Policy Memo #203

In mid-January, Sen. Michael Bennet (D-Colo.) introduced the Partnership to Build America Act of 2014 (S. 1957). As of this writing, the bill has 11 co-sponsors. The Senate bill is similar to a bill introduced in the House (H.R. 2084) by Rep. John Delaney (D-Md.), which now has 50 co-sponsors. These bills are a mix of good and bad, with the bad being important enough to argue against their passage.

The best part of the bills is that they would establish an infrastructure bank (called the American Infrastructure Fund) to provide funds and guarantees for investments in certain infrastructure projects by state and local governments. The initial funding for the bank would be $50 billion.

The worst part of the bills is how the initial funding is acquired—by providing expensive tax breaks for multinational corporations that contribute to its start-up financing. Specifically, the bills would reward multinationals that contribute to the bank’s financing by allowing them to repatriate earnings held overseas tax-free (a “repatriation tax holiday,” in budget jargon).

This policy memo examines the funding mechanism of the infrastructure bank proposed in H.R. 2084 and S. 1957. The principal findings are:

- The bids by multinational corporations to participate in the funding mechanism would likely be much less aggressive than the bill sponsors anticipate.

- The initial funding from multinational corporations could be below the $50 billion goal set in the proposals.

- It would be much cheaper from a federal budgeting perspective to simply finance the bank’s start-up with a direct appropriation of funds. To meet the $50 billion funding goal through the bills’ proposed mechanism would require the federal government to grant about $70 billion to $100 billion in tax breaks to multinational corporations.

How the funding mechanism works

The initial funding would come from the infrastructure bank selling bonds. The infrastructure bank would issue $50 billion in American Infrastructure Bonds (AIBs), which would be purchased by multinational corporations. The bonds would have a 50-year maturity and pay 1 percent interest (neither principal nor interest would be guaranteed by the full faith and credit of the U.S. government). The bonds would be sold through an unspecified competitive bidding process “that encourages aggressive bidding.”

This “bidding” is far from straightforward, however. For each $100 in AIBs, multinational corporations (MNCs) will propose a given amount of foreign-sourced earnings they can repatriate to the United States tax-free. Technically, what firms would actually bid on is how low a multiplier they would accept. For example, an MNC might bid to repatriate $300 in overseas earnings for each $100 in AIBs, making the “multiplier” in this case three.1

The cost to the federal government in this instance is the tax revenue foregone by allowing the MNC to repatriate the $300 in overseas earnings without paying taxes. The hope is that this cost of foregone tax revenue is minimized through competition, as MNCs, presumably eager to repatriate overseas earnings tax-free (and knowing there is an overall cap on how many will receive this preferential tax rate of zero), will bid less and less in terms of earnings to be repatriated in exchange for supplying each $100 in AIBs. Of course there is an economic cost to this bid that MNCs must consider—the firm has essentially tied up some amount for 50 years that will earn only 1 percent per year.

Feasible values for the multiplier

The goal of the bill sponsors is that $50 billion in AIBs be sold to fund the infrastructure bank. As explained below, this goal places a limit on how low the multiplier can be. To calculate feasible values for the multiplier (i.e., values that would generate at least $50 billion in AIB sales) requires two steps.

First, the effective tax rate that firms pay on earnings repatriated under this scheme is determined. However, in this case, the firms do not pay the “tax” to the government; rather, the tax is how much the firms lose by allowing $50 billion to be tied up for 50 years as AIBs. The tax takes into account the 1 percent interest rate and the time value of money (in other words, the tax accounts for the fact that the $50 billion could easily earn a much higher return over 50 years if invested elsewhere), as well as the risk of default.

Under reasonable assumptions (see the appendix for methodological details), we calculate that the implicit or effective tax rate is about 74 percent when the multiplier is equal to one—that is, when $50 billion of AIBs are purchased with the same amount of repatriated foreign-sourced earnings. If the multinational firms bought $50 billion in AIBs and repatriated $105 billion, then the multiplier would be 2.1, and the effective tax rate would fall to 35 percent (equal to the statutory corporate tax rate). With a multiplier of six (the proposed legal maximum), the firms would repatriate $300 billion and purchase $50 billion in AIBs, for an effective tax rate of about 12 percent.

