The Trump administration finalizes rule attacking federal workers’ right to union representation in workplace discrimination cases

In his final weeks in office, the Trump administration continues to attack federal workers’ right to union representation. Last week, the Equal Employment Opportunity Commission (EEOC) voted to finalize a rule that prohibits union representatives from using official time—which is paid work time representatives use for union activities—to represent their coworkers in equal employment opportunity (EEO) matters, overturning almost 50 years of precedent. By prohibiting union representatives from using official time during EEO matters, the final rule effectively limits the right of federal workers to choose their representative in the EEO complaint process.

The rule also creates enormous cost burdens for federal workers who want to file a workplace discrimination complaint. By prohibiting the use of official time in discrimination complaints, federal workers are faced with the choice of hiring a private attorney or asking an inexperienced coworker to be their representative on their own free time. The cost of an attorney will be too costly for many vulnerable federal workers, and between the choices of hiring an attorney, asking an inexperienced coworker to be a representative, or not filing at all, many will forgo exercising their rights.

This is only one of many ways the Trump administration has attacked federal workers’ unions. During his first year, President Trump issued three executive orders eroding the collective bargaining rights of federal workers. These orders shortened the time frame expected to complete bargaining and directed agencies not to bargain over certain topics, limited the use of official time for collective bargaining activities, and weakened due process protections for federal workers subject to discipline. In October 2019, Trump signed an executive order revoking an executive order issued by former President Obama that gave employees of federal contractors the right of first refusal for employment on a new contract when a federal service contract changes hand.

The economy President-elect Biden is inheriting: 26.8 million workers—15.8% of the workforce—are being directly hurt by the coronavirus crisis

We now have a full year of jobs data for 2020. This is an important moment to take stock of where things stand in the labor market.

The official unemployment rate was 6.7% in December, and the official number of unemployed workers was 10.7 million, according to the Bureau of Labor Statistics (BLS). These official numbers are a vast undercount of the number of workers being harmed by the weak labor market, however. In fact, 26.8 million workers—15.8% of the workforce—are either unemployed, otherwise out of work due to the pandemic, or employed but experiencing a drop in hours and pay. Here are the missing factors:

- Some workers are being misclassified as “employed, not at work” instead of unemployed. BLS has discussed at length that there have been many workers who have been misclassified as “employed, not at work” during this pandemic who should be classified as “temporarily unemployed.” In December, there were 1.0 million such workers, a substantial increase from November. (Wonky aside: Some of these workers may not have had the option of being classified as “temporarily unemployed,” meaning they weren’t technically misclassified, but all of them were out of work because of the virus.) Accounting for these workers, the unemployment rate would be 7.3%.

How to organize in the anti-union South

Amy Waters, RN, CPN, at Mission Hospital in Asheville, NC, detailed her story of a successful union drive as a member of National Nurses United at EPI’s panel discussion, “Rebuilding Collective Bargaining Back Better.”

“We are now the first private hospital in North Carolina with a union and we are the largest newly formed union in the South, since, I believe, the 1970s,” says Waters.

Teaching at the intersection of social-justice activism and education

Jesse Hagopian, teacher and co-adviser of the Black Student Union at Garfield High School in Seattle, WA, spoke about the intersection of social-justice unionism and the Black Lives Matter at School movement at EPI’s book event, “Strike for the Common Good: Fighting for the Future of Public Education.”

“I think the fundamental problem with our education system is this fundamental problem we have with all of our systems and institutions in this country, and that is that they’re a product of an economic and political structure that is built on profit, racism, oppression, and inequality—namely capitalism,” says Hagopian.

What to watch on jobs day: Little to no improvement in December and huge losses over 2020

Jobs day on Friday will not only give us a read on the labor market for December, but it will also give us a sense of the devastating economy of 2020 and the economy President-elect Biden is walking into. Overall job growth for December will likely continue to trend toward zero, with some chance of employment actually falling. At the same time, rising COVID-19 caseloads, hospitalizations, and deaths means our health and economic woes are far from over. President-elect Biden is inheriting an exceedingly troubled economy with millions of families just trying to stay afloat. Over the Trump administration’s term, more jobs were lost than gained—there are 541,000 fewer jobs in the U.S. economy than when he took office in January 2016. And not only does President-elect Biden enter his first term in a disastrous economy, he also inherits a litany of anti-worker policy decisions from his predecessor who squandered the labor market strength he inherited.

