Policy Memo #206

Currency manipulation distorts trade flows by artificially lowering the cost of U.S. imports and raising the cost of U.S. exports, and is the leading cause of stubbornly high U.S. trade deficits over the past 15 years. More than 20 countries, led by China, have, together, been spending about $1 trillion per year buying foreign assets to artificially suppress the value of their currencies. Several members of the proposed Trans-Pacific Partnership (TPP)—including Japan, Malaysia, and Singapore—are well known currency manipulators, and others—including South Korea, Taiwan, and China—have expressed interest in joining the agreement.

A growing number of economists, and a bipartisan majority of members of Congress, have called for the inclusion of “strong and enforceable foreign currency manipulation disciplines” in the TPP. This policy memorandum describes currency manipulation, outlines standards that should be used to define currency manipulation for enforcement purposes, and reviews enforcement tools that can be used to counter currency manipulation in the future. It also estimates jobs that would be gained by eliminating currency manipulation. As this research shows, ending currency manipulation could significantly reduce U.S. trade deficits and create millions of jobs, with job gains in every state and most or all U.S. congressional districts.

This policy memorandum, which draws heavily from research findings in a 2014 EPI report (Scott 2014), makes the following key points about currency manipulation:

- Government purchases of foreign exchange reserves and other financial assets denominated in foreign currencies are the principal tool of currency manipulation. Large-scale purchases of such assets keep the currencies of interveners undervalued, artificially subsidizing the cost of their exports and taxing their imports, and increasing their trade surpluses.

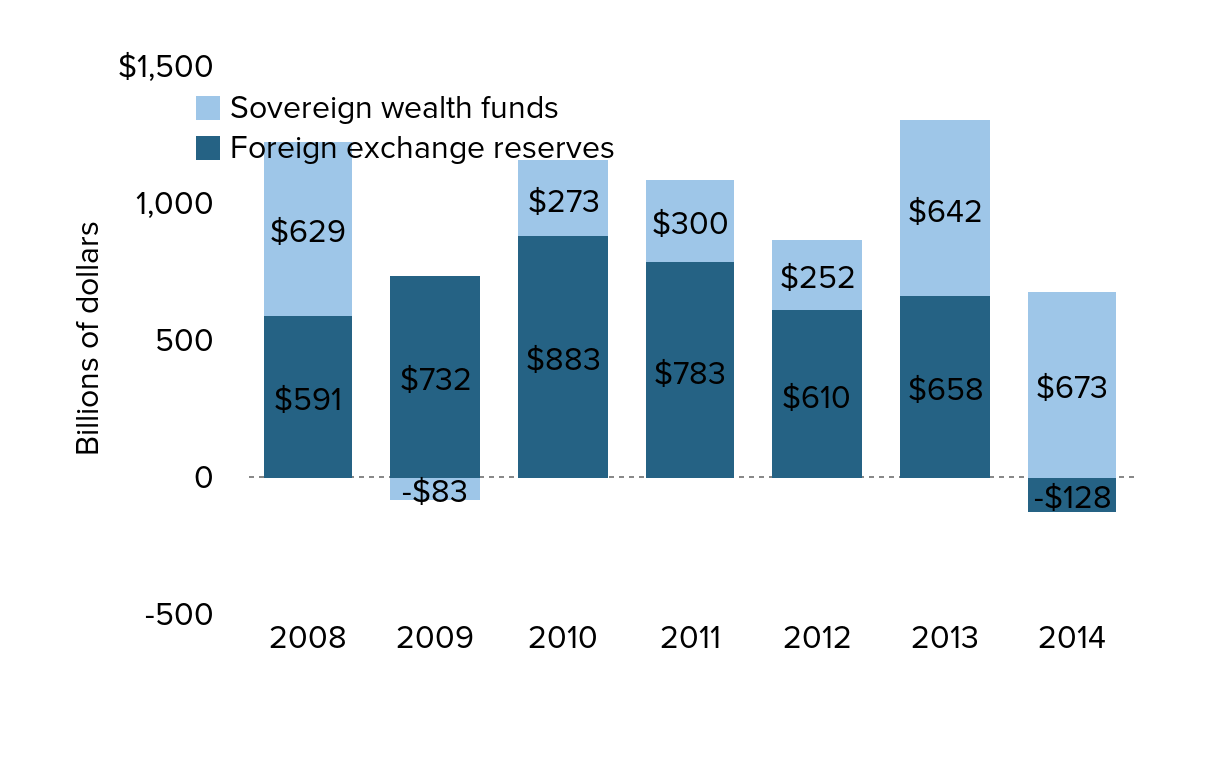

- Official (government) holdings of foreign exchange reserves and other foreign assets increased by roughly $1 trillion per year between 2008 and 2014. Although official holdings of foreign exchange reserves by currency manipulators fell slightly in 2014, largely due to the Russian financial crisis, total government holdings of other foreign assets increased by more than $600 billion. Currency manipulation kept the currencies of most interveners substantially undervalued in 2014.

