Unemployment rising too fast, then falling too fast … going forward, it should (unfortunately) be just right

Has the unemployment rate fallen “too fast” given underlying output growth over the past 18 months? Applying a simple Okun-type relationship between changes in unemployment and the difference between growth rates of actual and potential GDP (or, changes in the output gap) would indicate so. Between the fourth quarter of 2009 and fourth quarter of 2011, the output gap shrank by less than 0.8 percent per year – which historically would only have been associated with a 0.4 percentage-point decline in the unemployment rate. Instead, the unemployment rate fell by 1.2 percentage points – or three times as much as our Okun regression might suggest should’ve happened.

Federal Reserve Chairman Ben Bernanke noted this “too low” unemployment last week (so have Tim Duy and others). While there’s definitely some interesting stuff to examine here, we should first point out the one thing that nobody disagrees about. Going forward from now, the best estimate for what another 24 months of 0.8 percent average output gap reduction will buy us is the one provided by the classic Okun-style relationship: A very slight fall – about 0.4 percentage points – in the unemployment rate.

This cautionary tale about what to expect going forward is sometimes lost as people point out that the too rapid fall in unemployment recently is the mirror image of the too-rapid rise in unemployment in late 2009 and 2010. The graph below shows the actual unemployment rate and the one predicted by regressing two-year changes in unemployment on the two-year change in the output gap, as well the square of the change in the output gap (included to capture a non-linear effect pointed out by Zach Pandl at Goldman-Sachs; no link available, I’m afraid).

The graph clearly shows the too-rapid rise and fall of unemployment relative to predictions over the past couple of years. While interesting, this doesn’t change the most important thing that such an analysis tell us: If we want the unemployment rate to continue falling at the same rate that characterized the past year-and-a-half, we better see much faster GDP growth. As Bernanke said:

“However, to the extent that the decline in the unemployment rate since last summer has brought unemployment back more into line with the level of aggregate demand [note: i.e., recent too-rapid declines “making up for” earlier too-rapid gains], then further significant improvements in unemployment will likely require faster economic growth than we experienced during the past year.”

To be concrete, the Congressional Budget Office is projecting growth in potential GDP of 1.8 and 1.9 percent in 2012 and 2013, respectively. Mark Zandi of Moody’s Analytics is projecting actual GDP growth of 2.5 and 2.9 percent in those years, respectively. This means the two-year change from 2011 is right back at that 0.8 percent difference between actual and potential GDP growth that has characterized the last two years, which means we should expect unemployment to fall by only 0.4 percentage points over that time. This is what people should really know about unemployment changes going forward: absent serious measures to boost growth, they will be excruciatingly slow.

Lastly, it’s worth examining if there’s any odd economic development that might explain the too-rapid rise in actual unemployment between the second quarter of 2009 and the last quarter of 2010 – the time period that saw predicted unemployment begin lagging actual unemployment by more and more.

