See Snapshots Archive.

Snapshot for July 16, 2004

Inflation-adjusted wages fall again in June

Down six of the last seven months

With today’s release of inflation data for June, EPI analysis reveals that real hourly and weekly earnings have fallen for six out of the last seven months (see the figures below).

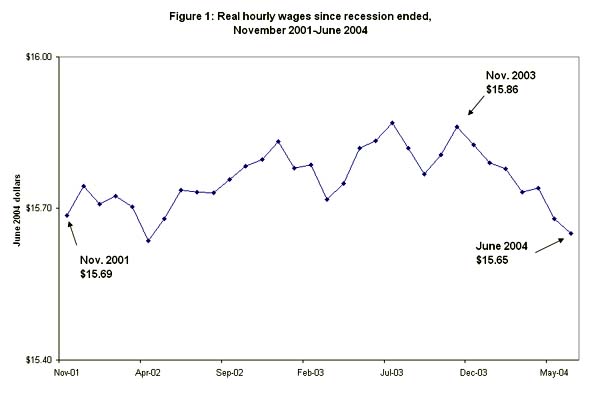

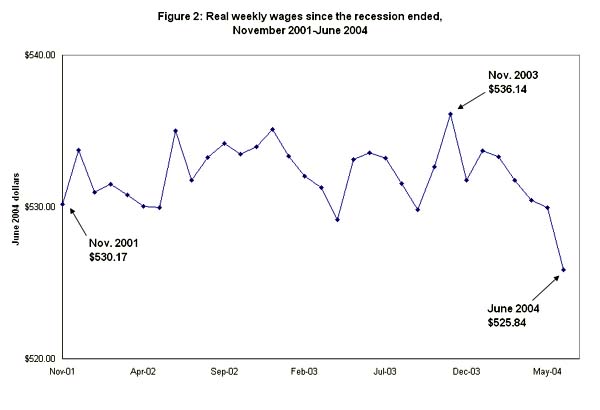

The average hourly wage of blue-collar (production) workers in manufacturing and non-managers in services was $15.65 last month (these workers represent about 80% of the private-sector workforce). When the recovery began in November 2001, their real wage was $15.69, slightly higher than the real value in June 2004 (see Figure 1). For weekly earnings, the relevant values are $530.17 in November 2001 and $525.84 last month, as shown in Figure 2 (the larger decline for weekly earnings is due to a loss in hours worked per week). In other words, after adjusting for inflation, both hourly and weekly earnings are below where they were when the current recovery got underway.

There are three factors contributing to the decline of real wages in the current labor market. The first and most important factor is the lingering effect of the formerly jobless recovery. Though employment is growing again, considerable slack remains in the labor market. The unemployment rate, for example, at 5.6% in June 2004, is at the very same rate as in November 2001 when the current recovery began. Under these labor market conditions, with an oversupply of workers relative to employers’ demands, there is little pressure to bid wages up.

Second, the quality of the net new jobs appears to be putting downward pressure on wage growth. Specifically, industries and occupations that are adding jobs most quickly pay less than those growing more slowly. There is considerable confusion on this point. For example, analysis published by factcheck.org reported that more job growth has occurred in sectors paying above the median wage than below that wage level. 1 But this is not what drives wage growth. Instead, the average wage is driven up when high-wage sectors grow faster than average and vice versa. Over the past year, industries and occupations growing faster than average pay 7% less than those that are growing more slowly.

Finally, faster inflation in recent months has meant that nominal wages need to grow faster to beat price growth. Yet, because of the factors noted above, nominal wage growth has slowed sharply, from an annual average of 2.9% in the second quarter of last year to 2.1% in the same quarter this year. Inflation over this same period has accelerated from 2.2% to 2.8%. Thus, even if inflation were back to its level of a year ago, wages would still be stagnant at best, with real wage growth far behind the growth rate of productivity.

Although employment has thankfully begun to rebound, the persistent effects of the longest jobless recovery on record continue to take a toll on wage growth, meaning working families have to work more hours to lift their real incomes.

1 The factcheck.org release also notes that real average weekly earnings are up 1.08% from January 2001 to June 2004. In fact, that increase is for January 2001 to May 2004. Since weekly earnings fell sharply in June 2004, including this month makes a significant difference. The actual increase in real average weekly earnings from January 2001 through June 2004 is 0.3%, not 1.08%.

Today’s Snapshot was written by EPI senior economist Jared Bernstein and EPI economist Elise Gould.