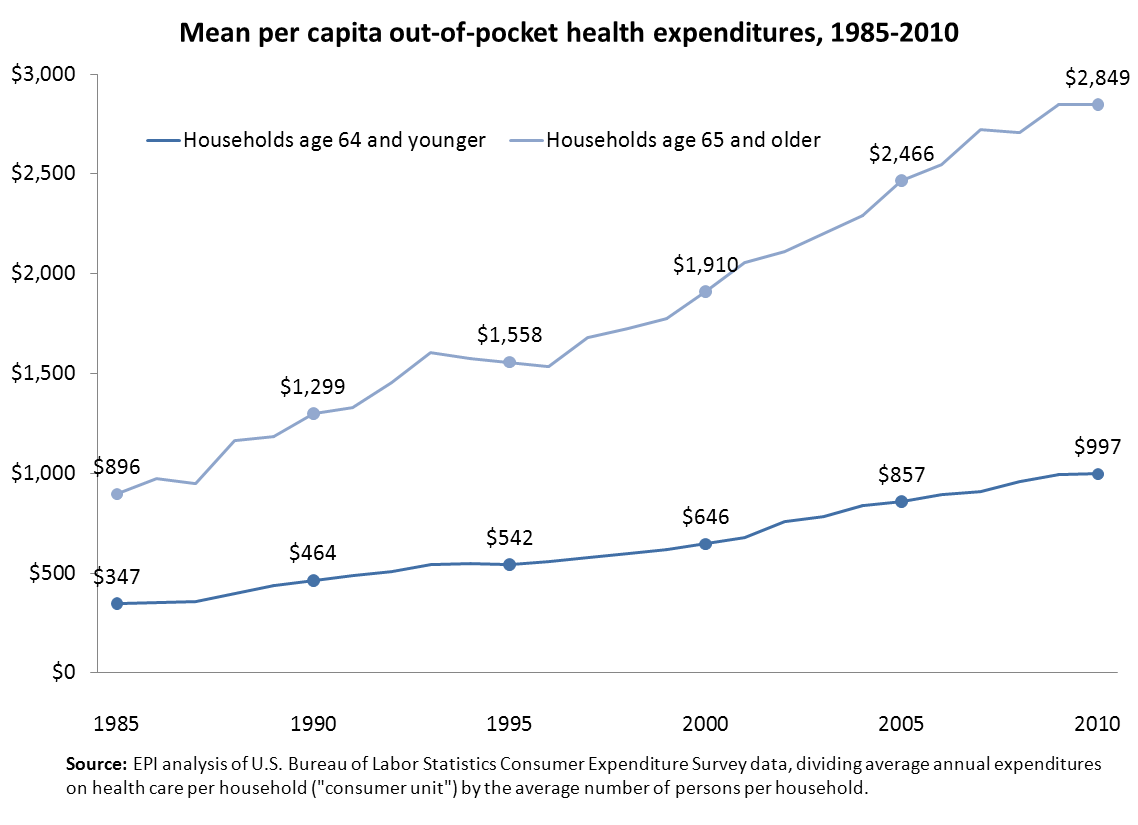

Seniors spend almost three times more on out-of-pocket health costs

Almost all seniors are covered by Medicare and most also have supplemental coverage. Nevertheless, out-of-pocket (OOP) health expenditures are higher for seniors than younger households because seniors tend to be in worse health. Though the weak economy and the 2006 Medicare prescription drug benefit have moderated growth in OOP spending, per capita costs are nearly three times higher for seniors than for younger households ($2,849 versus $997).

OOP costs have grown significantly faster than inflation over the past 25 years—at an average annual rate of 4.4 percent across all age groups (4.7 percent for seniors), compared to 2.7 percent annually for overall consumer price index (CPI-U) inflation. These figures are based on the U.S. Bureau of Labor Statistics’ Consumer Expenditure Survey (CEX) and reflect faster growth in the price of medical goods and services as well as greater consumption and cost sharing.

Average per capita spending for seniors now consumes 20 percent of the average Social Security retiree benefit, up from 16 percent in 1985. These figures understate the financial burden posed by OOP health spending because CEX does not survey people in nursing homes. A Kaiser Family Foundation analysis of Centers for Medicare & Medicaid Services (CMS) data found that long-term care constituted 19 percent of OOP health care spending for Medicare beneficiaries in 2006.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.