An increase Friday in the federal minimum wage to $7.25 per hour comes in the midst of a heated debate over health care reform, and it highlights another problem with the existing health care system. While workers at all income levels have suffered declining rates of employer-sponsored health coverage, low-paid workers are particularly unlikely to get employer-sponsored health insurance.

A 2008 paper by EPI’s Director of Health Policy Research, Elise Gould, found that individuals in the bottom 20% of the household income scale were the least likely to have employer coverage: 21.9% of those households had health insurance, compared with 86.4% of people in the top 20% of household income. The paper, which tracked an overall decline in the portion of Americans under the age of 65 with employer-sponsored health insurance between 2000 and 2007, found the lowest rates of coverage occurred in the lowest-income households. Only about one-in-five individuals in households in the bottom 20% of the income scale had employer-provided health insurance.

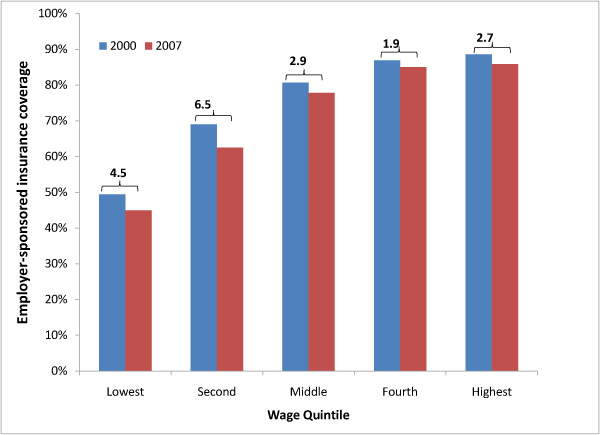

While the 2008 paper tracked employer-sponsored coverage by household income, there is a similar pattern of low and declining rates of insurance among the lowest wage earners, such as those earning minimum wage, as the following chart shows:

Employer-sponsored health insurance for individuals under 65, by wage, 2000 and 2007

.

.

“Workers earning lower hourly wages are significantly less likely to have employer-provided health coverage than those earning higher wages,” Gould wrote.

The Briefing Paper, The Erosion of Employer-Sponsored Health Insurance, also tracks different rates of coverage by age and race, and among children.