See Snapshots Archive.

Snapshot for September 2, 2004

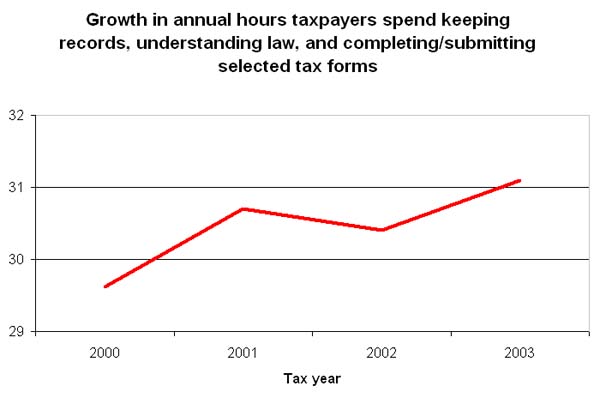

Tax system more complicated, time consuming under Bush Administration

It has been widely reported that President Bush will call for tax simplification and, possibly, for a new regressive national sales tax. At first glance, calling for simplification seems like a positive shift in direction, coming as it does from an administration that has made the tax system more complicated. A national sales tax would, however, be entirely consistent with the tax cuts of recent years in that it would dramatically cut taxes on the well-off and would shift a greater tax burden to middle- and low-income households. Simplification of the current system, made much more complex by administration policy, could distract the public from the regressive impact of the proposal.

The tax cuts of recent years have been accomplished through carefully targeted changes in a variety of tax law provisions. Although the benefits of the tax cuts themselves have been skewed to those with higher incomes, the increased time spent filling out forms has been more democratically distributed. The problem for most taxpayers is that, even if they don’t benefit much from a tax break, they have to fill out many of the same forms as those taxpayers saving millions of dollars.

The IRS is required by law to estimate how much time it takes per year, on average, for taxpayers to keep the records, learn the tax law, and prepare and mail each tax form. From 2000 to 2003, the IRS estimates of the time required for the set of forms associated with the 1040 has increased by 3 hours and 8 minutes. No taxpayer, however, files every form; a more representative group of forms still shows an increase of 1 hour and 29 minutes in additional time spent in filing taxes in 2003 as compared to 2000 (see chart below).

Source: Form 1040 Instructions 2000, 2001, 2002, 2003. Forms include 1040, and Schedules A, B, C-EZ, D, SE-Short.

Today’s Snapshot was written by EPI Economic Analysis and Research Network (EARN) director Michael Ettlinger.