The figure below provides a decent picture of the employment situation over the last year. In January and February, we saw solid job growth with gains of 214,000 and 251,000, respectively. After COVID-19 hit, federal legislation expanded unemployment insurance, increasing both eligibility and weekly payments, making it financially viable for millions of workers to safely stay home while public health officials assessed the situation. However, businesses that were shuttered in the interest of public health received insufficient federal economic support to keep paying their workers even as they remained safely at home. The U.S. economy experienced losses in March and April of 1.4 million and 20.8 million jobs, respectively, losses the likes of which we hadn’t experienced in modern history. Millions were on temporary layoff and once states started opening back up, some of those were rehired. We saw a significant bounce back in May and June with 2.7 million and 4.9 million jobs added, respectively. Unfortunately, over the succeeding five months, job growth has rapidly slowed as federal relief expired and the virus surged: 1.8 million in July down to 1.5 million in August then 711,000, 610,000, and a paltry 245,000 in November. December looks to continue the trend with low (or even negative) job growth expected.

First UI claims of 2021 are still higher than the worst of the Great Recession

There was an armed insurrection at the U.S. Capitol yesterday in which the police were complicit in a way that has everything to do with structural racism. Structural racism has also meant that Black and Latinx working people are experiencing a disproportionate health and economic impact of the COVID-19 pandemic. The UI data released this morning show a labor market in turmoil as COVID-19 surges.

Another 948,000 people applied for Unemployment Insurance (UI) benefits last week, including 787,000 people who applied for regular state UI and 161,000 who applied for Pandemic Unemployment Assistance (PUA). The 948,000 who applied for UI last week was a decrease of 152,000 from the prior week. That drop was driven almost entirely by a drop in PUA claims, undoubtedly due to uncertainty over whether PUA would be extended, as Trump delayed signing the relief bill during that week. Now that the program has been extended (more on that below), I expect PUA claims to rise again in coming weeks.

Last week was the 42nd straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were greater than the second-worst week of the Great Recession.)

Unemployment insurance claims continue to climb: Congress must pass a stimulus package to prevent millions of people from being left with nothing

Another 1.3 million people applied for Unemployment Insurance (UI) benefits last week, including 885,000 people who applied for regular state UI and 455,000 who applied for Pandemic Unemployment Assistance (PUA). The 1.3 million who applied for UI last week was an increase of 63,000 from the prior week. This was the second week in a row of increases, and initial claims are now back to their highest point since September. Layoffs are rising as the COVID-19 virus surges and demand weakens. And, last week was the 39th straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were greater than the second-worst week of the Great Recession.)

Most states provide 26 weeks (six months) of regular benefits. Given the length of this crisis, many workers have exhausted their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 273,000. For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is not rising as fast as continuing claims for regular state UI are dropping. Why? Many of the roughly 2 million workers who were on UI before the recession began, or who are in states with less than the standard 26 weeks of regular state benefits, are now exhausting PEUC benefits, at the same time others are taking it up. The Department of Labor reports that nearly 2 million workers have exhausted PEUC so far—and that is a vast undercount because many states have not yet reported PEUC exhaustions past October (see column C43 in form ETA 5159 for PEUC here).

In some states, if workers exhaust PEUC, they can get on yet another program, Extended Benefits (EB). However, in the latest data, just 694,000 workers were on EB. That’s likely less than a third of those who have exhausted PEUC. Most are left with nothing.

State attorneys general taking on protection of workers’ rights

State attorneys general (AGs) have been getting more and more involved in defending workers’ rights, including bringing wage theft cases, suing companies such as Uber and Lyft for misclassification, and fighting noncompete and no-poach agreements.

