress in reducing unemployment so that nominal wages never grow fast enough to actually boost living standards (or, never grow fast enough to boost real wages).

Last week, Fisher argued that a so-far unpublished (i.e. secret) paper by his staff showed that “declines in the unemployment rate below 6.1 percent exert significantly higher wage pressures than if the rate is above 6.1 percent.”

In the interview, Fisher mostly characterized this as a Phillips curve that is flat at unemployment rates higher than 6.1 percent, but which starts to have a negative slope below this rate, meaning that future declines in unemployment should be associated with higher rates of wage-growth. However, if you’re really thinking in terms of a stable Phillips Curve, this means that we can simply choose what unemployment/wage-inflation combination we’d like without worrying about accelerating inflation. Currently, nominal wage-growth is running around 2-2.5 percent. But as we’ve shown before, even the Fed’s too-conservative 2 percent inflation target is consistent with nominal wage growth of closer to 4 percent. So we have plenty of room to move “up” Fisher’s Phillips Curve before hitting even conservative inflation targets.

2013 ACS Shows Depth of Native American Poverty and Different Degrees of Economic Well-Being for Asian Ethnic Groups

Thursday’s release of 2013 American Community Survey (ACS) data allows us to fill in the blanks for minority populations that were not covered in Tuesday’s Census Bureau report on income, poverty, and health insurance coverage in 2013. ACS is an annual nationwide survey that provides detailed demographic, social, and economic data for smaller populations like Native Americans and the thirteen distinct ethnic groups that make up the Asian population.

Together with the 2013 Income, Poverty, and Health Insurance Coverage report, the 2013 ACS data provide a more complete picture of the economic status of America’s various racial and ethnic groups. This information helps to address the sense of “invisibility” felt by many of these groups, provides critical information for the states and local communities where these populations are concentrated and expands the scope for evaluating the impact of national policies.

Between 2012 and 2013, the real median household income for Native Americans increased 2.3 percent to $36,641. This was 70 percent of the national average in 2013 and $3,066 (-7.7 percent) lower than the group’s 2007 pre-recession level.

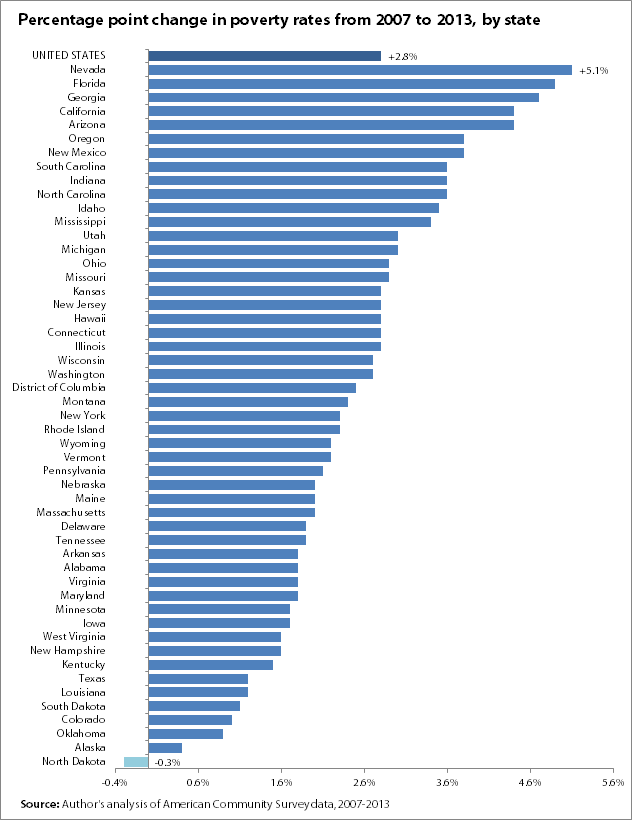

ACS Data Show Almost No Improvement in State Poverty Rates

The American Community Survey (ACS) poverty data that were released by the Census Bureau earlier today showed that poverty rates were essentially unchanged from 2012 to 2013 in virtually every state.1 Only six states had significant changes in their poverty rates: Colorado (-0.7 percentage points), New Hampshire (-1.3 percentage points), New Jersey (+0.6 percentage points), New Mexico (+1.1 percentage points), Texas (-0.4 percentage points), and Wyoming (-1.7 percentage points). All other states had no significant change from their 2012 poverty rates.

