Policy Memo #132

Introduction

The economy is undeniably in dire straits and needs help. While the financial market meltdown has received most of the media attention recently, we cannot forget that the real economy is struggling as well. Th is was confirmed when the National Bureau of Economic Research (NBER) recently declared that a recession had begun in December of last year.

The job market is currently in steep decline, with nearly a year of consecutive job losses. Since the start of the recession, nearly 2 million jobs have been lost, including over half a million in November alone. Housing prices dropped 18% in the last year nationally (Standard & Poor’s 2008) resulting in over $50,000 in lost wealth per household (Baker and Rosnick 2008) and the highest levels of foreclosure activity in a decade (RealtyTrac 2008). Other measures of real economic activity are also showing significant weaknesses. With less housing wealth to borrow against, fewer jobs, and low levels of consumer confidence, real consumer spending declined in the third quarter for the first time in 17 years (Bivens 2008), leading many economists—including analysts at Goldman Sachs and Morgan Stanley—to project continuing negative gross domestic product growth for the remainder of this year and through much of 2009 (Business Week 2008).

At the start of the year, Congress responded to the weakening economy by spending $152 billion on rebate checks and other tax incentives. About $100 billion was sent to individual taxpayers, while the remainder was an estimated cost of business incentives. While this cash injection to individuals may have provided some temporary assistance, it is clear that the economic troubles will continue.

The $700 billion financial market bailout recently passed by Congress was aimed at preventing further deterioration on Wall Street. While this was necessary, it is clear that we also need a strategy to stimulate the economy from the bottom up—indeed, Federal Reserve Chairman Ben Bernanke recently endorsed a fiscal stimulus designed to “boost overall spending and economic activity” (Bernanke 2008).

A package that provides funding for infrastructure, aid to states, and other provisions would begin to reverse our economic course by creating jobs while meeting national priorities. The package should also include a down-payment on longer-term reforms, as well. This memo outlines some elements that should be essential components of a more comprehensive recovery package and briefly examines the impact it would have on the economy and job creation.

Recovery package

The underlying strength of a bottom-up recovery package is job creation. By putting unemployed Americans back to work and tightening labor markets, the stimulus would boost consumer spending and would support incomes even for those with jobs. This stimulus would also improve our crumbling national infrastructure—thereby promoting greater economic efficiency—and supplement state budgets to avoid drastic cuts that would intensify the economic downturn.

Infrastructure

Investing in national infrastructure—rail and mass transit, water treatment, school buildings and grounds, port improvements, levees and dams, and airport improvements—is one of the most effective ways to boost job creation and put money back into the hands of working Americans, leading to higher productivity, better health, and better education of our children. This investment also creates economic ripple effects across the entire economy—for example, by providing more business for construction equipment manufacturers and the steelmakers that supply them—and this money will quickly circulate back into the economy as workers spend their salaries, increasing overall demand for goods and services. Significantly accelerating our infrastructure investments could grow the economy by creating hundreds of thousands of jobs.1

Given the state of the country’s infrastructure, more investment is certainly needed:

• Roads: According to the American Society of Civil Engineers, over two-thirds of roads are in poor or mediocre condition (TRIP 2005), resulting in $54 billion per year wasted on repairs and operating costs (American Society of Civil Engineers 2005a).

• Bridges: More than a quarter of all bridges are rated structurally deficient or obsolete, leading to closings and in some cases collapse (TRIP 2005).

• Waterways: Half of all waterway locks are functionally obsolete, resulting in waterway shutdowns and substantial business losses (American Society of Civil Engineers 2005b).

• Schools: School facilities are also in disrepair, and studies have shown that an additional $127-322 billion is needed to bring facilities into good overall condition (National Center for Education Statistics 2000). A Department of Education survey found that 43% of schools indicate that the condition of their facilities “interferes with the delivery of instruction” (National Center for Education Statistics 2007).

• Wastewater management: The deficiencies of the wastewater management infrastructure has left 772 communities experiencing a total of 9,471 identified combined sewer overflow problems, resulting in the release of approximately 850 billion gallons of raw or partially treated sewage annually (Mishel, Eisenbrey, and Irons 2008).

Repairing and modernizing our infrastructure has been delayed for years, but these needs cannot be ignored any longer. Greater investment in infrastructure will increase business productivity by lowering the cost of producing goods, leading to lower prices and increased sales. Many infrastructure projects— such as mass transit, home insulation and weatherization, and solar panel installations—have the added bonus of increasing energy effi ciency and reducing pollution.