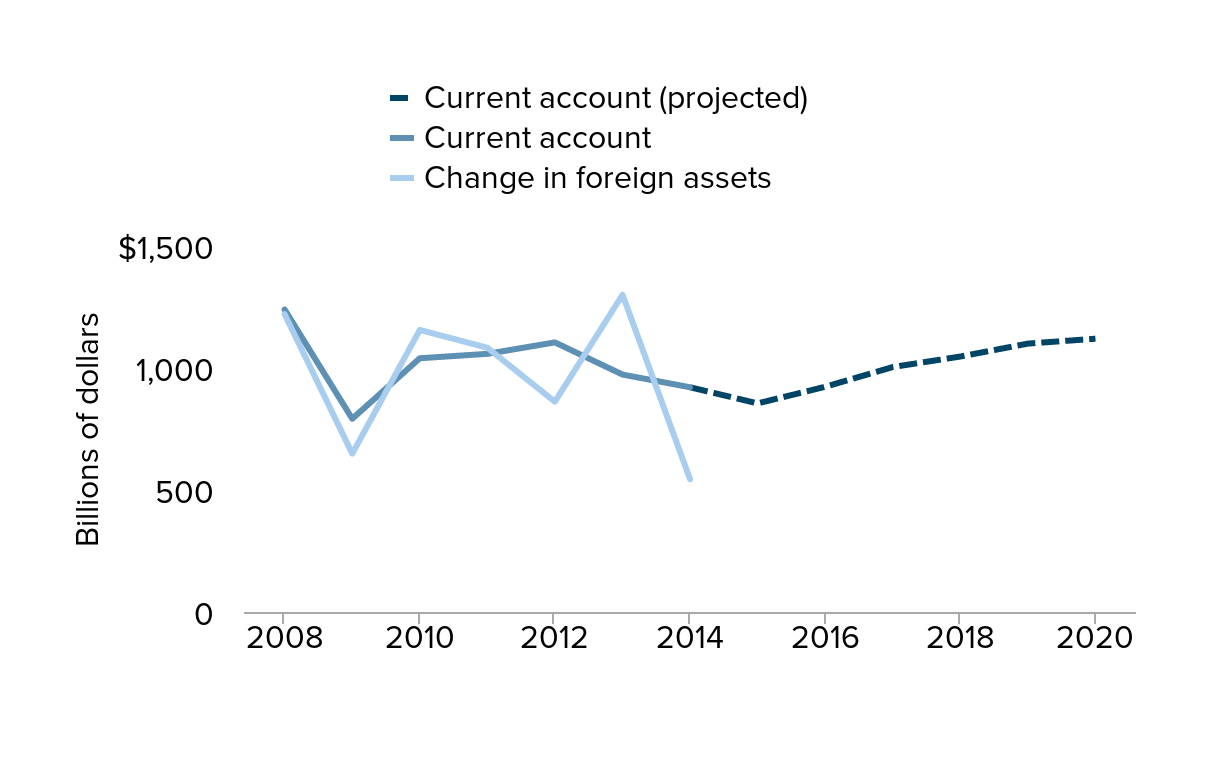

- There is a strong correlation between the trade (current account) surpluses of interveners and their purchases of foreign assets. Both averaged approximately $1 trillion per year between 2008 and 2014.

- Quantitative easing (QE) is easily distinguishable from currency manipulation; thus action to end currency manipulation won’t infringe on a nation’s right to engage in quantitative easing.

- Although currency manipulation is prohibited by both the International Monetary Fund (IMF) and the World Trade Organization (WTO), neither has been able to stop it. The IMF, in particular, has no enforcement tools to compel countries to abide by their obligations to avoid manipulating exchange rates for commercial gain.

- Eliminating currency manipulation would reduce the annual U.S. trade deficit by $200 billion under a low-impact scenario and $500 billion under a high-impact scenario. This would increase U.S. GDP by between $288 billion and $720 billion per year (between 2.0 percent and 4.9 percent) and create between 2.3 and 5.8 million jobs.