The increases in poverty in New Jersey and New Mexico are the most troubling, although the lack of any significant decrease in most other states is also deeply frustrating. As shown in the figure below, North Dakota is the only state where the poverty rate has fallen back down to pre-recession levels. In every other state nationwide, poverty rates remain significantly above their 2007 levels.

The failure to see any significant reduction in poverty over the last several years is a direct consequence of the continued weakness in the labor market. (It’s not surprising that poverty has fallen in North Dakota given that the state’s unemployment rate has averaged 3.3 percent from the start of the recession to today.) At the same time, however, policymakers have directly stymied poverty reduction by cutting back on unemployment insurance. If we want to start bringing poverty rates down, we need to restore the labor market back to full health, lift wages, and start sharing economic growth more broadly.

1. The ACS data also showed no significant change in the national poverty rate. This differs from the official national poverty rate generated from the Current Population Survey (CPS) that was released earlier this week, which did show a significant decrease in the share of families in poverty. This discrepancy is due to differences in the way the two surveys treat household members not related to the head of household, and the fact that the ACS data reflect a slightly different timeframe than the CPS. See here for further explanation.

Across the States, Some Modest Improvements, But Incomes are Still Below Where They Were at the Start of the Millenium

This morning the Census Bureau released its annual report on income and poverty within states, with data from the American Community Survey (ACS). This report follows the release earlier this week of national income and poverty statistics. Not surprisingly, the state report tells much the same story as the national data: for the typical U.S. family, incomes in most states were largely unchanged from where they were the year before—and still well below their levels from over a decade ago.

Between 2012 and 2013, median household income rose significantly in 14 states, while the remaining 36 states, plus the District of Columbia, had no significant change. The table below shows the states that had statistically significant year-over-year increases in median household income. The ACS data, which reflect a slightly different time period than the national income data gathered from the Current Population Survey, also showed a small, but significant increase in median income for the nation as a whole.

States with significant year-over-year changes in median household income, 2013 to 2012

| State | 2012 | 2013 | Change |

|---|---|---|---|

| United States | $51,915 | $52,250 | 0.6% |

| Alaska | $68,577 | $72,237 | 5.3% |

| California | $59,184 | $60,190 | 1.7% |

| Colorado | $57,430 | $58,823 | 2.4% |

| Florida | $45,578 | $46,036 | 1.0% |

| Kentucky | $42,230 | $43,399 | 2.8% |

| Michigan | $47,447 | $48,273 | 1.7% |

| Minnesota | $59,747 | $60,702 | 1.6% |

| Missouri | $45,919 | $46,931 | 2.2% |

| Ohio | $47,454 | $48,081 | 1.3% |

| Oklahoma | $44,903 | $45,690 | 1.8% |

| Tennessee | $43,504 | $44,297 | 1.8% |

| Texas | $51,198 | $51,704 | 1.0% |

| Utah | $57,841 | $59,770 | 3.3% |

| Wyoming | $55,569 | $58,752 | 5.7% |

Source: Adapted from Noss, Amanda. 2014. Household Income: 2013. U.S. Census Bureau. http://census.gov/content/dam/Census/library/publications/2014/acs/acsbr13-02.pdf