The common critique is that infrastructure projects have substantial lag times between the authorization of infrastructure spending and actual outlays (that “the fire’s out by the time the water gets to the hose”). Historically only 27% of federal highway funds are spent within a year of authorization, with 69% spent in the first two years (Buechner 2002). However, there are plenty of examples where the work can begin quickly if there is the will. For example, the replacement of the I-35 bridge in Minneapolis was completed just over one year after the original bridge collapsed in August 2007.

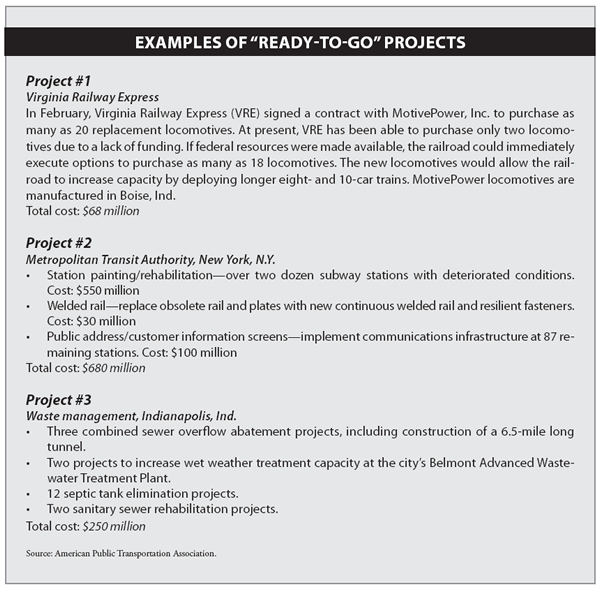

To speed the economic impact, the infrastructure investments should focus on maintenance projects—which can be begun and completed faster than new construction—and “ready-to-go” projects, which have already gone through most of the preliminary stages and are close to construction. Many of these projects have been delayed midway through the process due to lack of funding and would be able to restart immediately if federal funding were made available. For example, the American Association of State Highway and Transit Officials estimates there are 5,280 ready-to-go transportation projects totaling $65.90 billion (AASHTO 2008), while the National Association of Clean Water Agencies estimates $4 billion in ready-to-go wastewater treatment projects. These projects could all begin construction within 90 days of

legislative enactment. Additionally, school repair and maintenance projects could spend $10 billion over the summer months, while construction of new school buildings could begin immediately in hundreds of school districts around the country.

This critique is also less relevant in light of recent experience with recessions. In the last two recessions, job loss and labor market stagnation persisted well after the “official” end of the recession. Finding projects that will lead to sustained job creation should be seen as a virtue, not a vice.

Finally, because we have an infrastructure maintenance backlog, many of these expenditures are needed anyway. By accelerating federal funding, we are able to fund national priorities while simultaneously creating jobs.

State aid

Economic downturns usually cause problems for state budgets—income, sales, and other excise tax receipts shrink, while more people are in need of and eligible for state services. Most states have balanced budget requirements, forcing them to raise taxes and fees (which tend to be regressive) or, more likely, cut services. Both solutions depress overall demand for goods and services and exacerbate the economic downturn.

This time the situation is even more dire. As property values have plummeted, so too have property tax revenues, which flow to local governments to pay for services such as education and public safety. States are forced to backfill the lost revenue, leaving them with even larger holes in their own budgets (National Association of State Budget Officers 2008). The results have been devastating: at the beginning of the fiscal year, 29 states faced a combined $48 billion in FY2009 budget shortfalls, according to the Center for Budget and Policy Priorities (McNichol and Law 2008). Most states closed their shortfalls by raising taxes and fees and/or cutting services, but now recent data show that 29 of those states—plus four more, which did not previously face a budget gap—have opened up new mid-year budget shortfalls totaling $11 billion2 (Center on Budget and Policy Priorities 2008), forcing even more drastic cuts. In total, the states’ budget shortfall for 2009 is expected to be $79 billion, and the shortfall in 2010 may be even larger (McNichol and Law 2008a).

These shortfalls have real consequenses for state services. Maryland, for example, may cut nearly $400 million in spending on programs such as higher education and community college (raising tuition, which would require students to pay more) and social programs such as child-care subsidies (which might force parents to spend more or work less) (Wagner and Craig 2008).

