Elise Gould, director of health policy research at the Economic Policy Institute, participated in a Senate briefing on the Equal Rights Amendment: Unfinished Business for the Constitution, on Thursday, March 27, 2014. The Equal Rights Amendment is a proposed amendment to the United States Constitution that would guarantee equal rights for women and give Congress the power to enforce equal rights, should the need arise. Hosted by Senator Ben Cardin, the briefing included leaders from Progressive Democrats of America, National Organization for Women, National Women’s Political Caucus, and the Feminist Majority to discuss both the need for the Equal Rights Amendment and the impact equal rights will have on women for decades to come. This multimedia presentation is adapted from Gould’s presentation.

This presentation documents historical and current trends in wage and benefit disparities between women and men. It examines disparities at different points in the wage distribution, for different education levels and occupations, and by age, including workers in retirement. The main findings include the following:

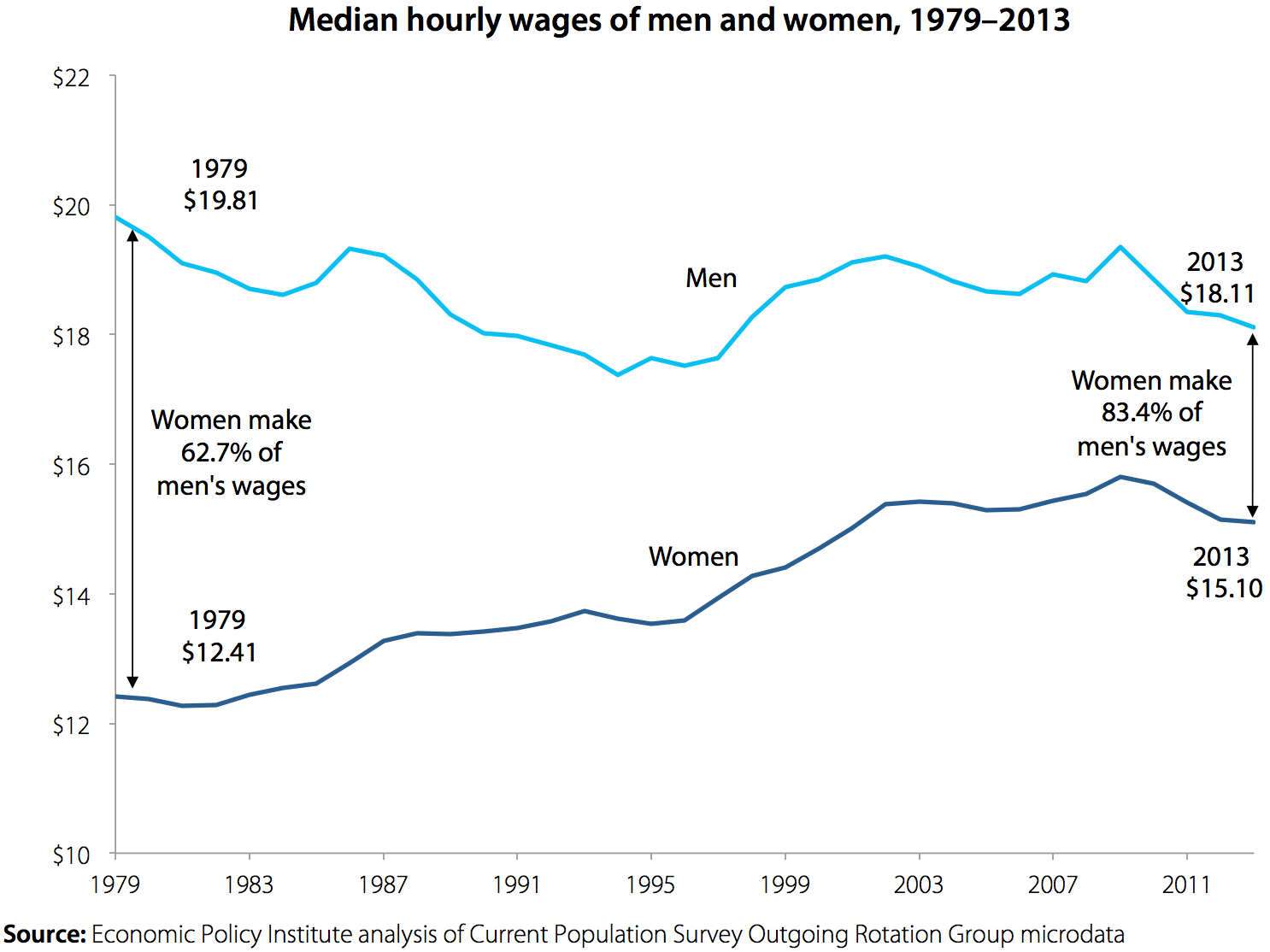

- Women’s wages still lag men’s, particularly at the high end of the wage distribution, though the gap has narrowed over time. In 2013, women’s hourly wages were 83.4 percent of men’s at the median of the wage distribution.

- Women are disproportionately in low-wage and service occupations.

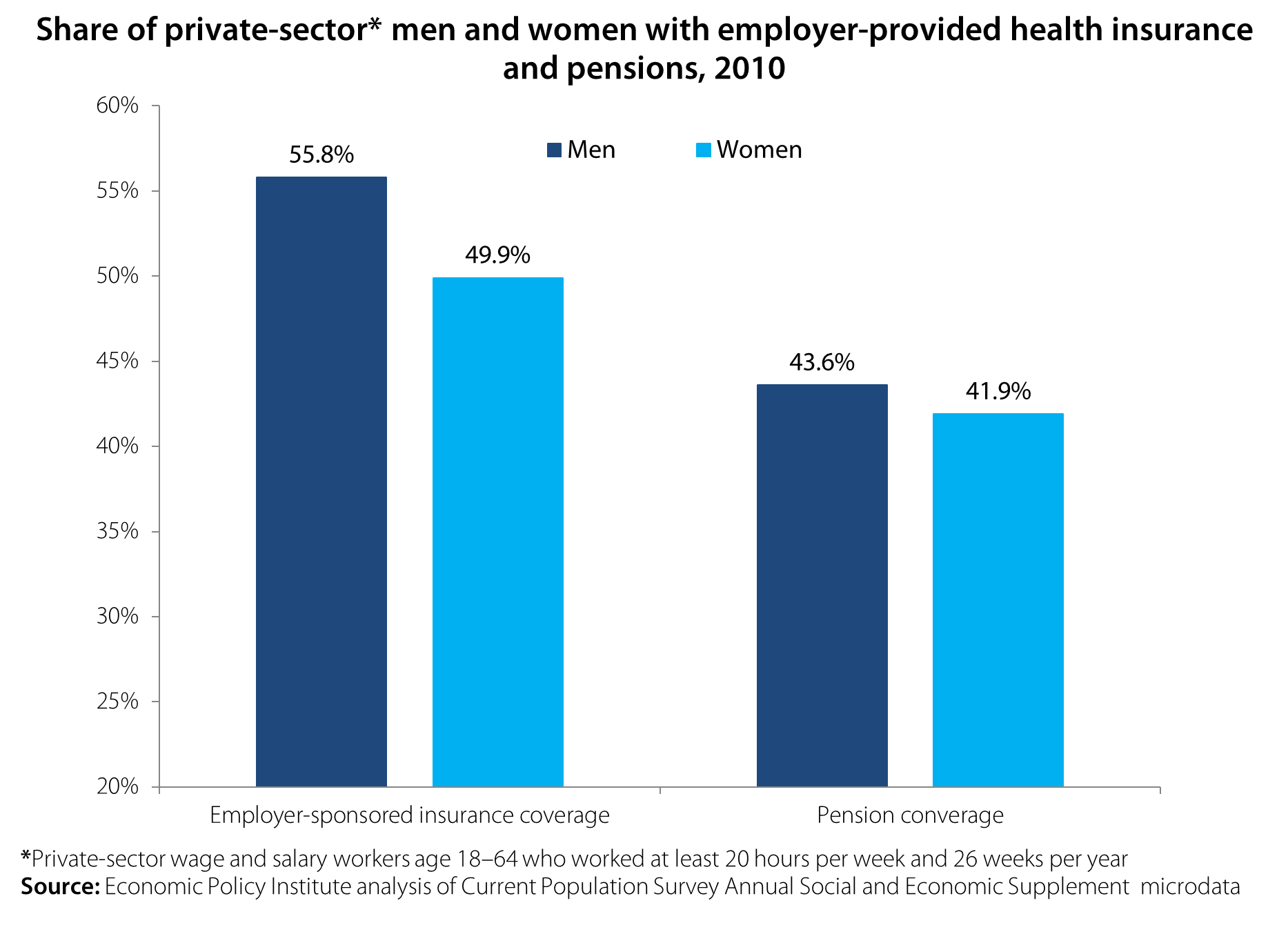

- Women are less likely to have workplace benefits such as employer-sponsored insurance and pensions than their male counterparts.