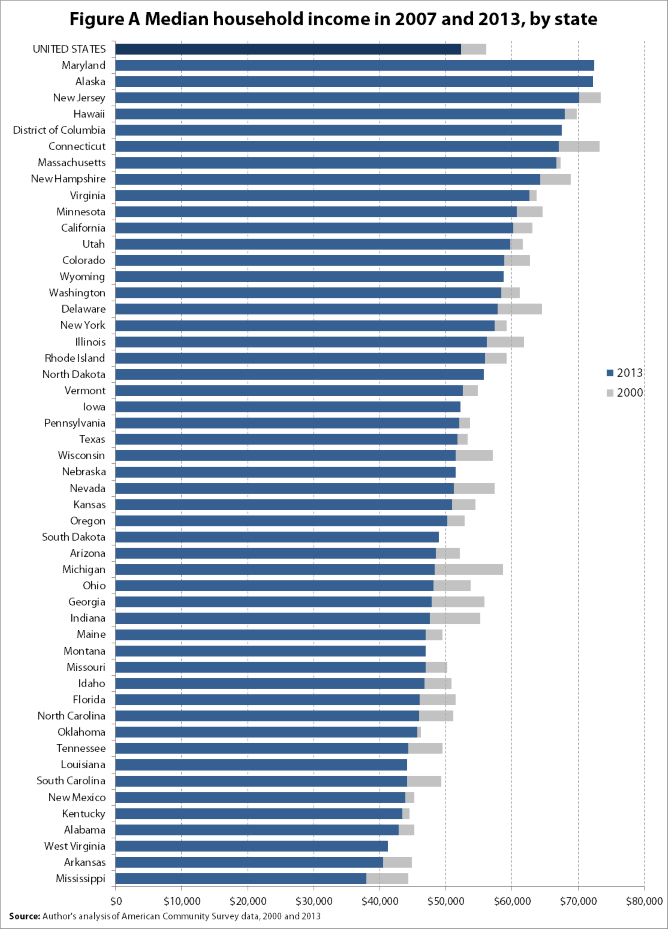

While these modest improvements are welcome, the reality is that household incomes have yet to recover from the recession virtually anywhere. Only four states (Alaska, Wyoming, North Dakota, and South Dakota), plus the District of Columbia have regained their levels from 2007, and most states has not seen income growth in over a decade. The figure below shows median household incomes, by state, in 2000 and 2013. The overlapping bars show that in the vast majority of states, median incomes are still well below where at the start of the millennium. Only Maryland, Alaska, Wyoming, North Dakota, Iowa, South Dakota, Montana, Louisiana, West Virginia, and the District of Columbia have managed to regain or surpass their median income levels from 2000.

As my colleagues Larry Mishel and Josh Bivens explain, “to get household incomes rising, we need to get real wages of the typical worker to rise, something we haven’t seen for more than a decade.” The policies that can help do this are not solely the province of federal lawmakers. A case in point: the only states that saw any wage growth over the past year where those that raised their state minimum wages.

The Fed’s Interest Rate Decisions, Census Data on Income and Poverty… and Occupy Wall Street

It’s been a busy week already for people who think about the economy. On Tuesday, the Census Bureau released its estimates of household income, poverty, and health insurance coverage for 2013. And on Wednesday, the Federal Reserve released its statement on monetary policy, projections of economic growth, and activity for the next year, and Federal Reserve Chair Janet Yellen held a press conference. Wednesday also marked the informal three-year anniversary of Occupy Wall Street (OWS). To incorrectly paraphrase Neil DeGrasse Tyson: it’s all connected, man.

First, the Fed. The debate swirling around the Fed these days is how soon they should start raising short-term interest rates to slow economic growth and forestall excessively high wage and price inflation. The answer to this should be simple: not soon at all. Wage and price inflation remain extraordinarily low, with no evidence that they’re accelerating. In fact, wage growth could effectively double from its current pace before really becoming inconsistent with even the Fed’s too-conservative 2 percent overall price inflation target.

So if this is what the evidence says, why is there a growing chorus arguing for the Fed to tighten?

Here’s where Occupy Wall Street comes in. Tightening now would keep unemployment higher than it would be under genuinely full employment, and stopping job growth short of full employment is a powerful tool to shift bargaining power away from low- and middle-wage workers and keep them from realizing inflation-adjusted wage increases. This tolerance of sub-full employment is a big reason why inflation-adjusted wages for the vast majority have failed to rise at all for most of the time since 1979, and have certainly not risen anywhere near the pace of overall productivity growth. This wasn’t always the case, but starting in the late 1970s a number of policy decisions made on behalf of corporate managers and owners of capital helped tilt the playing field away from low- and middle-wage workers, and this has been a prime source of the rise in income inequality since. A key part of this inequality by design was having macroeconomic policymakers—particularly the Fed—slow the economy down before full employment could spur across-the-board wage growth. The one time the Fed did not slow the economy “in time”—the late 1990s—led to the first across-the-board wage growth in a generation. If OWS had a grand organizing theme, it was certainly along the lines of the idea that economic policy has helped generate the rising inequality we’ve seen over the past generation. They’re right, and macroeconomic policy that has privileged very low rates of inflation over very low rates of unemployment is part of how policy did it.

