The March 2012 employment situation report from the Bureau of Labor Statistics was a negative surprise and underscored the fact that a robust jobs recovery has not yet solidified. The job growth of 120,000 was much lower than the 275,000 jobs added in January and 240,000 jobs added in February. However, much of the weak job growth in March was likely due to unseasonably warm weather in January and February (think, say, of hiring being pulled forward, i.e., people getting hired in January or February instead of March). Looking over the last three months, average job growth was 212,000, probably a better measure of underlying growth. This, however, is still a far cry from the roughly 350,000 jobs we need per month to get back to full employment in three years.

The unemployment rate ticked down by one-tenth of a percent to 8.2 percent in March, but that was largely due to people dropping out of the labor force, not an increase in the share of the working-age population with jobs. As a reminder of what a healthy unemployment rate looks like, consider that five years ago, in March 2007, the unemployment rate stood at 4.4 percent, and 12 years ago, in March 2000, the unemployment rate was 4.0 percent.

One broad concern is that the drop in the unemployment rate over the last two years has been unexpectedly large given the relatively tepid growth in gross domestic product over this period, and that further significant improvements in the unemployment rate will likely require faster GDP growth than what we’ve been seeing. For more on this, see this recent EPI analysis.

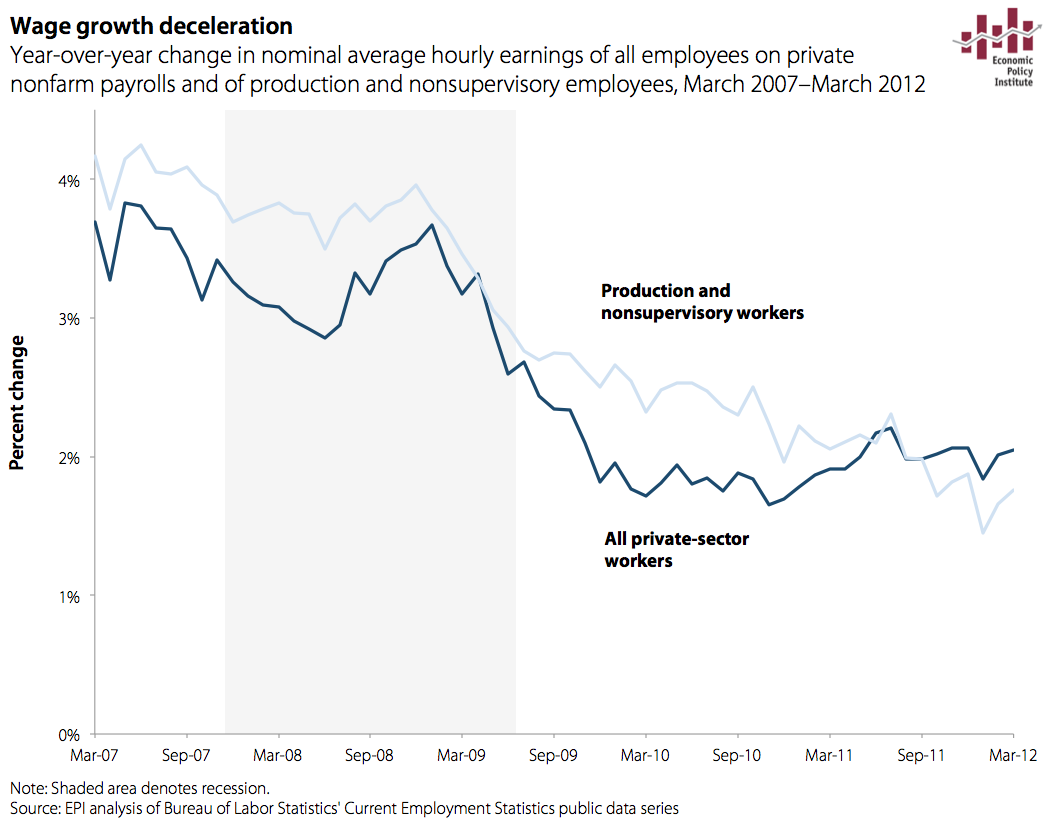

Wage growth is weak

Though the unemployment rate is slowly improving, it has now been over 8 percent for more than three years. The persistent very high unemployment exerts strong downward pressure on wage growth, since the existence of so many unemployed workers relative to job openings, along with a lack of outside job opportunities for workers with jobs, means employers don’t have to pay substantial wage increases to get and keep the workers they need. Average hourly wages for all private-sector workers increased by 5 cents in March, and at a 2.4 percent annualized growth rate over the last three months and a 2.1 percent growth rate over the last year. Average hourly wages for production and nonsupervisory workers increased by 3 cents in March, and a 1.9 percent annualized growth rate over the last three months and a 1.8 percent growth rate over the last year. As the figure shows, these growth rates remain far below their pre-recession rates.

Still very difficult environment for job seekers

The share of unemployed workers who have been unemployed for more than six months ticked down in March, from 42.6 percent to 42.5 percent. However, it is just 3 percentage points lower than its peak of 45.5 percent one year ago, and remains more than 25 percentage points above its December 2007 value of 17.4 percent. As mentioned above, the fact that there are still so many unemployed workers competing for each job opening means that it is still an extremely difficult environment for job seekers, with workers continuing to get stuck in unemployment for long periods.

