By Ross Eisenbrey

Reports that exaggerate the problem of looming deficits have left many Americans worried that Social Security will not be there when they retire. A survey conducted jointly by the Rockefeller Foundation and the National Academy of Social Insurance found that 90% of Americans are concerned about the program’s ability to pay benefits for the next generation. Because these same people believe strongly that workers should have financial security in their retirement, most want Social Security’s finances strengthened. Regardless of their party affiliation, 85% or more of survey respondents said it is important to keep Social Security financially solvent.

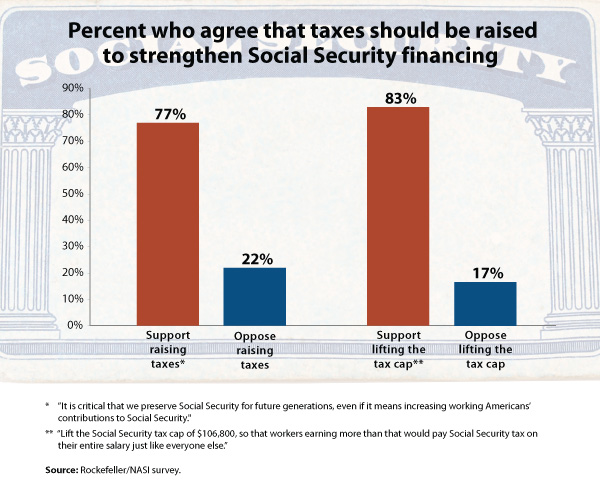

The most striking finding in the survey is that most Americans are willing to pay higher payroll taxes to preserve the Social Security program. When asked to respond to the statement: “It is critical that we preserve Social Security for future generations, even if it means increasing working Americans’ contributions to Social Security,” 77% of those surveyed said they agreed (see Figure). When presented with a specific way to strengthen Social Security, an even larger portion showed support. Of those surveyed, 83% said they supported lifting the Social Security tax cap of $106,800, so that high-income earners would pay the tax on all of their salary in the same way that lower-wage earners do. Because the projected shortfall in social security is much smaller and more manageable than is often presented, eliminating the cap on taxable earnings would bring in sufficient funds to close the projected Social Security shortfall over the next 75 years, solving the entire problem.