Poverty Reduction Stalled by Policy, Once Again: Unemployment Insurance Edition

As EPI’s Elise Gould pointed out back in January, a key barrier to translating overall economic growth in recent decades into rapid poverty reduction has been the rise in income inequality. Were economic growth more broadly shared, the poverty rate would be much lower. Here we make the case that this rise in inequality has large policy fingerprints all over it. Today’s data on income and poverty from the Census Bureau shows how a recent policy choice—specifically cutting back on unemployment insurance (UI) in recent years—has stalled poverty reduction.

Unemployment insurance is a key plank of the American social insurance system. During the ferocious period of job loss and historically high unemployment during and immediately after the Great Recession, policymakers responded by significantly expanding the duration of benefits, and the American Recovery and Reinvestment Act (ARRA) included boosts to the generosity of benefits as well. The result was that in 2009, UI benefits kept 3.3 million people out of poverty.

However, since 2010, this poverty-fighting impact has eroded, and the share of unemployed workers receiving UI benefits has fallen: Both of these trends are shown in the figure below. This is due to both the extended duration of unemployment for some workers outstripping the UI eligibility period as well as intentional policy changes that reduced UI recipiency. The federal government reduced total weeks available in 2012 and then all long-term benefits (those lasting longer than 27 weeks) were cut off at the end of 2013. (The impact of the long-term benefits cut won’t be seen until next year’s poverty figures are released.) Further, several states have also restricted eligibility. The result is that by 2013 only 1.2 million Americans were kept out of poverty by UI benefits.

Unemployment insurance (UI) recipiency rate* and the number of persons UI lifted out of poverty, 1987–2014

| UI recipiency rate* (right axis) | Persons lifted above poverty (left axis) | |

|---|---|---|

| 1987 | 31.2% | 0.684 |

| 1988 | 31.8% | 0.518 |

| 1989 | 34.0% | 0.481 |

| 1990 | 36.5% | 0.668 |

| 1991 | 41.2% | 1.006 |

| 1992 | 51.3% | 1.468 |

| 1993 | 47.7% | 1.208 |

| 1994 | 37.2% | 0.905 |

| 1995 | 36.3% | 0.716 |

| 1996 | 36.8% | 0.633 |

| 1997 | 35.4% | 0.601 |

| 1998 | 36.7% | 0.572 |

| 1999 | 38.1% | 0.602 |

| 2000 | 38.0% | 0.563 |

| 2001 | 44.3% | 0.726 |

| 2002 | 53.1% | 1.177 |

| 2003 | 50.3% | 1.257 |

| 2004 | 38.1% | 0.7 |

| 2005 | 35.9% | 0.656 |

| 2006 | 36.0% | 0.573 |

| 2007 | 36.7% | 0.488 |

| 2008 | 43.7% | 0.905 |

| 2009 | 64.3% | 3.322 |

| 2010 | 66.5% | 3.21 |

| 2011 | 56.4% | 2.306 |

| 2012 | 48.5% | 1.7 |

| 2013 | 40.8% | 1.2 |

| 2014** | 28.9% |

* Recipiency rate is defined as the number of people receiving any form of unemployment insurance (regular program and extended benefits) as a share of the total number of unemployed.

** 2014 UI recipiency rate value is based off of January–August data.

Source: EPI analysis of Current Population Survey basic monthly microdata; U.S. Department of Labor, "Persons Claiming UI Benefits in State and Federal UI Programs [Excel spreadsheet],” updated August 2014; Thomas Gabe and Julie M. Whittaker, Antipoverty Effects of Unemployment Insurance, Congressional Research Service, October 16, 2012; and Carmen DeNavas-Walt and Bernadette D. Proctor, "Income and Poverty in the United States: 2013," U.S. Census Bureau Current Population Reports, September 2014.