- Each of the 50 states and the District of Columbia would gain jobs under both the low- and high-impact scenarios. Job gains under the low-impact scenario would range from 1.06 percent of employment in Washington, D.C., to 2.29 percent of state employment in Wisconsin. Job gains under the high-impact scenario would range from 2.64 percent of employment in Washington, D.C., to 5.55 percent of employment in Wisconsin.

- Nine of the top 10 states gaining the most jobs (as a share of total employment) in both scenarios are in the Midwest. They are Wisconsin (64,700 to 156,600 jobs), Indiana (61,000 to 152,600 jobs), Iowa (34,000 to 79,600 jobs), Minnesota (55,900 to 135,300 jobs), Michigan (82,800 to 207,200 jobs), Ohio (103,200 to 254,600 jobs), South Dakota (9,200 to 21,100 jobs), Kansas (28,900 to 67,000 jobs), and Nebraska (19,000 to 44,200 jobs). In the West, Idaho (13,900 to 32,700 jobs) rounds out the top 10 states gaining the most jobs.

- Jobs are gained in all but two congressional districts under the low-impact scenario, and in all congressional districts under the high-impact scenario. Under the high-impact scenario, each of the top 20 districts by jobs created as a share of district employment would gain at least 14,700 jobs and as many as 24,400 jobs (gains representing between 5.79 percent and 8.65 percent of total district employment). Of the top 20 congressional districts, five are in California; three are in Wisconsin; two each in Indiana, Ohio, and Michigan; and one each in Kansas, Nebraska, Illinois, Minnesota, Washington, and Iowa. Under the high-impact scenario, among all districts, net job gains range from a low of 6,300 jobs in the 34th Congressional District in California to a high of 24,400 jobs in the 17th Congressional District in California.

Currency manipulation is a growing problem that has vexed policymakers for more than two decades. Currency manipulation has shifted production and jobs from deficit countries (principally the United States, and to a lesser extent, the European Union) to the surplus countries (China and other currency manipulators). In the current economic environment, this has contributed to critical trends bedeviling the U.S. economy: the slow recovery from the recent recession, the persistence of high levels of un- and under-employment, and the suppression of wage growth. In this context, it would be unconscionable for the administration to negotiate, or for Congress to approve, a trade agreement that does not include strong and enforceable tools to end currency manipulation.

Describing currency manipulation

The United States has run chronic trade deficits for well over a decade. For at least 15 years, these deficits have been largely driven by the decision made by several of our major trading partners to manage the value of their currency for competitive advantage in U.S. and global markets (Bergsten and Gagnon 2012; Bayoumi, Gagnon, and Saborowski 2014). They buy dollar-denominated financial assets to boost the value of the dollar and depress the value of their own currencies. This results in cheaper imports for the United States and makes U.S. exports more expensive in global markets. More than 20 countries, led by China, have been spending about $1 trillion per year buying foreign assets to artificially suppress the value of their currencies (Bergsten and Gagnon 2012). Ending this currency manipulation by our trading partners is thus crucially important for reducing U.S. trade deficits and stabilizing the global economy in coming years.

Given this, a trade agreement that includes several countries that are obvious currency manipulators would seem like a good place to start addressing the problem. Several members of the proposed TPP—including Japan, Malaysia, and Singapore—are well known currency manipulators, and others—including South Korea, Taiwan, and China—have expressed interest in joining the agreement. Yet U.S. Trade Representative Michael Froman has testified that currency manipulation has not been discussed in the TPP negotiations (McCormack 2014). The arguments against such provisions are weak. Particularly unconvincing is the argument that any such currency provision would somehow bar the Federal Reserve from undertaking expansionary monetary policy that included purchasing bonds to help the U.S. economy through a recession, also known as quantitative easing (Bergsten 2014).

All monetary policy tools, including quantitative easing, affect exchange rates. However, direct intervention in currency markets directly affects exchange rates through the purchase and sale of foreign currency assets. Quantitative easing, on the other hand, consists of Fed purchases of domestic assets (such as U.S. Treasuries and mortgage-backed securities), without affecting foreign currency assets (Bivens 2015). All relevant international rules and standards, including those of the International Monetary Fund and the G-7, acknowledge this distinction and clearly exempt QE policies from responsibility for currency manipulation (Bergsten 2014, 5). Other countries may complain about QE policies, but those objections have no merit and should be ignored (Bivens 2015).

Conversely, when people describe mercantilist currency management, they universally mean the purchase by a nation’s monetary and financial authorities of foreign assets. For example, the Chinese central bank buys not Chinese bonds, but U.S. Treasury bonds and mortgage-backed securities . This has a direct effect on the relative demand for Chinese versus U.S. assets, which moves the U.S.–China exchange rate.

