Elderly Women the Most Vulnerable, Social Security the Most Protective

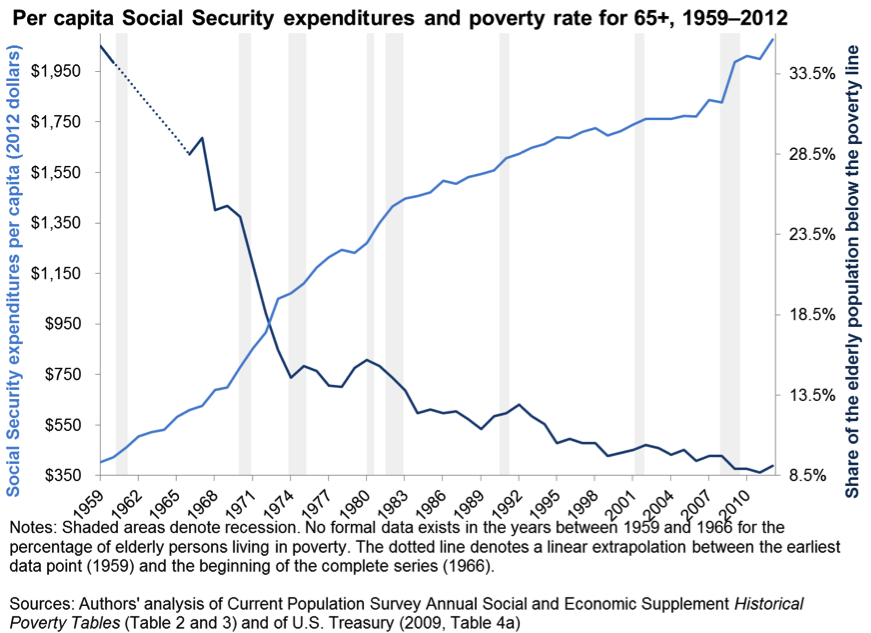

Social Security (and other social insurance programs like Medicare and Medicaid) has significantly helped reduce elderly poverty over the last several decades. The U.S. Census Bureau reported that 15.3 million elderly people would have been in poverty in 2012 without Social Security. That would have meant close to four times more elderly people in poverty. The figure below illustrates how declines in elderly poverty are directly associated with sharp increases in per capita Social Security expenditures—evidence that direct government transfers keep many people from falling below the poverty line.