There is a floor under plausible values of the multiplier. If the multiplier were less than 2.1, firms would have no incentive to participate in the infrastructure bank because the effective tax rate would be above the 35 percent statutory corporate tax rate they would have to pay when repatriating foreign-sourced earnings. Consequently, the multiplier determined in the bidding would have to be greater than 2.1 (but less than the proposed legal maximum of six).

Second, we estimate how much firms would actually increase their repatriations at various effective tax rates (see the appendix for details). The estimates are based on the experience from the 2004 repatriation holiday and estimates produced by the Joint Committee on Taxation (Barthold 2011). For example, it is estimated that at an effective tax rate of 25 percent, multinational firms would repatriate an additional $90 billion to $100 billion of foreign-sourced income. Unfortunately, a 25 percent effective tax rate could only be achieved with a multiplier of three—$50 billion in AIB sales would require $150 billion in additional repatriations. In this circumstance, the AIB sales of about $30 billion would leave a shortfall in funding for the infrastructure bank of about $20 billion.2 The analysis detailed in the appendix shows that the minimum multiplier consistent with raising $50 billion through AIB sales is approximately four. Consequently, only multipliers greater than four are feasible for meeting the $50 billion funding goal for the bank.

Cost to the government

Given these estimates, we can calculate the cost to the federal government of financing the infrastructure bank in this manner. To sell $50 billion in AIBs requires a multiplier greater than four, which translates in repatriations of at least $200 billion. The maximum amount of repatriations that would be allowed is $300 billion (when the multiplier is at the proposed legal maximum of six). The corporate income tax revenue lost from not taxing $200 billion of additional corporate foreign-sourced income is $70 billion (35 percent of the $200 billion), as it is likely that this $200 billion would eventually be repatriated and subject to the corporate tax in the absence of a one-time effective tax rate reduction.3 At the proposed maximum multiplier of six, the foregone tax revenue would be $105 billion (35 percent of $300 billion in repatriated foreign-sourced earnings).4

Conclusion

The goal of the House and Senate bills to establish an infrastructure bank is laudable. Unfortunately, the method of financing is not. The cost to the government of acquiring the initial $50 billion for the bank would be between about $70 billion and $100 billion in increased deficits and more debt. A direct appropriation of $50 billion would save the government a substantial amount of money—money that could be put to better use than subsidizing multinational corporations to do something they would eventually do anyway. When it comes to government budgeting, there is no such thing as “free money”—using tax gimmicks to fund new programs usually has a significant cost.

Using a repatriation holiday as a funding source also sets a bad precedent. Firms will expect future holidays to fund other worthy programs and will postpone repatriations of foreign-sourced earnings to wait for the next holiday. This postponement further reduces federal tax revenues. Even though Congress stated that the 2004 repatriation holiday would never be repeated, Sheppard and Sullivan (2009) and Johnston (2012) found that multinational corporations have been increasing accumulations of foreign earnings in the expectation of another holiday, which was proposed in 2009 but not enacted.

Appendix: Methodology and further analysis

Although firms do not pay corporate taxes on foreign-sourced earnings repatriated under this proposal, the requirement to invest in a 50-year American Infrastructure Bond (AIB) with a 1 percent interest rate (0.65 percent after-tax) does effectively tax these monies because of the time value of money and the risk of default. Calculating the effective tax rate for each multiplier requires first calculating the present discounted value of the bond. The discount rate used is 6.5 percent (4.225 percent after-tax), which is the 2007 return on a Baa-rated (Moody’s) corporate bond (2007 was the last normal year before the financial crisis and onset of the Great Recession). Under this assumption, the present discounted value of $50 billion in AIBs is $13.04 billion. Consequently, if firms repatriated $50 billion and invested this amount in AIBs (corresponding to a multiplier of one), they gain only $13 billion—essentially $37 billion is “taxed” away. This yields an effective tax rate of 74 percent on the $50 billion.