Many commentators narrowly define currency manipulation to include only official holdings of foreign exchange reserves by central banks. However, a growing number of countries have created sovereign wealth funds (SWFs) to invest in private companies, land and commodities, and other foreign financial assets. SWF investments also directly affect the demand for foreign currencies. Bergsten and Gagnon (2012, note 1) define “intervention to include all net purchases of foreign assets by the public sector, including in sovereign wealth funds.” The same definition is used here.

Figure A reports the change in foreign exchange reserves by the 22 currency manipulators identified by Bergsten and Gagnon and the change in sovereign wealth fund assets held by a subset of nine of those countries.1 Since 2008, holdings of foreign exchange reserves (principally U.S. Treasury bonds, mortgage-backed securities, and other government financial assets) have increased by $590 billion per year, on average, but this includes a decline of $128 billion in 2014 (largely due to the Russian financial crisis). Over the same period, holdings of SWF investments in nine countries identified by Bergsten and Gagnon increased by an average of $384 billion per year, but this average includes a $642 billion increase in 2013 and a $673 billion increase in 2014. Thus, as official holdings of foreign exchange reserves by central banks leveled off or declined in 2014, holdings of SWFs skyrocketed. Foreign governments have shifted the composition of their acquisitions, but the levels of net official purchases remained high, in excess of $500 billion in 2014, as shown in Figure A. Overall, holdings of foreign exchange reserves and SWFs increased $974 billion per year, as the figure shows.2 Currency manipulation remains a serious problem today.

Change in net holdings of foreign assets of currency manipulators, by type, 2008–2014

| Year | Foreign exchange reserves | Sovereign wealth funds |

|---|---|---|

| 2008 | $591 | $629 |

| 2009 | $732 | -$83 |

| 2010 | $883 | $273 |

| 2011 | $783 | $300 |

| 2012 | $610 | $252 |

| 2013 | $658 | $642 |

| 2014 | -$128 | $673 |

Source: Author's analysis of data from the International Monetary Fund, Sovereign Wealth Fund Institute, and Central Bank of the Republic of China

There is a near one-to-one correlation between the net increase in foreign asset holdings of currency manipulators between 1980 and 2010, and their total current account surplus (the broadest measure of trade in goods, services, and income), as shown by Bergsten and Gagnon (2012, Figure A). This strong correlation continued between 2008 and 2014, as shown in Figure B.3 Figure B also includes the latest (April 2015) IMF projections of the total current account surplus of the 22 currency manipulators for 2015–2020; the surplus is conservatively projected to increase from $855 billion in 2015 to $1.1 trillion in 2020, an increase of 31 percent. The United States will likely absorb the largest share of this increase, because it is the largest trading country, and because the dollar still makes up the majority of the foreign exchange reserves held by most countries.4

Change in foreign asset holdings, and current account surplus, of currency manipulators, 2008–2020

| Year | Current account | Current account (projected) | Change in foreign assets |

|---|---|---|---|

| 2008 | $1,240 | $1,221 | |

| 2009 | $792 | $649 | |

| 2010 | $1,040 | $1,156 | |

| 2011 | $1,058 | $1,083 | |

| 2012 | $1,105 | $862 | |

| 2013 | $973 | $1,300 | |

| 2014 | $921 | $921 | $544 |

| 2015 | $855 | ||

| 2016 | $923 | ||

| 2017 | $1,004 | ||

| 2018 | $1,047 | ||

| 2019 | $1,100 | ||

| 2020 | $1,120 |

Source: Author's analysis of International Monetary Fund 2015a, 2015b; Sovereign Wealth Fund Institute 2015; and Central Bank of the Republic of China 2015

Gagnon (2013) estimates that a country’s current account increases by between 60 and 100 cents for each dollar spent on intervention, confirming the strong correlation shown in Figure B. In more recent research, Bayoumi, Gagnon, and Saborowski (2014) find a somewhat smaller direct effect of intervention on the current account (42 cents on the dollar). However, they also find “that there is an important positive effect of lagged net official flows on current accounts,” which implies that for countries with open capital markets, both stocks and flows of net foreign official assets have positive effects on the current account. This research confirms that currency manipulation is a direct cause of current account imbalances.

Why hasn’t more been done to end currency manipulation?

Currency manipulation “to gain unfair comparative advantage” is prohibited in the charters of both the International Monetary Fund and the World Trade Organization (IMF 2015c, Bergsten 2014). The United States, which has suffered from large and growing trade deficits for 30 years, also has substantial incentives for ending currency manipulation. Yet neither the United States nor the IMF nor the WTO has been able to thwart currency manipulation. A variety of explanations have been advanced to explain why persistent currency manipulation and sustained current account imbalances have been tolerated, globally and by the United States.