The credit crunch has further exacerbated the state budget situation by freezing short-term credit routinely offered to states—for example, California was not even able to obtain revenue-anticipation bonds to close the temporary $7 billion gap between fall outlays and spring tax revenues. The credit crunch has also prevented many states from issuing bonds to pay for capital projects, forcing many projects to be delayed; for example, the Metropolitan Washington Airports Authority recently postponed plans for a $2.2 billion bond sale to expand the terminals at Dulles and National Airports (Richburg and Vick 2008). These foregone infrastructure projects will result in more unemployment, less demand for goods and services, and less overall economic activity.

In the last recession, Congress provided $20 billion in aid to states, split between general revenue sharing and a temporary increase in the federal match for Medicaid. The same kind of assistance should be provided again. Congress and the president should also consider creating a reserve fund with an automatic trigger—those funds would be made available to states if and only if certain measures of economic health deteriorate beyond a specified threshold. Such a reserve fund would eliminate the need for policy makers to enact additional legislation if the economy continues to worsen.

Furthermore, the federal government could guarantee state and local bonds to shield local governments from the credit crisis and reduce their borrowing costs. Such an effort would cost the federal government very little since state and local bond defaults are very rare.

Consumer supports

While infrastructure and state aid should comprise the lion’s share of the recovery package, additional revenue should be devoted to other provisions to stimulate the economy. These proposals are aimed at getting money into the hands of consumers, who are most likely to immediately spend the money back into the economy.

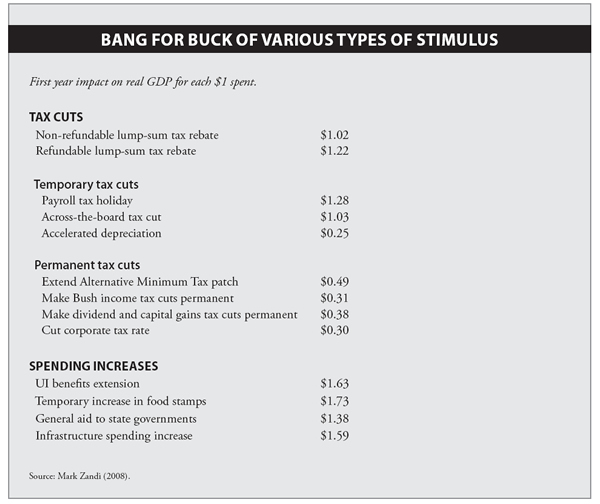

• The Unemployment Insurance Modernization Act: Mark Zandi of Moody’s Economy.com estimates that the multiplier effect of unemployment compensation is $1.63 for each dollar spent (Zandi 2008), while a 1999 Department of Labor study estimates that each dollar spent boosts GDP by $2.15. Federal legislation has extended unemployment insurance (UI) benefi ts for a maximum of 33 weeks beyond the regular 26 weeks of state benefi ts; however, the unemployment insurance recipiency rate is still unacceptably low (less than 40%), in part because of state laws that have the effect of denying benefits to the lowest-wage workers, to part-time workers, and to women. The Unemployment Insurance Modernization Act (UIMA), a bill to encourage the states to remove these obstacles to coverage from their laws, passed the House in the 110th Congress and should be part of the recovery package. The UIMA would provide an economic stimulus by broadening UI coverage to 500,000 deserving, but currently denied individuals. The five-year cost of UIMA is estimated to be $7 billion, of which $500 million in administrative funding could be paid immediately to the states, and another $1.7 billion would be quickly paid in incentive grants to states that have already made key changes in their laws. Another proposal, exempting unemployment compensation from taxation, would be more expensive and would generally benefit higher income individuals than those who would benefit from UIMA.

• Food stamps: Increases in food stamp benefits are another high-impact stimulus, because every dollar increase is likely to be spent quickly and locally, and—according to Zandi—will boost GDP by $1.73 (Zandi 2008). Furthermore, the higher benefits are needed to offset the recent increase in food prices. An effective increase would likely cost $5 billion or more.3

• Homeowner assistance: Congress is currently considering several proposals to assist homeowners facing falling home prices, increasing mortgage payments, and foreclosure. Such assistance would help to stem the decline in the housing market, which was one of the root causes of the current downturn. Such a program, however, would need to be crafted to ensure that taxpayer resources are not used simply to reward lenders.