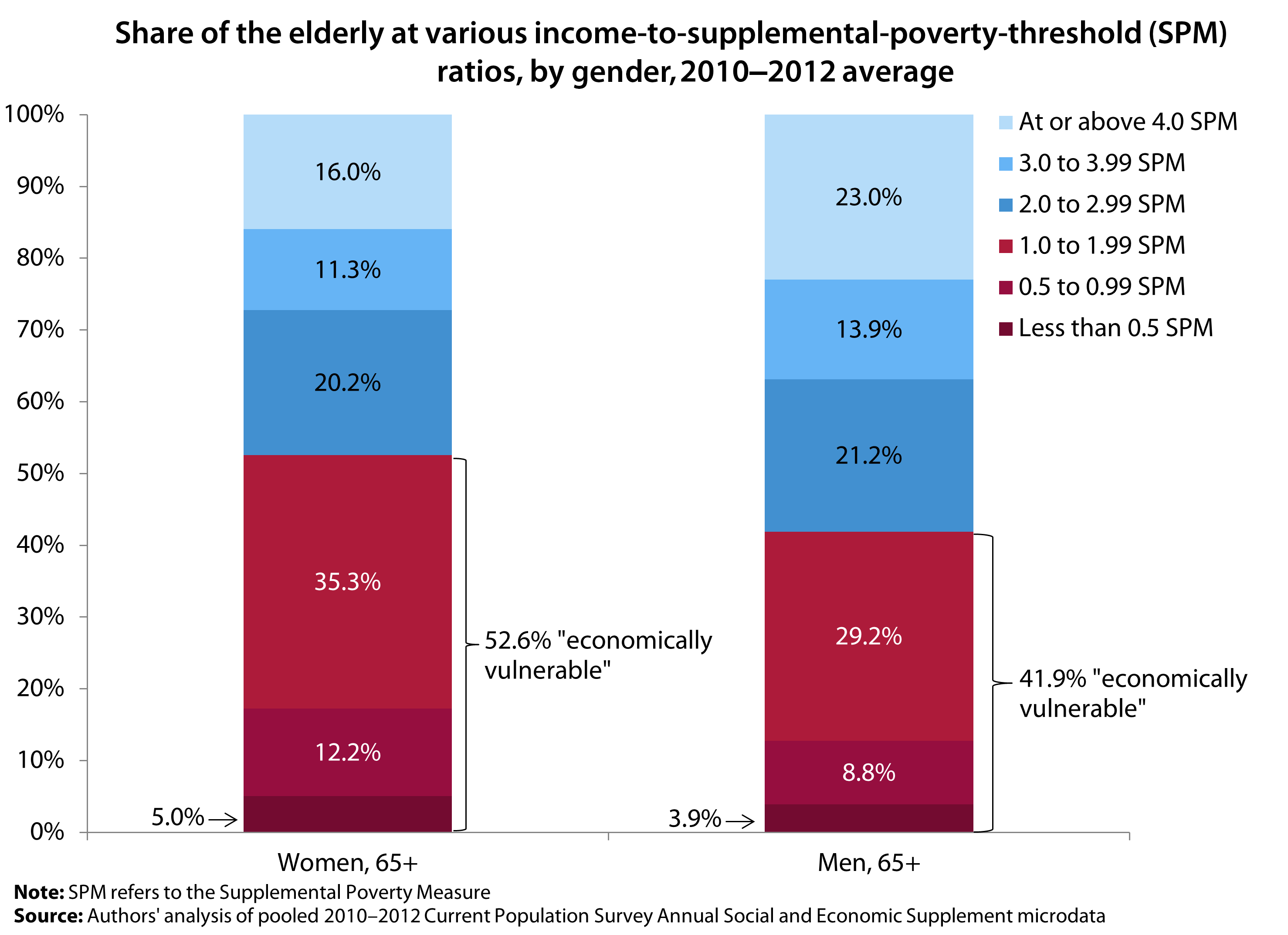

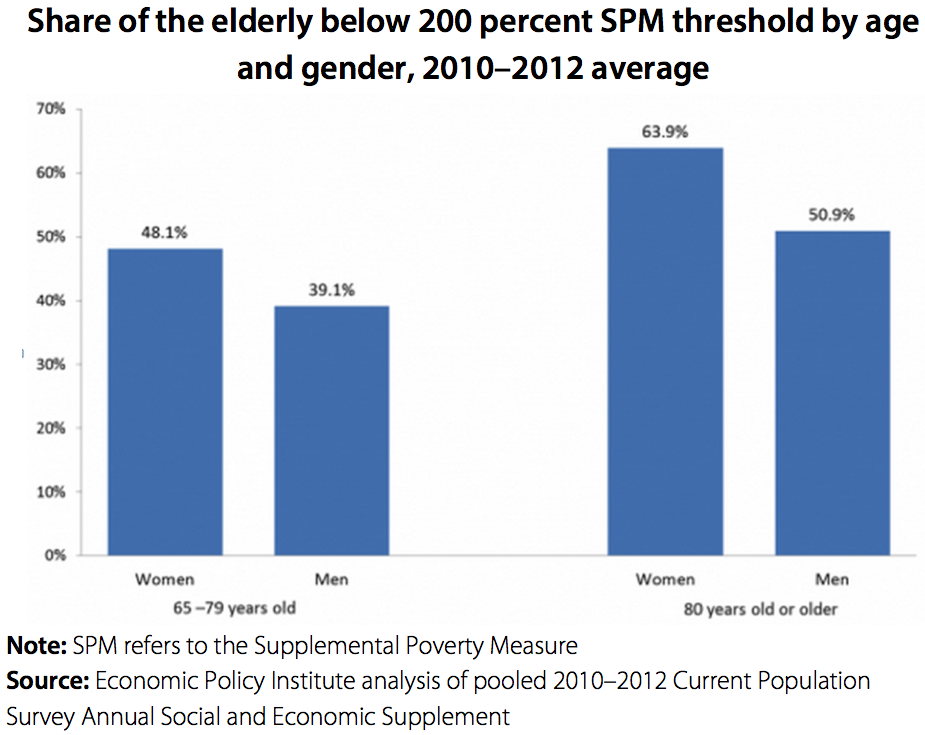

- A lifetime of compensation inequality means that women are more economically vulnerable in retirement: Elderly women are more than 10 percentage points more likely to be economically vulnerable than men.

There is no cost to the economy of women catching up to men. Through increasing bargaining power of workers generally, it’s possible to reduce the gender gap and increase wages.

Wage disparities between men and women

In 2013, the median hourly wage for men was $18.11 compared with $15.10 for women. At that point in the wage distribution, women make 83.4 percent of what men make—about 83 cents on the dollar. As shown in Figure A, this gap has been closing, though it’s clear that typical men’s wages have been stagnating as women’s wages are slowly increasing. In 1979, women at the middle made about 63 percent of what men made, or 63 cents on the dollar.