Currency policies and trade policies are generally managed by different branches of government. Finance ministries and central banks are typically responsible for currency issues, while trade and commerce officials are responsible for trade policy. Likewise, at the international level, the WTO handles trade while the IMF is responsible for exchange rates. Coordination problems between different agencies at the national and international levels have made it difficult to reconcile trade and exchange rate imbalances (Bergsten 2014).

In the United States, the Omnibus Foreign Trade and Competitiveness Act of 1988 requires the Treasury secretary to make semiannual reports on economic and exchange rate policies (Scott 2010). Since 1988, Treasury has identified three countries as currency manipulators: Taiwan, South Korea, and China, with Taiwan cited in 1988 and again in 1992. Each citation lasted for at least two six-month reporting periods, while China’s lasted for five periods, ending in 1994 (GAO 2005, 13). In each case, Treasury entered into negotiations with the offending country. Each ultimately made “substantial reforms to their foreign exchange regimes” (GAO 2005, 14).

The Treasury has not identified any countries as currency manipulators since 1994. Prior to the formation of the World Trade Organization, the United States had the authority to impose unilateral trade sanctions under Section 301 of the Trade Act of 1974 (as amended), to address unfair trade practices. When the United States joined the WTO in 1994, it gave up Section 301 enforcement actions and agreed to resolve trade disputes through the WTO dispute settlement mechanism (Dunn and Fennell 2004). This eliminated effective tools for enforcement actions against currency manipulation under the 1988 trade act.

Since 1994, Treasury has consistently expressed a preference for quiet diplomacy over open confrontation, and conducting negotiations about exchange rate policies, for example, through the annual Strategic and Economic Dialogues with Chinese officials. Yet despite these efforts, China and other countries continue to manipulate their exchange rates, as shown above. Treasury’s position appears to reflect the mixed effects of exchange rate policy on U.S. interest groups. While large trade deficits and currency manipulation are bad for export- and import-competing industries, implicit currency subsidies are good for U.S. industries that get access to artificially cheap components. Chinese capital inflows (the counterpart of China’s large trade surpluses) helped finance the U.S. federal deficit and the housing boom of the early 2000s. But these same capital flows also contributed to the housing bubble, which caused the financial collapse and Great Recession (Bernanke 2010).

In the WTO, the General Agreement on Tariffs and Trade (GATT) agreement (Article XV.4) states that “contracting parties shall not, by exchange action, frustrate the intent … of this agreement” (GATT 2015). However, Article XV also directs parties to consult with the IMF in the event of problems regarding “exchange arrangements.” Hence, the WTO relies on the IMF for resolution and enforcement of currency manipulation problems.

Article IV (Section 1.iii) of the IMF articles of incorporation clearly states that “each member shall … avoid manipulating exchange rates … to gain an unfair competitive advantage over other members.” However, the IMF has failed to resolve outstanding currency issues (Bergsten 2014). One reason for this is that the IMF has no national enforcement instruments to rely on to enforce its rules (Henning 2008).

Thus, both the United States and the IMF suffer from a common problem when it comes to dealing with currency manipulation. Both lack adequate enforcement mechanisms to compel countries to abandon sustained purchases of foreign exchange reserves which are causing substantial, sustained imbalances in global current account flows.

There is now widespread agreement among economists and elected officials that new tools and institutions are needed to address currency manipulation. A bipartisan majority of members of Congress have called for the inclusion of “strong and enforceable foreign currency manipulation disciplines” in the TPP. Experts such as Peterson Institute for International Economics director emeritus C. Fred Bergsten (2014) and former Treasury secretary Larry Summers (Summers and Balls 2015, 22) have recommended that new trade agreements address currency manipulation. Currency manipulation can and should be addressed through trade agreements such as the TPP (Bivens 2015).

How should currency manipulation be defined and regulated?

The objectives for new policies to end currency manipulation should be based on Article IV of the IMF articles of incorporation. Recent experience suggests that some clarification is needed on the criteria to be used to define currency manipulation. Also, a variety of enforcement tools should be developed, both within the proposed TPP agreement and in related trade legislation.

Bergsten and Gagnon (2012) have identified a clear set of criteria that can be used to define currency manipulation. There are three key elements5:

- Sustained net official (government-owned or controlled) purchases of foreign assets. This category must be clearly defined to include both traditional foreign exchange reserves as well as sovereign wealth funds and other government-controlled investments, including foreign investment by state-owned enterprises.