State AGs’ evolving labor-enforcement role was the topic of the “State Attorneys General as Protectors of Workers’ Rights” webinar hosted by the Economic Policy Institute and the Harvard Law School Labor and Worklife Program on December 3, 2020, which included insights from bureau, division, and section chiefs who lead labor rights work in their state attorneys general offices.

The panelists talked about some of their cases and shared thoughts about how state AGs select cases, how they decide whether to proceed civilly or with a criminal prosecution, and how they’ve worked, sometimes behind the scenes, to safeguard workplace safety and health during the pandemic. The webinar followed up on an August report on this topic issued by EPI and the Harvard Labor and Worklife Program.

Top five EPI blog posts of 2020

In 2020, we saw fissures of inequality become chasms, while aging unemployment systems shut workers out. Education was turned upside down—and we gained new respect for teachers.

We also saw unimaginable job losses, and this past spring our blog post predicting tens of millions of workers would be impacted by the pandemic got a lot of reader attention.

Here’s a countdown of the five most-read EPI blog posts in 2020.

The Biden administration can reverse much of Trump’s bad labor policy without Congress

For the last four years, at every turn, the Trump administration systematically promoted the interests of corporations and shareholders over those of working people. Through a series of executive orders and agency regulations, the Trump administration attacked workers’ health and safety, wages, and collective bargaining rights. It is critical that the Biden administration work from day one to reverse these actions and strengthen workers’ rights. Here, we review the Trump administration’s anti-worker executive and regulatory actions and chart a course for the new administration to address these harmful actions.

Top 10 EPI reports of 2020

Staying safe. Educating our children. Having a say in workplace conditions. Fighting for fair wages when systemic racism, consolidated wealth, and corporate power thwart opportunity.

These concerns were top of mind for our readers in 2020, according to our compilation of EPI’s most-read reports.

Unemployment claims hit highest level in months: Millions more jobs will be lost if Congress doesn’t act

Another 1.3 million people applied for UI benefits last week, including 853,000 people who applied for regular state UI and 428,000 who applied for Pandemic Unemployment Assistance (PUA). The 1.3 million who applied for UI last week was an increase of 276,000 from the prior week, bringing initial claims back to their highest point since September. Further, last week’s increase was not just due to week-to-week volatility in the data. The four-week moving average of total initial claims is now at its highest point since October. In other words, layoffs appear to be rising, consistent with the resurgent virus. And, last week was the 38th straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were greater than the second-worst week of the Great Recession.)

Most states provide 26 weeks (six months) of regular benefits, but this crisis has gone on for nearly nine months. That means many workers have exhausted their regular state UI benefits. In the most recent data, the four-week moving average of continuing claims for regular state UI dropped by 260,000 (note: the weekly number increased, but that was likely due to week-to-week volatility in the data).

The Job Openings and Labor Turnover Survey continues to show weaker levels of hires than before the recession hit: Any hope for a quick recovery is off the table unless Congress acts now

Last week, the Bureau of Labor Statistics (BLS) reported that, as of the middle of November, the economy was still 9.8 million jobs below where it was in February and job growth slowed considerably in November. Today’s BLS Job Openings and Labor Turnover Survey (JOLTS) reports little change in October, a clear and confirming sign that the recovery is not charging ahead. In fact, hiring and job openings are below where they were before the recession hit, which makes it impossible to recover anytime soon, when we have such a massive hole to fill in the labor market.

In October, job openings rose mildly (6.5 to 6.7 million) while hires softening slightly (5.9 to 5.8 million). Separations increased (4.8 to 5.1 million), largely due to an unfortunate increase in layoffs (1.4 to 1.6 million). On the whole, the U.S. economy is seeing a significantly slower pace of hiring than we experienced in May or June—hiring is roughly where it was before the recession, which is a big problem given that we have only recovered just over half of the job losses from this spring. And job openings are now substantially below where they were before the recession began (6.7 million at the end of October, compared to 7.1 million on average in the year prior to the recession). And today’s data release only covers through October, so it doesn’t even capture November’s slowdown in job growth. With hiring and job openings at these levels, the economy is facing a long slow recovery, unless Congress acts.