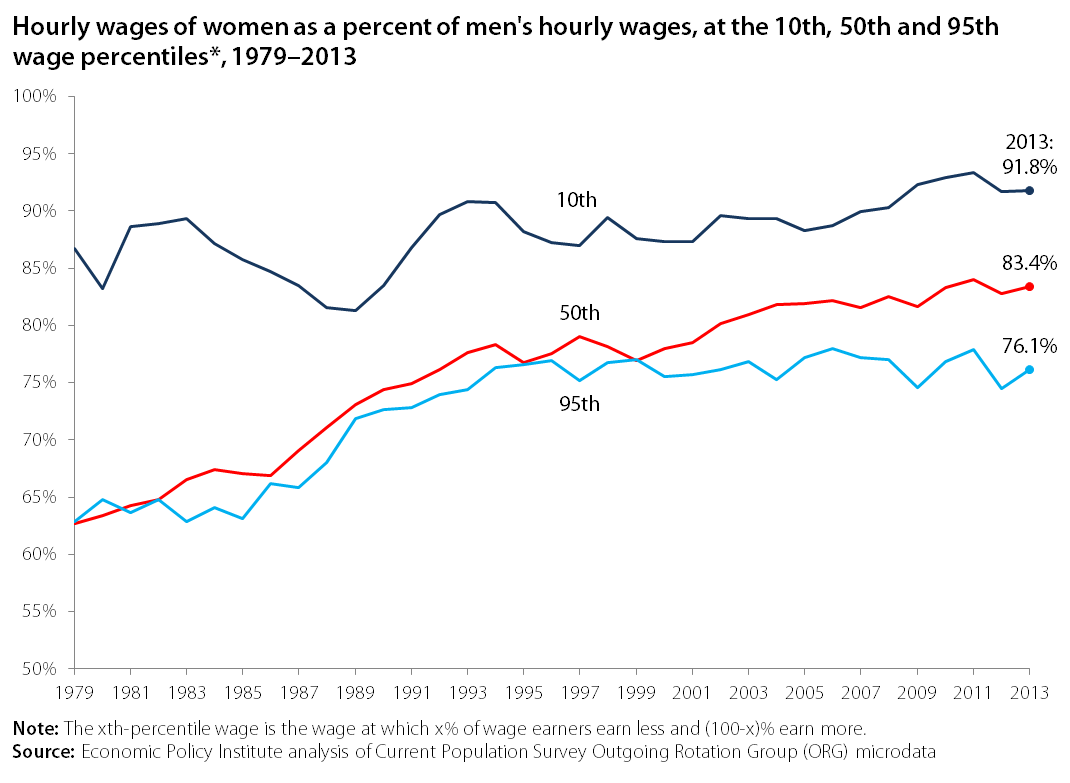

The gender wage gap occurs at all levels of the distribution. As shown in Figure B, the gender wage gap is greater at higher points of the wage distribution; women near the bottom (at the 10thpercentile) make about 92 cents on the dollar while women at the 95th percentile make only 76 cents on the dollar relative to men.