- Sustained current account surpluses in excess of some minimum threshold. The 22 countries identified by Bergsten and Gagnon had, on average, a surplus between 2001 and 2011.

- Foreign exchange reserves with a value in excess of three months of goods and services imports, or one year of short-term financial liabilities (whichever is larger).

The goal of enforcement actions should be to encourage currency manipulators to move toward current account balance (having neither a surplus nor deficit) within two to three years. For some countries with large stocks of foreign assets, divestiture may be necessary to achieve trade balance within a reasonable time period, due to the hangover impact of large stocks of reserves on current account balances.

Within the TPP, enforcement of currency manipulation standards could be achieved through the dispute settlement process used to enforce other trade, labor, and environmental disciplines in the agreement. Bergsten (2014) recommends that a currency manipulation chapter be included within the TPP. He identifies five different types of penalties which could be included as enforcement tools in the dispute settlement process. These include: a) a “snapback” provision which would withdraw the benefits of the agreement; b) imposition of countervailing duties; c) tariffs; d) other monetary penalties (fines); and e) countervailing currency intervention. The fifth penalty is in the form of a proposal for governments of deficit countries to purchase assets denominated in the currency of interveners to offset their purchases of foreign assets.

Inclusion of a currency manipulation clause in the TPP is an important first step—a way to get the “camel’s nose under the tent”—to begin to create a regime of enforceable currency manipulation disciplines. However, the long-run goal must be to end currency manipulation by all countries, not just those few who join the TPP (Japan, Singapore, and Malaysia), or others that could join in the near future (Korea, Taiwan, and ultimately China). The United States needs other tools to end currency manipulation, and new enforcement tools are the key.

Trade Promotion Authority, which the Obama administration has asked for to help it complete negotiations on the TPP, is being packaged with a number of related measures, such as trade adjustment assistance. Separate legislation to authorize the United States to impose countervailing duties on imports from any country engaging in currency manipulation should be included in that package. Currency manipulation is a direct subsidy to exports, and businesses in the United States should be able to obtain relief from it in the form of countervailing duties. A mechanism for countervailing duties might affect only a small share of total U.S. imports but would be an important signal that currency manipulation will no longer be tolerated.

The employment impacts of ending currency manipulation

Ending currency manipulation could significantly reduce U.S. trade deficits and create millions of U.S. jobs, with job gains in every state and most or all U.S. congressional districts. This section summarizes jobs that could be created by eliminating currency manipulation. as estimated in Scott 2014. (The findings estimate effects at the end of a three-year timeline for implementation; see Scott 2014 for methodology.)

Impact of ending currency manipulation on U.S. economy

| Scenario* | ||

|---|---|---|

| Change | Low impact | High impact |

| Trade deficit (billions of dollars) | -$200 | -$500 |

| Gross domestic product | ||

| in annual billions of dollars | +$288 | +$720 |

| as a share of GDP** | +2.0% | +4.9% |

| Number of jobs | +2,300,000 | +5,800,000 |

*The low-impact scenario assumes ending currency manipulation would reduce the trade deficit by $200 billion; the high-impact scenario assumes a $500 billion reduction in the trade deficit. The table shows the hypothetical change in 2015 three years after implementation.

**Percentages shown are relative to baseline forecasts for 2015.

Note: Dollar calculations are in 2005 dollars.

Source: Scott 2014

Eliminating currency manipulation would reduce the U.S. trade deficit by $200 billion under a low-impact scenario and $500 billion under a high-impact scenario. This would increase annual U.S. GDP by between $288 billion and $720 billion (between 2.0 percent and 4.9 percent), as shown in Table 1.

Each of the 50 states and the District of Columbia would gain jobs under both the low- and high-impact scenarios. As shown in Table 2 at the end of this memorandum, job gains under the low-impact scenario, expressed as a share of total jobs in the state, would range from 1.06 percent in Washington, D.C., to 2.29 percent in Wisconsin. Job gains under the high-impact scenario would range from 2.64 percent in Washington, D.C., to 5.55 percent in Wisconsin.

Nine of the top 10 states gaining the most jobs (as a share of total employment) in both scenarios are in the Midwest. They are Wisconsin (64,700 to 156,600 jobs), Indiana (61,000 to 152,600 jobs), Iowa (34,000 to 79,600 jobs), Minnesota (55,900 to 135,300 jobs), Michigan (82,800 to 207,200 jobs), Ohio (103,200 to 254,600 jobs), South Dakota (9,200 to 21,100 jobs), Kansas, (28,900 to 67,000 jobs), and Nebraska (19,000 to 44,200 jobs). In the West, Idaho (13,900 to 32,700 jobs) rounds out the top 10 states gaining the most jobs.

