See Snapshots Archive.

Snapshot for April 26, 2006.

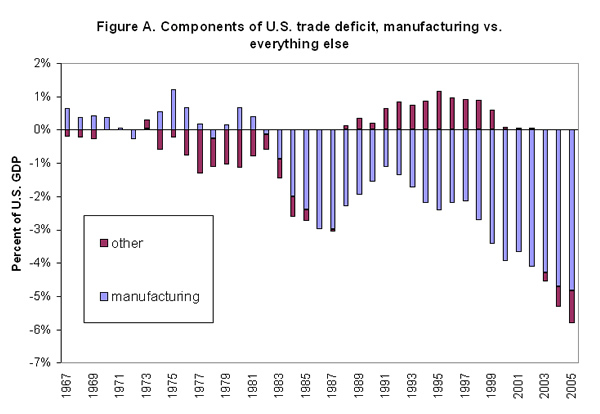

The importance of manufacturing in balancing the U.S. trade deficit

In 2005, the U.S. trade deficit reached $726 billion—a record 5.8% of total gross domestic product (GDP). The steady growth in this deficit has sparked great concern. Discussions of the trade deficit often omit the overwhelming role of manufactured goods trade in driving the overall trend. Even with the steadily rising price of oil in recent years, manufactured goods trade dominates the total trade account, accounting for over 83% of the deficit in 2005. All other trade categories—services, oil and resources, and agricultural goods—together constitute only 17% of the total deficit in 2005, and these categories are often positive in some years, depending largely on the volatile prices of natural resources and agricultural goods (Figure A). What is constant is the enormous (and climbing) deficit in manufactured goods.

Production of manufactured exports and import-replacing goods in the United States will have to play a huge role in unwinding the trade deficit with minimal dislocation in the economy. A truly significant increase in manufactured output will be needed to support this unwinding: with exports at $685 billion and imports at $1,288 billion, closing the $603 billion manufacturing deficit would require roughly a 24% increase in manufacturing output.1

The optimal policy solution to this imbalance is a substantial decline in the value of the U.S. dollar relative to American trading partners. This dollar decline would make U.S. exports cheaper (hence more competitive) in global markets and U.S. imports more expensive (giving domestic producers a better competitive position). This solution is currently blocked by nations who “peg” the value of the currency at a fixed level vis-à-vis the dollar, effectively blocking the needed adjustment. The steady run-up in U.S. trade deficits implies that this situation is not sustainable in the long-run, a situation recognized by the International Monetary Fund (IMF) in their latest World Economic Outlook. In the mid-1980s, a 30% reduction in the value of the dollar shaved almost 3% of GDP off the (then record) trade deficit. Given that the current trade deficit is almost twice as large, an even larger dollar correction will be needed in coming years.

Notes

[1] Currently, the manufacturing trade deficit equals roughly 40% of total manufacturing value-added. Note that imports and exports of manufactured goods include both manufacturing value-added and value-added produced in other sectors that enter manufactured goods as intermediate inputs (say, accounting services). So, the increase in manufacturing output that will be necessary to close the trade gap is less than this 40%. The manufacturing trade deficit as a share of manufacturing shipments (including both manufacturing and others sectors’ value-added) is closer to 14%. The increase in production needed to close the trade gap lies somewhere in between these two substantial numbers. It has been estimated that the manufacturing value-added in total imports and exports for the United States is roughly 50%, so, applying this yields the calculation that the manufacturing trade deficit in value-added terms accounts for 24% of manufacturing output.

This week’s Snapshot was written by EPI Economist L. Josh Bivens.