A down-payment on longer-term reforms

The economy needs fast stimulus now, but it also faces long-term problems that require solutions beyond the contracted time frame of a standard economic recovery proposal. Global environmental challenges offer America multiple opportunities to rebuild and grow its economy over the next five to 10 years.

Below are a few proposals that policy makers should consider when crafting a new stimulus plan. Th ese are longerterm projects, but we cannot aff ord to delay them anymore:

•Energy efficiency: According to the McKinsey Global Institute, not only are energy efficiency programs the most cost-effective means of reducing pollution, but many of them provid

e savings that significantly outweigh their costs (McKinsey Global Institute 2008). Programs such as the Clean Energy Corps—which combines training and job placement in order to put middle- to low-income people to work auditing and retro-fitting homes to be more energy efficient—would lower energy costs, help struggling communities, and create jobs.

•Green manufacturing: Over the next 50 years, the world will need and demand more and more clean energy. By developing its green technology industry, America can revive its economy by becoming a leading exporter of clean energy technology. Incentivizing automakers to build energy efficient vehicles here in the United Sates would improve our trade deficit and balance of payments, create jobs, and reduce carbon emissions. Provisions such as public-private research partnerships, research prizes, intellectual property reform, and R&D tax credits should be included to incentivize the research, development, commercialization, and mass production of clean energy technology and products. These provisions will reduce the trade deficit, reenergize the manufacturing sector, and create millions of high-paying jobs.

•Transportation: While much of our transportation infrastructure is in need of repair, more people are driving and riding than ever before. Building a modern interconnected public transit system would reduce traffic-related wasted time and fuel, expand labor markets by increasing mobility, lower the regressive transportation costs on the average household, and create high-paying jobs in construction, operation, and maintenance. Congress will consider a reauthorization of the surface transportation bill later in 2009, but setting aside additional funding for transportation projects by pre-funding the highway-trust fund with general revenues would expand the options available during reauthorization.

•Broadband deployment: The United States currently ranks 15th of 30 developed countries in overall broadband penetration as measured by the Organization for Economic Cooperation and Development (Irons and Townson 2008). Nations that have prioritized broadband infrastructure have already seen improvements. For example, Denmark’s broadband penetration reached 34 connections per 100 inhabitants in 2007, while the United States had just 22 per 100. Expanding broadband infrastructure in the United States would not simply improve the speed of our connections for entertainment purposes, but it would also bring a wealth of knowledge to more citizens in more areas. With greater reach, the United States could see improvements in education, health care, and first-responder capabilities as communications become faster, more efficient, and more effective.

• Health care information technology: Better management of health care records and delivery could result in better quality care at lower costs. Increased investments in better information technologies would yield significant economic returns (Girosi, Meili, and Scoville 2005) as well as better health care outcomes.

Potential and comparative impact of recovery plans

The $168 billion in rebates and other transfer payments that were distributed in May and June provided an immediate boost in consumer retail sales, which—along with strong exports—aided economic growth in the second quarter. However, the one-time transfer payments from the government to the private sector appear to have been only a temporary boost to output: retail sales have begun to decline (U.S. Census 2008).

Studies have suggested that as much as two-thirds of the 2001 rebates were spent back into the economy (Johnson, Parker, and Souleles 2004); however, more recent surveys find that only 20% of respondents planned to spend their 2008 rebates, with the majority planning on paying down debt or outstanding bills (Rooney 2008). Subsequent analyses of consumer spending show a positive, but modest, boost to consumer spending.4

This is not to say that the cash rebates had no impact, but rather that in the current environment, rebates by themselves may not be enough to turn the economy around.

Mark Zandi of Moody’s Economy.com estimates the one-year economic effect of tax rebates to be $1.22 per dollar— a significantly less per-dollar economic impact than spending on infrastructure ($1.59), aid to states ($1.38), food stamps ($1.73), or unemployment benefits ($1.63) (Zandi 2008). Considering the current state of the economy, the final recovery package should be weighted toward infrastructure, state aid, and family supports. If rebates are included, they should be narrowly targeted to low-income families who would be most likely to spend the money. For example, a payroll tax holiday would be well targeted and have a signifi cant impact on the economy.