Jobs are gained in all but two congressional districts under the low-impact scenario, and in all congressional districts under the high-impact scenario, as shown in Figure C.

Jobs created as a share of state employment from ending currency manipulation in high-impact scenario

| State | District | Employment | Jobs (high impact) | Jobs (low impact) | Jobs added as a share of district employment (low impact) | Jobs added as a share of district employment (high impact) |

|---|---|---|---|---|---|---|

| Alabama | 1 | 283,000 | 10,700 | 4,500 | 1.59% | 3.78% |

| Alabama | 2 | 276,900 | 10,900 | 4,200 | 1.52% | 3.94% |

| Alabama | 3 | 274,600 | 12,200 | 4,500 | 1.64% | 4.44% |

| Alabama | 4 | 262,900 | 13,700 | 5,200 | 1.98% | 5.21% |

| Alabama | 5 | 311,900 | 15,600 | 6,400 | 2.05% | 5.00% |

| Alabama | 6 | 318,400 | 12,100 | 4,600 | 1.44% | 3.80% |

| Alabama | 7 | 253,500 | 9,600 | 3,700 | 1.46% | 3.79% |

| Alaska | Statewide | 344,300 | 10,300 | 3,900 | 1.13% | 2.99% |

| Arizona | 1 | 264,900 | 10,300 | 4,500 | 1.70% | 3.89% |

| Arizona | 2 | 299,200 | 11,400 | 4,900 | 1.64% | 3.81% |

| Arizona | 3 | 262,200 | 10,300 | 4,300 | 1.64% | 3.93% |

| Arizona | 4 | 233,500 | 8,800 | 3,700 | 1.58% | 3.77% |

| Arizona | 5 | 317,900 | 14,200 | 5,700 | 1.79% | 4.47% |

| Arizona | 6 | 366,000 | 13,300 | 5,400 | 1.48% | 3.63% |

| Arizona | 7 | 282,300 | 11,100 | 4,400 | 1.56% | 3.93% |

| Arizona | 8 | 301,700 | 10,900 | 4,500 | 1.49% | 3.61% |

| Arizona | 9 | 360,300 | 14,700 | 6,100 | 1.69% | 4.08% |

| Arkansas | 1 | 277,400 | 14,800 | 6,100 | 2.20% | 5.34% |

| Arkansas | 2 | 336,300 | 11,300 | 4,400 | 1.31% | 3.36% |

| Arkansas | 3 | 327,000 | 15,200 | 6,000 | 1.83% | 4.65% |

| Arkansas | 4 | 295,100 | 15,000 | 6,000 | 2.03% | 5.08% |

| California | 1 | 260,300 | 9,400 | 3,900 | 1.50% | 3.61% |

| California | 2 | 323,100 | 11,900 | 4,700 | 1.45% | 3.68% |

| California | 3 | 286,600 | 10,700 | 4,500 | 1.57% | 3.73% |

| California | 4 | 294,200 | 10,400 | 4,200 | 1.43% | 3.54% |

| California | 5 | 326,800 | 13,300 | 5,500 | 1.68% | 4.07% |

| California | 6 | 288,300 | 8,900 | 3,500 | 1.21% | 3.09% |

| California | 7 | 313,200 | 9,900 | 3,900 | 1.25% | 3.16% |

| California | 8 | 235,500 | 7,600 | 3,000 | 1.27% | 3.23% |

| California | 9 | 275,300 | 11,000 | 4,600 | 1.67% | 4.00% |

| California | 10 | 277,200 | 12,200 | 5,300 | 1.91% | 4.40% |

| California | 11 | 324,200 | 11,600 | 4,600 | 1.42% | 3.58% |

| California | 12 | 399,400 | 13,200 | 4,700 | 1.18% | 3.30% |

| California | 13 | 340,200 | 12,000 | 4,300 | 1.26% | 3.53% |

| California | 14 | 364,000 | 13,800 | 5,100 | 1.40% | 3.79% |

| California | 15 | 336,400 | 15,700 | 5,900 | 1.75% | 4.67% |

| California | 16 | 244,900 | 14,700 | 6,700 | 2.74% | 6.00% |

| California | 17 | 346,100 | 24,400 | 9,300 | 2.69% | 7.05% |

| California | 18 | 344,500 | 19,900 | 7,700 | 2.24% | 5.78% |

| California | 19 | 324,000 | 19,300 | 7,500 | 2.31% | 5.96% |

| California | 20 | 302,500 | 17,700 | 8,000 | 2.64% | 5.85% |