COVID-19 relief should extend CARES Act work-sharing provisions

With over a million new unemployment claims still being filed each week, job growth slowing, and millions of workers about to lose emergency jobless benefits created through the CARES Act in March, it is imperative that Congress enact another COVID-19 emergency relief package as quickly as possible. In addition to key provisions such as aid to state and local governments and extending the emergency benefits for unemployed workers, Congress should also extend innovative provisions that helped prevent workers from being laid off in the first place—specifically the CARES Act’s federal subsidies for work-sharing.

Work-sharing provides a way for many businesses to cope with a drop in consumer demand without having to lay off staff. Under work-sharing, workers’ hours are reduced and they receive partial unemployment insurance (UI) benefits to make up a portion of their lost wages. For example, if a business anticipated having to lay off five workers, they might instead cut in half the hours of 10 staff—achieving the same reduction in total work hours—and those 10 workers would all receive partial unemployment benefits from the state to make up some of their lost income.

By keeping workers on the job, work-sharing mitigates the impact of joblessness and reduces unemployment peaks in downturns. Now that coronavirus vaccines appear to be on the horizon, maintaining a connection between more workers and their employers for the first part of next year makes even more sense. As the pandemic is brought under control and regular consumer demand picks up, companies with work-sharing programs won’t have to go through a process of recruiting, hiring, and training new staff; they will be able to quickly ramp back up simply by restoring participants in work-sharing to full time.

The economy President-elect Biden is inheriting: More than 26 million workers—15.5% of the workforce—are being directly hurt by the coronavirus downturn

Today was, perhaps astonishingly, the last jobs report of 2020. It’s a moment to take stock of where things stand after the first 11 months of 2020 and the first 9 months of the COVID-19 economic shock.

The Bureau of Labor Statistics (BLS) reported that the official number of unemployed workers in November was 10.7 million, and the unemployment rate was 6.7%. The official number of unemployed workers, however, is a vast undercount of the number of workers being harmed. In fact, 26.1 million workers—15.5% of the workforce—are either unemployed, otherwise out of work due to the pandemic, or employed but experiencing a drop in hours and pay. Here are the missing factors:

- Some workers are being misclassified as “employed, not at work” instead of unemployed. BLS has discussed at length that there have been many workers who have been misclassified as “employed, not at work” during this pandemic who should be classified as “temporarily unemployed.” In November, there were 0.6 million such workers. (Wonky aside: Some of these workers may not have had the option of being classified as “temporarily unemployed,” meaning they weren’t technically misclassified, but all of them were out at work because of the virus.) Accounting for these workers, the unemployment rate would be 7.1%.

What to watch on jobs day: An unfortunate continued slowing recovery due to the Senate’s inaction

While the U.S. labor market remains 10 million jobs below pre-pandemic levels, job growth has slowed significantly over the last several months. Job deficits remain sharpest in leisure and hospitality, with a 3.5 million job shortfall, followed by education and health services (1.3 million), government employment (1.2 million), and professional and business services (1.1 million). The initial rebound from the 22.2 million jobs lost in March and April began strong when important relief, including vital unemployment insurance (UI) expansions were put in place. By late summer/early fall, job growth slowed significantly, and some forecasters expect it will be even slower in November. The recovery continues to wane because of the removal of important relief measures as well as the fact that the “easy” gains from workers on temporary layoffs continue to dwindle. Without further relief, millions of workers and their families will continue to endure economic hardship as the virus continues to spread in the winter months.

It didn’t have to be this way. If the suite of UI programs were reinstated and extended through 2021, workers would not lose that valuable safety net and it would spur the creation of 5.1 million more jobs in 2021. As of now, the additional UI benefits will expire on December 26, leaving 12 million workers without a safety net, and over 4 million others will have already exhausted their benefits by this cutoff. Relief and recovery efforts need to also include aid to state and local governments, which unfortunately have seen outright losses in jobs over the last couple of months due to revenue shortfalls and costly forced austerity without federal assistance.