Real Median Household Incomes for all Racial Groups Remain Well Below Their 2007 Levels

Today’s Census Bureau report on income, poverty and health insurance coverage in 2013 shows that real median household income increased more among Latino (+$1,391) and African American (+$793) households than white households (+$433), but declined for Asian households (-$2,568). Between 2012 and 2013, the black-white income gap has narrowed from 58.4 cents for every dollar of white median household income to 59.4 cents for every dollar of white median household income. The Hispanic-white income gap has also narrowed from 68.4 to 70.3 cents on the dollar. This is fairly consistent with the modest labor market gains made by African Americans and Latinos in 2013. According to the Bureau of Labor Statistics, between 2012 and 2013, the share of employed adults increased for each of these populations while the share for whites remained unchanged. Despite these relative improvements, real median household incomes for all groups remain well below their 2007 levels. Between 2007 and 2013, median household incomes declined by 9.2 percent (-$3,506) for African Americans, 5.7 percent (-$2,492) for Latinos, 5.6 percent (-$3,432) for whites and 9.7 percent (-$7,201) for Asians. Asian households continue to have the highest median income in spite of large income losses in the wake of the recession.

Real median household income, by race and ethnicity, 1972–2013

| Year | White | Black | Hispanic | Asian |

|---|---|---|---|---|

| Jan-1972 | $51,380 | $29,569 | $38,229 | |

| Jan-1973 | $52,084 | $30,391 | $38,165 | |

| Jan-1974 | $50,314 | $29,669 | $37,942 | |

| Jan-1975 | $48,945 | $29,163 | $34,899 | |

| Jan-1976 | $50,477 | $29,415 | $35,621 | |

| Jan-1977 | $50,965 | $29,490 | $37,281 | |

| Jan-1978 | $52,282 | $30,838 | $38,676 | |

| Jan-1979 | $52,338 | $30,302 | $39,001 | |

| Jan-1980 | $51,180 | $28,972 | $36,743 | |

| Jan-1981 | $50,243 | $27,793 | $37,602 | |

| Jan-1982 | $49,764 | $27,739 | $35,179 | |

| Jan-1983 | (NA) | $27,628 | $35,357 | |

| Jan-1984 | $51,546 | $28,767 | $36,286 | |

| Jan-1985 | $52,581 | $30,595 | $36,058 | |

| Jan-1986 | $54,286 | $30,580 | $37,215 | |

| Jan-1987 | $55,342 | $30,742 | $37,929 | |

| Jan-1988 | $55,958 | $31,044 | $38,522 | |

| Jan-1989 | $56,339 | $32,801 | $39,762 | |

| Jan-1990 | $55,194 | $32,268 | $38,581 | |

| Jan-1991 | $53,914 | $31,369 | $37,848 | |

| Jan-1992 | $54,154 | $30,509 | $36,759 | |

| Jan-1993 | $54,249 | $31,008 | $36,331 | |

| Jan-1994 | $54,596 | $32,682 | $36,403 | |

| Jan-1995 | $56,427 | $33,987 | $34,696 | |

| Jan-1996 | $57,342 | $34,716 | $36,821 | |

| Jan-1997 | $58,720 | $36,250 | $38,534 | |

| Jan-1998 | $60,569 | $36,181 | $40,433 | |

| Jan-1999 | $61,733 | $39,019 | $42,984 | |

| Jan-2000 | $61,715 | $40,131 | $44,867 | |

| Jan-2001 | $60,927 | $38,776 | $44,164 | |

| Jan-2002 | $60,729 | $37,584 | $42,863 | $68,143 |

| Jan-2003 | $60,513 | $37,547 | $41,793 | $70,547 |

| Jan-2004 | $60,318 | $37,114 | $42,264 | $70,916 |

| Jan-2005 | $60,597 | $36,821 | $42,917 | $72,899 |

| Jan-2006 | $60,567 | $36,936 | $43,650 | $74,218 |

| Jan-2007 | $61,702 | $38,104 | $43,455 | $74,266 |

| Jan-2008 | $60,079 | $37,021 | $41,018 | $71,013 |

| Jan-2009 | $59,146 | $35,387 | $41,312 | $71,101 |

| Jan-2010 | $58,185 | $34,321 | $40,205 | $68,654 |

| Jan-2011 | $57,392 | $33,380 | $40,004 | $67,456 |

| Jan-2012 | $57,837 | $33,805 | $39,572 | $69,633 |

| Jan-2013 | $58,270 | $34,598 | $40,963 | $67,065 |

Note: White refers to non-Hispanic whites, black refers to blacks alone, Asian refers to Asians alone, and Hispanic refers to Hispanics of any race. Comparable data are not available prior to 2002 for Asians. Data for non-Hispanic whites are unavailable for the year 1983. Shaded areas denote recessions.

