Potential failure

Today’s report on gross domestic product (GDP) came with more news of disappointing growth. The economy has grown at an average rate of 1.75 percent so far this year. While the economy is growing and we are not in a recession (and there’s no sign a recession is imminent), it is important to note that this slow growth is not moving the economy much closer to full health, and may even be doing real damage to that long-run health.

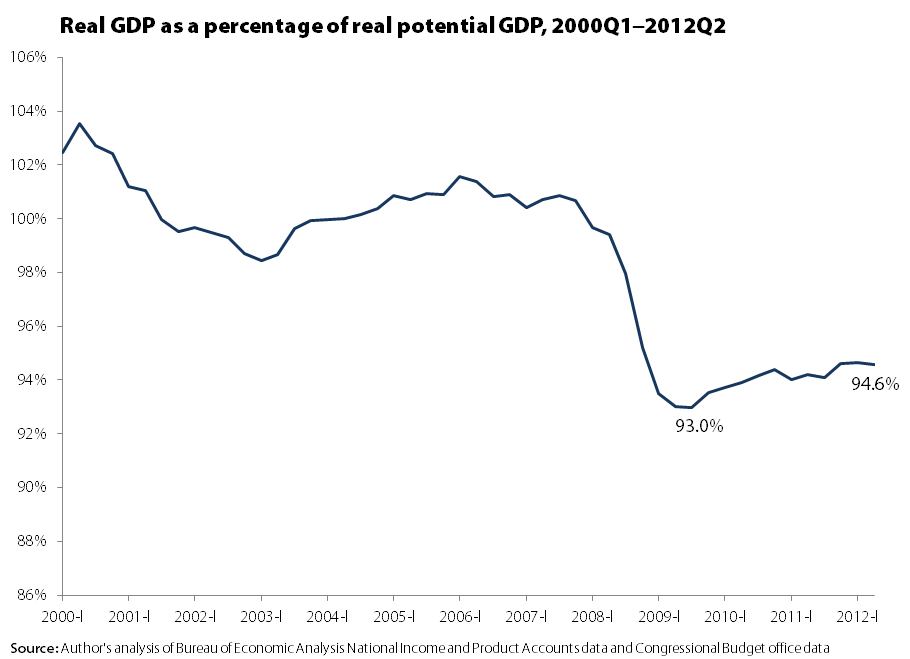

This problem can be highlighted by looking at actual GDP as a percentage of “potential ” GDP, a figure provided by the Congressional Budget Office. Potential GDP can be thought of as a capacity utilization rate for the whole economy: If we were utilizing all of our resources, including labor and capital, how much economic output would we be able to produce?

You can see that in 2000, actual and potential were roughly similar (actual slightly exceeds potential, in fact, because the CBO has a too-conservative view of what is the lowest sustainable rate of unemployment), but then this ratio crashes as the Great Recession hits.

At the trough of the recession in the third quarter of 2009, the U.S. economy was operating at only 93 percent of potential. In the nearly three years since, we’ve only recouped an additional 1.6 percent of potential output. Although GDP has been growing in that period, potential has been growing too (and faster), because of our increasing potential labor force and productivity growth.

What this means first is that “zero” is not the magic number for economic growth if the goal is to restore the economy’s health (and particularly, its labor-market health). Instead, when coming out of a deep recession, you need growth rates far in excess of potential GDP growth to achieve this health.

It also means that this slack in the economy represents a loss of $775 billion in economic output that should be shared across the economy.

And lastly, even a closing of the actual/potential gap might not be unambiguously good news. There’s a long line of research that finds that extended slumps can actually reduce potential GDP; think of all the factories and labor market skills that would’ve been built and nurtured over the past four years if the economy was running at full capacity.

This continuing economic slack clearly signals that the economy would benefit from more support from policymakers.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.