What a Romney-Ryan budget would mean for Americans

Republican presidential candidate Mitt Romney has selected House Budget Committee Chairman Paul Ryan (R-Wis.) as his running mate, further elevating tax and budget policy issues. Ryan is known for providing seemingly wonky budget plans over the last decade. Below, we highlight and summarize previous analyses of these plans. What stands out is that Ryan’s budget blueprints impose huge cuts to non-defense spending yet still fail to address long-run fiscal challenges in any serious way. Further, they clearly exacerbate many pressing economic challenges, like restoring full employment, rebuilding the middle class, and curbing health costs. Lastly, they are often simply incomplete or even dishonest, claiming to hold overall revenue levels constant while offering no tax increases to counterbalance very large tax cuts aimed at the highest-income households. Simply put, the Ryan budgets fail to correctly diagnose the most pressing economic problems facing the U.S. economy, and hence fail to propose real solutions. Here are themes everyone needs to know about the Romney-Ryan agenda for the federal budget, and a 10-point overview of Ryan’s budgets.

- The Ryan budget blueprints would derail economic recovery and lower employment in the near term by prematurely cutting domestic spending.

- Ryan’s budgets make deep cuts to Medicare, Medicaid, and Social Security, as well as repeal the Affordable Care Act .

- Ryan has proposed cutting non-defense spending and public investments—areas including education, infrastructure, and scientific research—to implausibly low levels that impede near- and long-term growth.

- Ryan’s budget blueprints shift the burden of taxation from the most upper-income households to the middle class, redistributing wealth up the income distribution.

- Ryan’s budgets appear fiscally responsible on paper only by dissembling which taxes will be raised to cover his enormous cuts to tax bills of high-income households and corporations. Read more

Making the tax code work for the middle class

A few weeks ago at a congressional hearing, Gene Steuerle pointed out that the design of our tax code and safety net can result in low-income households facing high effective marginal tax rates. For example, Steuerle finds that a household whose income rises from $10,000 to $40,000 would actually face a nearly 30 percent marginal tax rate. Factoring in the loss of safety net benefits like nutrition assistance, health insurance coverage, and other program benefits translates into an 82 percent marginal rate. In other words, a household making $10,000 that gets a raise of $30,000 would end up only $5,400 better off.

This happens because much of our social safety net is means tested, meaning that benefits phase out as household income rises. A simple way to solve this problem is to delay the phase-out and extend the schedule, making the benefit in question phase-out more slowly. This would not only tear down the high marginal rate wall between low-income and middle class taxpayers, but would also help middle-income households who have too much income to benefit from social safety net programs but too little income to utilize many of the tax breaks that the tax code provides disproportionately to high-income households. Read more

Bill Keller and Third Way’s misinformed and ironic baby boomer bashing

I know I’m getting to this debate a little late, but it’s too good to pass up. As you may have read, the centrist think tank Third Way recently came out with a paper finding that entitlement spending has crowded out public investments, and therefore Democrats who care about children should endorse cutting health and retirement benefits for the poor and/or elderly. Bill Keller then used the paper as the basis for a New York Times column on how the baby boomer generation is greedy. Dylan Matthews and Jamie Galbraith vehemently disagreed.

Let’s state up front that Keller and Third Way’s concern for our currently-low levels of public investment is totally spot on. We’ve written extensively on how public investments act both as a vital driver of economic growth and how they help push against inequality trends, helping us achieve a future where a higher level of prosperity is shared by more people. EPI has been writing about the deficit in public investment for more than two decades.

But there are two intrinsic problems with the Third Way/Keller narrative. The first is that the data do not really support it at all. Below is their central graph, supposedly proving their point:

I’ve redrawn the graph below, lopping off the data after 2011 because, as I understand it, their point is that historically public investments have been crowded out by entitlement spending, so we should only look at historical data. After all, the point is to look at what has already happened, and once you do that, it’s clear that the data do not at all support Third Way’s hypothesis.Read more

DHS initiative for young unauthorized immigrants is cost-effective and benefits American workers

Next week, about 1.2 million young people who reside in the United States without proper authorization—but who were brought here by their parents when they were children—will be eligible to apply to the Department of Homeland Security (DHS) for a discretionary grant of relief from removal (also known as deportation). This relief will be valid for two years and renewable in two-year increments. If granted, beneficiaries would also be eligible for an Employment Authorization Document, which would allow them to work legally in the United States with full labor and employment rights. This will clearly benefit the American workforce, and it’s unlikely to cost a dime of taxpayer money.

On Tuesday, the Migration Policy Institute (MPI) hosted a forum to discuss how DHS’s new process—known officially as the Deferred Action for Childhood Arrivals (DACA) initiative—will function in practice. The keynote speaker was Alejandro Mayorkas, Director of U.S. Citizenship and Immigration Services (USCIS), which is the DHS agency that will process and adjudicate DACA applications. Mayorkas outlined the programmatic aspects of the initiative and its requirements, and four immigration experts offered their thoughts in response. It was a valuable discussion that shed some much-needed light on DACA.

We know from multiple reports that many of those who will seek this type of relief from removal are some of the best and brightest students—and future workers—our country has to offer. They arrived in the United States through no fault of their own, and it would be unjust to send them to a country they barely know or do not remember, and where many would not even know the language. They deserve to stay here and to become Americans, and to be allowed to contribute to our labor market. But despite bipartisan support and a decade’s worth of bipartisan proposals in Congress, gridlock and obstructionism have blocked a solution that would grant them a permanent status. That’s one of the reasons why President Obama announced on June 15 that his administration would use its discretionary administrative authority to refrain from removing young unauthorized immigrants who are not criminals and pose no threat to national security.

However, it is clear that USCIS has quite a task on its hands. Read more

For-profit colleges have the poorest students and richest leaders

For-profit colleges prey on the poorest students while generating a great deal of wealth to shareholders, owners, and CEOs. Figure A shows that in 2008, the median family income of students attending for-profit colleges was $22,932. This amount is only slightly higher than the U.S. Census Bureau’s poverty threshold for a family of four. The families of students at public colleges had about twice as much income, and those at private non-profit colleges nearly three times as much.

Despite having the poorest student bodies, the CEOs running for-profit education companies earn far more than the richest leaders of traditional public and private colleges and universities. CEOs of publicly-traded for-profit education companies had an average compensation of $7.3 million in 2009, while the richest five leaders of private non-profit colleges and universities had an average compensation of $3 million (Figure B). The richest five leaders of public universities had an average compensation of $1 million.

For-profit colleges are so profitable because they charge very high tuition and invest rather little in education. Among for-profit college students, 96 percent take out student loans to pay for their education, a much higher rate than at other colleges. Since most of these loans are from the Department of Education financial aid program or U.S. military educational programs, it is ultimately taxpayers who are paying these CEOs’ salaries. These students who were already low-income often end up saddled with a very large amount of debt. Since student loan debt cannot be expunged even through bankruptcy, these debts can be “a lifelong drag on people who already are struggling.”

