Proposed New York state minimum wage legislation would boost wages for nearly 2.9 million workers: Minimum wages would range by region from $20 to $21.25 per hour by 2026

Key takeaways:

- Proposed Raise Up New York legislation, sponsored by State Senator Jessica Ramos and Assembly Member Latoya Joyner, would raise the minimum wage to $21.25 an hour in New York City and suburban Nassau, Westchester, and Suffolk counties by 2026. It would also raise upstate New York’s minimum wage to $20 an hour by 2026.

- Starting in 2027, upstate New York would catch up to the statewide wage, and both would be adjusted each year to keep up with rising consumer prices and worker productivity.

- We find that nearly 2.9 million workers—32% of the state’s workforce—would receive raises averaging $3,307 a year.

- These minimum wage increases would be a vital support for low-wage workers in one of the most expensive states in the nation and arrive at a time when the purchasing power of workers’ wages has been eroded rapidly by recent price increases.

Updated minimum wage legislation in the New York State Senate and Assembly (S3062D/A7503C) would secure much-needed wage increases for almost 2.9 million workers throughout the state. The proposed Raise Up New York legislation—which would index annual statewide increases to inflation and labor productivity—would help protect workers’ economic security as prices rise, and prevent inequality from widening as the economy grows.

A fair way of calculating the minimum wage

Currently, New York has distinct minimum wage schedules for three different regions in the state: New York City, the suburban counties of Nassau, Westchester, and Suffolk, and the remainder of upstate New York. As shown in Table 1, New York City’s minimum wage is $15 per hour, where it has stood since 2018. Nassau, Westchester, and Suffolk counties’ minimum wage reached $15 per hour at the end of 2021, while the minimum wage for the rest of the state is currently $13.20 with scheduled annual increases that will track nominal labor productivity (real productivity plus inflation) until it eventually reaches $15.00 per hour.

The proposed Raise Up New York legislation would increase the minimum wage for New York City and Nassau, Westchester, and Suffolk counties to $21.25 through 2026, and then increase the minimum wage annually by nominal labor productivity. The tipped minimum wage would also increase while remaining two-thirds of the regular minimum wage as stipulated in New York law.1 The minimum wage for the rest of the state would reach $20.00 an hour in 2026 before catching up to NYC and the suburban counties in 2027.2 The inflation and labor productivity adjustments would follow the same formula that New York has already been using for state minimum wage increases in recent years.

Raise Up New York legislation would increase the state minimum wage to more than $21.25 in 2027: Current and proposed minimum wage values by region of New York, 2023–2027

| Year | New York City | Nassau, Westchester, and Suffolk counties | Upstate New York |

|---|---|---|---|

| Current minimum wage values | |||

| 2023 | $15.00 | $15.00 | $13.20 + annual increase |

| Raise Up New York increases | |||

| 2024 | $17.25 | $17.25 | $16.00 |

| 2025 | $19.25 | $19.25 | $18.00 |

| 2026 | $21.25 | $21.25 | $20.00 |

| 2027 | $21.25 + annual increase | $21.25 + annual increase | $21.25 + annual increase |

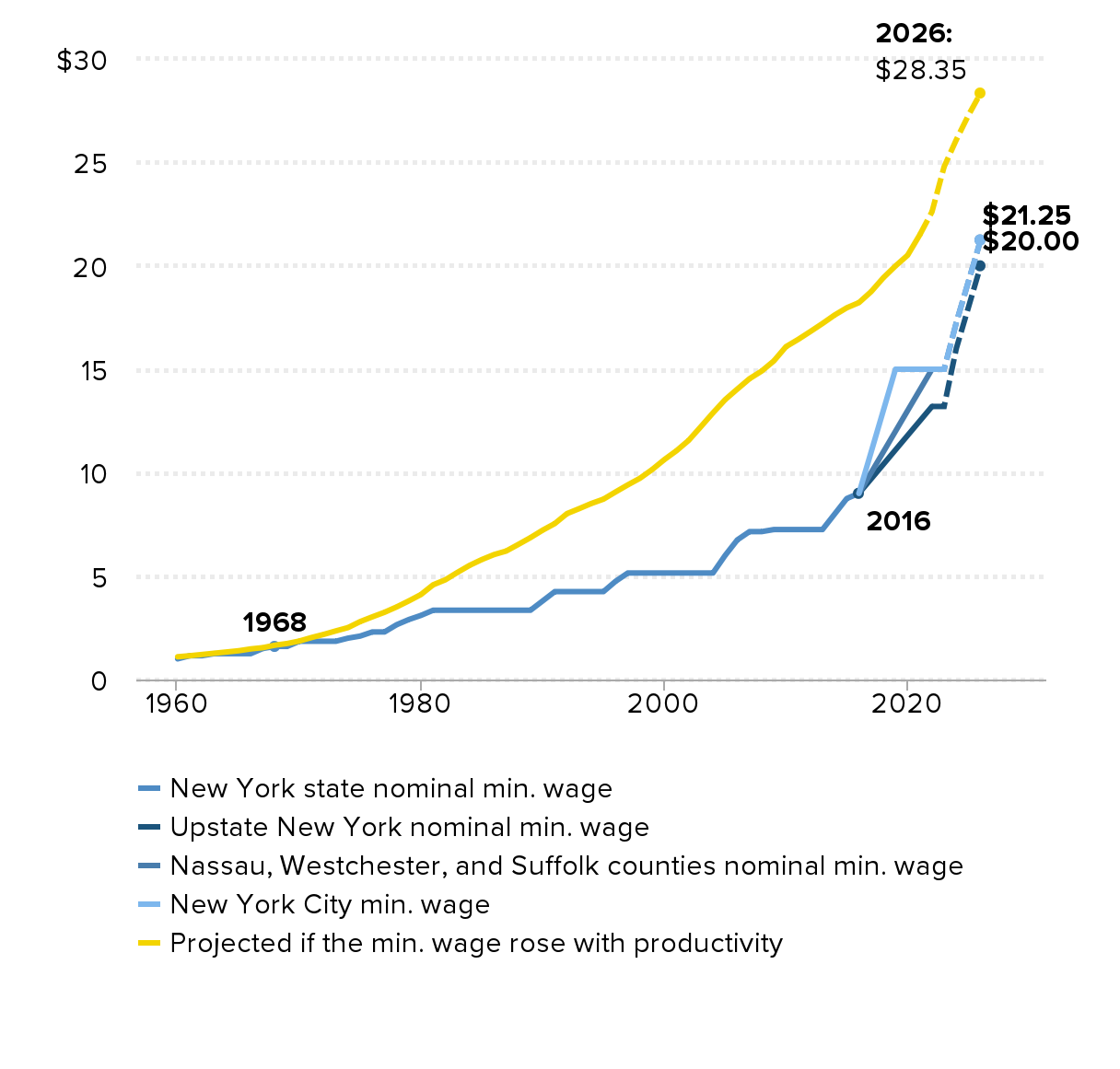

As EPI has documented, labor productivity has more than doubled in the last 50 years. Figure A shows how the increases through 2026 would help New York workers recapture some of the gains in productivity in the economy over the last five decades. If the minimum wage for New Yorkers had increased with productivity and price increases since its peak real value in 1968, it would be greater than $22 per hour in 2022 and most likely exceed $28 per hour in 2026. This means that Raise Up New York’s scheduled increases to $21.25 are well within the economy’s ability to afford. It makes no sense for workers to be paid less today than in 1968 when the economy has experienced such enormous growth.