Source: EPI analysis of Current Population Survey Annual Social and Economic Supplement Historical Poverty Tables (Table H-5 and H-9)

The Generation-Long Trend Towards Ever-Greater Income Inequality Continues

Today’s release of data on family income from the Census Bureau reinforces the fact that the generation-long trend towards ever-greater income inequality seems to be firmly underway again, after only the briefest interruption caused by the Great Recession.

Several economic commentators noted the decline in income inequality (mostly driven by steep but temporary falls in income at the very top of the distribution) that accompanied the aftermath of both the early 2000s recession and the Great Recession, some even going so far as to suggest that the recessions had somehow solved the problem of rising income inequality. Yet the evidence is clear that this isn’t the case—recessions seem to only suspend the growth of inequality temporarily. This, of course, should not be a shock—declines at the top of the income distribution are driven largely by stock market movements, and the steep stock market declines of the early 2000s and 2008 bottomed out quickly, and stock prices rose relatively quickly thereafter.

Figure 1 below shows the long-run rise in family income inequality. It tracks growth in average family income by various income groupings since 1947. A key feature of this figure is the extraordinarily tight distribution of income growth from 1947 to 1979 (all lines move upward in a tight bunch), and the rapid pulling apart of income growth thereafter (the lines start pulling apart from each other).

Modest Income Growth in 2013 Puts Slight Dent in More than a Decade of Income Losses

Wage trends greatly determine how fast incomes at the middle and bottom grow, as well as the overall path of income inequality, as we argued in Raising America’s Pay. This is for the simple reason that most households, including those with low incomes, rely on labor earnings for the vast majority of their income. That is why my initial look at the data from the newly released Census Bureau report on income and, poverty in 2013 will look at wages and the incomes of working age households.

The Census data show that from 2012 to 2013, median household income for non-elderly households (those with a head of household younger than 65 years old) increased 0.4 percent from $58,186 to $58,448. However, that modest growth barely begins to offset the losses incurred during the Great Recession or the losses that prevailed in the prior business cycle from 2000 to 2007. Between 2007 and 2013, median household income for non-elderly households dropped from $63,527 to $58,448, a decline of $5,079, or 8.0 percent. Furthermore, the disappointing trends of the Great Recession and its aftermath come on the heels of the weak labor market from 2000-2007, where the median income of non-elderly households fell significantly, from $65,785 to $63,527, the first time in the post-war period that incomes failed to grow over a business cycle. Altogether, from 2000 to 2013, median income for non-elderly households fell from $65,785 to $58,448, a decline of $7,337, or 11.2 percent.