High cost and high debt for students at for-profit colleges

For-profit colleges tend to enroll students who are not familiar with traditional higher education. They are more likely to be low-income, African American or Latino. Significant numbers of veterans also enroll in these schools. The Senate Committee on Health, Education, Labor, and Pensions found that recruiters “were trained to locate and push on the pain in students’ lives.” Additionally, undercover recordings by the Government Accountability Office and other sources show that many for-profit college recruiters “misled prospective students with regard to the cost of the program, the availability and obligations of Federal aid, the time to complete the program, the completion rates of other students, the job placement rate of other students, the transferability of the credit, or the reputation and accreditation of the school.”

This combination of naïve students and misleading information allows for-profit colleges to set tuition in line with their profit goals (many of these colleges are publicly-traded companies) rather than in line with the cost of education. Figure A shows that the average cost of a certificate program at a for-profit college is 4.7 times the cost of an equivalent program at a public community college. The average cost of an associate degree is 4.2 times what it would cost at a typical community college. Bachelor’s degree programs average 19 percent higher at a for-profit college than at a flagship state public university.

Investment, employment trends belie claims that regulation and ‘too much government’ impede recovery

The claim that an excess of regulatory activity is stifling the economy and jobs growth continues to ignore the roots of the economy’s problems (the collapse of the housing and financial sectors) and the reality of current economic trends. We will save discussion of the causes of the downturn for a different day, except for noting the irony that regulatory opponents are fighting implementation of the stronger financial rules that could help prevent future collapses. Instead, we will update key information from a previous EPI analysis of whether business decisions, specifically investments, are consistent with the excessive regulation story. The earlier report documented that “what employers are doing in terms of hiring and investment” was inconsistent with business claims that regulatory uncertainty under the Obama administration was impeding job growth. The new data include four additional quarters of results and also take into account revisions to the earlier data that were made available in late July (the Bureau of Economic Analysis annual benchmarking of the National Income and Product Accounts data leads to some revisions). Altogether, we are now able to compare investment trends during the first 12 quarters (or three years) of this recovery to the first 12 quarters of the three prior recoveries.

Of particular interest is whether businesses are holding back from investing in equipment and software because of fears of new or potential regulations. This investment category leaves out residential investment and investments in business “structures”—because those types of investments are clearly faltering as a result of the bursting of the residential and commercial real estate bubble (and not because of regulatory activity).

As a share of the economy, the data show that equipment and software investment has increased more in this recovery than in the three prior recoveries. Indeed, three years into this recovery the growth of 1.6 percentage points in the share of GDP going to investment in equipment and software is more than twice as large as the growth during the first three years of either the George W. Bush or the Reagan recoveries. That means that this recovery, with the Obama regulatory approach, is far more investment-led than the recoveries under the generally deregulatory Bush and Reagan administrations.

Keep your government hands on my Medicare!

Celebrating Medicare and Medicaid’s 47th birthday this week, here are some quick thoughts on government’s role in ensuring access to affordable health care:

- The United States spends nearly double what other countries spend. Americans spent a total of around $7,600 per person on health care in 2010, compared with around $3,900 on average for countries with similar standards of living, according to the Kaiser Family Foundation. Despite this higher spending, health outcomes are no better than in other developed countries.

- Government picks up nearly half the tab. As fewer Americans are covered by employer-sponsored insurance, government has taken up the slack. State and federal programs now directly or indirectly cover 45 percent of health care costs in the United States.

- High and rising health care costs are the biggest fiscal challenge our country faces. The Congressional Budget Office (CBO) projects that federal spending on major health programs will increase from 7.4 percent of GDP in 2022 to 10.4 percent in 2037 if current policies remain in place. Nearly two-thirds of this increase is due to the assumption that per capita health care expenditures will grow faster than per capita GDP. In the absence of this excess cost inflation, spending on these programs would increase to a more manageable 8.6 percent of GDP in 2037, largely reflecting the long-anticipated baby boomer retirement. Read more

The folly of the GOP’s ‘tax reform’ agenda

Mitt Romney and House Budget Committee Chairman Paul Ryan (R-Wis.) are both pushing “tax reform” plans that would lower marginal tax rates while broadening the base (curbing tax deductions, credits, and exclusions). Romney’s plan, for example, would reduce all individual income tax rates by a fifth—e.g., the top 35 percent rate would fall to 28 percent—and the revenue loss would be made up by limiting or eliminating unspecified tax expenditures. And he says he would do this without cutting taxes for high-income households (beyond continuing their Bush-era tax cuts), meaning that he would more or less preserve the progressivity of the current tax code (i.e., tax burden distribution).

For the moment, let’s leave aside the fact that these plans neglect to raise a dollar in additional revenue at a time when we need more revenue to put the government on a sustainable fiscal path. Why are these proposals pure folly? First, because they’re obviously not serious—if they were, the plans would lead with the tax expenditure reform rather than the rate cuts. Instead, they’re sold in manner suggesting that Romney and Ryan wanted to propose big across-the-board tax cuts but didn’t want to be seen as blowing up the deficit, so they included vague language on base-broadening in order to ignore the monumental cost of slashing tax rates.

But most importantly, these plans aren’t serious because their stated intent isn’t mathematically possible. In an analysis released Wednesday, researchers at Brookings and the Tax Policy Center analyzed a plan that is consistent with Romney’s proposal, including lowering rates by a fifth and eliminating the Alternative Minimum Tax. The researchers then attempted to construct a base-broadening approach to both make up the revenue lost from the rate cuts and maintain the progressivity of the current tax code. Read more

Potential failure

Today’s report on gross domestic product (GDP) came with more news of disappointing growth. The economy has grown at an average rate of 1.75 percent so far this year. While the economy is growing and we are not in a recession (and there’s no sign a recession is imminent), it is important to note that this slow growth is not moving the economy much closer to full health, and may even be doing real damage to that long-run health.

