Issue Brief #102

Updated Feb. 28, 1996 | Issue Brief #102

1. The ability of many lower- and middle-income families to maintain or improve their incomes is tied strongly to the strength of the minimum wage.

- The typical American family has seen either little or negative income growth since 1979.

- Middle-class incomes fell in the 1989-92 period and have not grown since 1992 despite the recovery. The predominant cause has been the sharp decline in hourly wages, and part of this decline is directly attributable to the fall in the real value of the minimum wage. Thus, raising the minimum wage will have the direct and immediate effect of stanching the income loss to low- and middle-income families.

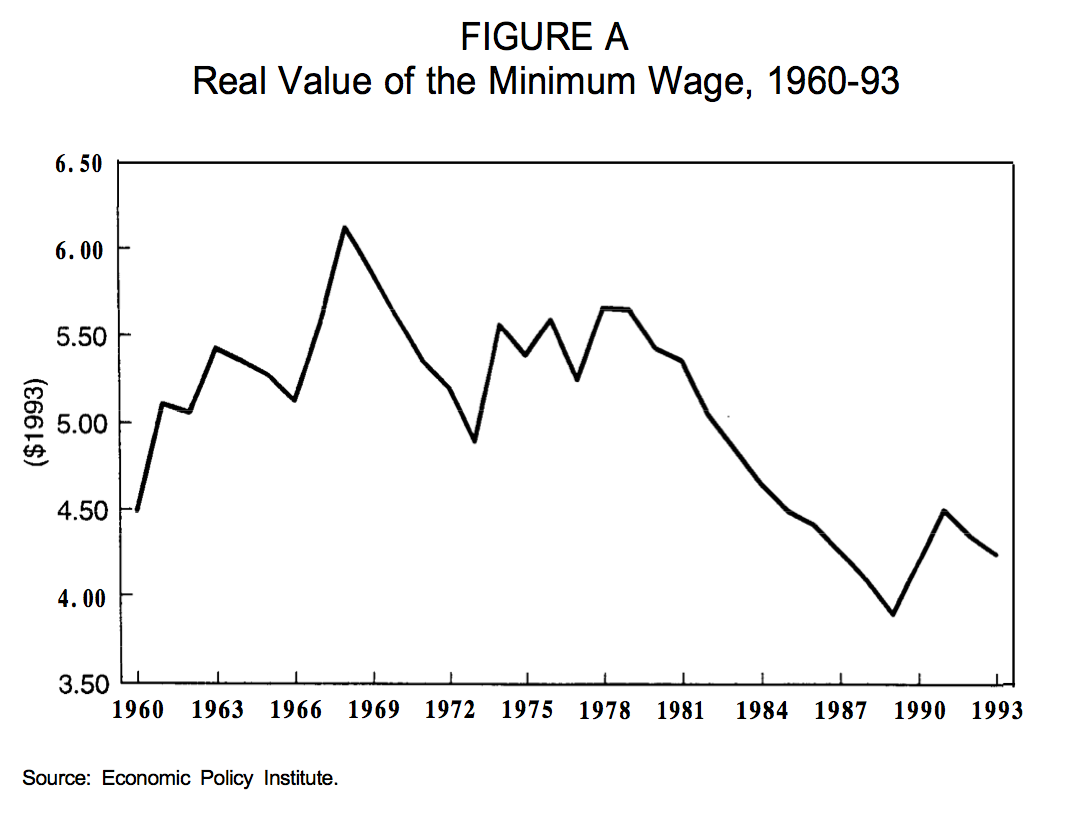

- Today’s minimum wage ($4.25) is more than 30% below its average level ($5.75 in 1995 dollars) of the 1970s. It would have to be raised to almost $6.00 to give it the same value it had in 1979. (See Figure A.)

2. The minimum wage is not just for part-time teenage workers.

- Adults make up roughly 75% of the workers who would be affected by the Clinton proposal for a $0.90-an-hour increase in the minimum wage.