One million people applied for unemployment insurance last week: Unless Congress acts, millions of people will soon be left without a safety net

Another 1.0 million people applied for UI benefits last week, including 712,000 people who applied for regular state UI and 289,000 who applied for Pandemic Unemployment Assistance (PUA). After two weeks of increases, the 1.0 million who applied for UI last week was a welcome decline of 105,000 from the prior week. However, last week was the 37th straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still nearly three times where they were a year ago.)

Most states provide 26 weeks (six months) of regular benefits, but this crisis has gone on for nearly nine months. That means many workers have exhausted their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 569,000.

For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is set to expire on December 26 (as is PUA—more on these expirations below).

Reinstating and extending the pandemic unemployment insurance programs through 2021 could create or save 5.1 million jobs

Key takeaways:

- While the economy remains 10 million jobs below pre-pandemic levels and job growth is slowing significantly as the pandemic surges, the remaining suite of pandemic unemployment insurance (UI) programs are set to expire on December 26, even as one of the most important—the extra $600 per week—has already expired and millions of workers have already exhausted benefits or had them significantly slashed.

- The economic shock from COVID-19 has been ongoing long enough that roughly one-third of unemployed workers have been unemployed for 27 weeks or longer. Unemployment insurance benefits should not just be made much more generous, they should also have their durations extended substantially. Once again, this highlights that UI benefit generosity and duration should never be tied to arbitrary dates but should rather be dictated by economic conditions (preferably tied to employment rates).

- If these programs—including the extra $600—are reinstated and extended through 2021, and if the virus is brought under control so that economic growth for 2021 returns to being simply a function of aggregate demand growth, the economy would be boosted by 3.5% and 5.1 million more jobs would be added in 2021.

Wages for the top 1% skyrocketed 160% since 1979 while the share of wages for the bottom 90% shrunk: Time to remake wage pattern with economic policies that generate robust wage-growth for vast majority

Newly available wage data tell a familiar story: In every period since 1979, wages for the bottom 90% were continuously redistributed upward to the top 10% and frequently to the very highest 1.0% and 0.1%. This unceasing growth of wage inequality that undercuts wage growth for the bottom 90% reaffirms the need to place generating robust wage growth for the vast majority and worker power at the center of economic policymaking.

For last year, 2019, the data show a continuation of the trend of annual wages rising fastest for those in the top 10% while those in the bottom 90% saw below-average wage growth. However, within the top 10%, wages rose faster for those in the 90th–99th percentiles than for those in the top 1%.

A similar pattern as in 2019 prevailed over the entire 2007–2019 business cycle as wages were redistributed in two ways, up from the bottom 90% to the top 10% and within the top 10% downward from the top 1% to those in the 90th–99th percentiles. Still, the top 1% has done far better in the 2009–2019 recovery (wages rose 20.4%) than did those in the bottom 90% (wages rose only 8.7%).

Unemployment claims rise for second week in a row: Millions will lose federal unemployment benefits in December unless Senate Republicans act

Because of the Thanksgiving holiday this week, data on unemployment insurance (UI) claims—usually released on Thursdays—were released today. The data show that another 1.1 million people applied for UI benefits last week, including 778,000 people who applied for regular state UI and 312,000 who applied for Pandemic Unemployment Assistance (PUA). The 1.1 million who applied for UI last week was an increase of 22,000 from the prior week’s figures—the second week in a row that initial claims have risen. Further, last week was the 36th straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still greater than the second-worst week of the Great Recession.)

Most states provide 26 weeks of regular benefits, but this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 299,000, from 6.4 million to 6.1 million.

For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is set to expire on December 26 (as is PUA—more on these expirations below).

Racism and the Economy: Focus on Employment

Valerie Wilson, director of the Economic Policy Institute Program on Race, Ethnicity, and the Economy, gave the keynote address at the Federal Reserve Symposium on Racism and the Economy. These are her remarks.

According to the Center for Assessment and Policy Development, racial equity is the condition that would be achieved if one’s racial identity no longer predicted, in a statistical sense, how one fares.

In reality, statistical analysis often reveals that racial identity is a measurable, significant, and persistent predictor of labor market outcomes. Let’s pause and think about that for a moment. Why should racial identity—something as arbitrary and superficial as physical appearance (skin color)—be statistically correlated with one’s likelihood of being employed or how much they are paid for their labor?