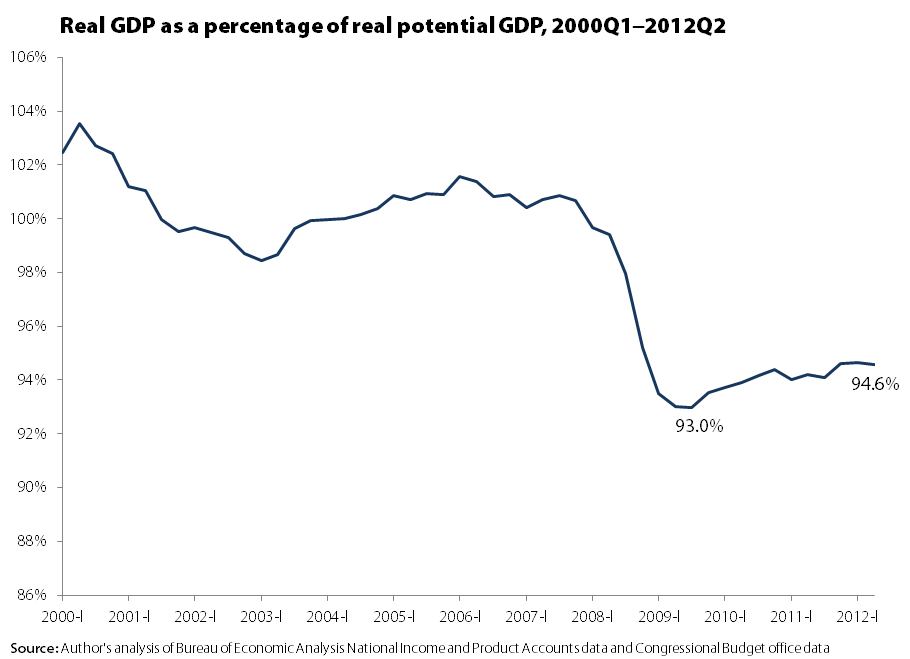

This problem can be highlighted by looking at actual GDP as a percentage of “potential ” GDP, a figure provided by the Congressional Budget Office. Potential GDP can be thought of as a capacity utilization rate for the whole economy: If we were utilizing all of our resources, including labor and capital, how much economic output would we be able to produce?

You can see that in 2000, actual and potential were roughly similar (actual slightly exceeds potential, in fact, because the CBO has a too-conservative view of what is the lowest sustainable rate of unemployment), but then this ratio crashes as the Great Recession hits.

At the trough of the recession in the third quarter of 2009, the U.S. economy was operating at only 93 percent of potential. In the nearly three years since, we’ve only recouped an additional 1.6 percent of potential output. Although GDP has been growing in that period, potential has been growing too (and faster), because of our increasing potential labor force and productivity growth.

Investigations reveal forced labor of immigrants but Congress won’t allow the Labor Department to combat it

Congress holds the keys to fixing many of the problems in one of the main temporary foreign worker programs used by employers to displace U.S. workers, depress wages, and exploit foreign workers. The Department of Labor has already issued the important fixes, but they’ve been temporarily enjoined by a federal court. However, going forward, Congress is considering nullifying the rules entirely by denying funding for their implementation.

The program in question is the H-2B guest worker program. On Tuesday, I joined the Southern Poverty Law Center (SPLC), the AFL-CIO, and two H-2B guest workers from Central America at the National Press Club to call on Congress to help unemployed workers have increased access to jobs in a number of occupations—including landscaping, hospitality, forestry, and seafood processing—by allowing the DOL’s new rules governing the H-2B program to come into force. The new rules would require employers to first recruit unemployed workers before turning to foreign workers, ensure that U.S. and foreign workers are not underpaid, and protect guest workers from becoming victims of forced labor and human trafficking, as well as from being retaliated against if they attempt to assert their labor and employment rights.

Although the new rules include common sense protections for U.S. and foreign guest workers, they are far from extreme or burdensome. If anything, the rules and requirements on employers are quite basic and modest.

Recently, the scandalous side of the H-2B program received some well-deserved attention from the media. A few weeks ago, a New York Times editorial, “Forced Labor on American Shores,” offered a powerful and depressing reminder that the days of forced labor (also known as slavery) are still with us. In fact, the H-2B guest worker program helps facilitate it, and in the editorial’s case, forced labor was occurring for the benefit of Walmart, the largest private employer in the world, by C.J.’s Seafood, one of its suppliers. Walmart’s size and purchasing power give it leverage to demand the lowest prices possible from its vendors and manufacturers. This in turn, can motivate suppliers like C.J.’s in Louisiana to exploit and abuse their workers in order to bring down labor costs. Read more

Confirming the further redistribution of wealth upward

A new Congressional Research Service report by Linda Levine is the first update on the distribution of wealth (including that of the top 1 percent) I’ve seen based on the recently released Federal Reserve Board (FRB) data on wealth for 2010. Levine’s analysis (see two of her tables below) shows a large upward change in the distribution of wealth over 2007-2010, with losses in the bottom 90 percent and large gains for the top 10 percent. Specifically, the bottom 90 percent in 2010 had just 25.4 percent of all wealth, down from 28.5 percent in 2007. The gainers were primarily those in the 90-to-99th percentiles (up 2.3 percentage points) of wealth, though the top 1 percent saw gains (up 0.7 percentage points) too. Levine’s data goes back to 1989 and show the wealth share of the bottom 90 percent to be at its lowest in 2010, far lower than the 32.9 percent share in both 1989 and 1992.

Levine reports data directly from the FRB showing that average wealth is down from 2007 but still far greater in 2010 ( $498,800) than in 1989 ($313,600) or 1992 ($282,900). In contrast, the wealth of the median household (wealthier than half of households but less wealthy than the other half) in 2010 was $77,300, not much different than in 1989 ($79,100) or 1992 ($75,100). In other words, wealth grew 59 percent from 1989 to 2007, but the typical household’s wealth was actually 2 percent less.

This is yet another dimension of the same old story about the economy being able to provide for most people but failing to do so, a story that will be told more fully in the forthcoming State of Working America (being released in late August). The new edition will include a more detailed report on wealth distribution from 1962 to 2010, based on an analysis by New York University’s Edward Wolff (see the last report, written by Sylvia Allegretto).

Happy birthday, CFPB

Tomorrow, the Consumer Financial Protection Bureau completes its first year of operation. Created under the Dodd-Frank Act, we’re starting to see the benefits of a strong federal agency that protects consumers from the dangers posed by an unchecked financial industry.

The CFPB notched its first enforcement action—and hopefully, the first of many—yesterday with the announcement that Capital One will pay up to $210 million to settle federal charges that it violated consumer protection requirements. According to CFPB charges, Capital One used “deceptive practices” to sell unnecessary add-ons to credit card holders. Between $140 million and $150 million will be paid to the two million customers affected. Capital One will pay another $60 million in fines, with $25 million going to the CFPB and $35 million to the bank-regulating Office of the Comptroller of the Currency.

Today, the CFPB followed up this victory with the release of a report on the private student loan industry, to which American consumers owe more than $150 billion in debt. The extensive report identifies several consumer protection issues in the private student loan marketplace. Importantly, though, the report doesn’t just stop there: It includes strong congressional policy recommendations by CFPB Director Richard Cordray and Secretary of Education Arne Duncan.

These actions by the CFPB are encouraging, but the history of financial regulation teaches us that the real challenge is maintaining vigilance over time. This means keeping up with financial intermediaries’ attempts to arbitrage between different regulatory agencies, bypass current regulatory structures, and capture regulating agencies. The CFPB had a good first year, but the real challenges will appear in the years to come.

Nearly 3 years, and counting: Minimum wage increase helps working families and the economy

At the end of March, Iowa Sen. Tom Harkin introduced the Rebuild America Act, a bill that contains important provisions to strengthen the economy and improve the well-being of working Americans. Among the many worthy elements of this bill is a proposal to increase the federal minimum wage to $9.80 by July 1, 2014. Next week will mark the third anniversary of the most recent increase in the federal minimum wage. Rather than increase the federal minimum wage annually to allow low-income workers to maintain their standard of living and share in the fruits of their ever-more productive labor as should be the case, Congress too often raises the minimum wage and then puts the well-being of low-wage workers on the back burner for years at a stretch.