Women are concentrated in low-wage sectors

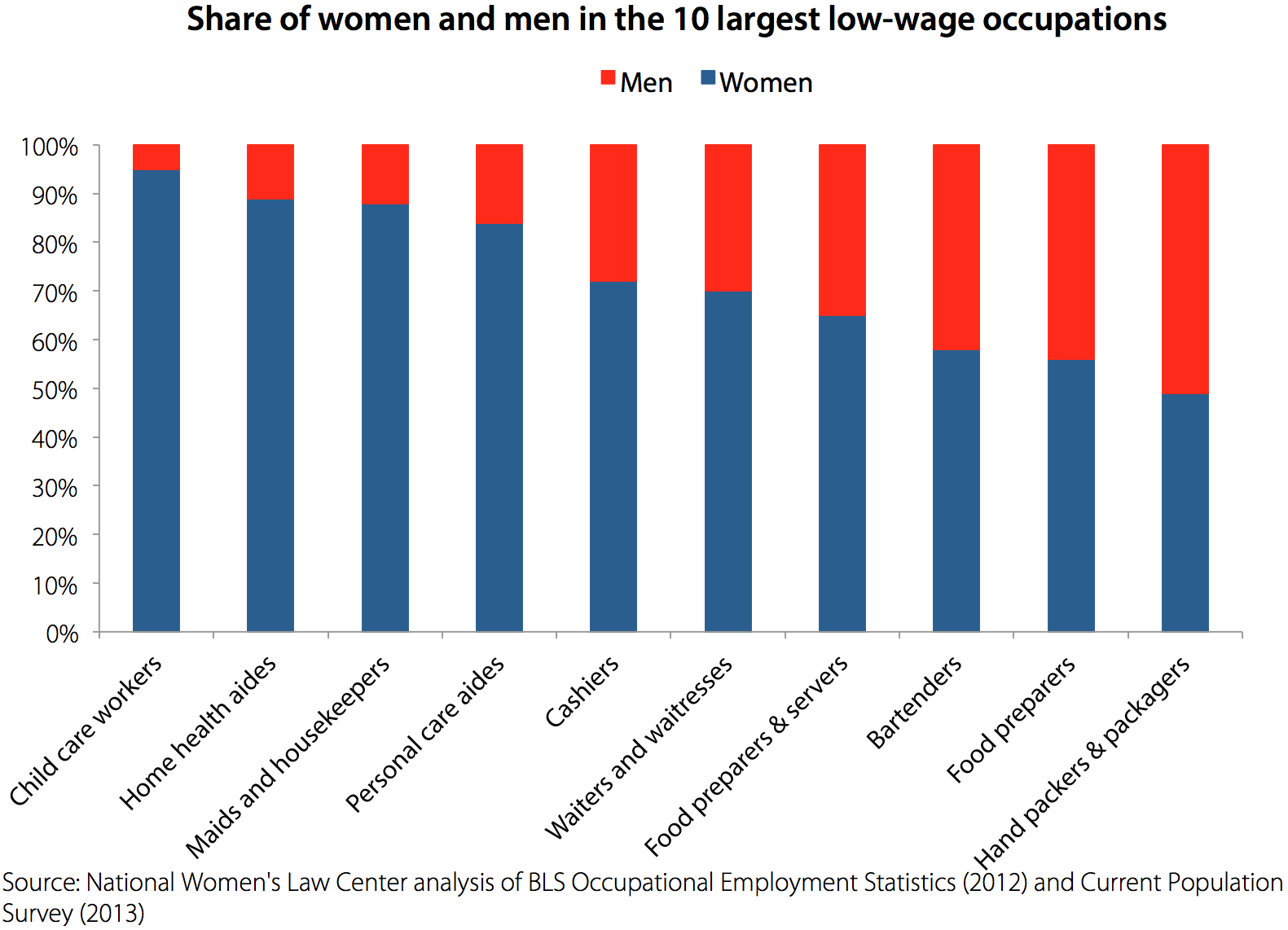

According to a recent Council of Economic Advisers presentation, “Women are concentrated in low-wage sectors of the labor force such as health care support and personal care and are underrepresented in occupations with high average wages, such as STEM occupations.”

Furthermore, the National Women’s Law Center (NWLC) finds that women make up three-fourths of workers in the 10 largest occupations that typically pay low wages (Figure C), and over one-third of these low-wage workers are women of color.

Low-wage job growth has fueled the recovery for women. Between 2009 and 2013, 35 percent of women’s employment growth can be attributed to low-wage occupations, twice as large as the low-wage share of men’s employment growth (18 percent), according to NWLC. Notably, these low-wage occupations are still paying full-time working women 10 percent less than men.

As Figure D shows, women are also less likely to have workplace benefits. Among strongly attached private-sector workers, 55.8 percent of men have employer-sponsored health insurance coverage compared with only 49.9 percent of women. Women are also less likely to have employment-based pension coverage: 41.9 percent compared with 43.6 percent for men.

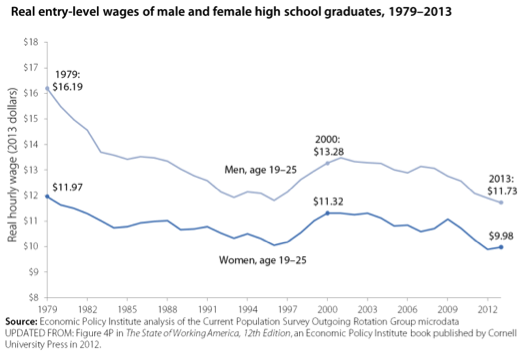

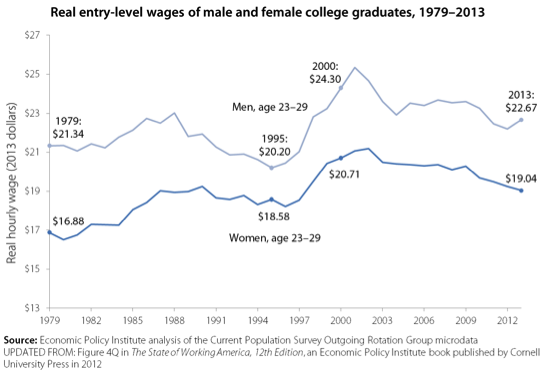

Even at the start of their careers, there is a substantial gap between wages of women and men. Figures E and F examine wages for recent high school and college graduates, respectively. Entry-level wages for men with only a high school degree were $11.73 on average in 2013 compared with only $9.98 for women. Among recent college graduates, men earn on average $22.67 an hour compared with $19.04 for women. These gaps are particularly striking given the fact that women have likely not left the labor force at this point to care for children.