Of course, no firm would participate in the infrastructure bank at a multiplier of one because it could just repatriate $50 billion and pay the 35 percent corporate tax rate ($17.5 billion in corporate income taxes). Firms would not consider purchasing AIBs unless the effective tax rate was below the statutory corporate tax rate of 35 percent. The effective tax rate of AIBs is 35 percent at a multiplier of 2.1—firms repatriate $105 billion, invest in $50 billion of AIBs, and “pay” an effective tax of $37 billion.

Table A1 reports the effective tax rate for multipliers between the minimum of 2.1 and the maximum of six. The column labeled “Required repatriations” shows the amount of repatriated foreign-sourced income needed to generate $50 billion in AIB sales.

Repatriations needed to yield $50 billion in American Infrastructure Bond (AIB) sales

| Multiplier* | Required repatriations | Effective tax rate** |

|---|---|---|

| 2.1 | $105 billion | 35.0% |

| 3 | $150 billion | 24.6% |

| 4 | $200 billion | 18.5% |

| 5 | $250 billion | 14.8% |

| 6 | $300 billion | 12.3% |

* Ratio of repatriations to dollar amount of AIBs purchased

** Implicit cost to firms of purchasing AIBs

Source: Author's calculations

Various observers estimate that about $2 trillion in fairly liquid offshore income is available for repatriation to the United States.5 Using JCT’s ratios of repatriations to offshore income, it is estimated that firms would increase repatriations by $1 trillion if the effective tax rate were 5.25 percent and by $507 billion if the effective tax rate were 10.5 percent. It is reasonable to assume that repatriations would not increase at all if the effective tax rate were equal to the statutory corporate tax rate of 35 percent. These three data points appear to follow an exponential trend.

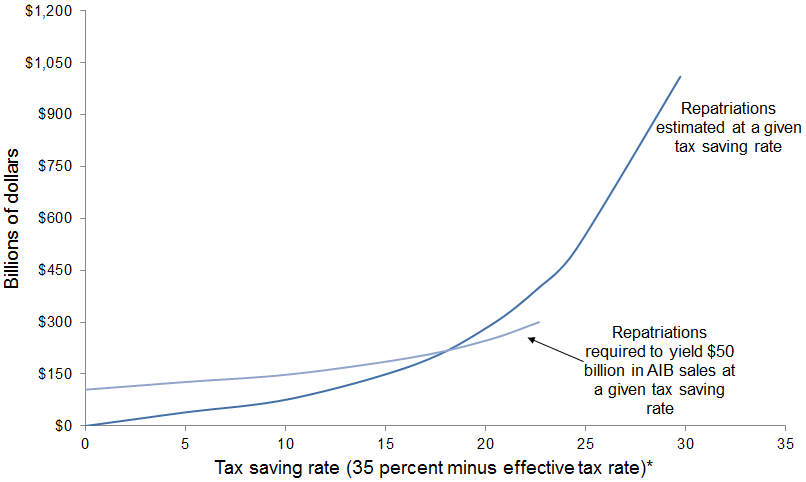

Figure A1 shows estimated repatriations and required repatriations as a function of the “tax saving rate,” which is equal to the statutory corporate tax rate of 35 percent minus the effective tax rate. This tax saving rate represents the percentage “saved” by buying AIBs (and participating in the infrastructure bank funding mechanism) compared with paying the statutory corporate tax rate. At a tax saving rate of zero, the effective tax rate is 35 percent. This effective tax rate corresponds to a multiplier of 2.1. Repatriations required to generate $50 billion in AIB sales would be $105 billion, but estimated repatriations would be zero.

