See Snapshots Archive.

Snapshot for March 31, 2004.

Congressional budget resolution takes the deficit from bad to worse

The budget resolution passed by the House of Representatives on March 25 is an odd response to current concerns about deficits. 1 Instead of lowering deficits, the resolution would increase deficits through at least 2005, for a total increase of $242 billion over five years.

The meaning of “increase” here is critical to understanding the budget proposal in context. With no policy changes and very optimistic assumptions, the “baseline” deficit is projected to drop to $170 billion in 2009. Thus, doing nothing implies an automatic decrease from the projected 2005 level of $323 billion. In contrast, the resolution proposes tax and spending changes that would put the deficit at $231 billion in 2009—$61 billion higher than the baseline level of $170 billion.

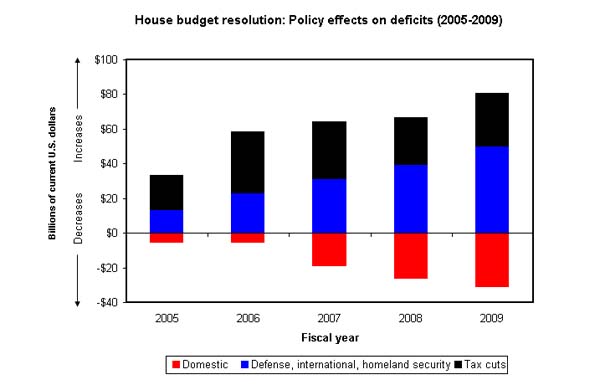

The figure below illustrates the components of the resolution. Each block shows the effect of the resolution on changes in deficits from 2005 to 2009. The red block in chart shows the negative effect of proposed cuts in domestic spending (not including homeland security). Aside from the inherent problems of cutting domestic spending, this measure alone would reduce deficits.

Along with these spending cuts, however, the House proposes increases in spending for defense, international affairs, and homeland security (the blue block in the figure below). These increases more than offset the cuts in domestic spending. On top of these spending increases are further tax cuts. Taken together, the spending increases and tax cuts ensure deficit increases over the period.

The Senate budget resolution differs in its particulars but has the same ultimate effects: domestic spending cuts offset by security-related spending increases, tax cuts, and higher deficits. In both the House and the Senate resolutions, the deficit increases accelerate over a 10-year period to levels that are at least seven times higher than they would be without any budget changes—in excess of $1.3 trillion.

Note: 1 Because budget resolutions are nonbinding, they have no legal force.

Sources: Richard Kogan, Joel Friedman, and David Kamin, Center on Budget and Policy Priorities, “Digging the hole deeper: The Senate plan substantially increases deficits,” March 26, 2004; Richard Kogan and Robert Greenstein, “House budget plan would swell deficits by extending the 2001 and 2003 tax cuts and making them permanent,” March 25, 2004.

Today’s Snapshot was written by EPI economist Max Sawicky.