Apple execs (like everyone else) overlook global exchange rates

Charles Duhigg and Keith Bradsher have a justly buzzed-about article in the New York Times this week on how the production of the iPhone (and Apple products more generally) has become almost completely globalized. A quick but important addition to their story, though, is the role of exchange rates. Yes, I’m getting boring on this topic, but, exchange rates are by far the single most important determinant of U.S. trade performance, so if the question is “why isn’t X made in the US anymore,” it’s very likely that the answer remains “the dollar is overvalued.”

And, strikingly, even the Apple-specific timeline fits the data regarding the biggest exchange rate development – China’s mammoth intervention in international currency markets to keep their own currency from rising vis-à-vis the dollar. This is how Duhigg and Bradsher write it up:

“In its early days, Apple usually didn’t look beyond its own backyard for manufacturing solutions. A few years after Apple began building the Macintosh in 1983, for instance, Mr. Jobs bragged that it was “a machine that is made in America.” In 1990, while Mr. Jobs was running NeXT, which was eventually bought by Apple, the executive told a reporter that “I’m as proud of the factory as I am of the computer.” As late as 2002, top Apple executives occasionally drove two hours northeast of their headquarters to visit the company’s iMac plant in Elk Grove, Calif. But by 2004, Apple had largely turned to foreign manufacturing….”

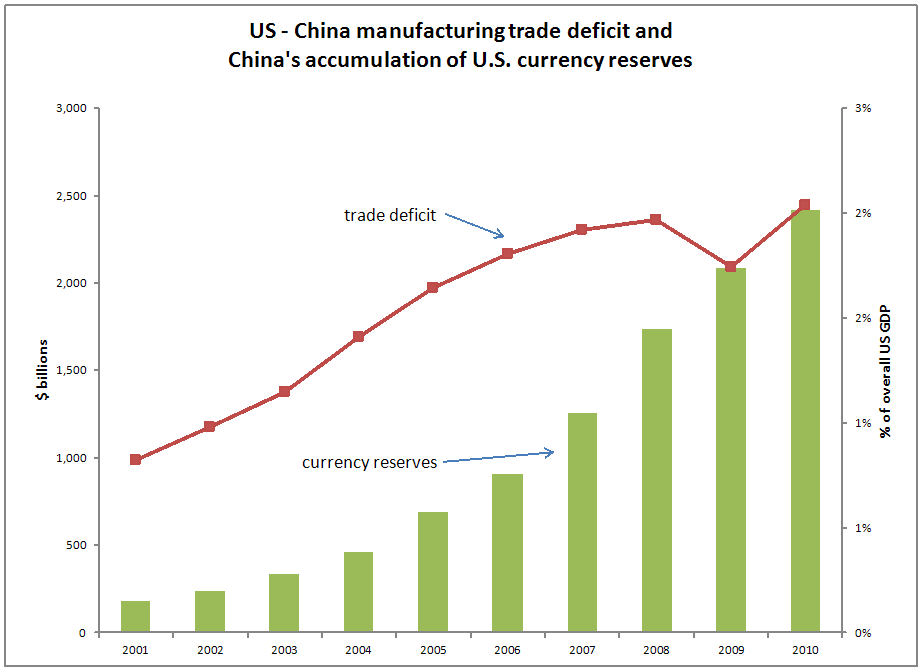

So, after 2002 Apple more and more turns to China for manufacturing? Huh. Not surprising – the graph below shows that the pace of Chinese accumulation of U.S. reserves (which leads inexorably to rising pressure on the dollar’s value, keeping Chinese products more competitive in U.S. and global markets) coincides with an accelerating increase in the U.S./China trade deficit around this time as well.

There is, after all, a reason why economists harp on the importance of the exchange rate – it drives lots and lots of hugely important economic decisions. As China intervenes to keep the value of its currency from rising against the dollar, this gives them an ever-increasing cost advantage versus the United States. The result is lots and lots of individual firm-level decisions (like Apple’s) to produce in China rather than the United States (because the exchange rate makes it cheaper) and the sum of these individual decisions cumulate to a huge aggregate trade deficit. The macro downsides of this trade deficit have been documented plenty of places, but if you’re writing about any feature of the US/China economic relationship and not mentioning this currency issue, you’re essentially writing Hamlet without the prince.

It’s frankly kind of amazing that Apple executives quoted in the article tell stories about how their global sourcing shifts are really about American skills, while managing to not mention global exchange rates. After all, there is an obvious trend in exchange rates and currency intervention that hamstring American competitiveness vis-à-vis China in the early-to-mid 2000s – but it’s awfully hard to make the case that American workers just got a lot dumber at the same time. But maybe blaming American workers can get some government subsidies for Apple to hire and train people in the U.S., while pointing out the effect of exchange rates might just lead to calls to rebalance the status quo U.S./China trade relationship – a status quo that has served Apple (and many other global manufacturers) very well.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.