Job creation

The president-elect has suggested that we need a recovery package that would create 2.5 million jobs over the next two years. A rough estimate suggests that just over 2.5 million jobs could be created by a two-year $350 billion recovery program that includes a payroll tax holiday ($100 billion), assistance to state governments ($100 billion), infrastructure spending ($100 billion), and a temporary increase in low-income assistance, such as food benefits ($50 billion). Such a program would lower the unemployment rate by about 1.7 percentage points at the end of the two years.

Since the economy has already lost nearly 2 million jobs since the start of the recession, and since we can expect more job losses in the future, we think this goal should be seen as a minimum target, and we should aim for a package large enough to ensure that we do not miss the target on the low side.

For example, a two-year $600 billion recovery package with a similar split as above—$171 billion each for state assistance, infrastructure, and a payroll tax holiday; and $86 billion for low-income assistance—would create nearly 2.3 million jobs in the first year and 4.5 million jobs over two years. The program would lower the unemployment rate by about 2.9 percentage points. An $850 billion two-year stimulus would create approximately 3.3 million jobs by the end of the first year and 6.4 million jobs by the end of 2010, with a 4 percentage-point drop in the unemployment rate.

A package this size or larger could include the elements above as well as significant down payments on longer-term reforms, including investments in health care information technology, a build-out of broadband Internet access, and investments in energy efficiency. A program of this size is more likely to have an impact of sufficient magnitude to begin to fill the jobs and output gap that we are likely to see next year.

Conclusion

Our economy is in a dangerous place, with economic trends threatening the employment, income, and opportunities of millions of Americans. A bottom-up approach that includes infrastructure spending, state aid, and other provisions must be adopted to boost demand, create jobs, and help the millions of families who are suff ering the most.

Also, placing a down payment on longer-term reforms—including investments in broadband deployment, health care information technology, energy effi ciency, and green jobs—would help to ensure long-term economic growth while stimulating the economy in the short-run. Th e U.S. economy cannot aff ord to wait—it is important to begin as soon as possible to rebuild the economy and create jobs.

Endnotes

1. Various estimates suggest that $1 billion in construction spending creates between 14,000 and 38,000 jobs (for example, see estimates from t

he Federal Highway Administration). Using the conservative lower-bound estimate, $75 billion in construction spending, for example, would create 1,050,000 jobs.

2. In fact, GDP account numbers from the BEA show that in FY2008, tax revenues for state and local governments fell short of outlays by a combined $34 billion, balanced mainly with rainy day fund draw-downs and bond issuances.

3. Senate proposals have included a $5 billion boost (see http://frac.org/news/econstimulus2.htm), and other advocates support $10.7 billion worth of food-related supports. See Coalition on Human Needs, “Towards Shared Recovery,” September 9, 2008, at http://www.chn.org/pdf/2008/stimulus9908.pdf

4. For household level analysis, see http://www.voxeu.org/index.php?q=node/1541; and for aggregate spending perspective, see M. Feldstein, “Th e Tax Rebate Was a Flop. Obama’s Stimulus Plan Won’t Work Either,” Wall Street Journal, August 6, 2008.

References

AASHTO. 2008. “5,000 ‘Ready-To-Go’ Transportation Projects Could Put Millions to Work.” December 5. http://news.transportation.org/press_release.aspx?Action=ViewNews&NewsID=202 American Society of Civil Engineers. 2005a. “Report Card for America’s Infrastructure: Roads.” http://www.asce.org/reportcard/2005/page.cfm?id=30

American Society of Civil Engineers. 2005b. “Report Card for America’s Infrastructure.” http://www.asce.org/files/pdf/reportcard/ 2005_Report_Card-Full_Report.pdf

Baker and Rosnick. 2008. Th e Impact of the Housing Crash on Family Wealth. Washington, D.C: Center for Economic Policy Research. http://www.cepr.net/documents/publications/wealth_2008_07.pdf

Bernanke, Ben S. 2008. Statement of Ben S. Bernanke before the House Committee on the Budget. United States House of Representatives. October 20. http://budget.house.gov/hearings/2008/10.20.2008_Bernanke_Testimony.pdf

Bivens, Josh. 2008. “Consumption Spending Falls for Frst Time in 17 Years: Economy Shrinks Two of Last Four Quarters.” Washington, D.C.: Economic Policy Institute. http://www.epi.org/content.cfm/webfeatures_econindicators_gdppict_20081030

