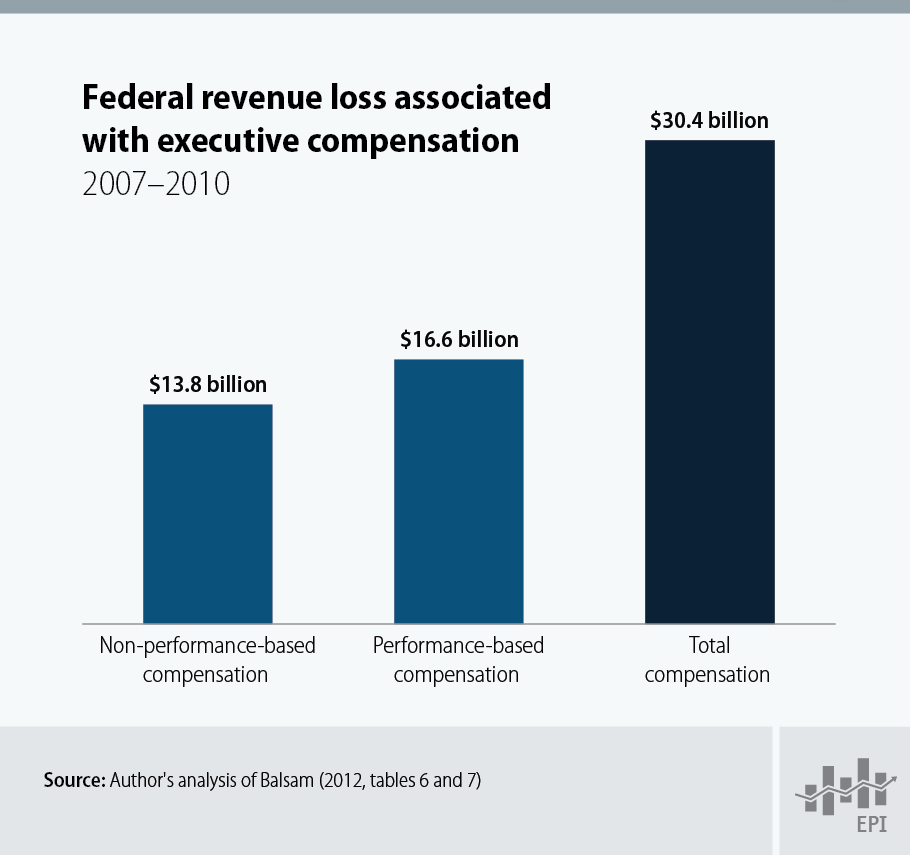

A new EPI report, Taxes and executive compensation, by Temple University accounting professor Steven Balsam, provides estimates of the tax deductions and lost tax revenue associated with the executive compensation of publicly-held companies. The graph shows that tax-deductible executive compensation cost the federal treasury $30.4 billion over the years 2007–2010; $16.6 billion from performance-based compensation and $13.8 billion from other forms of compensation such as bonuses and salary.

Section 162(m) of the Internal Revenue Code, adopted in 1993 to discourage excessive executive pay, limits the deduction for executive compensation at publicly-traded corporations to $1 million in compensation per covered executive. An exception to the provision, however, allows corporations to deduct qualified performance-based compensation. This exception has a major weakness: While it requires that shareholders approve the performance-based compensation to preserve deductibility, corporations are only required to provide shareholders with general information. Thus, shareholders are asked to, and usually do, approve compensation plans without knowing the potential payouts from the plans or whether the performance conditions are challenging.