Increased productivity means the economy has the potential for higher living standards, but only if those gains are passed along as wage increases for workers. Adjusting the minimum wage for labor productivity is a sensible policy that would help protect the living standards of low-wage workers as the economy grows.

Indexing the minimum wage to labor productivity will improve workers' standard of living as the economy grows: New York minimum wage over time and projected 1968 minimum wage value if it had grown with productivity, 1960–2022, and Raise Up New York projected values, 2023–2026

| Year | New York state nominal min. wage | Upstate New York nominal min. wage | Projected min. wage for upstate New York | Nassau, Westchester, and Suffolk counties nominal min. wage | Projected min. wage for Nassau, Westchester, and Suffolk counties | New York City min. wage | Projected min. wage for NYC and suburb counties | Projected if the min. wage rose with productivity | Projected if the min. wage rose with productivity |

|---|---|---|---|---|---|---|---|---|---|

| 1960 | $1.00 | $ 1.10 | |||||||

| 1961 | $1.15 | $ 1.15 | |||||||

| 1962 | $1.15 | $ 1.21 | |||||||

| 1963 | $1.25 | $ 1.27 | |||||||

| 1964 | $1.25 | $ 1.33 | |||||||

| 1965 | $1.25 | $ 1.39 | |||||||

| 1966 | $1.25 | $ 1.48 | |||||||

| 1967 | $1.50 | $ 1.54 | |||||||

| 1968 | $1.60 | $ 1.66 | |||||||

| 1969 | $1.60 | $ 1.74 | |||||||

| 1970 | $1.85 | $ 1.86 | |||||||

| 1971 | $1.85 | $ 2.03 | |||||||

| 1972 | $1.85 | $ 2.18 | |||||||

| 1973 | $1.85 | $ 2.35 | |||||||

| 1974 | $2.00 | $ 2.51 | |||||||

| 1975 | $2.10 | $ 2.80 | |||||||

| 1976 | $2.30 | $ 3.03 | |||||||

| 1977 | $2.30 | $ 3.25 | |||||||

| 1978 | $2.65 | $ 3.51 | |||||||

| 1979 | $2.90 | $ 3.80 | |||||||

| 1980 | $3.10 | $ 4.11 | |||||||

| 1981 | $3.35 | $ 4.58 | |||||||

| 1982 | $3.35 | $ 4.82 | |||||||

| 1983 | $3.35 | $ 5.18 | |||||||

| 1984 | $3.35 | $ 5.52 | |||||||

| 1985 | $3.35 | $ 5.80 | |||||||

| 1986 | $3.35 | $ 6.04 | |||||||

| 1987 | $3.35 | $ 6.21 | |||||||

| 1988 | $3.35 | $ 6.53 | |||||||

| 1989 | $3.35 | $ 6.86 | |||||||

| 1990 | $3.80 | $ 7.22 | |||||||

| 1991 | $4.25 | $ 7.54 | |||||||

| 1992 | $4.25 | $ 8.02 | |||||||

| 1993 | $4.25 | $ 8.26 | |||||||

| 1994 | $4.25 | $ 8.51 | |||||||

| 1995 | $4.25 | $ 8.72 | |||||||

| 1996 | $4.75 | $ 9.07 | |||||||

| 1997 | $5.15 | $ 9.41 | |||||||

| 1998 | $5.15 | $ 9.73 | |||||||

| 1999 | $5.15 | $ 10.15 | |||||||

| 2000 | $5.15 | $ 10.63 | |||||||

| 2001 | $5.15 | $ 11.06 | |||||||

| 2002 | $5.15 | $ 11.56 | |||||||

| 2003 | $5.15 | $ 12.22 | |||||||

| 2004 | $5.15 | $ 12.89 | |||||||

| 2005 | $6.00 | $ 13.53 | |||||||

| 2006 | $6.75 | $ 14.04 | |||||||

| 2007 | $7.15 | $ 14.54 | |||||||

| 2008 | $7.15 | $ 14.91 | |||||||

| 2009 | $7.25 | $ 15.40 | |||||||

| 2010 | $7.25 | $ 16.09 | |||||||

| 2011 | $7.25 | $ 16.44 | |||||||

| 2012 | $7.25 | $ 16.82 | |||||||

| 2013 | $7.25 | $ 17.21 | |||||||

| 2014 | $8.00 | $ 17.62 | |||||||

| 2015 | $8.75 | $ 17.97 | |||||||

| 2016 | $9.00 | $9.00 | $9.00 | $9.00 | $ 18.22 | ||||

| 2017 | $9.70 | $10.00 | $11.00 | $ 18.75 | |||||

| 2018 | $10.40 | $11.00 | $13.00 | $ 19.42 | |||||

| 2019 | $11.10 | $12.00 | $15.00 | $ 19.99 | |||||

| 2020 | $11.80 | $13.00 | $15.00 | $ 20.51 | |||||

| 2021 | $12.50 | $14.00 | $15.00 | $ 21.50 | $ 21.50 | ||||

| 2022 | $13.20 | $13.20 | $15.00 | $15.00 | $15.00 | $15.00 | $ 22.61 | ||

| 2023 | $13.20 | $15.00 | $15.00 | $ 24.79 | |||||

| 2024 | $16.00 | $17.25 | $17.25 | $ 26.09 | |||||

| 2025 | $18.00 | $19.25 | $19.25 | $ 27.28 | |||||

| 2026 | $20.00 | $21.25 | $21.25 | $28.35 | |||||

| 2027 | |||||||||

| 2028 |

Notes: Inflation measured using CPI-U-RS. Productivity is measured as total economy productivity net depreciation. In 1968, the federal minimum wage achieved its highest real value. In 2016, New York created three separate minimum wages for New York City, Nassau, Westchester, and Suffolk counties, and the remainder of the state.

