Note: New data released on December 3 show the unemployment rate rose to 9.8% in November

People did not know it at the time, but three years ago this month, in December of 2007, the country entered what was to become the most severe recession since the Great Depression. Three years ago, the unemployment rate was just 5%, but the economy had already been weakened by earlier policy choices.

That fledgling downturn turned out to be far longer and deeper than anyone expected, even a year later. In late 2008 as President-elect Obama and his team were putting together an economic stimulus plan, most economists were projecting an unemployment rate of 6.9% in the first quarter of 2009. In fact, unemployment reached 8.1% by that point, and although the American Recovery and Reinvestment Act succeeded in creating millions of jobs, it was just not large enough to fill such a large hole. A recent report by Princeton Economist Alan Blinder and chief economist at Moody’s Analytics Mark Zandi, found that if the federal government had not intervened to rescue the economy, then the unemployment rate would be close to 16% today.

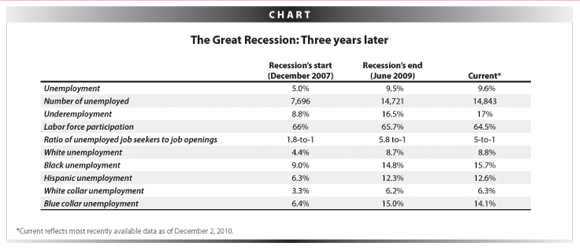

Today, even though the National Bureau of Economic Research says the recession has been officially over for 18 months, economic distress and joblessness remain widespread. The official unemployment rate stands at 9.6%, 14.8 million Americans are unemployed, and the jobs crisis remains so severe that there are five unemployed workers competing for every single job opening.

“What is infuriating is that this recession was unnecessary — it was caused by deregulation and indifference to speculation,” said EPI President Lawrence Mishel. “Plus its depth and duration have been deepened by political forces resisting efforts to generate the millions more jobs we have needed. Unfortunately, there’s much more pain ahead in the pipeline”

How much longer will it take to return to a pre-recession job market?

Some figures point to an answer: As the Chart shows, unemployment is almost double the December 2007 level of 5%, and underemployment has risen from 8.7% to 17% over that same period. Labor force participation has fallen from 66% to 64.5% overall, and has dropped more sharply among some age groups, suggesting that large numbers of discouraged jobs seekers have left the labor force. Minority workers and blue-collar workers continue to experience rates of unemployment far above the nationwide level. In October, unemployment was 15.7% for black workers, 12.6% for Hispanic workers, and 14.1% for blue-collar workers.

This is not the first time that joblessness has continued to rise after the end of a recession. The two prior recessions, in 2001 and 1990, were both followed by lengthy jobless recoveries in which overall economic growth resumed but employment remained weak. But because of the severe nature of this recent recession, without serious policy action, it could be well into the next decade before the country returns to pre-recession levels of unemployment. Job growth picked up in October, when the country added 159,000 jobs, but in an analysis of that data, economist Heidi Shierholz noted that, even if that strong pace of job growth continued, it would still take 15 to 20 years to return to full employment.

Many families who suffered a job loss during the recession find themselves in a more dire situation today than they were in a year or two ago. Although the job market has seen little improvement since the recession ended, workers who cannot find jobs are now seeing the safety net shredded beneath them. On November 30, the Emergency Compensation Program expired, meaning that millions of long-term unemployed workers could lose their unemployment insurance benefits by the end of the year. In the third quarter of 2010, 43% of the unemployed had been looking for work for more than six months, meaning they are officially long-term unemployed and could lose benefits without an extension of emergency benefits. And 22.7% of all unemployed workers had been seeking employment for more than a year.

Meanwhile, a heightened focus on deficit reduction threatens to impose a wide range of cuts that would increase the burden on working families while neglecting the investments in job creation that not only are essential to reducing unemployment, but are ultimately the key to widely shared prosperity and economic health. The National Commission on Fiscal Responsibility co-chairs Alan Simpson and Erskine Bowles have proposed a wide range of cuts that would increase the burden on working families. Earlier this week, EPI together with Demos and The Century Foundation, unveiled Investing in America’s Economy, a deficit reduction proposal that prioritizes a strong economic recovery. That plan recognizes that widespread job creation and robust economic growth are essential to successful deficit reduction.

-Kathryn Edwards provided research assistance