Snapshot for September 10, 2003.

Tax cuts pump up future budget deficits

The latest update from the Congressional Budget Office (CBO) reveals looming budget problems. Largely as a result of the Bush Administration’s recent tax cuts, the federal debt is on track to increase by $4.614 trillion in the next 10 years.

By law the CBO is required to assume current law remains unchanged when estimating the future deficit, which results in radically understated deficit projections. This “baseline” projection of budget deficits can be misleading because it fails to include important future costs. However, the CBO provides the information necessary to construct a more realistic forecast.

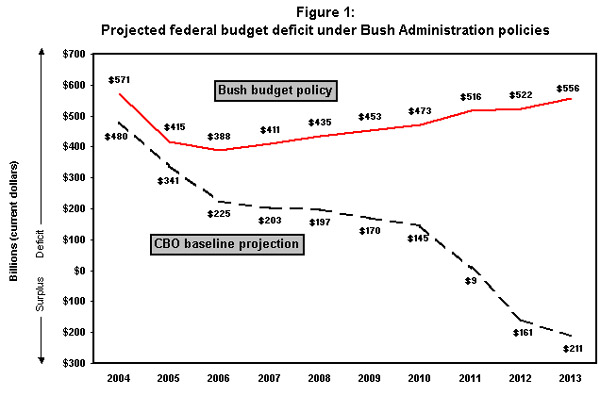

Figure 1 compares the deficits implied by current Bush Administration policy for the next 10 years, under conservative assumptions about spending growth, to the baseline deficits projected by the CBO. The baseline projection dips below zero in 2012, which means the budget is projected to go into surplus. The top line plots the much larger deficits implied by current Bush Administration policy. The result is derived from the following adjustments:

- All tax cuts passed since 2001 remain in effect indefinitely, rather than being phased out under unlikely “sunset” provisions of the legislation.

- The cost of the Bush Administration’s Medicare/prescription drug benefit is included. The amount requested by the administration is $400 billion over the next 10 years, although the benefit could easily cost more.

- The extra defense spending for the Iraq occupation is included for fiscal year 2004.

- Total discretionary spending is assumed to grow by no less than 5% a year. This 5% would include all defense increases after 2004. (The discretionary increases since 2000 have been nearly 9% annually, so 5% is a conservative estimate of growth in this area.)

- Finally, new interest costs are included, based on the CBO’s estimate of a long-term interest rate of 5.8%.

The Bush Administration claims that future deficits can be remedied through spending discipline, but the total deficits shown in the figure would require much less growth in discretionary spending than is likely to occur.

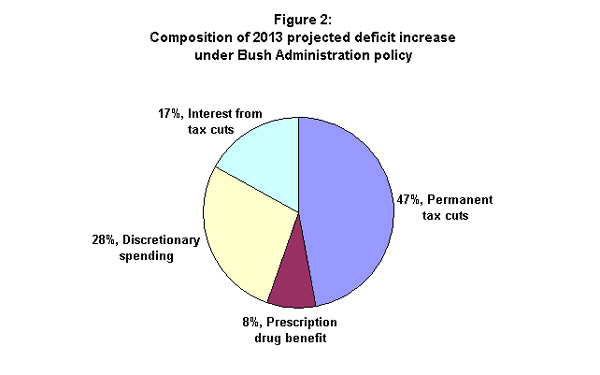

The likely increase in the deficit brought about by the administration’s budget policy is primarily the result of the recent tax cuts. As shown in Figure 2, these tax cuts are the largest contribution (in percentage terms) to the $767 billion projected deficit increase by 2013.

Total federal debt under this scenario would increase to $8.6 trillion by 2013, or 49% of gross domestic product (GDP). This is a substantial increase from the current level of $3.986 trillion in total debt, or 37% of GDP. The overall implication is that budget deficits under current Bush Administration policy are not sustainable. Large adjustments will be necessary to prevent the public debt from more than doubling in the next 10 years.

Today’s snapshot was written by EPI economist Max Sawicky.

Check out the archive for past Economic Snapshots.