GDP Picture for July 31, 2009

More than 500 days of recession

By Josh Bivens

The Commerce Department reported today that gross domestic product (GDP) contracted at a 1% annual rate in the second quarter of 2009, following a 6.4% decline in the previous quarter. GDP is the total market value of goods and services produced in the U.S. economy; it is generally considered the most comprehensive measure of economic activity.

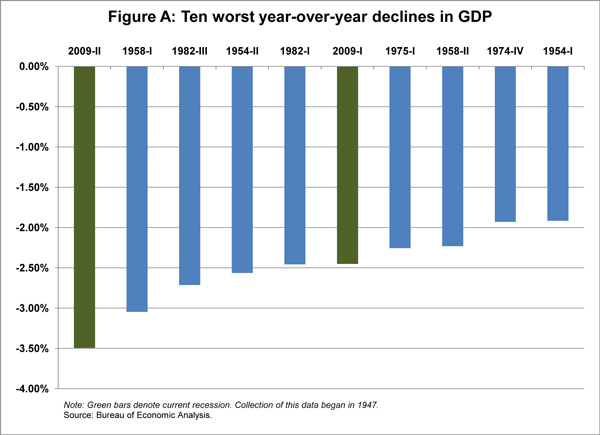

The marked improvement in this quarter relative to last is largely due to the American Recovery and Reinvestment Act (ARRA). Despite the needed boost from the ARRA (up to 3 full percentage points of annualized growth in the quarter), the U.S. economy has still contracted over the past year by 3.9%, the largest annual contraction since 1947 (see Figure A below).

Much of last quarter’s contraction could be accounted for by declining business inventory investment, which knocked 0.8% off of overall growth for the quarter. Given that inventories are a particularly volatile part of the economy, analysts often look to final sales — down 0.2% for the quarter — as a better indicator of economic health.

Domestic demand remains weak, with final sales to domestic purchasers falling by 1.5%. Personal consumption expenditures fell at a 1.2% annual rate, down from 0.6% growth in the previous quarter. Residential investment declined at a 29% annual rate, showing no sign of bottoming out. Ironically, this sector has declined so much in the past three years that it now has little effect on the overall economy, accounting for only 2.4% of overall GDP, down from a peak of over 6%.

No component of non-residential investment registered positive growth in the quarter, although the contraction in each category was slightly less than the previous quarter. Investment in equipment and software fell at a 9% annual rate, which, while dismal, still represents a substantial improvement over the previous quarter’s contraction of 36%.

Given this weak domestic demand, trade flows contributed a particularly welcome 1.4% to annualized growth in the second quarter, as imports fell faster than exports.

Despite the overall contraction, the fingerprints of the American Recovery and Reinvestment Act could be seen in some aspect of today’s report. Federal government spending grew at an 11% rate in the quarter, adding roughly 0.8% to overall GDP. State and local government spending grew at a 2.4% annual rate, the fastest growth since the middle of 2007. It is clear that the large amount of state aid contained in the ARRA made this growth possible.

Furthermore, real (inflation-adjusted) disposable personal income rose by 3.2% in the quarter, after rising by only 1% in the previous quarter. A large contribution to this increase was made by the Making Work Pay tax credit passed in conjunction with the ARRA, as this was the first full quarter that the credit was in effect. Inflation-adjusted transfer payments (including a one-time payment to Social Security recipients) rose at an annual rate of over 6% in the quarter as well.

This increase in disposable personal incomes did not translate into a sharp boost in consumption spending because the personal savings rate jumped again — rising to 5.2% in the second quarter, up from 4% in the previous quarter. This slippage between personal incomes and consumption spending caused by a rising savings rate makes plain that, instead of focusing on even more tax cuts, it was wise to make sure that much of the ARRA was devoted to direct public investment spending. The public investment spending in the ARRA, while not having a significant impact in the second quarter, will provide an even stronger boost to the economy in quarters to come.

The consensus of macroeconomic forecasters is that ARRA contributed roughly 3% to annualized growth rates in the second quarter. This means that absent its effects, economic performance would have resembled that of the previous three quarters, when the economy contracted at an average annual rate of 4.9%. In short, the recovery act turned this quarter’s economic performance from disastrous to merely bad. This is no small achievement, but with even more public relief and investments, the U.S. economy could do much better.