As my colleague David Cooper wrote in April, increasing the federal minimum wage to $9.80 by July 1, 2014 would benefit over 28 million workers and increase national GDP by over $25 billion, in the process creating over 100,000 jobs. Given the lackluster recovery that continues to cast a pall over the nation, this positive step should be embraced by all those who care about the well-being of working families.

In a forthcoming paper, I’ll be detailing the demographic characteristics of those affected by increasing the minimum wage as proposed by Harkin (a proposal that has been mirrored in Conn. Rep. Rosa DeLauro’s Rebuild America Act and in a bill for which Calif. Rep. George Miller is currently gathering support). This paper will also highlight the state level impact of the proposed increase, breaking out state-specific demographic impacts and also highlighting the economic and employment impacts.

Here are a few graphs to whet your collective appetites:

Figure 1: Educational attainment

As seen in Figure 1, over three-quarters of those affected by the proposed increase to $9.80 have completed high school or more, including 42.3 percent who have completed some college, have an associates degree, a bachelor’s degree, or more. Read more

80% of jobs created since the recession’s end have gone to men?

The U.S. economy has created 2.6 million net jobs since the end of the Great Recession in June 2009. According to a Los Angeles Times analysis of Bureau of Labor Statistics data, men have filled 2.07 million of these new jobs. There are several possible explanations for this, and a couple of important points to keep this disparity in context:

- Men suffered higher levels of job loss during the recession than women, and their level of employment today relative to pre-recession levels is still lower than women’s.

- Women hold the majority of jobs in the public sector, which is by far the sector that has seen the worst performance since the recovery began.

- Male-dominated manufacturing is recovering, albeit slowly.

- Men are taking jobs in sectors that women have traditionally been the majority in.

The construction sector suffered the largest job losses of any industry during the recession, followed by manufacturing. These sectors are overwhelmingly male, meaning that their initial losses in the recession outpaced losses for women. Even today, unemployment among men is 8.4 percent, while for women it’s 8.0 percent.

Because women have historically filled the majority of public-sector jobs, they’ve been disproportionately affected by state and local governments’ decisions to cut positions in the wake of state fiscal troubles—a phenomenon that has largely occurred since the recession’s end. An EPI report from May found that of the 765,000 public-sector jobs lost between 2007 and 2011, 70 percent were jobs held by women. While the private sector has slowly recovered some of the jobs it lost during the recession, the public sector is still cutting them at a rapid rate; 2011 was the worst public-sector job decline on record. This public-sector employment loss is almost surely the single largest reason for women’s comparative struggles since the recovery began. Read more

The five serious flaws of Bowles-Simpson

Yesterday, a selection of past members of the Bowles-Simpson commission, anti-deficit groups like the Peterson Foundation and the Committee for a Responsible Federal Budget, and a handful of retired politicians launched the Fix the Debt Campaign in order to push a deficit reduction package in line with the original Bowles-Simpson framework (full disclosure: I served on the Bowles-Simpson commission staff in fall 2010). The event was characterized by high-minded rhetoric about coming together and solving problems and little in the way of specific policies, a reflection of the fact that in the year-and-a-half since its initial release, the Bowles-Simpson proposal has become more a symbol of seriousness and bipartisanship than an actual set of discrete recommendations that can be analyzed. This is unfortunate because the proposal itself is pretty detailed, and although it has some good components, it also has some major flaws that—without serious revision—should render it an inappropriate template for deficit reduction.

1) It would weaken the economy by cutting way too fast

The proposal admits that Congress should not cut too soon “in order to avoid shocking the fragile economy,” but addresses this by “waiting until 2012 to begin enacting programmatic spending cuts, and waiting until fiscal year 2013 before making large nominal cuts.” Given the current weak state of the economy, it’s clear that this timetable was way off. But it’s not like this was unexpected: In Aug. 2010 (three months before the Bowles-Simpson proposal was released) the Congressional Budget Office projected that the unemployment rate would be still be 8.4 percent in fiscal year 2012. Of course, it was possible that the economy would outperform this projection, but it was also possible it would underperform. Given this uncertainty, the proposal should have included an economic trigger and not just a simple-minded timeline—for example, the cuts would only take effect if the economy was experiencing healthy growth and well on its way to full recovery. At the time, EPI had recommended this trigger be set at 6 percent unemployment for six months, which in retrospect looks quite prescient.

2) It had an unbalanced ratio of spending cuts to revenue increases

The advertised ratio of spending cuts to revenue increases was 3-to-1. This isn’t totally accurate: Excluding interest savings (which are a function of both spending and revenue decisions) and including the additional revenue assumed in the baseline (i.e., the assumed conditions against which the proposal is measured) from the expiration of the high-income Bush tax cuts, the ratio was closer to 55-to-45.

But that’s still too heavily weighted towards spending cuts. Over the last two decades, budget deals have skimped on tax increases in favor of heavy spending cuts, and the most recent deal—the Budget Control Act—was 100 percent spending cuts. Furthermore, the Bush tax cuts themselves account for nearly half of the total debt accrued during this period. Finally, spending cuts exacerbate the massive and growing income inequality in this country by generally falling on middle- and low-income households (Paul Ryan’s budget, for example) while federal tax increases can be designed to ensure that high-income individuals pay their fair share. Read more

Inequality, exhibit A: Walmart and the wealth of American families

Two weeks ago saw the 50th anniversary of the opening of the first Walmart. And just a week before that, the Federal Reserve released the underlying data on family wealth from the Survey of Consumer Finances (SCF). The SCF is the survey that reported the median wealth of American families (that is, the wealth of that American family that is exactly wealthier than half of all families and less wealthy than half) fell by 38.8 percent between 2007 and 2010.

We have argued previously that Walmart is a useful archetype for trends in the larger American economy over the past three decades. Its enormous size and bargaining power has led to fabulous wealth for its owners (most notably the Walton family), while the compensation it pays its employees is generally low, even by retail standards; and the ubiquity of Walmart stores means that it is effectively the marginal employer in many U.S. counties. And its role as this marginal employer often serves to drive down workers’ wages county-wide.

The three years of wealth data from 2007 to 2010 just provides an extreme example of how the economic fortunes of Walmart’s owners have diverged from those of typical American households. Concretely, between 2007 and 2010, while median family wealth fell by 38.8 percent, the wealth of the Walton family members rose from $73.3 billion to $89.5 billion (note that the 2007 wealth number is slightly larger than was reported at the time—to provide an inflation-adjusted comparison, I converted the 2007 wealth value of $69.7 billion to 2010 dollars using the consumer price index (the CPI-U-RS, to be specific)).

In 2007, it was reported that the Walton family wealth was as large as the bottom 35 million families in the wealth distribution combined, or 30.5 percent of all American families.

