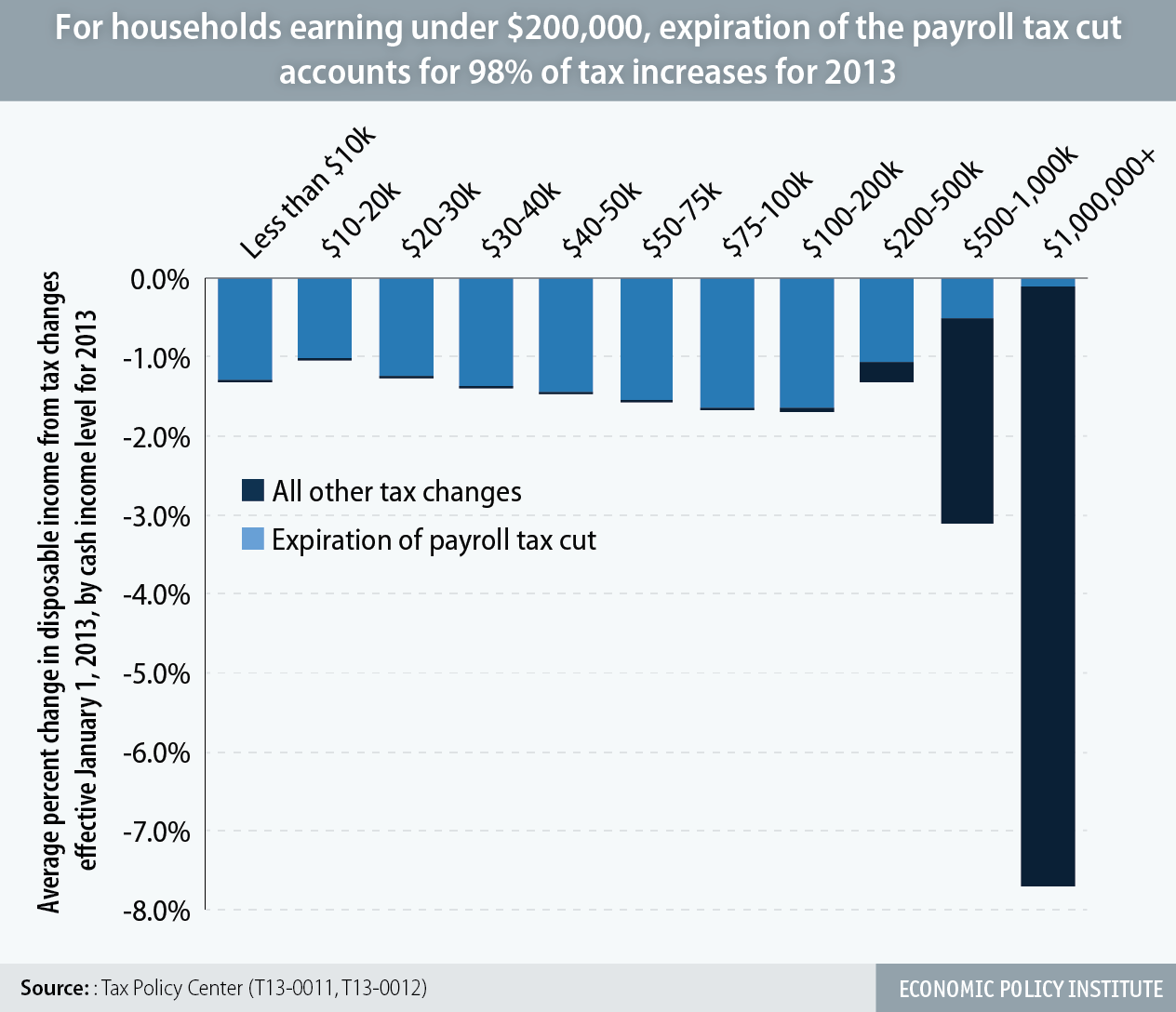

American workers will see their taxes rise in 2013 compared to 2012. For households making less than $200,000 (96 percent of all households), essentially the entire increase (98 percent) in taxes this year will result from the end of the payroll tax cut, which was enacted for 2011-2012 to boost consumption and demand. This payroll tax increase in 2013 will take an average of $721 out of households’ pockets over the year and will decrease overall disposable income by roughly $114 billion. Worse, no alternative stimulus was put forward to replace the payroll tax cut, and the resulting decline in consumer spending will significantly slow job growth in 2013.

The figure below shows the total tax increase that families in different income categories will see this year as a percent change in disposable income, breaking out the impact of the expiring payroll tax cut (light blue) versus all other tax changes for 2013 (darker blue).

For the four percent of households making over $200,000, tax changes resulting from the American Taxpayer Relief Act (which allowed the Bush-era tax cuts on high incomes to expire on schedule) and the increased taxes enacted with health-reform (see a description of these health-reform tax changes in this blog post) explain a much large share of the total 2013 tax change.