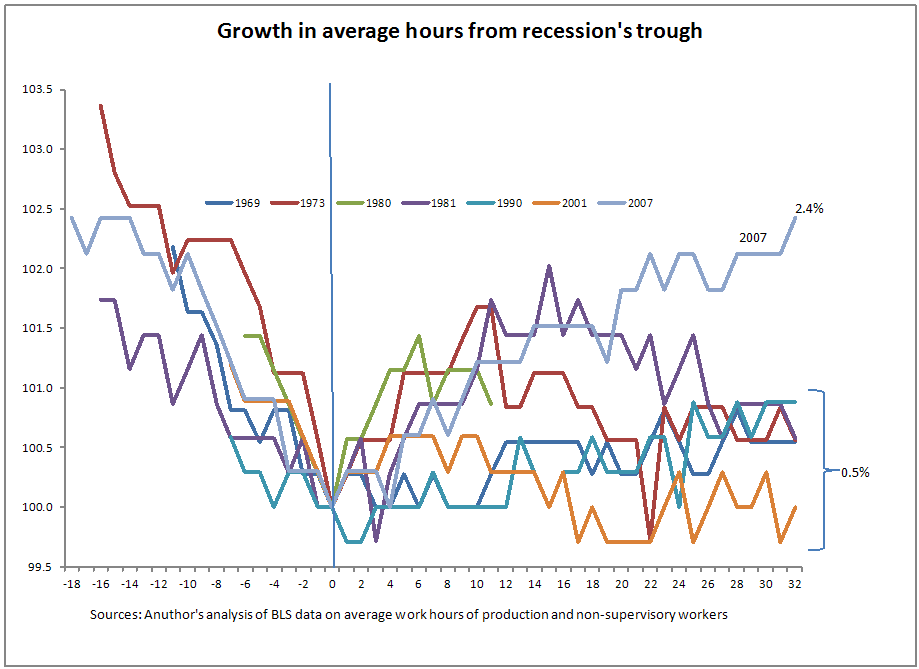

One pretty clear suspect is fingered in the graph below, which shows the rise in average hours across economic recoveries. For the most recent recovery, the index begins in the second quarter of 2009 (the official trough of the recession).

One can see clearly that the rise in average hours worked was atypically fast in the current recovery. In fact, compared to previous averages, the length of the work-week rose by about 2 percent. This is a big deal, representing about 2.3 million workers that did not have to be hired because rising demand was absorbed by rising hours of incumbents instead.

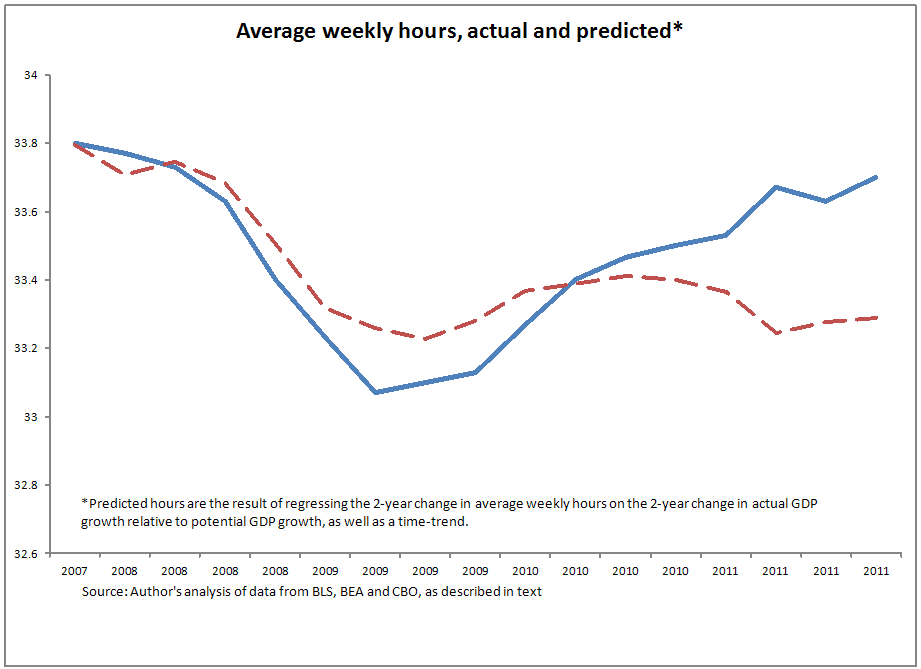

But shouldn’t this change in hours be soaked up in our Okun regressions by the output gap variable (since hours always tend to be procyclical)? Not this time. A regression of the change in hours on the change in the output gap (and a time trend) under-predicts the rise in hours between the second quarter of 2009 and second quarter of 2011 by nearly 2 percent. Between the second quarter of 2011 and the fourth quarter of 2011, the predicted rise is actually slightly greater than the actual rise.

So, what to make of all this?

First, going forward, the best predictor of what will happen to unemployment remains the Okun-based estimates based on GDP growth. Given that most estimates of GDP growth in the next couple of years do not see it beating growth in potential output by much, there is little reason to expect that the recent rapid declines in unemployment rates will continue.

Second, rising average hours might explain a lot of the too-rapid rise in unemployment in 2009 and 2010.

Lastly, given this large rise in hours, an aggressive program to promote work-sharing instituted during the recession could have been a big help in not allowing rising hours to soak up so much of the extra labor demand, and would’ve allowed the economic activity spurred by the American Recovery and Reinvestment Act to translate more directly into higher head counts and lower unemployment. The Center for Economic and Policy Research’s Dean Baker had a good real-time proposal that would have been a real help. It’s not totally too late either – work-sharing pilot programs were included in the recent extension of payroll tax cuts.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.