And in 2010, as the Walton’s wealth has risen and most other Americans’ wealth declined, it is now the case that the Walton family wealth is as large as the bottom 48.8 million families in the wealth distribution (constituting 41.5 percent of all American families) combined.

It’s hardly a surprise that the economic circumstances of the Walton family and that of most Americans are moving in opposite directions, but some have attempted to quibble with the use of this particular statistic by noting that nearly 13 million American families have negative net worth—meaning that they have outstanding debts greater than the value of their assets. This is a bit of a strange objection—of course, many American families have negative net worth, but this is an economic reality, not a statistical fluke. Read more

Wages and Social Security

In a 2011 briefing paper, I estimated that weak and unequal wage growth accounted for more than half the projected Social Security shortfall that has emerged since 1983. Despite their importance, wages have received much less attention than life expectancy, a relatively minor factor hyped by alarmists like former Senator Alan Simpson, co-chair of President Obama’s Fiscal Commission.

Demographic trends affecting the worker-to-beneficiary ratio are often presented as inexorable, though many are influenced by public policies. Neo-Malthusian arguments exaggerating the challenges posed by a growing dependent (in this case elderly) population are used to argue that social insurance is increasingly unaffordable, ignoring productivity growth and other positive trends while falsely suggesting that policymakers have few alternatives to benefit cuts.

The Social Security system requires periodic adjustments to maintain fiscal balance and keep up with changing times. The only unusual thing about the current situation is the fact that a distant and relatively modest projected shortfall has been labeled a “crisis.” Though there have been 21 contribution rate increases in Social Security’s history, none have been legislated since the Social Security Amendments of 1983 ushered in a period of retrenchment.1

The 2012 Trustees Report puts the 75-year shortfall at just under 2.7 percent of taxable payroll, meaning that an immediate increase in employer and employee contribution rates of 1.4 percentage points (from 6.2 to 7.6 percent) would be more than enough to close the shortfall,2 as would a gradual increase in the contribution rate from 6.2 to 9.4 percent over the 75-year projection period.3 To put this in perspective, average real wages are projected to grow by a cumulative 140 percent in inflation-adjusted terms by the end of this period.4 Thus, an increase in the contribution rate would still leave future workers significantly better off than today’s workers while preventing a further erosion of the Social Security replacement rate, which is already declining from 49 percent in 1980 to 36 percent in 2080 for the prototypical “medium earner” retiring at 65. In contrast, the plan proposed by Simpson and his Fiscal Commission co-chair Erskine Bowles would result in Social Security benefits replacing just 28 percent of wages for medium earners in 2080.5 Read more

The ‘technology did it’ zombie has arisen

Recent days have seen some signs that the technology explanation for poor labor market outcomes for many workers is stirring again (maybe John Quiggin needs to add a chapter to his magnum opus?).

The Center for Economic and Policy Research’s David Rosnick and Dean Baker do a good job stomping on an awfully weak version of this argument put forward by a recent OECD report. Some of their report is wonky, but it’s worth reading and the takeaways are pretty clear:

- The OECD intentionally misses the largest increase in inequality by looking at the 90/10 ratio of wages—but most of the action in income concentration has taken place well above the 90thpercentile

- The OECD’s “technology” variable is the subject of some odd adjustments—and more sensible treatments of it make its influence on measured inequality fade away

- Adding in a variable ignored by the OECD—financial intermediation as a share of the economy—adds significantly to the explanation of rising inequality, as rising financial shares are associated (not shockingly) with increased inequality

What is really dismaying is the degree to which analytical discipline is allowed to collapse so long as one is telling a well-accepted story about inequality. If the same degree of evidence marshaled by this study in the cause of blaming technology was instead put in the cause of blaming, say, de-unionization for the rise in inequality, it would be met by some widespread jeers among economists (as it should be—the OECD technology evidence is weak). But it’s always safe to be conventionally wrong, I guess.

Anyway, check out Rosnick and Baker’s paper for the full scoop.

Robert Samuelson says the economy isn’t allowed to have the Keynesian cures it needs because of … Keynesians (from the 1960s)

Robert Samuelson’s Washington Post column today is, to be charitable, baffling. He mostly agrees that Keynesians have it right about what the economy needs today: more stimulus, or fiscal support, or spending, or whatever you want to call it. But in a desire to tell us that it is actually Keynesians’ own fault for why we can’t have it, he blames … John F. Kennedy for destroying the nation’s fiscal norms so completely that we somehow can’t afford economic stimulus five decades later.

To be clear, I buy none of this argument that anything keeps us from pursuing more expansionary policy today except for today’s policymakers (and I particularly don’t buy the part of Samuelson’s argument about some magical and well-defined “threshold” of public debt above which we just can’t afford more stimulus and the economy tanks). And, even if there was some reason to think that rising debt/GDP ratios do hamper future policymakers’ response to recessions, the notion that public debt rapidly shrank as a share of overall GDP during the 1960s really should give Samuelson at least some pause about his thesis.

But even if I did believe that some past president had destroyed the historic norm of fiscal probity that preceded their inauguration, I have to ask: Why Kennedy, when there’s much clearer suspects in our more-recent past? The figure below shows net lending by the federal government for the six quarters before the inaugurations of Kennedy, Ronald Reagan, and George W. Bush, as well as what happened during their two terms in office (why six quarters before? I wanted some measure of the alleged fiscal “norms” they inherited, and the Bureau of Economic Analysis data that the chart is based on starts in the middle of 1959, so this simplified my choice).

Again, I actually think concern about budget deficits per se is way overblown in policy debates (for lots of reasons—for example, the budget is affected by the business cycle, which ran differently for all three presidents compared—though, strikingly, all had recessions early in their terms and saw the economy either back in recession (Bush) or within one (Kennedy) or two years (Reagan) of reentering recession by the time their tenures ended. Oh, and wars—wars affect budget deficits).

But if you’re making the argument that running deficits that are larger than the historic norms you inherited is some mammoth economic sin, I ask again: Why Kennedy and not Reagan or Bush?

The point of Samuelson’s column is pretty obviously to blame Keynesians for today’s troubles even though they are exactly right about how to solve them.

On health care reform, Mitt Romney knows better

Republican presidential nominee Mitt Romney is stirring controversy with his equivocation over whether or not the individual mandate in the Affordable Care Act (ACA)—and hence the mandate in his Massachusetts health care reform, the model for much of ACA—is a tax or a penalty. But Romney was unequivocal about one thing in his response to the Supreme Court’s decision to uphold the ACA—and unequivocally dishonest—when he claimed: “ObamaCare adds trillions to our deficits and to our national debt, and pushes those obligations onto coming generations.”