Buechner, William. 2002. Testimony of the American Road and Transportation Builders Association before the Subcommittee on Transportation, Infrastructure, and Nuclear Safety, Committee on Environment and Public Works. United States Senate. September 30. http://epw.senate.gov/107th/Buechner_093002.htm

Business Week. 2008. Around the street: Th e bailout, the economy, and the Fed. September 29. http://www.businessweek.com/investor/content/sep2008/pi20080929_576396.htm?chan=top+news_top+news+index+-+temp_investing

Center on Budget and Policy Priorities. 2008. “States in Trouble Due to Economic Downturn.” CBPP Policy Points. Washington, D.C.: CBPP. October 20. http://www.cbpp.org/policy-points10-20-08.htm

Girosi, Federico, Robin Meili, and Richard Scoville. 2005. Extrapolating Evidence of Health Information Technology Savings and Costs. Santa Monica, Calif.: RAND.

Irons, John, and Ian Townson. 2008. “U.S. Lags Behind in Broadband Infrastructure.” EPI Economic Snapshot. Washington, D.C.: EPI. April. http://www.epi.org/content.cfm/webfeatures_snapshots_20080423

Johnson, David, Parker, Jonathon, and Nicholas Souleles. 2004. Household Expenditures and the Income Tax Rebates of 2001. Princeton , N.J.: Princeton University. August. http://wws.princeton.edu/econdp/pdf/dp231.pdf

Macroeconomic Advisors. 2008. Monthly GDP Index. October 16. http://www.macroadvisers.com/content/MA_Monthly_GDP_Index.xls

McKinsey Global Institute. 2008. “The Carbon Productivity Challenge: Curbing Climate Change and Sustaining Economic Growth.” June. http://www.mckinsey.com/mgi/publications/Carbon_Productivity/index.asp

McNichol, Elizabeth, and Iris Lav. 2008a. “29 States Faced Total Budget Shortfall of At Least $48 Billion in 2009.” Washington D.C.: Center on Budget and Policy Priorities. August 5. http://www.cbpp.org/1-15-08sfp.htm

McNichol, Elizabeth, and Iris Lav. 2008b. “State Budget Troubles Worsen.” Washington D.C.: Center on Budget and Policy Priorities. December 10. http://www.cbpp.org/9-8-08sfp.htm

Mishel, Lawrence, Ross Eisenbrey, and John Irons. 2008. Strategy for Economic Rebound. Economic Policy Institute Briefing Paper. Washington, D.C.: EPI. http://www.epi.org/content.cfm/bp210

Mui, Ylan, and Dion Haynes. 2008. Pinched and watching pennies. Washington Post. October 3. http://www.washingtonpost.com/wp-dyn/content/article/2008/10/02/AR2008100203632.html

National Center for Education Statistics. 2007. “Fast Facts.” http://nces.ed.gov/fastfacts/display.asp?id=94

National Center for Education Statistics. 2008. “Condition of America’s Public School Facilities: 1999.” June 2000, pg. B-29 ($127 billion) and pg. 17 ($322 billion). http://nces.ed.gov/pubs2000/2000032.pdf

National Governors Association/National Association of State Budget Offi cers. 2008. “The Fiscal Survey of States.” June. http://www.nga.org/Files/pdf/FSS0806.PDF

RealtyTrac. 2008. “Foreclosure Activity Increases 12 Percent in August.” September 12. http://www.realtytrac.com/ContentManagement/pressrelease.aspx?ChannelID=9&ItemID=5163&accnt=64847

Richburg, Keith, and Karl Vick. 2008. Fiscal crisis is hitting some states hard. Washington Post. October 4. http://www.washingtonpost.com/wp-dyn/content/article/2008/10/03/AR2008100303486.html

Rooney, Ben. 2008. Rebate checks won’t get spent. CNN Money.com. March 24. http://money.cnn.com/2008/03/24/news/economy/rebates_poll/index.htm?postversion=2008032412

Standard & Poor’s. 2008. S&P/Case-Shiller Home Price Indices. July. http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_csmahp/0,0,0,0,0,0,0,0,0,1,1,0,0,0,0,0.html

TRIP. 2005. “Key Facts About America’s Road and Bridge Conditions and Federal Funding.” Washington, D.C.: TRIP. http://www.tripnet.org/nationalfactsheet.htm

United States Census Bureau. 2008. Retail Sales (Excluding Food Services). http://www.census.gov/marts/www/download/text/adv44000.txt