Thomas Piketty’s new book Capital in the Twenty-First Century, which is getting deserved attention and plaudits, argues that if the rate of return to capital exceeds the overall economic growth rate, then wealth and income will become more concentrated among the already comparatively well-off.

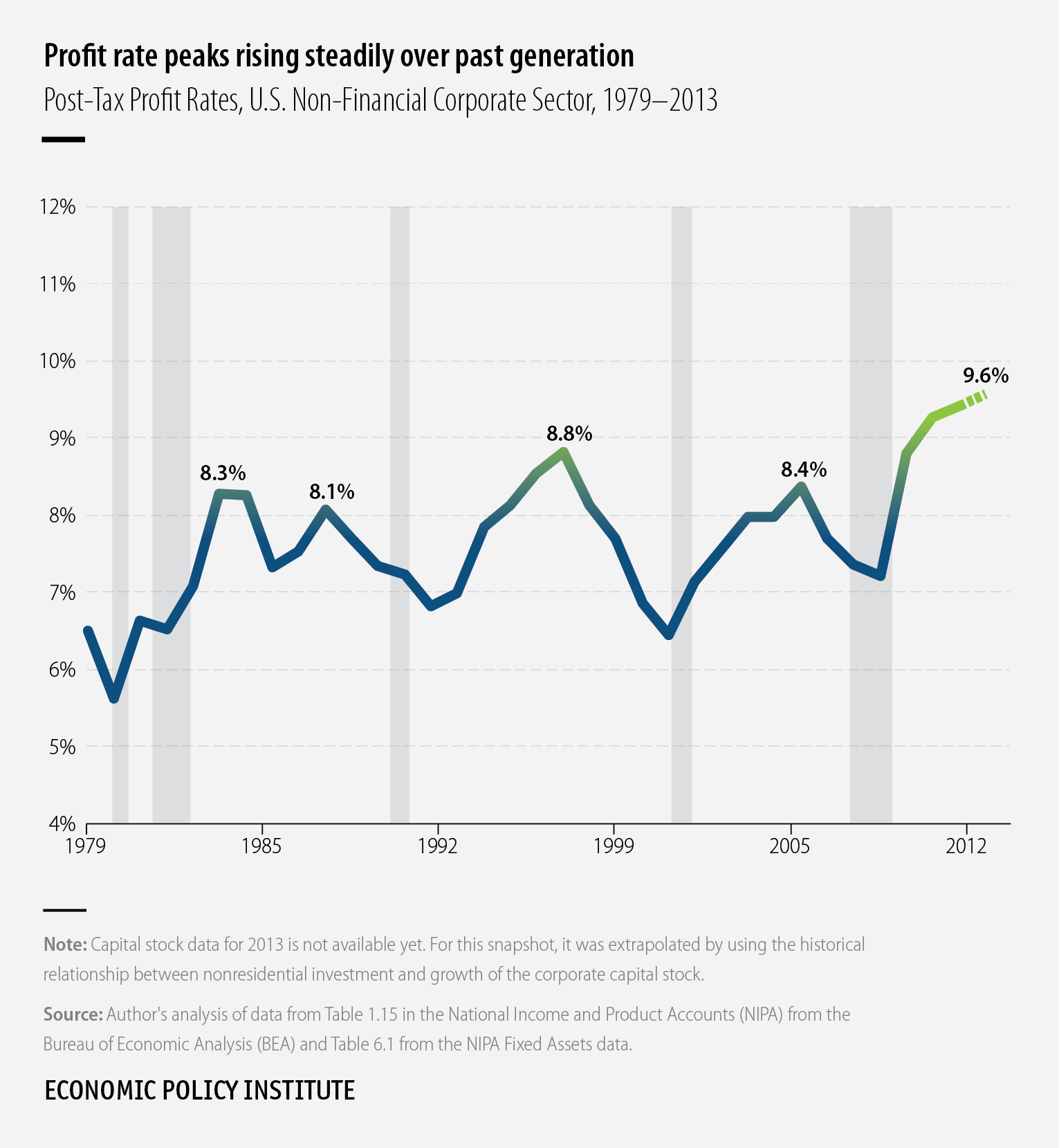

In the United States, a key driver of the overall rate of return to capital has been the profit rate in the corporate sector. As shown in the figure below, the corporate profit rate has risen fairly steadily (aside from dips during recessions) since 1979. By 2012, the post-tax profit rate had reached its highest level since the late 1960s. The data point for 2013 is estimated (capital stock data for 2013 have not yet been released)—but corporate profits came in significantly higher than in 2012, so it seems likely that the profit rate (given trends in corporate investment) will rise even further.

A key point that Piketty stresses in his book—but too many commenters have missed—is that the profit rate is not an iron law of economics, and instead reflects policy decisions that raise or lower the bargaining power of capital owners relative to workers. Over the past generation, these policy decisions have reliably boosted capital’s bargaining power, resulting in the steady rise of the profit rate.

It’s important to note that even seemingly small changes in the profit rate imply large redistributions of income. If today’s profit rate (9.4 percent) were instead equal to the one that prevailed in 1979 (6.5 percent), more than $430 billion of corporate sector income could have flowed to workers rather than capital owners in the past year, boosting compensation in the non-financial corporate sector by just over 9 percent.