This is patently false, and the former Massachusetts governor should know better. ACA is the most substantial piece of deficit-reduction legislation of the past decade, if not decades. Beyond the first decade, when ACA is gradually being implemented, health reform is projected to lower annual budget deficits by roughly half a percent of GDP, according to the Congressional Budget Office (CBO). Put in perspective, half a percent of projected GDP for 2022 is $125 billion; if ACA is fully implemented, we’re looking at well over $1 trillion of net deficit reduction in the second decade. Passage of ACA was the largest force driving CBO’s dramatic recent improvements in long-term public debt projections: between 2009 and 2010 (pre- and post-ACA enactment), their extended baseline projection for public debt in 2083 was revised sharply downwards from 306 percent of GDP to just 111 percent—a decrease of nearly two-thirds. Since those estimates, ACA is likely to produce even more long-term deficit reduction because the long-term care insurance program (CLASS Act) has been scrapped and some states may be sufficiently principled and foolish to refuse tens of billions of federal dollars for the Medicaid expansion. (Note: neither is a policy success in my book.) Read more

Obama gets tough on China’s unfair tariffs on U.S. auto exports

The Obama administration announced yesterday that it has filed a complaint at the World Trade Organization (WTO) with China over its tariffs on large vehicles exported from the United States to China. This is the seventh complaint filed by the administration against China, and the White House noted that “the previous six have all been successful.”1 The Obama administration should be applauded for its continuing support of the U.S. auto industry, and for this action, which will help preserve U.S. jobs supported by about $3 billion of U.S. exports in 2011.

Much more needs to be done to stop unfair trade and industrial policies in China’s auto industry, which the Chinese government has targeted as a “pillar industry,” for development. Between 2001 and 2011, according to a report by EPI Research Associate Usha Haley, “the Chinese auto parts industry has received about $27.5 billion in subsidies.” U.S. imports of auto parts (including tires) increased more than 600 percent between 2001 and 2011, and are on track to reach $14.5 billion in 2012. The rapid growth of subsidized and unfairly traded auto parts from China puts at risk every job both directly and indirectly supported by the U.S. auto–parts industry. The U.S. auto parts industry directly and indirectly supported 1.6 million jobs in 2009, with jobs at risk in every state.

Adding insult to injury, China continues to manipulate its currency. This magnifies the benefits of subsidies and other unfair trade policies that benefit China’s auto-parts exports. Currency manipulation artificially reduces the costs of China’s exports and inflates the costs of exports from the United States (and other countries) in China and all other countries where they compete with China. I estimated last year that a 25-to-30 percent appreciation of China’s yuan and other manipulated Asian currencies would support the creation of up to 2.25 million U.S. jobs, stimulating up to $286 billion in GDP growth (1.9 percent) and reducing federal budget deficits by up to $71 billion per year. Read more

Three years into recovery, just how much has state and local austerity hurt job growth?

This morning’s release of the June 2012 employment situation report by the Bureau of Labor Statistics marked three years since the official start of the recovery from the Great Recession in June 2009. That makes this a useful moment to assess how this recovery stacks up against earlier ones, and to identify obvious policy measures that could ameliorate glaring weaknesses in the current recovery.

The figure below shows that while jobs fell much further and faster during the Great Recession than in the previous two recessions (marked by the lines to the left of the zero point on the x-axis), job growth in the current recovery is similar to job growth by this point in the previous two recoveries, just slightly lagging job growth following the recession of 1990-91 and outpacing job growth following the recovery after the 2001 recession.1

Of course, three years into recovery from those recessions, unemployment was not stuck at levels anywhere near as high as today’s 8.2 percent. But it is important to note that it is the historic length and severity of the Great Recession that explains why the economy is so much worse three years into the current recovery than it was three years into the recoveries of the early 1990s and 2000s, and that there is not something atypically weak about the current recovery relative to those earlier ones.2

Further, the most glaring weakness in the current recovery relative to previous ones is the unprecedented public-sector job loss seen over the last three years. The figure below shows that private sector job growth in the current recovery is close to that of the recovery following the early 1990s recession and is substantially stronger than the recovery following the early 2000s recession.

Yet, as the figure below shows, the public sector has seen massive job loss in the current recovery—largely due to budget cuts at the state and local level — which represents a serious drag that was not weighing on earlier recoveries.

How many more jobs would we have if the public sector hadn’t been shedding jobs for the last three years? The simplest answer is that the public sector has shed 627,000 jobs since June 2009. However, this raw job-loss figure understates the drag of public-sector employment relative to how the economy functions normally. Read more

Another reminder that good regulations save lives

Imagine going to a fast-food restaurant and unknowingly consuming food contaminated with toxic chemicals. Or buying cooking oil laden with carcinogens. Or purchasing medicine that makes you sick because it contains excessive levels of the heavy metal chromium.

Sadly, these are not hypothetical situations but real problems discovered in recent years in China. The Chinese financial newspaper Caixin Online declares that “these publicized food safety scandals represent only a fraction of [the] unsafe food production practices.” Caixin concludes that food safety in China is “governed by the law of the jungle.”

China’s food safety problems are not limited to small mom-and-pop businesses. The bad fast-food referred to above was the result of a toxic chemical being added to chicken served at McDonald’s and KFC restaurants. The carcinogenic food oil was found in Wal-Mart. A big business is not a guarantee of a safe product.

In the early 20th century, the United States faced food and drug crises similar to the ones in China today. These crises in the United States led to the creation of the Food and Drug Administration and to dramatic improvements in American health and life expectancy. While the United States still has its share of contaminated food, the rate of problems in the United States is far below that of China. As Caixin states, “the size and severity of the food safety crisis” in China “is unique.” There is less toxic food in the United States, in part, because we have a stronger regulatory and enforcement system.

These days, conservatives regularly condemn regulation, but the fact of the matter is that regulations save lives. Last month, my colleague Ross Eisenbrey illustrated how good Occupational Safety and Health Administration (OSHA) standards save lives in the workplace. Experts in China believe that achieving real food safety there will require much more action and involvement by the Chinese government.

David Brooks thinks that the ACA should be replaced with … lots of stuff already in the ACA

In a column about the Supreme Court’s health care decision today, David Brooks offers up a series of recommendations about how to improve the nation’s health care system that he’s positive are not already in the Affordable Care Act (ACA). It’s worth quoting at length because it’s so revealing:

“Crucially, we haven’t addressed the structural perversities that are driving the health care system to bankruptcy. Obamacare or no Obamacare, American health care is still distorted by the fee-for-service system that rewards quantity over quality and creates a gigantic incentive for inefficiency and waste. Obamacare or no Obamacare, the system is still distorted by the tax exclusion for employer-provided plans that prevents transparency, hides the relationship between cost and value and encourages overspending. … Republicans tend to believe that the perverse incentives can only be corrected if we repeal Obamacare and move to a defined-benefit plan — if we get rid of the employer tax credit and give people subsidies to select their own plans within regulated markets.”

Let’s take these in turn:

“Obamacare or no Obamacare, American health care is still distorted by the fee-for-service system that rewards quantity over quality … inefficiency and waste”

Actually, no. The ACA has introduced pretty sweeping reforms to payment delivery; see the Independent Payments Advisory Board (IPAB), created precisely to engage the issues Brooks raises.