Sources: EPI analysis of the Raise Up New York legislation, Fair Labor Standards Act and amendments and history of New York minimum wage. Total economy productivity data from the Bureau of Labor Statistics Labor Productivity and Costs program.

Increasing the minimum wage continues to be a pressing need for New Yorkers. New York City and Nassau, Westchester, and Suffolk counties are known as some of the most expensive places to live in the nation. According to EPI’s Family Budget Calculator, a family of two adults and two children in the New York metro area needs $134,938 a year in 2022 to achieve a modest, but adequate standard of living. In the Nassau and Suffolk metro area, the same family would need $142,695 annually.

However, many areas in upstate New York are expensive as well. The annual budget for a family of two adults and two children is $104,415 in Albany County (Albany), $97,056 in Monroe County (Rochester), and $92,530 in Erie County (Buffalo). For comparison, two adults working full time earning a minimum wage of $21.25 per hour would earn $88,400—significantly closer to the Family Budget Calculator’s threshold for these counties than under the current minimum wages ($54,912 at $13.20 an hour and $62,400 at $15 an hour), but still short of real economic security. With rising costs since the beginning of the pandemic eroding the real earnings of working-class New Yorkers, it is time to increase the minimum wage.

The impact of proposed minimum wage increases

As shown in Table 2, we estimate that the Raise Up New York legislation would increase wages for 2.9 million workers in the state in 2026, or 32.4% of the state’s workforce. The greatest number of affected workers would be in NYC (Table 3), where 1.4 million workers would see wage increases, while wages would rise for 500,000 workers in the suburban counties (Table 4) and 1.0 million workers in the rest of the state (Table 5). These estimates include workers with wages directly lifted by the new minimum wage as well as workers just above the new minimum wage who would benefit indirectly as their employers adjust wage ladders to reflect the new minimum.

In total, we estimate New York workers would gain more than $9.5 billion in wages. For the average affected worker, the increases would raise their hourly pay by $1.95 an hour in real terms (inflation adjusted), a 13.0% increase. On an annual basis, these changes add up to $3,307 in additional wages a year.

These gains would be distributed across the full gamut of working-class New Yorkers. Of the affected workers, 71.0% are 25 or older, almost two-thirds (62.9%) work full time, and 44.7% have at least some college education. More than a quarter of affected workers are parents (27.9%) and almost half are single parents (47.9%) who will see their earnings increase from the higher minimum wage. In total, we estimate more than 760,000 children live in households in New York that would benefit from the minimum wage increase, or roughly a fifth of the total number of children in the state.3

Boosting wages at the bottom of the earnings distribution would have significant impacts on reducing poverty. Minimum wage increases have been shown to meaningfully reduce the poverty rate, helping workers achieve greater economic security and reducing inequality. We estimate that 78.4% of workers below the poverty line would see wage increases, with full-time workers seeing annual gains of $4,333 on average. However, since poverty thresholds set in the 1960s do not reflect changing shares of spending on various necessities by low-income families, researchers consider the twice-poverty rate a better cutoff for whether a family is able to make ends meet. Looking at workers below 200% of the poverty line, more than 1.1 million workers would benefit from the minimum wage increase.

Long-standing occupational segregation, discrimination, and other labor market disparities cause women, Black, and Hispanic workers to be more likely to hold low-wage jobs. As a result, the proposed minimum wage increases would be a force for equity by disproportionately benefiting these workers and reducing both gender and racial wage gaps. More than half (55.3%) of workers receiving wage increases would be women. Large shares of Hispanic (50.5%), Black (41.8%), AAPI (31.0%) and multiracial and Native American workers (37.8%) would also see benefits. In New York City, 84.3% of affected workers would be people of color, compared with 61.3% in Nassau, Westchester, and Suffolk counties and 30.4% of workers in upstate New York. Despite the disproportionate impacts among workers of color, white workers as a group make up the largest share of overall affected workers (38.6%) with 1.11 million white workers benefitting.

Conclusion

Passing the Raise Up New York legislation would lead to wage increases for millions of workers in New York. Just as with the increase to $15 an hour in the state, New Yorkers can expect that increasing the minimum wage would achieve its intended effects, raising pay for low-wage workers with little to no negative impact on employment. This minimum wage increase would be a vital support for low-wage workers in one of the most expensive states in the nation and arrive at a time when the purchasing power of workers’ wages has been eroded rapidly by recent price increases. Furthermore, the new legislation includes important steps to protect the economic security of low-wage workers over time by indexing annual increases to changes in inflation and labor productivity. We urge New York lawmakers to pass this legislation and help strengthen the well-being and future of New York’s lowest paid workers.

More than 2.9 million New York workers would benefit from minimum wage increases: Number, shares, and wage increases of affected workers in New York state through 2026, by select worker characteristics

| Group | Wage-earning workforce | Total affected directly or indirectly | Share affected directly or indirectly | Total change in annual wagebill | Average change in annual wages | Average change in hourly wages |

|---|---|---|---|---|---|---|

| All workers | 8,872,900 | 2,878,800 | 32.4% | $9,520,204,000 | $3,307 | $1.95 |

| Gender | ||||||

| Men | 4,505,800 | 1,286,200 | 28.5% | $4,361,687,000 | $3,391 | $1.89 |

| Women | 4,367,100 | 1,592,600 | 36.5% | $5,158,517,000 | $3,239 | $1.99 |

| Teenager flag | ||||||

| Teenager | 227,200 | 158,900 | 70.0% | $605,795,000 | $3,811 | $3.35 |

| Age 20 or older | 8,645,700 | 2,719,900 | 31.5% | $8,914,409,000 | $3,277 | $1.87 |

| Age category | ||||||

| Age 16 to 24 | 1,005,200 | 699,300 | 69.6% | $2,763,886,000 | $3,952 | $2.72 |

| Age 25 to 39 | 3,127,600 | 1,015,100 | 32.5% | $3,437,531,000 | $3,386 | $1.81 |

| Age 40 to 54 | 2,779,600 | 657,800 | 23.7% | $1,976,905,000 | $3,005 | $1.61 |

| Age 55 or older | 1,960,500 | 506,600 | 25.8% | $1,341,882,000 | $2,649 | $1.58 |

| Race / ethnicity | ||||||

| White, non-Hispanic | 4,761,800 | 1,109,800 | 23.3% | $2,863,733,000 | $2,580 | $1.71 |

| Black, non-Hispanic | 1,217,500 | 508,600 | 41.8% | $1,780,669,000 | $3,501 | $1.99 |