- Nearly half are full-time workers, and nearly a fourth are the heads of households. Roughly 40% are the only earners in their families.

- The minimum wage is especially important for women, who make up 58% of minimum-wage workers.

3. An increase in the minimum wage will help families.

- Raising the minimum wage by $0.90 would result in an average increase in weekly earnings of at least 10% for those earning between $4.25 and $5.15 an hour.

- In 1979, a full-time worker at the minimum wage could maintain a family of three just above the poverty line. In 1994, the minimum wage was $2,503 per year short of the poverty line for a three-person family.

- The earnings of minimum-wage workers are important to working families. These workers contribute just under half (45%) of the total earnings of their families.

4. Workers at or near the minimum wage are the ones who have lost the most ground since the 1970s.

The inflation-adjusted wage for low-wage men (those at the 20th percentile, i.e., they make less than the other 80% of the workforce) dropped 20% between 1979 and 1993. Among low-wage women it dropped 7%.

5. The economic evidence is that a modest rise in the minimum wage (such as to $5.00 or $6.00) would not increase unemployment.

In 1995, 101 economists, including three Nobel Prize winners, made this point in a statement of support for a $0.90 minimum-wage increase. “We believe that the minimum wage can be increased by a moderate amount without significantly jeopardizing employment opportunities,” the statement said.

6. The Earned Income Tax Credit (EITC), while important, is not a substitute for the minimum wage. The two policies complement one another.

- The EITC is a refundable tax credit that varies according to a worker’s earnings and his or her family size.

- Even at the highest rates foreseen by current EITC provisions, low-wage workers will not be compensated for the decline in the real value of the minimum wage since 1979.

- For low-wage workers, the minimum wage has the advantage that it is paid out with their weekly paychecks, not once a year in a lump-sum payment.

- EITC payments reduce government tax revenues, while tax payments on higher minimum- wage rates make a positive contribution.

7. To the extent that it is not now economical for people to leave welfare and go to work, a higher minimum wage will increase the incentive to choose work.

One study shows that the wages available to low-wage workers have the greatest impact on whether welfare rolls grow or decline.

References

Card, David. 1992a. “Do Minimum Wages Reduce Employment? A Case Study of California, 1987-89.” Industrial and Labor Relations Review, Vol. 46 (October), pp. 38-54.

Card, David. 1992b. “Using Regional Variation in Wages to Measure the Effects of the Federal Minimum Wage.” Industrial and Labor Relations Review, Vol. 46 (October), pp. 22-37.

Card. David and Alan Krueger. 1995. The Minimum Wage. Princeton, N.J: Princeton University Press. Dinardo, John, Nicole M. Fortin. and Thomas Lemieux. 1994. “Labor Market Institutions and the Distribution of Wages, 1973- 1992: A Semiparametric Approach.” Unpublished.

Katz, Lawrence and Alan Krueger. 1992. “The Effect of the Minimum Wage on the Fast Food Industry.” Industrial and Labor Relations Review, Vol. 46 (October), pp. 6-2 1.

Mishel, Lawrence and Jared Bernstein. 1994. The State of Working America 1994-95. Armonk, N.Y.: M.E. Sharpe.

Shapiro, Isaac. 1995. “Four Years and Still Falling: The Decline in the Value of the Minimum Wage.” Washington, D.C.: Center on Budget and Policy Priorities.

Spriggs, William and Bruce Klein. 1994. Raising the Floor: The Effects of the Minimum Wage on Low-Wage Workers. Washington, D.C.: Economic Policy Institute.

Spriggs, William and John Schmitt. 1996. “The Minimum Wage.” In Todd Schafer and Jeff Faux, eds.,Re-

claiming Prosperity: A Blueprintfor Progressive Economic Reform. Armonk, N.Y.: M.E. Sharpe. Wellington, Alison. 1991. “Effects of the Minimum Wage on the Employment Status of Youths: An Update.” Journal of Human Resources, Vol. 26 (Winter), pp. 27-46.