“Obamacare or no Obamacare, the system is still distorted by the tax exclusion for employer-provided plans that prevents transparency…”

Again, no. The ACA does indeed limit the value of this tax exclusion over time. Read more

A Solow system

Social Security is a hybrid between a pay-as-you-go and an advance-funded pension system, with most benefits paid out of current taxes but some potentially paid out of trust fund savings. Under ordinary circumstances, the trust fund serves more like a checking than a saving account, though substantial savings may be amassed in advance of bigger-than-usual outlays like the Baby Boomer retirement. This (mostly) pay-as-you-go design allowed Social Security to start paying out benefits shortly after its inception and helps insulate the system from financial market fluctuations.

Nobel Prize-winning economist Robert Solow highlighted the system’s pay-as-you-go properties in a characteristically simple and elegant model presented at a National Academy of Social Insurance gathering last week. Headlining a panel on the Baby Boomers, Solow framed a discussion in terms of basic economic constraints (math-phobes can skip the equations):

1. Labor Productivity x Hours Worked Per Worker x Active Workers = Gross National Product

2. Gross National Product = Labor Income + Capital Income

3. Labor Income = Active Worker Share + Retiree Share

Where:

Labor Income = Wage x Hours Worked Per Worker x Active Workers

Active Worker Share = Labor Income – Social Security Taxes

Retiree Share = Social Security Benefit x Retirees

With some rearranging, it follows from Equation 3 that:

4. (Social Security Benefit/Wage) = (Active Workers/Retirees) x (Social Security Taxes/Labor Income)

Solow emphasized that most of the factors in his simple model were determined outside the Social Security system, with the obvious exceptions of the first and last terms in Equation 4.1 This suggests that a decline in the worker-beneficiary ratio requires a reduction in benefits, an increase in the effective tax rate, or both. Read more

Combating foreign currency manipulation would boost manufacturing and U.S. jobs

A story in Tuesday’s Wall Street Journal highlights a truth about the economy that Washington’s policy makers have chosen to ignore. The value of our currency relative to our competitor nations’ currencies is a huge driver of factory location. Despite its positive connotations, a strong dollar is bad for U.S. exports and U.S. manufacturers. For years, Japan bought U.S. treasurys as a way to cheapen its own currency and strengthen ours, just as China does. The result was that Japanese imports to the U.S. were artificially cheaper and Japanese cars built in Japan had a price advantage even overseas, when competing with U.S.-built cars. (The same would be true for refrigerators or construction equipment, or any other manufactured goods.)

But lately, Japan has been unable to prevent its currency from strengthening against the dollar, so much so that the advantage has been flipped, and it is beginning to make more sense for Japanese automakers to build their cars in the U.S. than in Japan. As a result, Nissan is closing plants in Japan and moving lines to Tennessee and Mississippi, and Honda plans to export cars from the U.S. in large numbers—150,000 a year by 2017.

What is true for Japan is true in spades for China, which for years has maintained a weak yuan relative to the dollar. Other countries in Asia have also followed China’s lead. If China let its currency strengthen, products made in China would be much more expensive here, leading many producers to move manufacturing operations back to the U.S. By the same token, products made in the U.S. get an immediate price advantage and would once again be competitive in world markets.

The Obama administration and Congress should agree to legislation that would force China and other Asia currency manipulators to give up their tactics and give our manufacturers a fair chance to compete. As EPI’s senior trade economist Robert Scott has shown, no other single legislative action is likely to create more jobs, do more to correct our trade deficit, or do more for our budget deficit.

Foxconn is no exception: New report finds labor violations common throughout Apple’s supply chain

China Labor Watch just released a new report investigating working conditions at 10 of Apple’s suppliers in China, including the Foxconn factory in Shenzhen. The New York-based group was able to collect this information even though local authorities in China sometimes literally kicked its investigators out of town. As others have also determined, including the Fair Labor Association in a study sponsored by Apple, CLW found working conditions at the Foxconn factory to be severe, with workers employed long hours at low pay under harsh living conditions. The CLW report also breaks new ground in three areas. The report finds:

- Deplorable labor practices are not just characteristic of Foxconn factories, but exist in factories throughout Apple’s supply chain. The report documents, for instance, that employees in most of the factories typically work 11 hours a day and can only take one day off a month (low wage levels and management pressure compel them to work such hours); that employee dorms are frequently overcrowded, dirty and lacking in facilities; and that there is little ability for workers at Apple suppliers to push for reasonable working conditions on their own.

- As bad as working conditions at Foxconn are, they are even worse at some of the other factories in China that supply Apple. The report flags the three Riteng factories investigated as particularly difficult places to work. The table below includes key findings from the report. It indicates: Riteng workers typically work 12 hours per day nearly every day of the year (including weekends and holidays), compared to 10 hours per day at the Foxconn factories, with some days off. The average wage for the Riteng workers amounts to $1.28 per hour, or well below the already quite low average hourly wage of $1.65 for Foxconn workers. Health and safety conditions are much worse at the Riteng factories than at the Foxconn factory, and living conditions are worse for the Riteng workers as well.

Riteng vs. Foxconn

| Riteng (Shanghai) | Foxconn (Shenzhen) | |

|---|---|---|

| Approximate number of workers |

20,000 |

120,000 |

| Percent of workers that are dispatched |

50% |

8% |

| Average number of hours worked per day |

11.8 |

10 |

| Average number of days worked per month |

29.4 |

23.9 |

| Average hourly wage (RMB) |

8.2 |

10.5 |

| Average hourly wage in U.S. dollars |

$1.28 |

$1.65 |

| Percent rating factory’s performance on work safety and health as ‘bad’ |

50% |

2% |

| Percent rating dorm conditions as ‘bad’ or ‘very bad’ |

76% |

21% |

| Percent indicating food is unsanitary |

67% |

39% |

Source: China Labor Watch

- Certain serious labor problems have so far been neglected in the discussion of work practices at Apple suppliers in China. In particular, the new report documents the troubling yet common practice by Apple suppliers of using dispatched labor. This practice enables factories to reduce the compensation and benefits they provide to their workers, makes it even easier to compel workers to work exceptionally long overtime hours, and creates damaging uncertainty over who is responsible for any worker injuries.

In recent months, stories about when the next iPhone will be released or whether Apple will add a television to its product line have helped push the troubling issues concerning how Apple’s products are made to the sidelines. The new CLW report is a needed reminder that those issues should not be forgotten. Apple has the responsibility to ensure that basic labor standards are met not just at Foxconn factories, but also at the factories of other suppliers that have received less media attention. And, as I summarized previously, Apple easily has the resources to advance any necessary changes.