No improvement in initial unemployment claims as labor market gains falter

Another 1.1 million people applied for unemployment insurance (UI) benefits last week, including 742,000 people who applied for regular state UI and 320,000 who applied for Pandemic Unemployment Assistance (PUA). The 1.1 million who applied for UI last week was an increase of 55,000 from the prior week’s figures. Last week was the 35th straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still 3.3 times where they were a year ago.)

Most states provide 26 weeks of regular benefits, but this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 429,000, from 6.8 million to 6.4 million.

For now, after an individual exhausts regular state benefits, they can move on to Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is set to expire on December 26 (as is PUA).

In the latest data available for PEUC (the week ending October 31), PEUC rose by 233,000, from 4.1 million to 4.4 million, offsetting only about 60% of the 383,000 decline in continuing claims for regular state benefits for the same week. This is likely due in large part to the fact that many of the roughly 2 million workers who were on UI before the recession began, or who are in states with less than the standard 26 weeks of regular state benefits, are exhausting PEUC benefits at the same time others are taking it up. More than 1.5 million workers have exhausted PEUC so far (see column C43 in form ETA 5159 for PEUC here). Last week, 634,000 workers were on Extended Benefits (EB), which is a program that eligible unemployed workers in some states can get on if they’ve exhausted PEUC.

Learning during the pandemic: What decreased learning time in school means for student learning

One reflection of how much students have learned and developed since schools closed in March can be found in late Argentinian cartoonist Quino’s 2007 comic strip, in Manolito and his peers’ self-assessments of what they learned in school. When Manolito’s teacher asks, he replies: “From March to today, nothing.” (The implied message is: Others are learning, while he is stuck.)

Lavado, Joaquín Salvador, Quino. 2007. Toda Mafalda. Buenos Aires, Ediciones de la Flor.

As many parents and teachers have seen, these are the likely realities for students in 2020. Because learning time in school matters, and students’ learning and development tend to vary greatly even when schools operate in normal circumstances, challenges to learning were magnified when schools closed—due to prolonged cuts to learning time in school, the access to some “substitute” educational opportunities during the pandemic, and the many factors that influence out-of-school learning.

In this blog post, we review the consequences of reduced learning time in school settings during the pandemic, and what the evidence tells us to do about it when we begin to control the spread of the virus. (For a detailed review of the challenges COVID-19 brought to education and our policy recommendations, see “COVID-19 and student performance, equity, and U.S. education policy: Lessons from pre-pandemic research to inform relief, recovery, and rebuilding.”)

With unemployment benefits for millions of workers set to expire in December, Senate Republicans must stop blocking aid

More than 1.0 million people applied for unemployment insurance (UI) benefits again last week, including 709,000 people who applied for regular state UI and 298,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program that provides up to 39 weeks of benefits for workers who are not eligible for regular unemployment insurance, like the self-employed. Without congressional action, PUA will expire on December 26 (more on that below).

The 1.0 million who applied for UI last week was a decline of 112,000 from the prior week’s figures. Last week was the 34th straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still more than 3.0 times where they were a year ago.)

Most states provide 26 weeks of regular benefits, but this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 436,000, from 7.2 million to 6.8 million.

For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, like PUA, PEUC is set to expire on December 26 (more on that below).

Voters chose more than just the president: A review of important state ballot initiative outcomes

With enormous attention focused—understandably—on the outcome of the presidential and congressional races on November 3, it’s easy to forget that voters also decided on nearly 6,000 state legislative races and a host of ballot measures in states and localities, including many with important implications for workers, economic justice, racial equity, and the fight against climate change.

There were 120 statewide measures considered by voters across the country. In this post, we briefly highlight some of the notable measures that would have a meaningful impact on the welfare of workers, families, and communities; the power of workers and communities to have a voice in economic policy decisions; and the ability of all people to achieve economic security, regardless of race, ethnicity, or gender. We also call attention to the advocacy and research of Economic Analysis and Research Network (EARN) members in these states, whose work in many cases was critical in explaining the implications of the measures for workers, families, and communities.