Not a surprise that the labor force participation rate didn’t rise

Labor force participation dropped in March to 63.8 percent, just slightly higher than its low point of the downturn, which was 63.7 percent in January. Labor force participation remains far below its pre-recession rate of 66.0 percent in December 2007. There are currently 2.4 million “marginally attached” workers (using our own seasonal adjustment calculation). These are workers who want a job, are available to work, but have given up actively seeking work. If these workers were in the labor force and counted as unemployed, the unemployment rate would be 9.6 percent right now (BLS calls this the U-5 measure of labor underutilization, and the March rate is a slight improvement from the February rate of 9.7 percent). However, despite the fact that the labor market is slowly getting stronger, it remains a very difficult environment for job seekers (as mentioned above) and it is unlikely that these missing workers are going to be drawn back into the labor force in large numbers until job prospects are strong enough that they won’t face months of fruitless job search. For more on this, see this recent commentary.

Underemployment dropped more than unemployment due to decline in involuntary part-timers

The “underemployment rate” (officially, the U-6 measure of labor underutilization) is the Bureau of Labor Statistics’ most comprehensive measure of labor market slack. It includes not just the officially unemployed and the marginally attached (jobless workers who want a job and are available to work but have given up actively seeking work), but also people who want full-time jobs but have had to settle for part-time work. This measure decreased from 14.9 percent to 14.5 percent over the last month, largely due to a 447,000 decline in “involuntary” part-time workers. The number of involuntary part-timers has made substantial improvement over the last six months, decreasing from 9.3 million to 7.7 million over that period.

Industry breakdowns

A piece of good news is that public-sector job loss has slowed, with a decline of 1,000 in March and an average growth of 1,000 over the last three months, compared with an average loss of 23,000 jobs per month for the 18 months before that (excluding temporary hires to conduct the 2010 Census). Public-sector job loss has been a big drain on the recovery, so improvements in this sector are welcome. Manufacturing had another strong showing, adding 37,000 jobs, right in line with monthly growth over the prior three months. Durable goods added 26,000 jobs, while non-durable goods added 11,000.

Employment in restaurants and bars increased by 37,000 in March, compared with an increase of 30,000 over the prior three months. Health care added 26,000 jobs, not far off its average monthly growth of 33,000 in the prior three months. Temporary help services declined by 8,000, but this could be a weather effect; 46,000 temp-help jobs were added each month on average in January and February. Two additional sectors where weather likely was a factor were retail (with a decline of 34,000 jobs after adding 1,000 per month on average for the prior three months) and construction (with a decline of 7,000 jobs after adding 13,000 per month on average for the prior three months).

Demographic breakdowns

Unemployment in March 2012 was 8.0 percent for those age 25 and older with a high school degree but no additional education, and 4.2 percent for those age 25 and older with a college degree or more. While workers with higher levels of education have lower unemployment rates, workers at all levels of education have seen their unemployment rates roughly double since 2007, running counter to the notion that unemployment is high because employers are unable to fill their demand for workers with higher education credentials.

Considering additional breakdowns by age and race/ethnicity, we find that all major groups of workers have experienced substantial increases in unemployment over the Great Recession and its aftermath. However, young workers and racial and ethnic minorities have been and continue to be hit particularly hard.

- In March, unemployment was 16.4 percent among workers age 16–24, 7.1 percent among workers age 25–54, and 6.2 percent among workers age 55 and older (up 4.7, 3.1, and 3.0 percentage points, respectively, since the start of the recession in December 2007).

- Among workers younger than age 25 who are not enrolled in school, unemployment over the last year averaged 20.9 percent for those with a high school degree, and 8.5 percent for those with a college degree (reflecting increases of 8.9 and 3.1 percentage points, respectively, since the annual average of 2007). (Twelve-month averages are used here since seasonally adjusted data are unavailable.)

- Unemployment in March was 14.0 percent for African American workers, 10.3 percent for Hispanic workers, and 7.3 percent for white workers (up 5.0, 4.0, and 2.9 percentage points, respectively, since the start of the recession).

- Men saw a much larger increase in unemployment than women did during the recession, but have seen stronger improvements in the recovery. The unemployment rate reached its pre-recession low in late 2006 and early 2007, at 4.4 percent for men and 4.3 percent for women. Male unemployment peaked at 11.2 percent in October of 2009, and has since fallen to 8.3 percent. Female unemployment continued to rise for another year, when it peaked at 9.0 percent in November 2010, and has since fallen to 8.1 percent.

Conclusion

Despite ongoing improvements, the labor market still has a deficit of nearly 10 million jobs, and the lack of demand for workers means unemployment remains high and wage growth for people with jobs remains low. To get back to full employment in three years we would need to be adding around 350,000 jobs per month. The nation’s labor market remains weak, and we continue to need aggressive policies to create jobs.

— Research assistance provided by Nicholas Finio, Natalie Sabadish, and Hilary Wething