| Hispanic, any race | 1,792,100 | 904,300 | 50.5% | $3,646,256,000 | $4,032 | $2.19 |

| Asian, non-Hispanic | 882,000 | 273,100 | 31.0% | $968,951,000 | $3,548 | $2.05 |

| Other race/ethnicity | 219,600 | 83,100 | 37.8% | $260,596,000 | $3,136 | $1.93 |

| Person of color | ||||||

| Not person of color | 4,761,800 | 1,109,800 | 23.3% | $2,863,733,000 | $2,580 | $1.71 |

| Person of color | 4,111,100 | 1,769,000 | 43.0% | $6,656,471,000 | $3,763 | $2.10 |

| Family status | ||||||

| Married parent | 2,114,400 | 461,300 | 21.8% | $1,413,354,000 | $3,064 | $1.68 |

| Single parent | 720,100 | 342,800 | 47.6% | $1,248,570,000 | $3,642 | $2.00 |

| Married, no children | 2,239,900 | 509,500 | 22.7% | $1,433,300,000 | $2,813 | $1.58 |

| Unmarried, no children | 3,798,400 | 1,565,300 | 41.2% | $5,424,980,000 | $3,466 | $2.14 |

| Usual weekly work hours category | ||||||

| Part time (<20 hours per week) | 513,600 | 282,600 | 55.0% | $453,816,000 | $1,606 | $2.53 |

| Mid time (20-34 hours) | 1,214,200 | 786,100 | 64.7% | $2,590,523,000 | $3,296 | $2.47 |

| Full time (35+ hours) | 7,145,100 | 1,810,200 | 25.3% | $6,475,865,000 | $3,577 | $1.63 |

| Educational attainment | ||||||

| Less than high school | 796,600 | 560,100 | 70.3% | $2,575,651,000 | $4,599 | $2.55 |

| High school | 1,984,800 | 1,033,200 | 52.1% | $3,423,726,000 | $3,314 | $1.90 |

| Some college, no degree | 1,548,100 | 700,600 | 45.3% | $2,222,889,000 | $3,173 | $2.03 |

| Associates degree | 828,700 | 259,000 | 31.2% | $667,686,000 | $2,578 | $1.54 |

| Bachelors degree or higher | 3,714,700 | 326,000 | 8.8% | $630,251,000 | $1,933 | $1.21 |

| Major Industry | ||||||

| Agriculture, fishing, forestry, mining | 32,100 | 18,200 | 56.8% | $86,298,000 | $4,732 | $2.16 |

| Construction | 460,200 | 121,100 | 26.3% | $317,460,000 | $2,622 | $1.33 |

| Manufacturing | 548,100 | 137,700 | 25.1% | $395,636,000 | $2,873 | $1.51 |

| Wholesale trade | 207,200 | 58,900 | 28.4% | $182,062,000 | $3,091 | $1.63 |

| Retail trade | 903,000 | 505,500 | 56.0% | $1,778,209,000 | $3,518 | $2.25 |

| Transportation, warehousing, utilities | 484,700 | 142,400 | 29.4% | $396,392,000 | $2,784 | $1.46 |

| Information | 265,800 | 32,400 | 12.2% | $77,743,000 | $2,400 | $1.65 |

| Finance, insurance, real estate | 764,900 | 93,100 | 12.2% | $230,131,000 | $2,472 | $1.38 |

| Professional, science, management services | 692,200 | 58,200 | 8.4% | $124,499,000 | $2,141 | $1.33 |

| Administrative, support, waste services | 313,300 | 144,400 | 46.1% | $479,396,000 | $3,319 | $1.83 |

| Educational services | 1,028,100 | 208,800 | 20.3% | $444,874,000 | $2,131 | $1.64 |

| Healthcare, social assistance | 1,521,700 | 566,200 | 37.2% | $1,822,020,000 | $3,218 | $1.83 |

| Arts, entertainment, recreational services | 190,600 | 82,700 | 43.4% | $274,769,000 | $3,322 | $2.22 |

| Accommodation | 91,800 | 45,800 | 49.9% | $168,815,000 | $3,689 | $2.04 |

| Restaurants | 557,500 | 435,900 | 78.2% | $1,918,089,000 | $4,400 | $2.56 |

| Other services | 371,600 | 183,500 | 49.4% | $723,826,000 | $3,943 | $2.21 |

| Public administration | 439,900 | 44,000 | 10.0% | $99,985,000 | $2,273 | $1.31 |

| Sector | ||||||

| For profit | 6,391,200 | 2,377,000 | 37.2% | $8,204,299,000 | $3,452 | $2.01 |

| Nonprofit | 1,014,700 | 262,800 | 25.9% | $726,115,000 | $2,763 | $1.76 |

| Government | 1,466,900 | 239,100 | 16.3% | $589,790,000 | $2,467 | $1.54 |

| Family income category | ||||||

| Less than $25,000 | 791,800 | 617,800 | 78.0% | $2,611,857,000 | $4,228 | $2.49 |

| $25,000 – $49,999 | 1,400,900 | 775,600 | 55.4% | $2,367,476,000 | $3,052 | $1.66 |

| $50,000 – $74,999 | 1,375,500 | 449,200 | 32.7% | $1,380,565,000 | $3,073 | $1.77 |

| $75,000 – $99,999 | 1,177,600 | 314,900 | 26.7% | $970,856,000 | $3,083 | $1.79 |

| $100,000 – $149,999 | 1,735,300 | 363,500 | 20.9% | $1,090,936,000 | $3,001 | $1.84 |

| $150,000 or more | 2,304,000 | 297,500 | 12.9% | $876,361,000 | $2,946 | $1.90 |

| NA | 87,700 | 60,200 | 68.7% | $222,153,000 | $3,688 | $3.06 |

| Tipped occupations | ||||||

| Not tipped | 8,695,600 | 2,701,500 | 31.1% | $8,820,372,000 | $3,265 | $1.92 |

| Tipped worker | 177,300 | 177,300 | 100.0% | $699,832,000 | $3,947 | $2.40 |

| Family income-to-poverty status | ||||||

| In Poverty | 538,100 | 421,700 | 78.4% | $1,827,181,000 | $4,333 | $2.85 |

| 100 – 199% poverty | 1,005,400 | 744,400 | 74.0% | $2,782,079,000 | $3,737 | $2.04 |

| 200-399% poverty | 2,323,900 | 990,100 | 42.6% | $2,918,695,000 | $2,948 | $1.65 |

| 400%+ poverty | 5,005,400 | 722,700 | 14.4% | $1,992,250,000 | $2,757 | $1.73 |

Notes: Estimated effect of minimum wage increases through 2026 in order to avoid projecting labor productivity and inflation in 2027. All wages in 2021 dollars. AAPI stands for Asian American and Pacific Islander.

