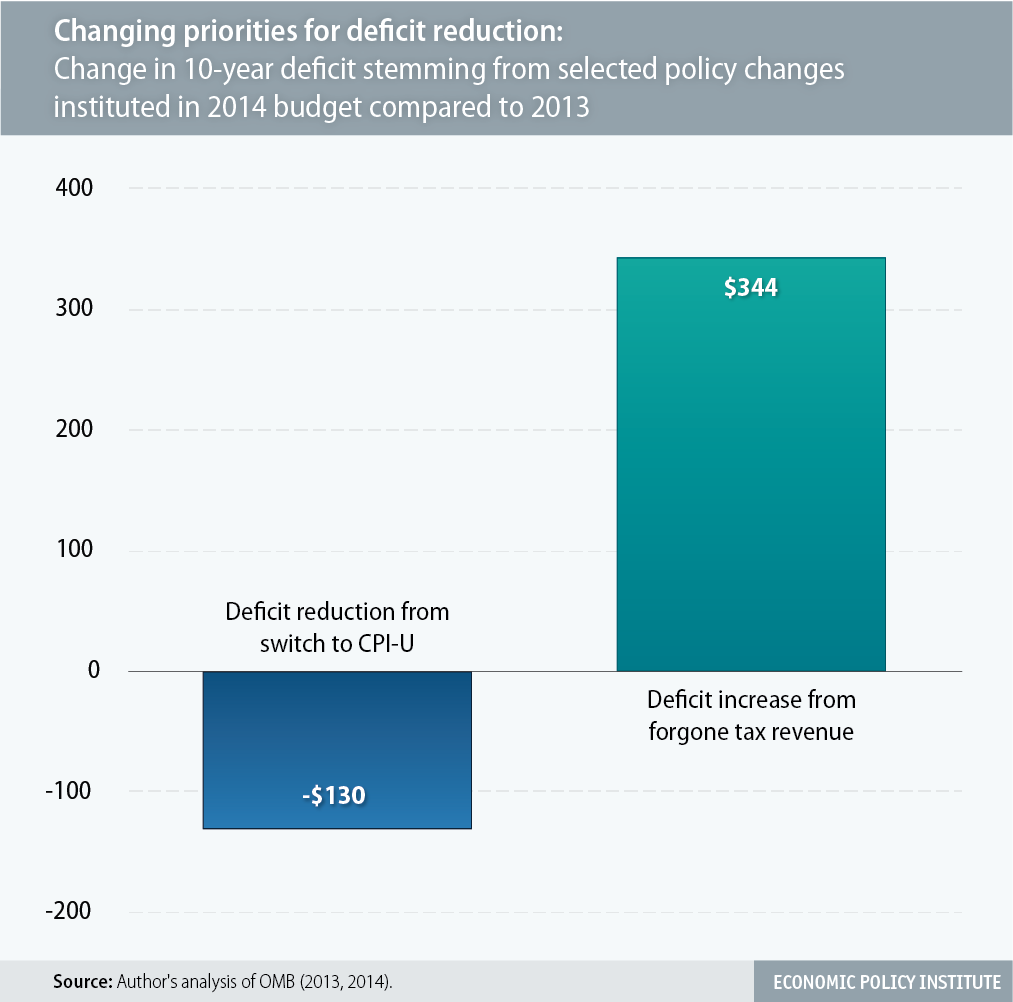

President Obama’s 2014 budget proposal is substantially different than his 2013 version. Its adoption of a “chained” price index for calculating the annual cost-of-living adjustment for Social Security and other programs has attracted much attention. This switch will cut Social Security benefits by $130 billion over the 10-year budget window.

However, not every change in this year’s budget reduces the deficit. For example, the 2014 budget calls for significantly less tax revenue to be raised from high-income households over the decade. These tax changes essentially mean accepting the income tax brackets negotiated in January’s “fiscal cliff” deal (the American Taxpayer Relief Act, or ATRA) instead of allowing tax rates to revert to pre-2001 levels for households making over $250,000 – a policy the Obama administration had publicly supported since the 2008 election and until the passage of ATRA. These ATRA changes also mean that the 2014 Obama budget’s other signature tax proposal—capping the value of tax deductions at 28%— raises less money.

All told, the 2014 budget raises $344 billion less in individual income taxes between 2013 and 2022 than last year’s budget raised during the same time period. Giving up on this revenue means that deficit reduction had to come from other places in the budget, including the Social Security COLA. The figure below shows how the 10-year deficit reduction added in this year’s budget from adopting the chained consumer price index (C-CPI-U, in the jargon) for calculating the Social Security COLA stacks up against the 10-year deficit reduction from high-income tax hikes that was scaled back in this year’s budget relative to last.