Real median household income, all and non-elderly, 1979–2013

| All households | Non-elderly households | |

|---|---|---|

| Jan-1979 | $49,225 | |

| Jan-1980 | $47,668 | |

| Jan-1981 | $46,876 | |

| Jan-1982 | $46,752 | |

| Jan-1983 | $46,425 | |

| Jan-1984 | $47,867 | |

| Jan-1985 | $48,761 | |

| Jan-1986 | $50,487 | |

| Jan-1987 | $51,121 | |

| Jan-1988 | $51,514 | |

| Jan-1989 | $52,432 | |

| Jan-1990 | $51,735 | |

| Jan-1991 | $50,249 | |

| Jan-1992 | $49,836 | |

| Jan-1993 | $49,594 | |

| Jan-1994 | $50,147 | $57,893 |

| Jan-1995 | $51,719 | $59,417 |

| Jan-1996 | $52,472 | $60,527 |

| Jan-1997 | $53,551 | $61,307 |

| Jan-1998 | $55,497 | $63,792 |

| Jan-1999 | $56,895 | $65,435 |

| Jan-2000 | $56,801 | $65,785 |

| Jan-2001 | $55,562 | $64,772 |

| Jan-2002 | $54,914 | $64,108 |

| Jan-2003 | $54,865 | $63,545 |

| Jan-2004 | $54,674 | $62,801 |

| Jan-2005 | $55,278 | $62,391 |

| Jan-2006 | $55,690 | $63,228 |

| Jan-2007 | $56,435 | $63,527 |

| Jan-2008 | $54,424 | $61,443 |

| Jan-2009 | $54,059 | $60,623 |

| Jan-2010 | $52,646 | $59,057 |

| Jan-2011 | $51,843 | $57,627 |

| Jan-2012 | $51,758 | $58,186 |

| Jan-2013 | $51,939 | $58,448 |

Note: Non-elderly households are those in which the head of household is younger than age 65. Data for non-elderly households are not available prior to 1994. Shaded areas denote recessions.

Source: EPI analysis of Current Population Survey Annual Social and Economic Supplement Historical Income Tables (Tables H-5 and HINC-02)

What to Look for in next Week’s Census Income Data: How Long Will It Take to Claw Back Lost Years of Income Growth?

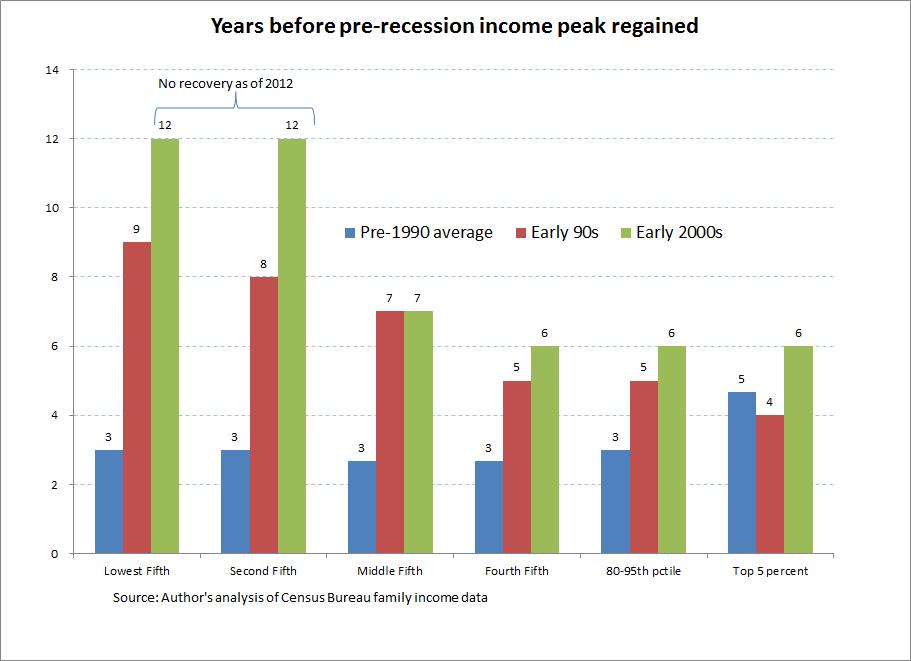

Next week will see the release of Census data on family income (as well as poverty and health insurance coverage) for 2013. Before the data are released, it’s worth reminding ourselves of one thing that last year’s data showed clearly: economic recoveries in recent recessions have been increasingly unequal, largely mirroring the generation-long upwards march of income inequality more generally. And this pattern seems poised to continue in the recovery from the Great Recession.

The figure below shows these unequal recoveries from recessions in a potentially new way. It essentially looks at just how many years of income growth were lost by each income grouping in various recessions. It measures this by simply counting how many years it took after a recession for each group to regain its previous income peak. For example, incomes for the middle fifth saw a peak in 1989 at $62,212. The recession in the following year led average income for these middle-fifth families to fall for a time, and the 1989 peak of $62,212 was not re-gained for these families until 1996, meaning that essentially seven years (from 1989 to 1996) of income growth for this group was stalled by the recession of the early 1990s. The figure below shows this number of lost years of income growth by income grouping across a range of recessions.