By Algernon Austin

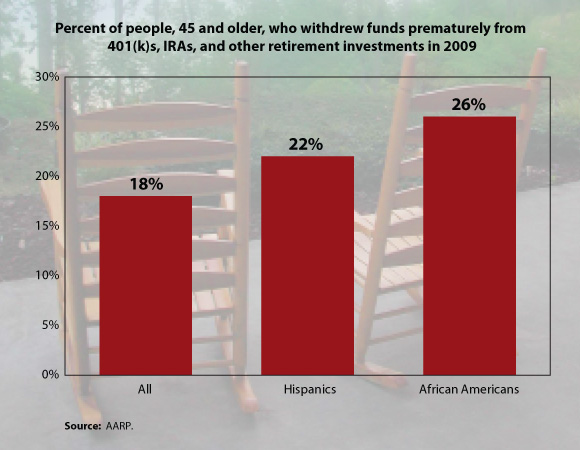

Nearly one-in-five Americans age 45 and older prematurely withdrew money from their retirement accounts in 2009 to pay their mortgage, utilities, health expenses, and other bills, according to a recent study from AARP. Not surprisingly, groups experiencing greater economic hardship — often people of color — were more likely to tap into these funds. Across all ethnicities, 18% of those surveyed reported making early withdraws, but the level was 22% for Hispanics and 26% for African Americans. Since elderly retired Hispanics and African Americans already have very high rates of poverty, this raises the prospect that their poverty rates will be even higher in the future, and highlights the importance of Social Security, which for most workers is the most important source – and the only guaranteed one — of retirement income.

The AARP study was based on a cross section of the over-44 population, including those who had no retirement savings from which to withdraw. When looking just at individuals who have 401(k)s or other retirement savings, rates of early withdraw are even higher. Tapping retirement savings prematurely is a desperate measure, since there are often significant penalties for early withdrawal, and it leaves people with less income when they retire. Although the market has partly rebounded from its sharp decline in 2008, aggregate balances in retirement accounts remain 10% below 2007 levels, based on an EPI analysis of Federal Reserve data.