Source: Economic Policy Institute Minimum Wage Simulation Model; see Technical Methodology by Dave Cooper, Zane Mokhiber, and Ben Zipperer.

In NYC, 68.8% of affected workers work full-time and 64.8% are ages 25–54: Number, shares, and wage increases of affected workers in New York City through 2026, by select worker characteristics

| Group | Wage-earning workforce | Total affected directly or indirectly | Share affected directly or indirectly | Total change in annual wagebill | Average change in annual wages | Average change in hourly wages |

|---|---|---|---|---|---|---|

| All workers | 4,342,300 | 1,369,600 | 31.5% | $5,065,218,000 | $3,698 | $2.06 |

| Gender | ||||||

| Men | 2,267,500 | 642,300 | 28.3% | $2,386,922,000 | $3,716 | $1.95 |

| Women | 2,074,800 | 727,300 | 35.1% | $2,678,296,000 | $3,682 | $2.15 |

| Teenager flag | ||||||

| Teenager | 54,700 | 39,000 | 71.2% | $162,513,000 | $4,172 | $3.48 |

| Age 20 or older | 4,287,600 | 1,330,700 | 31.0% | $4,902,705,000 | $3,684 | $2.01 |

| Age category | ||||||

| Age 16 to 24 | 381,800 | 248,400 | 65.1% | $1,077,186,000 | $4,336 | $2.82 |

| Age 25 to 39 | 1,740,100 | 529,500 | 30.4% | $1,986,411,000 | $3,751 | $1.97 |

| Age 40 to 54 | 1,366,200 | 358,100 | 26.2% | $1,231,186,000 | $3,438 | $1.80 |

| Age 55 or older | 854,300 | 233,600 | 27.3% | $770,434,000 | $3,298 | $1.84 |

| Race / ethnicity | ||||||

| White, non-Hispanic | 1,554,500 | 215,000 | 13.8% | $591,658,000 | $2,752 | $1.69 |

| Black, non-Hispanic | 814,100 | 322,100 | 39.6% | $1,145,614,000 | $3,557 | $1.99 |

| Hispanic, any race | 1,190,300 | 592,600 | 49.8% | $2,457,024,000 | $4,146 | $2.22 |

| Asian, non-Hispanic | 664,600 | 202,900 | 30.5% | $750,666,000 | $3,700 | $2.09 |

| Other race/ethnicity | 118,900 | 37,000 | 31.2% | $120,255,000 | $3,247 | $1.88 |

| Person of color | ||||||

| Not person of color | 1,554,500 | 215,000 | 13.8% | $591,658,000 | $2,752 | $1.69 |

| Person of color | 2,787,900 | 1,154,600 | 41.4% | $4,473,560,000 | $3,874 | $2.12 |

| Family status | ||||||

| Married parent | 1,032,400 | 245,500 | 23.8% | $848,631,000 | $3,457 | $1.84 |

| Single parent | 335,400 | 164,000 | 48.9% | $658,100,000 | $4,012 | $2.18 |

| Married, no children | 1,027,800 | 249,800 | 24.3% | $850,466,000 | $3,404 | $1.81 |

| Unmarried, no children | 1,946,800 | 710,300 | 36.5% | $2,708,021,000 | $3,812 | $2.19 |

| Usual weekly work hours category | ||||||

| Part time (<20 hours per week) | 171,900 | 88,400 | 51.4% | $150,420,000 | $1,701 | $2.64 |

| Mid time (20-34 hours) | 513,500 | 338,400 | 65.9% | $1,197,070,000 | $3,537 | $2.63 |

| Full time (35+ hours) | 3,656,900 | 942,800 | 25.8% | $3,717,728,000 | $3,943 | $1.80 |

| Educational attainment | ||||||

| Less than high school | 434,500 | 320,200 | 73.7% | $1,604,227,000 | $5,009 | $2.62 |

| High school | 869,000 | 482,800 | 55.6% | $1,773,119,000 | $3,673 | $2.01 |

| Some college, no degree | 649,800 | 292,400 | 45.0% | $1,018,548,000 | $3,483 | $2.12 |

| Associates degree | 299,000 | 101,600 | 34.0% | $301,064,000 | $2,963 | $1.70 |

| Bachelors degree or higher | 2,090,100 | 172,600 | 8.3% | $368,260,000 | $2,133 | $1.26 |

| Major Industry | ||||||

| Agriculture, fishing, forestry, mining | 3,600 | 2,300 | 63.1% | – | – | – |

| Construction | 236,200 | 70,700 | 29.9% | $196,611,000 | $2,779 | $1.39 |

| Manufacturing | 138,700 | 47,300 | 34.1% | $167,353,000 | $3,538 | $1.87 |

| Wholesale trade | 90,600 | 28,300 | 31.2% | $97,799,000 | $3,457 | $1.78 |

| Retail trade | 367,900 | 198,900 | 54.1% | $809,309,000 | $4,068 | $2.40 |

| Transportation, warehousing, utilities | 269,100 | 86,700 | 32.2% | $265,251,000 | $3,060 | $1.56 |

| Information | 177,800 | 15,400 | 8.7% | $43,500,000 | $2,821 | $1.65 |

| Finance, insurance, real estate | 490,000 | 51,700 | 10.5% | $145,105,000 | $2,808 | $1.51 |

| Professional, science, management services | 434,800 | 29,200 | 6.7% | $68,724,000 | $2,351 | $1.41 |

| Administrative, support, waste services | 164,300 | 74,000 | 45.0% | $265,044,000 | $3,583 | $1.96 |

| Educational services | 421,400 | 82,400 | 19.6% | $191,501,000 | $2,324 | $1.68 |

| Healthcare, social assistance | 737,500 | 298,000 | 40.4% | $1,083,158,000 | $3,634 | $2.05 |

| Arts, entertainment, recreational services | 94,000 | 32,500 | 34.6% | $115,509,000 | $3,549 | $2.26 |

| Accommodation | 53,700 | 21,800 | 40.5% | $75,942,000 | $3,490 | $1.82 |

| Restaurants | 272,600 | 217,800 | 79.9% | $1,070,302,000 | $4,915 | $2.60 |

| Other services | 183,600 | 90,500 | 49.3% | $403,004,000 | $4,454 | $2.37 |

| Public administration | 206,600 | 22,100 | 10.7% | $55,624,000 | $2,514 | $1.34 |