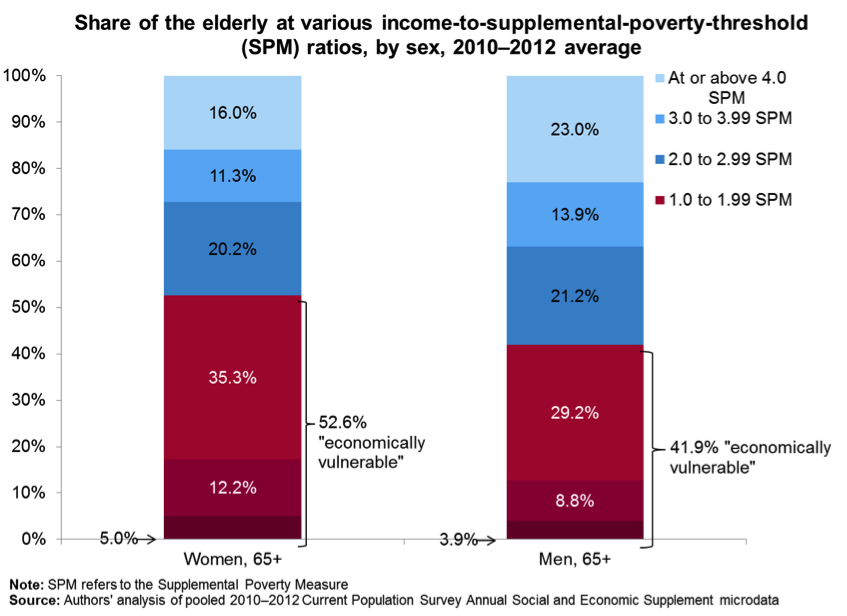

But Social Security, Medicare and Medicaid—as valuable as they are—do not provide a lavish lifestyle. Most of America’s 41 million seniors live on modest retirement incomes that cover just the costs of basic necessities and support a simple, yet dignified, quality of life. To highlight how official poverty measures may paint too rosy a picture of the living standards of America’s seniors, my colleague Dave Cooper and I showed nearly half of the elderly population in the United States are “economically vulnerable,” defined as having an income that is less than two times the supplemental poverty threshold (a poverty line more comprehensive than the traditional federal poverty line). A data update to that analysis shows that 47.9 percent of the elderly are economically vulnerable.

While this percentage is alarming enough in its own right, a closer look at the data reveals more troubling trends. As the figure below shows, 52.6 percent of women, ages 65 and older, are “economically vulnerable,” compared with 41.9 percent of men, ages 65 and older. In fact, the shares of men at every level of the distribution above the “economically vulnerable” threshold are larger than the corresponding shares of women, and the shares of men are smaller at every level below the “economically vulnerable” threshold than the corresponding shares of women. In short, retirement security should surely be seen as a women’s issue.

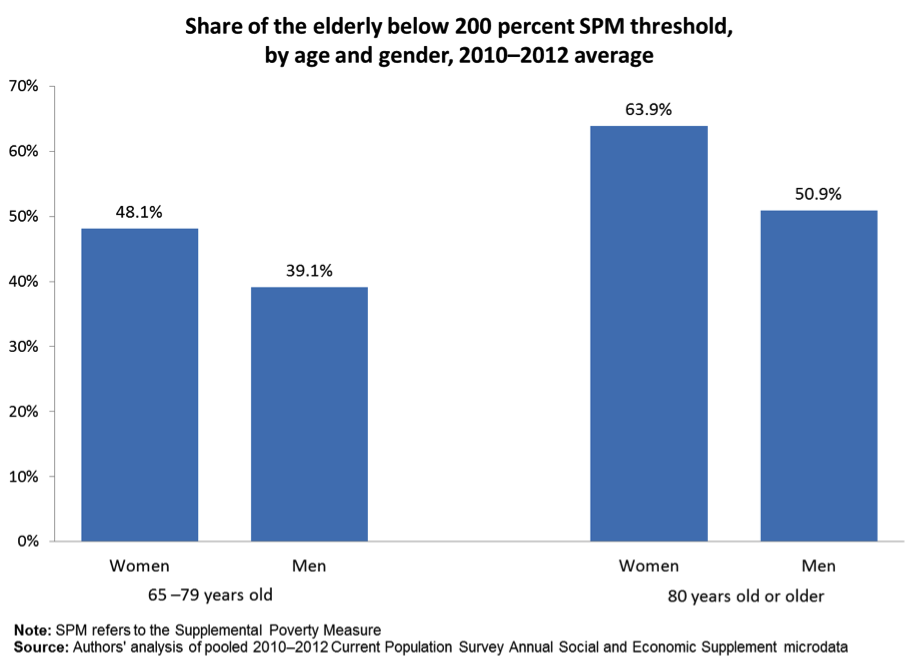

This is not a statistical artifact based on the fact that women live longer than men—although women’s longer lifespans do indeed make retirement planning that much more challenging. In fact, women are more likely to be economically vulnerable than men among both the young elderly and the older elderly (as shown in the figure below). Women, ages 65 to 79, are 9 percentage points more likely to be economically vulnerable than men, and women, 80 and older, are 13 percentage points more likely to be economically vulnerable than men.

We know what works in providing retirement security—Social Security, Medicare and Medicaid. We also know what hasn’t worked: The 401-k “revolution” in recent decades has left a dismaying number of Americans unprepared for retirement. Luckily, a growing number of policymakers seem to recognize this, and are resisting efforts to cut Social Security and even considering efforts to expand it [pdf]. Having facts and evidence finally begin to inform the retirement security policy debate should be a big win for all Americans, and particularly American women.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.