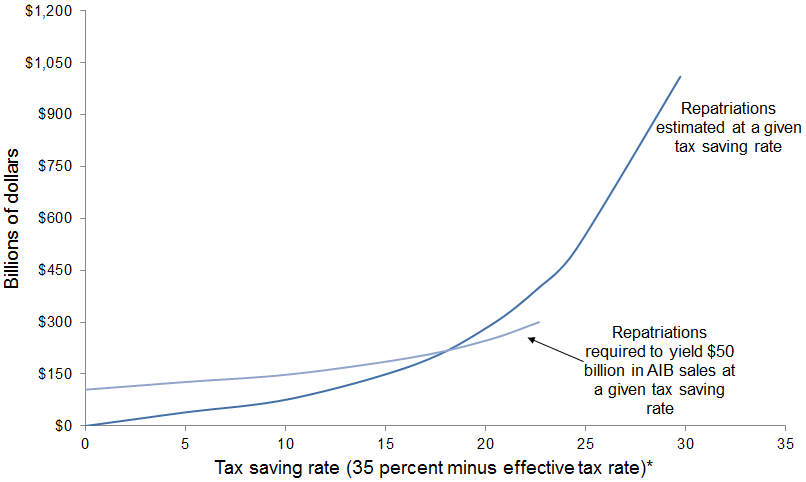

Figure A1

Estimated and required repatriations at a given tax saving rate

| Tax saving rate (35 percent minus effective tax rate) | Estimated repatriations (billions) | Required repatriations (billions) |

|---|---|---|

| 29.75 | $1009.54 | |

| 24.5 | $507.5017 | |

| 22.68 | $399.8462107 | $300 |

| 20.22 | $289.6924955 | $250 |

| 16.52 | $178.4163743 | $200 |

| 10.36 | $79.61161506 | $150 |

| 5 | $39.4 | $127 |

| 0 | $0 | $105 |

* Percentage "saved" by buying American Infrastructure Bonds compared with paying 35 percent statutory corporate tax rate

Source: Author's calculations and author's analysis of Barthold (2011)

This chart appears in:

Previous chart: « Repatriations needed to yield $50 billion in American Infrastructure Bond (AIB) sales

Next chart: Tax extender packages passed since 1998 »