| Sector | ||||||

| For profit | 3,223,500 | 1,151,900 | 35.7% | $4,413,638,000 | $3,832 | $2.11 |

| Nonprofit | 467,400 | 111,600 | 23.9% | $350,741,000 | $3,142 | $1.92 |

| Government | 651,400 | 106,100 | 16.3% | $300,838,000 | $2,835 | $1.60 |

| Family income category | ||||||

| Less than $25,000 | 391,600 | 308,700 | 78.8% | $1,454,835,000 | $4,712 | $2.69 |

| $25,000 – $49,999 | 686,700 | 413,000 | 60.1% | $1,412,927,000 | $3,421 | $1.80 |

| $50,000 – $74,999 | 663,500 | 217,700 | 32.8% | $766,917,000 | $3,523 | $1.93 |

| $75,000 – $99,999 | 548,800 | 143,400 | 26.1% | $492,022,000 | $3,430 | $1.88 |

| $100,000 – $149,999 | 791,600 | 152,100 | 19.2% | $494,193,000 | $3,248 | $1.85 |

| $150,000 or more | 1,236,000 | 117,000 | 9.5% | $368,050,000 | $3,147 | $1.84 |

| NA | 24,200 | 17,700 | 73.2% | $76,274,000 | $4,311 | $3.05 |

| Tipped occupations | ||||||

| Not tipped | 4,257,300 | 1,284,600 | 30.2% | $4,689,953,000 | $3,651 | $2.03 |

| Tipped worker | 85,000 | 85,000 | 100.0% | $375,265,000 | $4,413 | $2.43 |

| Family income-to-poverty status | ||||||

| In Poverty | 255,400 | 203,300 | 79.6% | $962,709,000 | $4,735 | $2.94 |

| 100 – 199% poverty | 519,400 | 397,800 | 76.6% | $1,653,630,000 | $4,157 | $2.23 |

| 200-399% poverty | 1,069,500 | 483,200 | 45.2% | $1,591,225,000 | $3,293 | $1.74 |

| 400%+ poverty | 2,498,100 | 285,300 | 11.4% | $857,654,000 | $3,006 | $1.72 |

Notes: Estimated effect of minimum wage increases through 2026 in order to avoid projecting labor productivity and inflation in 2027. All wages in 2021 dollars. AAPI stands for Asian American and Pacific Islander.

Source: Economic Policy Institute Minimum Wage Simulation Model; see Technical Methodology by Dave Cooper, Zane Mokhiber, and Ben Zipperer.

Raise Up New York legislation would increase wages for 43.5% of Black workers and 52.6% of Hispanic workers in suburban New York: Number, shares, and wage increases of affected workers in Nassau, Westchester, and Suffolk counties through 2026, by select worker characteristics

| Group | Wage-earning workforce | Total affected directly or indirectly | Share affected directly or indirectly | Total change in annual wagebill | Average change in annual wages | Average change in hourly wages |

|---|---|---|---|---|---|---|

| All workers | 1,500,500 | 504,900 | 33.6% | $1,761,448,000 | $3,489 | $2.10 |

| Gender | ||||||

| Men | 743,000 | 225,300 | 30.3% | $824,109,000 | $3,657 | $2.07 |

| Women | 757,500 | 279,600 | 36.9% | $937,339,000 | $3,353 | $2.13 |

| Teenager flag | ||||||

| Teenager | 49,300 | 35,000 | 71.0% | $138,050,000 | $3,943 | $3.50 |

| Age 20 or older | 1,451,200 | 469,900 | 32.4% | $1,623,399,000 | $3,455 | $2.00 |

| Age category | ||||||

| Age 16 to 24 | 190,100 | 140,100 | 73.7% | $573,012,000 | $4,089 | $2.89 |

| Age 25 to 39 | 446,400 | 162,200 | 36.3% | $591,718,000 | $3,647 | $1.94 |

| Age 40 to 54 | 489,100 | 114,000 | 23.3% | $360,047,000 | $3,157 | $1.71 |

| Age 55 or older | 375,000 | 88,500 | 23.6% | $236,671,000 | $2,675 | $1.65 |

| Race / ethnicity | ||||||

| White, non-Hispanic | 828,600 | 195,600 | 23.6% | $551,067,000 | $2,817 | $1.97 |

| Black, non-Hispanic | 174,300 | 75,900 | 43.5% | $278,077,000 | $3,663 | $2.13 |

| Hispanic, any race | 361,600 | 190,100 | 52.6% | $786,711,000 | $4,138 | $2.25 |

| Asian, non-Hispanic | 105,400 | 30,600 | 29.0% | $105,610,000 | $3,455 | $2.03 |

| Other race/ethnicity | 30,700 | 12,700 | 41.4% | $39,984,000 | $3,151 | $1.99 |

| Person of color | ||||||

| Not person of color | 828,600 | 195,600 | 23.6% | $551,067,000 | $2,817 | $1.97 |

| Person of color | 671,900 | 309,300 | 46.0% | $1,210,381,000 | $3,913 | $2.19 |

| Family status | ||||||

| Married parent | 387,000 | 81,900 | 21.2% | $268,466,000 | $3,278 | $1.79 |

| Single parent | 107,000 | 51,700 | 48.4% | $210,722,000 | $4,074 | $2.19 |

| Married, no children | 395,100 | 87,000 | 22.0% | $247,580,000 | $2,845 | $1.65 |

| Unmarried, no children | 611,500 | 284,200 | 46.5% | $1,034,681,000 | $3,640 | $2.32 |

| Usual weekly work hours category | ||||||

| Part time (<20 hours per week) | 104,200 | 58,400 | 56.1% | $101,532,000 | $1,738 | $2.65 |

| Mid time (20-34 hours) | 228,100 | 142,000 | 62.3% | $482,806,000 | $3,399 | $2.60 |

| Full time (35+ hours) | 1,168,200 | 304,400 | 26.1% | $1,177,110,000 | $3,867 | $1.76 |

| Educational attainment | ||||||

| Less than high school | 144,900 | 101,100 | 69.7% | $471,090,000 | $4,661 | $2.60 |

| High school | 343,900 | 174,700 | 50.8% | $618,113,000 | $3,538 | $2.08 |

| Some college, no degree | 276,600 | 124,900 | 45.2% | $424,827,000 | $3,400 | $2.22 |

| Associates degree | 136,700 | 43,700 | 32.0% | $125,844,000 | $2,877 | $1.79 |

| Bachelors degree or higher | 598,400 | 60,400 | 10.1% | $121,574,000 | $2,012 | $1.31 |

