Jobs Picture, January 9, 2009

Job losses ballooned in final quarter of 2008

by Heidi Shierholz with research assistance from Tobin Marcus

This morning the Bureau of Labor Statistics reported the nation shed 524,000 jobs last month, capping 12 months of declining payroll employment. The BLS also revised its employment estimates for previous months downward by 154,000 jobs, showing that the U.S. economy lost nearly 2.6 million jobs since December 2007.

Just to keep up with the ever-expanding labor force, the economy would have needed to create 1.5 million jobs over the last 12 months. This means that the 2.6 million jobs lost leaves us over 4 million jobs short of what the economy required to provide employment for the American workforce.

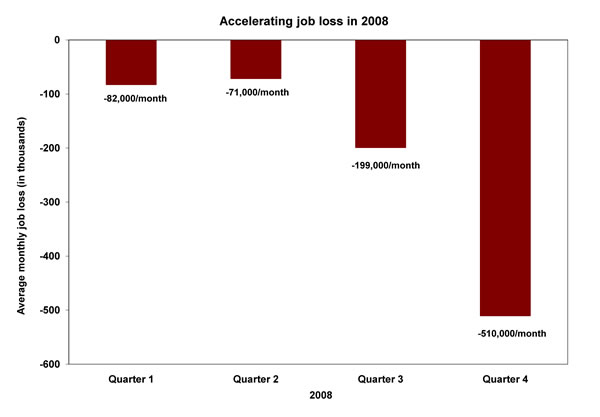

Furthermore, job losses accelerated sharply over the course of the year, with an average of 216,000 jobs lost per month over the year but an average of 510,000 lost per month in the last three months (see Figure). The total loss of over 1.5 million jobs in the fourth quarter of 2008-a 1.1% drop in employment-is the largest quarterly loss as a percentage of employment since the first quarter of 1975, and is a sobering indicator of what lies ahead if swift intervention in the economy does not take place.

Because public sector employment expanded slightly, job losses in the private sector have been even more dramatic, down 531,000 in December and nearly 2.8 million over the past 12 months.

The unemployment rate rose from 6.8% in November to 7.2% in December, the highest rate in almost 16 years, and an increase of 2.3 points since the recession started in December 2007, when the unemployment rate was 4.9%. Over the past 12 months, 3.5 million workers have been added to the jobless rolls. There are now 11.1 million unemployed workers in this country.

The increase in the unemployment rate in the first year of this recession is as much or greater than the total rise in the unemployment rate in the recessions of the 1990s and early 2000s.

Underemployment, a more comprehensive measure of weakness in the labor market, skyrocketed to 13.5%-an increase of 4.8 points since December 2007, when the underemployment rate was 8.7%. The growth in underemployment has been largely due to an increase in people working part-time who want full-time jobs-up 715,000 in December and 3.4 million over the past 12 months.

More than one in eight workers in the United States-over 21 million people-is now either unemployed or underemployed.

Racial and ethnic minorities experienced the largest increases in unemployment in the first year of this recession, with the unemployment rates of both black and Hispanics increasing by 3.0 percentage points, while that of whites increased by 2.2 percentage points. In December, the unemployment rate increased to 11.9% for blacks, 9.2% for Hispanics, and 6.6% for whites.

Breakdowns by education level also reveal disparities. Workers without a college degree currently face an unemployment rate of 7.3%, while those with a college degree face an unemployment rate of 3.7%. The 3.7% unemployment rate among those with a college degree falls just short of the record 3.9% unemployment among that group at the depths of the 1980s recession in January 1983.

The extremely weak job market now often translates into long spells of unemployment for workers who find themselves out of a job. In December, over 40% of unemployed workers had been out of a job for at least 15 weeks, and 23.2%-nearly one in four unemployed workers-had been out of a job for at least six months.

Most industries are contracting, demonstrating the widespread weakness in the labor market. According to the diffusion index, three-quarters of industries lost jobs in December. Manufacturing was hit especially hard, losing 149,000 jobs last month. Many were in automobile and auto-parts manufacturing, which saw a decline of 21,400 jobs. Manufacturing has now seen a decline in employment every month for two and a half years, including a loss of 791,000 jobs over the last 12 months alone.

Job losses also continued in construction, which was down 101,000 last month and 632,000 over the last 12 months, with losses in both residential and non-residential building.

Service employment was also down, as private services (excluding government) shed 280,000 jobs. Retail trade, on a seasonally adjusted basis, was down 66,600, with particularly large losses in motor vehicle and parts dealers (down 25,000). Professional services also continued to see large losses, shedding 113,000 jobs last month and 681,000 over the last 12 months.

On a positive note, health care continued to reliably generate job growth. Health care added 31,600 jobs in December and 371,600 over the last 12 months. Government also added 7,000 jobs in December, despite a loss of 2,000 federal jobs. State governments added 6,000 jobs, while local governments added 3,000.

The index of aggregate weekly hours fell 4% over the last 12 months, signaling an enormous shrinkage in the economy. The decline was much more dramatic than in the first year of the past two recessions, and matched the decline in the first year of the recession of 1981. Weekly hours eroded from 33.5 in November to 33.3 in December 2008 (down from 33.8 in December 2007).

Nominal hourly earnings increased by 3.7% over the past year, and because of slowing inflation, real hourly earnings were likely positive last year. However, the decline in hours worked meant that weekly paychecks were up only 2.2%, before adjusting for inflation.

As this jobs picture shows, the U.S. labor market is deteriorating more quickly than in past recessions, and virtually all signals indicate that the economy is nowhere near the bottom. Since U.S. consumers are now under such strain that they are unable to consume what the economy is able to produce, the government is the sole remaining spender with the capacity to bolster aggregate demand and thereby create jobs. It is essential that government now embrace that role with swift action on a massive recovery package large enough to generate sufficient jobs to prevent further increases in the U.S. unemployment rate.