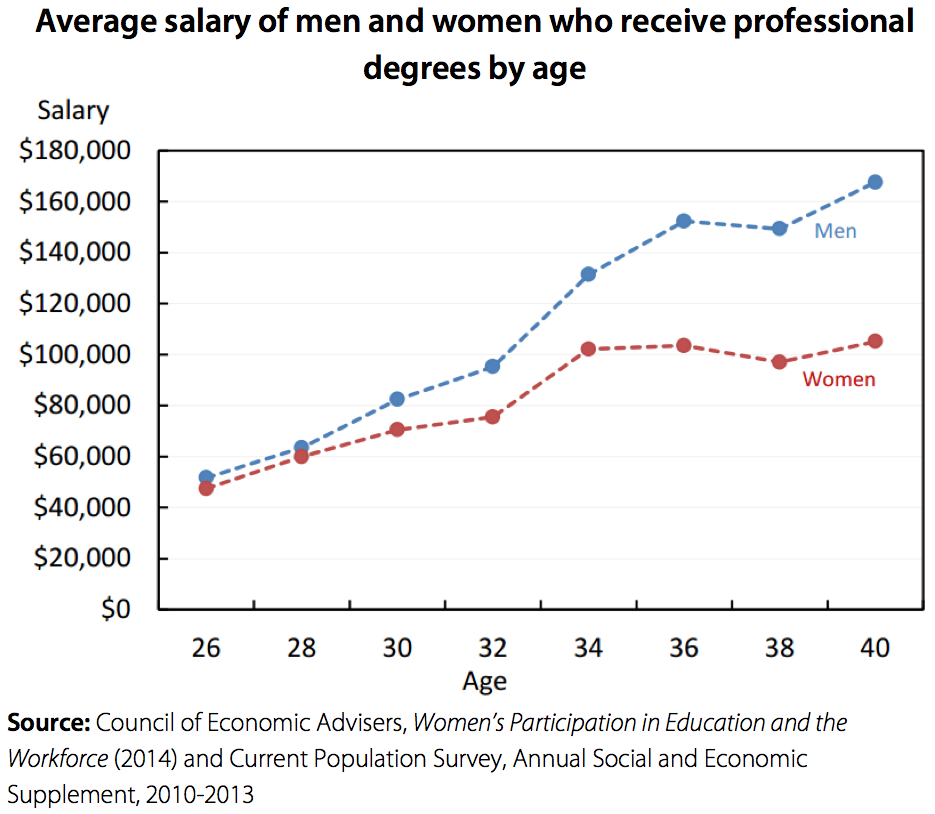

Among those with advanced degrees, however, it is clear from Figure G that the gender wage gap grows throughout women’s lifetimes. Wages are similar for men and women early in their careers, however, the earnings gap widens substantially over time; by their mid-30s and approaching 40, earnings for men are more than 50 percent higher than women’s earnings.

A lifetime of inequality means that women are more economically vulnerable in retirement

As Figure H shows, 52.6 percent of women age 65 and older are “economically vulnerable,” compared with 41.9 percent of men age 65 and older. In fact, at every level of the distribution, the shares of men who are above the “economically vulnerable” threshold are larger than the corresponding shares of women who are above this threshold. Likewise, at every level, the shares of men below the “economically vulnerable” threshold are smaller than the corresponding shares of women.

It’s important to note as well that this is not a statistical artifact based on the fact that women live longer than men—although women’s longer lifespans do indeed make retirement planning that much more challenging. In fact, women are more likely to be economically vulnerable than men among both the young elderly and the older elderly (as shown in Figure I). Women age 65 to 79 are 9 percentage points more likely to be economically vulnerable than men, and women age 80 and older are 13 percentage points more likely to be economically vulnerable than men.

