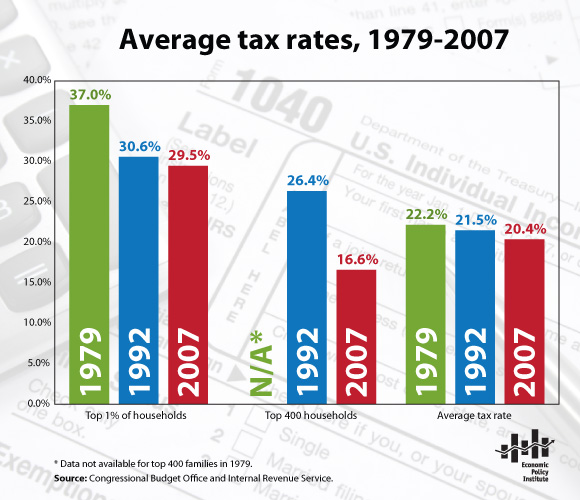

With Tax Day fast approaching and deficit reduction all the rage, one fact deserves significant attention: the wealthy are enjoying some of the lowest taxes in generations. The Figure shows the average tax rate in 1979, 1992, and 2007, as well as the tax rate for the top 1% of households, and the top 400 households (who have an average annual income of nearly $350 million). Since 1979, the country’s overall average tax rate—the share of income paid in taxes—has fallen slightly, but for those at the top of the earnings ladder this share has fallen dramatically.

This diminished tax burden on the wealthiest has contributed to the historically low federal revenue levels we are seeing today, and in turn, to higher deficits. The Congressional Budget Office projects federal revenue in 2011 will total 14.8% of GDP—the lowest level since 1950. At the same time that the tax burden has shifted away from the wealthy, this same top income group has enjoyed massively disproportionate income gains. Between 1992 and 2007, a time in which income for the average household and top one percent grew 13% and 123%, respectively, the income for the top 400 households grew fully 399%.