| Major Industry | ||||||

| Agriculture, fishing, forestry, mining | 4,100 | 2,600 | 63.9% | – | – | – |

| Construction | 81,000 | 21,200 | 26.2% | $61,391,000 | $2,892 | $1.46 |

| Manufacturing | 100,000 | 27,000 | 27.0% | $88,867,000 | $3,294 | $1.73 |

| Wholesale trade | 48,000 | 12,800 | 26.6% | $43,664,000 | $3,413 | $1.76 |

| Retail trade | 181,200 | 102,600 | 56.6% | $382,603,000 | $3,730 | $2.49 |

| Transportation, warehousing, utilities | 76,600 | 21,400 | 27.9% | $60,642,000 | $2,839 | $1.55 |

| Information | 33,100 | 5,600 | 17.0% | $13,352,000 | $2,373 | $1.83 |

| Finance, insurance, real estate | 108,800 | 14,700 | 13.5% | $33,735,000 | $2,297 | $1.34 |

| Professional, science, management services | 102,100 | 12,000 | 11.7% | $27,266,000 | $2,277 | $1.43 |

| Administrative, support, waste services | 54,100 | 26,900 | 49.8% | $104,501,000 | $3,883 | $2.04 |

| Educational services | 186,100 | 34,200 | 18.4% | $80,444,000 | $2,351 | $1.79 |

| Healthcare, social assistance | 267,600 | 87,900 | 32.8% | $274,483,000 | $3,122 | $1.79 |

| Arts, entertainment, recreational services | 34,900 | 17,600 | 50.6% | $61,541,000 | $3,488 | $2.36 |

| Accommodation | 8,500 | 4,900 | 57.7% | $24,006,000 | $4,874 | $2.62 |

| Restaurants | 90,300 | 70,200 | 77.8% | $322,220,000 | $4,588 | $2.76 |

| Other services | 68,100 | 37,300 | 54.8% | $156,190,000 | $4,186 | $2.39 |

| Public administration | 55,900 | 5,900 | 10.5% | $13,651,000 | $2,326 | $1.49 |

| Sector | ||||||

| For profit | 1,114,900 | 432,300 | 38.8% | $1,566,807,000 | $3,624 | $2.16 |

| Nonprofit | 147,400 | 36,600 | 24.8% | $105,055,000 | $2,874 | $1.81 |

| Government | 238,300 | 36,000 | 15.1% | $89,586,000 | $2,487 | $1.69 |

| Family income category | ||||||

| Less than $25,000 | 85,500 | 67,900 | 79.4% | $317,275,000 | $4,671 | $2.71 |

| $25,000 – $49,999 | 166,600 | 102,200 | 61.3% | $356,578,000 | $3,489 | $1.91 |

| $50,000 – $74,999 | 181,400 | 70,200 | 38.7% | $235,297,000 | $3,353 | $1.99 |

| $75,000 – $99,999 | 182,700 | 62,500 | 34.2% | $214,383,000 | $3,433 | $2.02 |

| $100,000 – $149,999 | 322,800 | 93,300 | 28.9% | $298,455,000 | $3,200 | $1.98 |

| $150,000 or more | 550,300 | 101,500 | 18.4% | $310,735,000 | $3,062 | $2.04 |

| NA | 11,200 | 7,400 | 65.9% | $28,724,000 | $3,898 | $3.24 |

| Tipped occupations | ||||||

| Not tipped | 1,470,100 | 474,400 | 32.3% | $1,639,479,000 | $3,456 | $2.07 |

| Tipped worker | 30,500 | 30,500 | 100.0% | $121,969,000 | $4,005 | $2.59 |

| Family income-to-poverty status | ||||||

| In Poverty | 59,400 | 46,700 | 78.6% | $218,717,000 | $4,687 | $3.05 |

| 100 – 199% poverty | 125,000 | 95,000 | 76.0% | $409,604,000 | $4,313 | $2.35 |

| 200-399% poverty | 341,100 | 168,800 | 49.5% | $553,223,000 | $3,277 | $1.89 |

| 400%+ poverty | 975,000 | 194,400 | 19.9% | $579,904,000 | $2,983 | $1.94 |

Notes: Estimated effect of minimum wage increases through 2026 in order to avoid projecting labor productivity and inflation in 2027. All wages in 2021 dollars. AAPI stands for Asian American and Pacific Islander.

Source: Economic Policy Institute Minimum Wage Simulation Model; see Technical Methodology by Dave Cooper, Zane Mokhiber, and Ben Zipperer.

42% of affected workers in upstate New York live below the poverty line: Number, shares, and wage increases of affected workers in upstate New York through 2026, by select worker characteristics

| Group | Wage-earning workforce | Total affected directly or indirectly | Share affected directly or indirectly | Total change in annual wagebill | Average change in annual wages | Average change in hourly wages |

|---|---|---|---|---|---|---|

| All workers | 3,030,000 | 1,004,300 | 33.1% | $2,693,538,000 | $2,682 | $1.72 |

| Gender | ||||||

| Men | 1,495,200 | 418,600 | 28.0% | $1,150,656,000 | $2,749 | $1.71 |

| Women | 1,534,800 | 585,700 | 38.2% | $1,542,882,000 | $2,634 | $1.73 |

| Teenager flag | ||||||

| Teenager | 123,200 | 85,000 | 69.0% | $305,232,000 | $3,592 | $3.24 |

| Age 20 or older | 2,906,800 | 919,400 | 31.6% | $2,388,306,000 | $2,598 | $1.58 |

| Age category | ||||||

| Age 16 to 24 | 433,300 | 310,800 | 71.7% | $1,113,688,000 | $3,584 | $2.56 |

| Age 25 to 39 | 941,100 | 323,400 | 34.4% | $859,402,000 | $2,658 | $1.49 |

| Age 40 to 54 | 924,300 | 185,700 | 20.1% | $385,672,000 | $2,076 | $1.20 |

| Age 55 or older | 731,300 | 184,500 | 25.2% | $334,776,000 | $1,815 | $1.23 |

| Race / ethnicity | ||||||

| White, non-Hispanic | 2,378,700 | 699,200 | 29.4% | $1,721,008,000 | $2,461 | $1.64 |

| Black, non-Hispanic | 229,100 | 110,500 | 48.3% | $356,977,000 | $3,229 | $1.90 |

| Hispanic, any race | 240,300 | 121,600 | 50.6% | $402,521,000 | $3,311 | $1.92 |

| Asian, non-Hispanic | 112,000 | 39,600 | 35.4% | $112,675,000 | $2,844 | $1.86 |

| Other race/ethnicity | 70,000 | 33,400 | 47.6% | $100,357,000 | $3,008 | $1.96 |

| Person of color | ||||||

| Not person of color | 2,378,700 | 699,200 | 29.4% | $1,721,008,000 | $2,461 | $1.64 |