The Job Openings and Labor Turnover Survey shows declines in hires: As winter hits, the Biden administration will be facing a mounting, not waning, crisis

Last week, the Bureau of Labor Statistics (BLS) reported that, as of the middle of September, the economy was still 10 million jobs below where it was in February. Job growth slowed considerably over the last few months and the jobs deficit in October was easily over 11.6 million from where we would have been if the economy had continued adding jobs at the pre-pandemic pace.

Today’s BLS Job Openings and Labor Turnover Survey (JOLTS) reports job openings changed little at 6.4 million in September while hires and layoffs fell. While the slowdown in layoffs is promising from 1.5 million to 1.3 million, the softening in hires is a concern (6.0 million to 5.9 million). The U.S. economy is seeing a significantly slower pace of hiring than we experienced in May or June—hiring is roughly where it was before the recession, which is a big problem given that we have more than 11.6 million jobs to make up. And job openings are now substantially below where they were before the recession began (6.4 million at the end of September, compared to 7.1 million on average in the year prior to the recession). No matter how it is measured, the U.S. economy is facing a huge job shortfall.

One of the most striking indicators from today’s report is the job seekers ratio, that is, the ratio of unemployed workers (averaged for mid-September and mid-October) to job openings (at the end of September). On average, there were 11.8 million unemployed workers while there were only 6.4 million job openings. This translates into a job seeker ratio of about 1.8 unemployed workers to every job opening. Another way to think about this: for every 18 workers who were officially counted as unemployed, there were only available jobs for 10 of them. That means, no matter what they did, there were no jobs for 5.4 million unemployed workers. And this misses the fact that many more weren’t counted among the unemployed. The economic pain remains widespread with more than 25 million workers hurt by the coronavirus downturn. Without congressional action to stimulate the economy, we are facing a slow, painful recovery.Read more

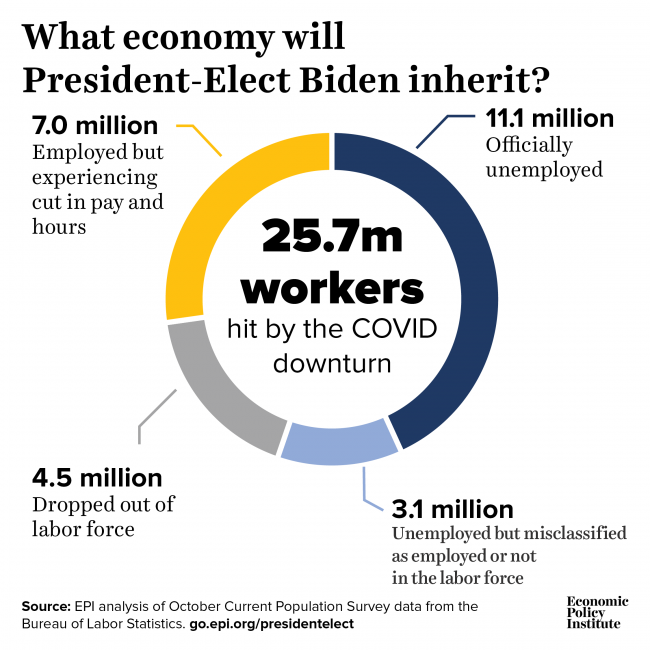

What the next president inherits: More than 25 million workers are being hurt by the coronavirus downturn

Some of the most frequent questions I’ve gotten in the last few months are, “How many workers are being hurt by the coronavirus recession?” and “What kind of economy will the next president inherit?”

There is a huge amount of confusion about the number of workers impacted by this downturn because two major, completely separate, government data sets that address these questions are reporting very different numbers. Specifically, the Bureau of Labor Statistics (BLS) reported that the official number of unemployed workers in October, from the Current Population Survey, was 11.1 million. But during the reference week for the October monthly unemployment figure—the week ending October 17—the Department of Labor (DOL) reported that there were a total of 21.5 million people claiming unemployment insurance (UI) benefits in all programs. The UI number is compiled by DOL from reports it receives from state unemployment insurance agencies.