The efficiencies of publicly provided health care, revisited

Following the Supreme Court’s ruling in favor of the Patient Protection and Affordable Care Act (ACA) and its lynchpin—the individual mandate—my colleague Josh Bivens noted all the ways conservatives have tried to keep health care from being delivered efficiently, notably by blocking government from using its monopsony power and economies of scale wisely. This, of course, is difficult to square with conservatives’ professed concerns about public debt, because rapidly rising health costs are, by far, the single biggest impediment to stabilizing long-run public debt (if the economy operates at full potential over this long-run). Political opportunism aside, reasonable policy should unequivocally aim to lower health care cost-growth; so here’s some evidence worth revisiting on the comparative efficiency of public versus private provision of health care.

The United States has a patchwork health care system of universal single-payer insurance for seniors (Medicare), publicly funded health coverage for the disabled and poor children and seniors (Medicaid and SCHIP), a rapidly unraveling system of employer-sponsored health insurance, fragmented private self-insurance markets, and 49 million non-elderly Americans (under the age of 65) without any health insurance. It’s important to note that the ACA was already a preemptive compromise with those opposed to a much more expansive role of government in directly financing health care. This, of course, doesn’t stop its opponents from lambasting it as a “government takeover,” but the ACA actually preserved the basic (inelegant) structure of American health care, seeking to fill in its gaps rather than a total overhaul. This makes its cost-containment provisions subject to much variability—some may work very well to restrain growth while others might not. And it also means that a clear, evidence-based tool for restraining these costs was left on the table: direct public provision of care and financing of costs.

By using its monopsony power and economies of scale gained by insuring tens of millions of people, public health programs have done a better job at restraining costs than private insurers. For example, since 1970, cost growth in inflation-adjusted Medicare spending per beneficiary has averaged 4.5 percent annually, versus 5.7 percent for private insurers.1 This underlying trend has been remarkably consistent over time: The 10-year rolling average of annual per enrollee cost growth for all benefits provided by private health insurers has exceeded that of Medicare in 28 of the past 31 years.

This divergent rate of cost growth compounds markedly over time. Since 1969, cumulative growth in private insurance spending per beneficiary has increased 60.8 percent more than that of Medicare.

And as I noted a while back, the Congressional Budget Office has estimated that Medicare is 11 percent cheaper than an actuarially equivalent private insurance plan, an efficiency premium that will similarly compound with time: Fee-for-service Medicare is projected to be at least 29 percent cheaper than an equivalent private insurance plan by 2030 (relative to CBO’s alternative fiscal scenario for the long-term budget outlook).

The ACA is projected to expand coverage to some 30-33 million additional non-elderly Americans by the end of the decade, a critical step for risk-pooling, increasing cost-saving preventive care, and decreasing uncompensated care costs passed along to providers and policy holders. It also included ambitious reforms to control costs (particularly the Independent Payment Advisory Board, or IPAB), but too many provisions leveraging the public sector’s ability to directly contain costs—notably offering a public insurance option (e.g., Medicare buy-in) and negotiating Medicare Part D prescription drug prices with pharmaceutical companies (as is done for Medicaid)—were lobbied out of the bill. Even though stronger cost-containments could have been included, the Supreme Court’s ruling in favor of the ACA is a major victory for long-run fiscal sustainability, as health reform is projected to reduce annual long-run budget deficits by roughly half-a-percentage point of GDP.

The ACA is a momentous step toward more efficient and comprehensive health care coverage in the United States, but reform will undoubtedly remain a work in progress—particularly as the various cost-containment provisions in the ACA are evaluated and successes merit replication. Our experience over the last 40 years should guide policymakers as they inevitably go back to the drawing board on health care reform; and the evidence over this time overwhelmingly suggests that public provision of health care is more effective at containing excess cost growth and more efficient than private insurance provision.

1. Data from the Centers for Medicare and Medicaid Services’ National Health Expenditure Accounts Table 16, adjusted to constant 2011 dollars using CPI-U-RS.

The mandate lives and conservatives weep that Americans don’t have to pay more for health coverage

The individual mandate lives! Excellent.

For uninsured Americans anyway. But for those of us who had comments ready in case it was struck down, it’s kind of inconvenient.

So, in the interest of recycling, I do want to keep something front-and-center about this particular conservative attack (opposition to the mandate) on health reform: Whatever it’s premised upon, the practical impact of opposing the mandate (and since this is true of all recent conservative ideas on health care one might be forgiven for thinking that it’s a strategy, not a quirk) is simply to make health care more expensive.

And why are conservatives dedicated to making sure Americans pay too much for health insurance? Sometimes, it’s just the price of shoveling subsidies to corporations as part of any health reform. Other times, it’s making sure that Americans don’t see government doing things too efficiently and outperforming the private sector (witness the fevered desire to “reform” Medicare by privatizing it—which will predictably make it more expensive). In the end, I guess you don’t need to believe me when I say that that’s the goal of conservative health reform; but when it’s the practical impact of everything they propose, then I think my argument is looking pretty good.

Anyway, here’s my quick primer on the mandate and why opposing it was simply another exercise in making sure Americans paid too much for health insurance.

A key barrier to individuals gaining coverage if they’re not employed by a large company (which has the clout and the legal protections to force insurance companies to cover all their employees as a group, rather than just cherry-pick the healthy ones) is insurance companies refusing to cover those with pre-existing conditions—or even just those that may become sick (and hence expensive to insure) sometime in the future. The Affordable Care Act (ACA) dealt with this by mandating insurance companies offer coverage to everybody who comes to their door (“guaranteed issue,” in the jargon of reform), and to make this a real, not just a notional “offer,” mandating that these companies charge each beneficiary the same premium (“community rating,” in the jargon, with some variation allowed by age and smoking status). These provisions, again, keep insurance companies from being able to cherry-pick just the healthy to cover.

But, if I could get insured whenever I wanted and at the same rate as everybody else, shouldn’t I just choose to not pay premiums while I’m healthy and then buy coverage after I’m already sick? This would be a big problem for insurance companies, as their pool of covered beneficiaries would be a pretty unhealthy group. And since the ACA provides subsidies to help make coverage affordable, this means that the per-beneficiary level of subsidy would be pretty high, as only unhealthy people would be receiving subsidies.

The answer to this “free-rider” problem? Make sure people carry insurance even while healthy, to make for a larger, more predictable, and healthier insurance pool to keep costs down. This is what the mandate is for.

Essentially, the ACA imposes some restrictions on insurance companies (guaranteed issue and community rating) but then gives them something in return to make sure these restrictions don’t lead to them having to cover an unhealthy pool of beneficiaries (that something in return is the mandate) and rising costs.

So the mandate makes reform more efficient. This means it must be opposed by conservatives, because they have all along been determined to make any health reform as inefficient as possible. Remember the 2006 Medicare Part D legislation that cost way too much because it barred the government from bargaining with pharmaceutical companies over drug prices? And which subsidized private HMOs to cover Medicare beneficiaries? Remember the public option, which would’ve saved the public money but was taken out of the ACA in the early stages? Remember the voucherization of Medicare called for in the Ryan budget, which would insure that Americans spend far more to cover health costs in the future?

This was no grand constitutional issue, this was just conservatives doing what they reflexively do when it comes to health reform: trying to make sure it’s as inefficient as possible.