| Person of color | 651,300 | 305,100 | 46.8% | $972,530,000 | $3,187 | $1.91 |

| Family status | ||||||

| Married parent | 695,000 | 133,900 | 19.3% | $296,258,000 | $2,213 | $1.30 |

| Single parent | 277,800 | 127,000 | 45.7% | $379,748,000 | $2,989 | $1.69 |

| Married, no children | 817,100 | 172,700 | 21.1% | $335,255,000 | $1,942 | $1.21 |

| Unmarried, no children | 1,240,200 | 570,700 | 46.0% | $1,682,278,000 | $2,948 | $1.98 |

| Usual weekly work hours category | ||||||

| Part time (<20 hours per week) | 237,500 | 135,700 | 57.1% | $201,864,000 | $1,487 | $2.40 |

| Mid time (20-34 hours) | 472,500 | 305,600 | 64.7% | $910,647,000 | $2,980 | $2.23 |

| Full time (35+ hours) | 2,320,000 | 563,000 | 24.3% | $1,581,026,000 | $2,808 | $1.28 |

| Educational attainment | ||||||

| Less than high school | 217,200 | 138,800 | 63.9% | $500,335,000 | $3,605 | $2.33 |

| High school | 771,900 | 375,700 | 48.7% | $1,032,494,000 | $2,748 | $1.69 |

| Some college, no degree | 621,800 | 283,200 | 45.6% | $779,515,000 | $2,752 | $1.86 |

| Associates degree | 393,000 | 113,600 | 28.9% | $240,778,000 | $2,119 | $1.32 |

| Bachelors degree or higher | 1,026,200 | 93,000 | 9.1% | $140,417,000 | $1,510 | $1.04 |

| Major Industry | ||||||

| Agriculture, fishing, forestry, mining | 24,400 | 13,300 | 54.7% | $61,925,000 | $4,649 | $2.09 |

| Construction | 143,000 | 29,100 | 20.3% | $59,458,000 | $2,044 | $1.08 |

| Manufacturing | 309,500 | 63,400 | 20.5% | $139,416,000 | $2,198 | $1.15 |

| Wholesale trade | 68,700 | 17,800 | 25.9% | $40,599,000 | $2,279 | $1.29 |

| Retail trade | 353,900 | 204,000 | 57.6% | $586,297,000 | $2,874 | $1.99 |

| Transportation, warehousing, utilities | 139,000 | 34,400 | 24.7% | $70,498,000 | $2,052 | $1.17 |

| Information | 54,800 | 11,400 | 20.7% | $20,891,000 | $1,840 | $1.57 |

| Finance, insurance, real estate | 166,100 | 26,700 | 16.1% | $51,290,000 | $1,918 | $1.15 |

| Professional, science, management services | 155,200 | 16,900 | 10.9% | $28,509,000 | $1,682 | $1.11 |

| Administrative, support, waste services | 95,000 | 43,500 | 45.8% | $109,850,000 | $2,523 | $1.48 |

| Educational services | 420,700 | 92,200 | 21.9% | $172,929,000 | $1,876 | $1.54 |

| Healthcare, social assistance | 516,600 | 180,300 | 34.9% | $464,379,000 | $2,576 | $1.49 |

| Arts, entertainment, recreational services | 61,800 | 32,500 | 52.6% | $97,718,000 | $3,005 | $2.10 |

| Accommodation | 29,500 | 19,100 | 64.6% | $68,867,000 | $3,609 | $2.16 |

| Restaurants | 194,500 | 148,000 | 76.1% | $525,567,000 | $3,552 | $2.40 |

| Other services | 119,900 | 55,800 | 46.5% | $164,632,000 | $2,952 | $1.84 |

| Public administration | 177,400 | 16,000 | 9.0% | $30,711,000 | $1,920 | $1.19 |

| Sector | ||||||

| For profit | 2,052,800 | 792,800 | 38.6% | $2,223,853,000 | $2,805 | $1.78 |

| Nonprofit | 400,000 | 114,600 | 28.7% | $270,319,000 | $2,358 | $1.58 |

| Government | 577,200 | 96,900 | 16.8% | $199,366,000 | $2,057 | $1.41 |

| Family income category | ||||||

| Less than $25,000 | 314,800 | 241,100 | 76.6% | $839,747,000 | $3,482 | $2.17 |

| $25,000 – $49,999 | 547,600 | 260,400 | 47.6% | $597,971,000 | $2,296 | $1.34 |

| $50,000 – $74,999 | 530,600 | 161,400 | 30.4% | $378,350,000 | $2,344 | $1.46 |

| $75,000 – $99,999 | 446,000 | 109,000 | 24.4% | $264,451,000 | $2,425 | $1.56 |

| $100,000 – $149,999 | 620,900 | 118,100 | 19.0% | $298,287,000 | $2,526 | $1.73 |

| $150,000 or more | 517,800 | 79,100 | 15.3% | $197,576,000 | $2,499 | $1.80 |

| NA | 52,300 | 35,200 | 67.2% | $117,155,000 | $3,331 | $3.03 |

| Tipped occupations | ||||||

| Not tipped | 2,968,200 | 942,500 | 31.8% | $2,490,940,000 | $2,643 | $1.69 |

| Tipped worker | 61,800 | 61,800 | 100.0% | $202,598,000 | $3,277 | $2.26 |

| Family income-to-poverty status | ||||||

| In Poverty | 223,300 | 171,700 | 76.9% | $645,754,000 | $3,761 | $2.69 |

| 100 – 199% poverty | 361,000 | 251,600 | 69.7% | $718,845,000 | $2,857 | $1.64 |

| 200-399% poverty | 913,400 | 338,000 | 37.0% | $774,246,000 | $2,290 | $1.39 |

| 400%+ poverty | 1,532,300 | 242,900 | 15.9% | $554,692,000 | $2,283 | $1.58 |

Notes: Estimated effect of minimum wage increases through 2026 in order to avoid projecting labor productivity and inflation in 2027. All wages in 2021 dollars. AAPI stands for Asian American and Pacific Islander.

Source: Economic Policy Institute Minimum Wage Simulation Model; see Technical Methodology by Dave Cooper, Zane Mokhiber, and Ben Zipperer.

Notes

1. Under separate proposed legislation (S808A/A10203), the lower tipped minimum wage would be gradually phased out in the restaurant industry, as New York has already done in most other industries.

2. We estimate results for 2026 instead of 2027 (when the entire state reaches the same level) in order to avoid projecting real labor productivity and the Consumer Price Index (CPI) in 2027.

3. EPI analysis of ACS microdata.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.