Latest Research

-

The Trump administration’s short-sighted attacks on the Federal Mediation and Conciliation Service

-

The Trump administration’s macroeconomic agenda harms affordability and raises inequality

-

Workers’ resolve drives increase in unionization in 2025

-

Everything you need to know about “no tax on overtime”

-

Rights to unionize and collectively bargain: State solutions to the U.S. worker rights crisis

Blog

-

U.S. economy lost an alarming 92,000 jobs in February: Private sector experienced vast majority of losses, one-third were due to temporary strikes

-

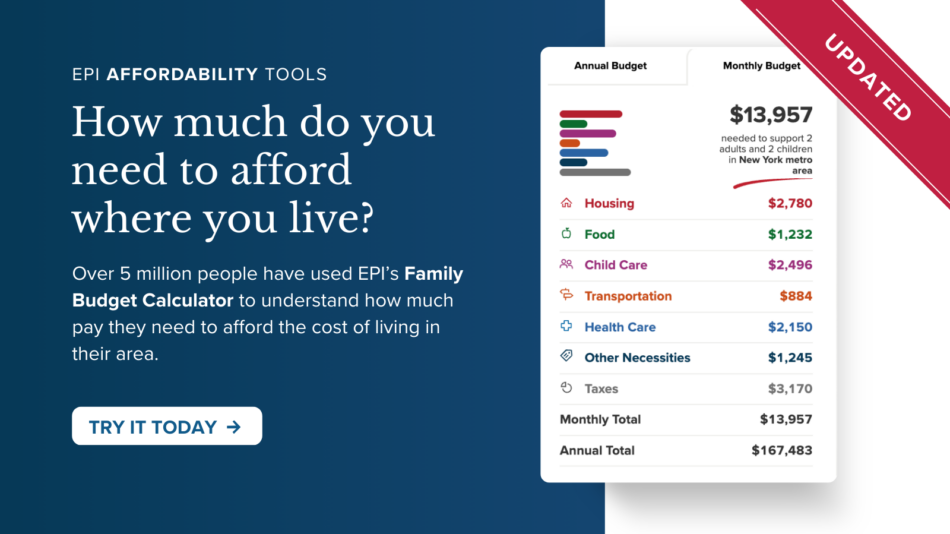

EPI’s updated Family Budget Calculator shows that higher minimum wages are needed in states like Oklahoma to afford the cost of living

-

How Trump’s economic policies are worsening affordability

-

Employer assessment fees are not an adequate solution to low wages and large safety net cuts

-

You can’t starve the public sector to excellence

-

Indiana lawmakers are once again trying to weaken child labor laws: Bill sponsored by business owner would enable employers to hide child labor violations

-

We’ve been here before, and we know what comes next: White supremacy has always been used to usher in massive economic inequality

EPI in the news

-

Kiplinger | March 9, 2026

-

KDHL Radio (Minnesota) | March 9, 2026

-

South Florida Reporter | March 9, 2026

-

Seattle Times | March 9, 2026

-

Investopedia | March 9, 2026

-

Media Matters for America | March 9, 2026

-

KTTC-TV (Minnesota) | March 9, 2026