Inducing comparable pay would have real benefits for women’s living standards

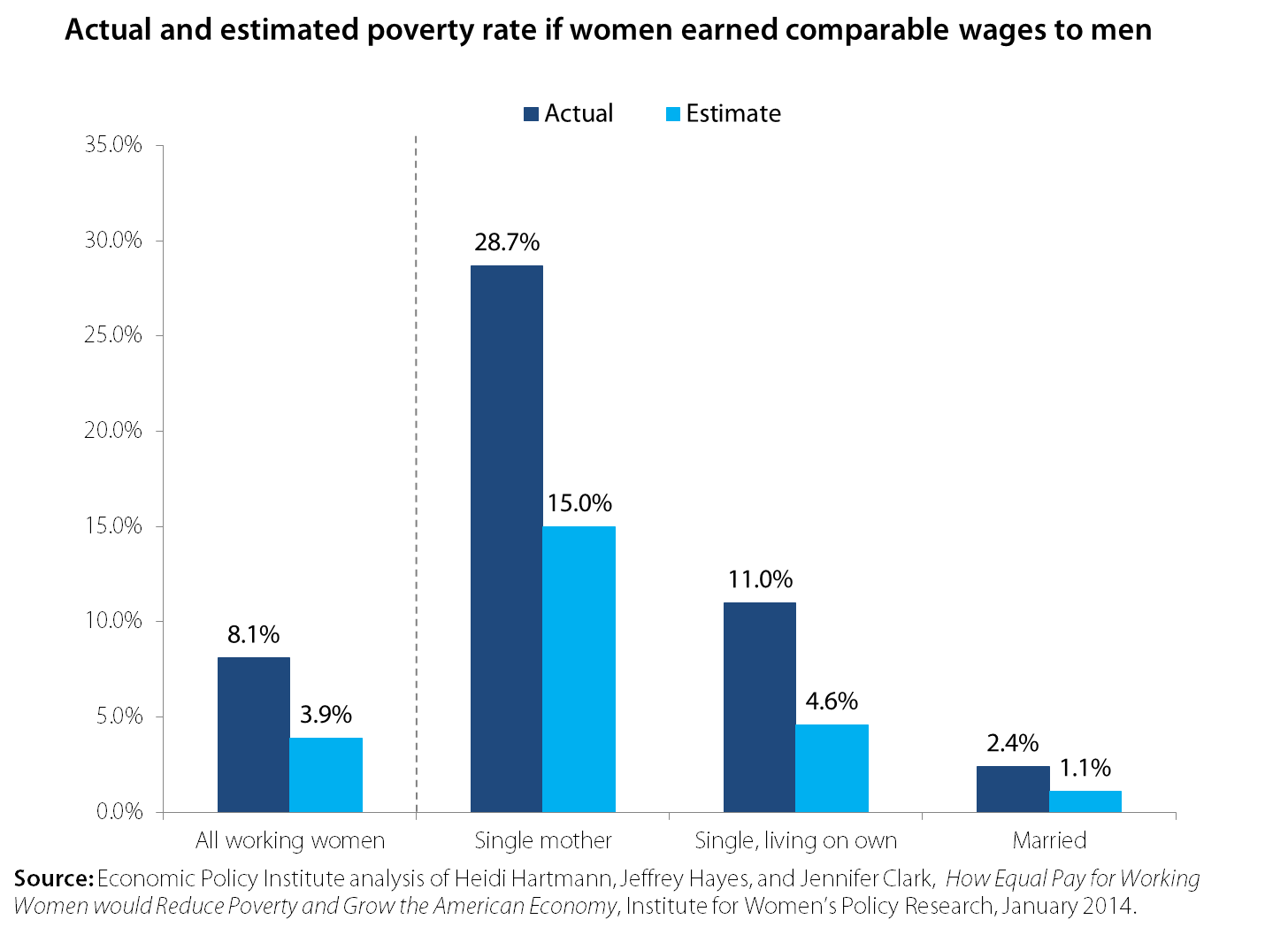

If we want to reduce poverty, comparable pay is a great way to do it, as shown in Figure J.

According to a January 2014 report on equal pay from the Institute for Women’s Policy Research, “providing equal pay to women would have a dramatic impact on their families. The poverty rate [of working women] would be cut in half, falling to 3.9 percent from 8.1 percent.” The impact on single women and single mothers with children is particularly dramatic.

There is no cost to the economy of women catching up to men. Workers generally have failed to see gains from a growing economy; there’s plenty of room to increase bargaining power of workers generally, reducing the gender gap and increasing wages.