See Snapshots Archive.

Snapshot for July 14, 2004

Falling corporate tax revenues push budget deficits even higher

Since 2000, the bulk of federal tax cuts have applied to the individual income tax. The effect of these cuts on the deterioration of the federal budget outlook has been a prominent controversy in economic policy. Less noticed has been the erosion of proceeds from the corporate income tax. Tax bills pending in Congress are projected to further deplete revenues and raise budget deficits.

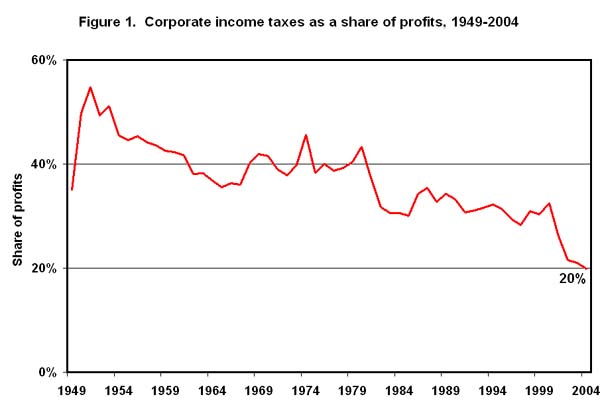

As a share of profits, the postwar average of federal, state, and local corporate income tax revenues is 37%. In the late 1940s, it was as high as 55%. As Figure 1 shows, after some leveling off between 1969 and 1981, the corporate income tax share of profits has stayed well below 37%. After 2000, it dropped by more than a third, from 32% to 20%.

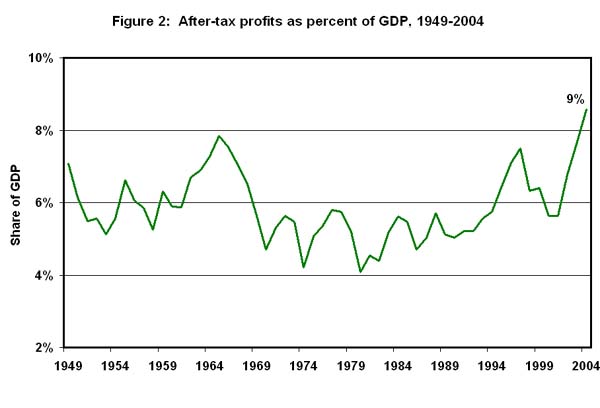

To some extent, the postwar revenue decreases have resulted from a lower profit share of gross domestic product (GDP). But after 1970 profits stayed in the range of 8% to 10% of GDP, while the tax share of profits fell from 42% to 20%. At the same time, after-tax profits as a share of GDP, shown in Figure 2, have more than doubled since 1980 from 4% to 9% (the highest level on record, going back to 1929).

For fiscal year 2003, federal corporate tax revenues were $132 billion. If the federal corporate income tax were expanded to take up the difference between current levels and the postwar average for federal, state, and local governments, revenues for calendar year 2003 would have increased by almost $190 billion and cut the deficit by half. A reconstituted corporate income tax would go a long way toward alleviating adverse deficit trends over the coming decade.

Source: National Income and Product Accounts, Bureau of Economic Analysis.

Today’s Snapshot was written by EPI economist Max Sawicky.