Estimated and required repatriations at a given tax saving rate

| Tax saving rate (35 percent minus effective tax rate) | Estimated repatriations (billions) | Required repatriations (billions) |

|---|---|---|

| 29.75 | $1009.54 | |

| 24.5 | $507.5017 | |

| 22.68 | $399.8462107 | $300 |

| 20.22 | $289.6924955 | $250 |

| 16.52 | $178.4163743 | $200 |

| 10.36 | $79.61161506 | $150 |

| 5 | $39.4 | $127 |

| 0 | $0 | $105 |

* Percentage "saved" by buying American Infrastructure Bonds compared with paying 35 percent statutory corporate tax rate

Source: Author's calculations and author's analysis of Barthold (2011)

The two curves intersect at about a 17 percent tax saving rate, or an 18 percent effective tax rate (= 35 percent – 17 percent). The multiplier corresponding to this effective tax rate is four. At higher tax saving rates (or lower effective tax rates), estimated repatriations are greater than required repatriations—the additional repatriations induced by the effective tax rate would yield at least $50 billion in AIB sales. Conversely, at tax saving rates below 17 percent (or effective tax rates above 18 percent), AIB sales would be below $50 billion; the infrastructure bank would not attract enough funding to meet the $50 billion goal.

Acknowledgments

The author thanks the Ford Foundation for their support of this research.

About the author

Thomas L. Hungerford joined the Economic Policy Institute in 2013 as a senior economist and is also director of tax and budget policy. Prior to joining EPI, Hungerford worked at the General Accounting Office, the Office of Management and Budget, the Social Security Administration, and the Congressional Research Service. He has published research articles in journals such as the Review of Economics and Statistics, Journal of International Economics, Journal of Human Resources, Journal of Urban Economics, Review of Income and Wealth, Journal of Policy Analysis and Management, Challenge, and Tax Notes. He has taught economics at Wayne State University, American University, and Johns Hopkins University. He has a Ph.D. in economics from the University of Michigan.

Endnotes

1. Both bills stipulate that these additional repatriations have to be greater than the firm’s average repatriations of foreign-sourced income in the base period years (three taxable years among the five most recent taxable years). {{2.}} Repatriations of $90 billion to $100 billion with a multiplier of three would generate $30 billion to $33 billion in AIB sales (AIB sales equal repatriations divided by the multiplier). {{3.}} Brennan (2010) found that the increase in repatriations due to the 2004 holiday were offset by reductions in subsequent repatriations. If the foreign-sourced income was truly permanently reinvested overseas, it would already be in fixed assets and, therefore, illiquid. {{4.}} While three is not a feasible multiplier because it would generate only $26 billion for the bank, nevertheless the cost to the government in foregone tax revenue would be $28 billion. {{5.}} See, for example, Linebaugh (2013) and Murphy (2013).

References

Barthold, Thomas A. 2011. “Letter to the Honorable Lloyd Doggett from Thomas A. Barthold, chief of staff of the Joint Committee on Taxation.” April 15. http://doggett.house.gov/images/pdf/jct_repatriation_score.pdf.

Brennan, Thomas J. 2010. “What Happens After a Holiday? Long-Term Effects of the Repatriation Provision of the AJCA.” Northwestern Journal of Law and Social Policy, vol. 5, no. 1, 1–18.

Johnston, David Cay. 2012. “Idle Corporate Cash Piles Up.” Reuters blog, July 16. http://blogs.reuters.com/david-cay-johnston/2012/07/16/idle-corporate-cash-piles-up.

Lee, A. Sheppard, and Martin A. Sullivan. 2009. “Multinationals Accumulate to Repatriate.” Tax Notes, January 19, 295–298.

Linebaugh, Kate. 2013. “Firms Keep Stockpiles of ‘Foreign’ Cash in U.S.” Wall Street Journal, January 22. http://online.wsj.com/news/articles/SB1000142412788732330110457825566224471212.

Murphy, Maxwell. 2013. “Indefinitely Reinvested Foreign Earnings on the Rise.” Wall Street Journal “CFO Journal” blog, May 7. http://blogs.wsj.com/cfo/2013/05/07/indefinitely-reinvested-foreign-earnings-on-the-rise.