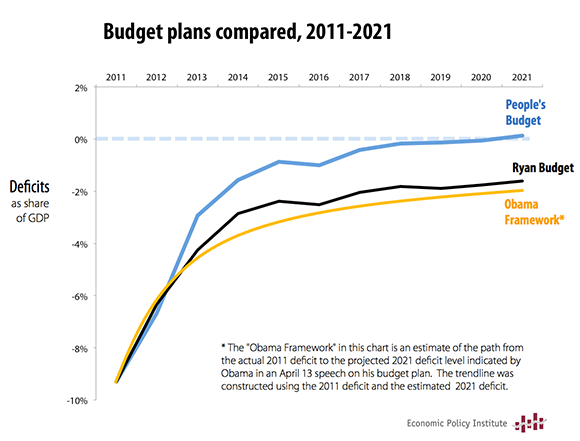

Three major plans for addressing the federal budget deficit are competing for support on Capitol Hill and with the public. President Obama’s budget framework, as detailed in a speech two weeks ago, reduces deficits from around 10% of gross domestic product (GDP) today to an estimated 2% by the end of the decade. House Budget Committee Chairman Paul Ryan claims his plan would bring deficit levels to 1.6% of GDP by 2021. The People’s Budget, developed by the Congressional Progressive Caucus with assistance from the Economic Policy Institute, goes further than both of those plans, achieving small budget surpluses by 2021.

The most important difference, however, is how each of the plans achieves savings. President Obama’s deficit reduction comes from a deep domestic discretionary spending cut, a slight security/defense spending cut, savings from health care reform, and broad-based tax reform. Rep. Ryan’s deficit reduction comes mostly from cutting non-security domestic discretionary spending, slashing Medicaid funding, and converting Medicare from a secure health-coverage program into a poorly funded voucher program. In contrast, the People’s Budget achieves deficit reduction mainly by shifting the tax burden more fairly to high-income individuals and corporations: Its proposals include rolling back the Bush tax cuts, taxing capital gains as ordinary income, raising the payroll tax cap, and enacting a financial transactions tax. The plan also cuts defense spending, enacts a public option for health care coverage, and makes room for $1.4 trillion in vital investments in infrastructure, education, and innovation over the next decade.

The People’s Budget makes it clear that putting our budget on a sustainable path does not require us to dismantle the social safety net and dangerously underinvest in our country’s physical, human, and knowledge capital.