What is going on? In a nutshell: The BLS official number of unemployed workers vastly understates the number of workers who have faced the negative consequences of the coronavirus recession, and DOL’s UI number overstates the number of workers receiving unemployment benefits.

Let’s first look at UI. One straightforward way that the weekly UI numbers are higher than the monthly unemployment numbers is that the UI numbers include both Puerto Rico and the Virgin Islands, and the monthly unemployment numbers include only the 50 states and the District of Columbia. The number of people on UI (regular state benefits, Pandemic Unemployment Assistance, Pandemic Emergency Unemployment Compensation, or Extended Benefits) for the week ending October 17 was 294,000 in Puerto Rico and 4,000 in the Virgin Islands, for a total of nearly 300,000 UI claims outside of the 50 states and the District of Columbia.

Over a million people still filed initial unemployment claims last week with no COVID-19 relief in sight

Another 1.1 million people applied for unemployment insurance (UI) benefits last week, including 751,000 people who applied for regular state UI and 363,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program that provides up to 39 weeks of benefits for workers who are not eligible for regular unemployment insurance, like the self-employed. Without congressional action, PUA will expire in less than two months (more on that below).

The 1.1 million who applied for UI last week was little changed (a decline of 3,000) from the prior week’s revised figures. Last week was the 33rd straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still 3.6 times where they were a year ago.)

Most states provide 26 weeks of regular benefits, but this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 538,000, from 7.8 million to 7.3 million.

For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is set to expire in less than two months (more on that below).

Older workers are voting with an eye on the economy

Recent polls have shown that older Americans and women appear to have turned against President Trump, and the reasons aren’t hard to grasp. The administration’s mishandling of the COVID-19 pandemic has been especially deadly for older Americans, while women have borne the brunt of the economic downturn, with greater job losses and caregiving responsibilities.

One factor has received less attention: Older Americans, too, have been hard hit in the economic downturn. Senior women (women ages 65 and older) have seen a steep decline in employment—almost as steep as that of young women just entering the labor force (see Table 1). Senior men also saw a steep decline in employment early in the pandemic but rebounded faster than senior women.

Heading into election day, at least 30 million workers are being hurt by the coronavirus recession

One of the most frequent questions I’ve gotten in the last few months is, “How many workers are being hurt by the coronavirus recession?” There is a huge amount of confusion about this because two major, completely separate, government data sets that address this question are reporting very different numbers. Specifically, the Bureau of Labor Statistics (BLS) reported that the official number of unemployed workers in September, from the Current Population Survey, was 12.6 million (September is the latest data available; October numbers will be released this Friday). But during the reference week for the September monthly unemployment figure—the week ending September 12—the Department of Labor (DOL) reported that there were a total of 26.5 million people claiming unemployment insurance (UI) benefits. The UI number is compiled by DOL from reports it receives from state unemployment insurance agencies.

What is going on? In a nutshell: The BLS official number of unemployed workers vastly understates the number of workers who have faced the negative consequences of the coronavirus recession, and DOL’s UI number overstates the number of workers receiving unemployment benefits.

Let’s first look at UI. An important way the numbers coming out of DOL are overstating the number of people receiving UI benefits right now has to do with delays in the processing of applications (delays caused by the overwhelming number of applications UI agencies have received during the COVID-19 crisis). When a worker’s benefits are delayed, they are paid retroactively. This is as it should be, but it causes reporting problems. Say a worker claims UI benefits not just for their most recent week of unemployment, but also for the six prior weeks. That worker will show up in the data not as one person who claimed seven weeks of benefits, but as seven claims. Nobody knows how extensive that problem is, but this New York Times article has good information on it. Another issue is that state UI agencies have been the target of fraud—not individuals filing one or two fraudulent claims, but sophisticated cyberattacks involving extensive identity theft and the overriding of security systems. Note: None of this negates the fact that the expansions of unemployment insurance in the CARES Act were an enormous success! These expansions have been a lifeline to millions and a crucial boost to the economy.