| California | 21 | 243,800 | 21,100 | 10,100 | 4.14% | 8.65% |

| California | 22 | 289,600 | 14,100 | 6,300 | 2.18% | 4.87% |

| California | 23 | 274,100 | 11,700 | 4,700 | 1.71% | 4.27% |

| California | 24 | 323,500 | 16,000 | 7,000 | 2.16% | 4.95% |

| California | 25 | 302,700 | 13,700 | 5,700 | 1.88% | 4.53% |

| California | 26 | 325,900 | 17,900 | 7,700 | 2.36% | 5.49% |

| California | 27 | 332,200 | 10,300 | 3,100 | 0.93% | 3.10% |

| California | 28 | 359,900 | 10,900 | 3,400 | 0.94% | 3.03% |

| California | 29 | 303,700 | 12,300 | 4,400 | 1.45% | 4.05% |

| California | 30 | 358,200 | 12,300 | 4,200 | 1.17% | 3.43% |

| California | 31 | 292,200 | 10,300 | 3,900 | 1.33% | 3.52% |

| California | 32 | 293,800 | 11,900 | 4,000 | 1.36% | 4.05% |

| California | 33 | 364,200 | 14,200 | 5,200 | 1.43% | 3.90% |

| California | 34 | 309,400 | 6,300 | -2,100 | -0.68% | 2.04% |

| California | 35 | 284,800 | 11,700 | 3,900 | 1.37% | 4.11% |

| California | 36 | 251,900 | 9,700 | 4,100 | 1.63% | 3.85% |

| California | 37 | 335,600 | 10,600 | 2,900 | 0.86% | 3.16% |

| California | 38 | 313,300 | 12,100 | 4,000 | 1.28% | 3.86% |

| California | 39 | 332,000 | 14,000 | 5,300 | 1.60% | 4.22% |

| California | 40 | 280,500 | 7,900 | -800 | -0.29% | 2.82% |

| California | 41 | 271,900 | 10,600 | 4,100 | 1.51% | 3.90% |

| California | 42 | 307,000 | 12,800 | 5,100 | 1.66% | 4.17% |

| California | 43 | 302,800 | 12,300 | 4,400 | 1.45% | 4.06% |

| California | 44 | 270,600 | 11,200 | 3,300 | 1.22% | 4.14% |

| California | 45 | 354,400 | 16,100 | 6,400 | 1.81% | 4.54% |

| California | 46 | 314,400 | 14,600 | 5,100 | 1.62% | 4.64% |

| California | 47 | 327,600 | 12,400 | 4,500 | 1.37% | 3.79% |

| California | 48 | 352,600 | 16,000 | 5,900 | 1.67% | 4.54% |

| California | 49 | 299,700 | 12,500 | 4,700 | 1.57% | 4.17% |

| California | 50 | 296,200 | 14,000 | 5,900 | 1.99% | 4.73% |

| California | 51 | 258,600 | 10,000 | 4,000 | 1.55% | 3.87% |

| California | 52 | 350,100 | 15,500 | 6,200 | 1.77% | 4.43% |

| California | 53 | 342,700 | 12,400 | 5,000 | 1.46% | 3.62% |

| Colorado | 1 | 384,400 | 13,700 | 5,400 | 1.40% | 3.56% |

| Colorado | 2 | 384,600 | 15,900 | 6,500 | 1.69% | 4.13% |

| Colorado | 3 | 331,400 | 12,600 | 5,100 | 1.54% | 3.80% |

| Colorado | 4 | 344,100 | 16,000 | 6,500 | 1.89% | 4.65% |

| Colorado | 5 | 315,900 | 11,600 | 4,800 | 1.52% | 3.67% |

| Colorado | 6 | 369,600 | 12,900 | 5,100 | 1.38% | 3.49% |

| Colorado | 7 | 362,500 | 12,900 | 5,000 | 1.38% | 3.56% |

| Connecticut | 1 | 349,800 | 15,000 | 6,300 | 1.80% | 4.29% |

| Connecticut | 2 | 348,600 | 15,900 | 6,900 | 1.98% | 4.56% |

| Connecticut | 3 | 352,700 | 15,700 | 6,600 | 1.87% | 4.45% |

| Connecticut | 4 | 343,000 | 13,700 | 5,500 | 1.60% | 3.99% |

| Connecticut | 5 | 348,300 | 16,800 | 7,100 | 2.04% | 4.82% |

| Delaware | Statewide | 420,400 | 16,200 | 6,700 | 1.59% | 3.85% |

| DC | Statewide | 310,600 | 8,200 | 3,300 | 1.06% | 2.64% |

| Florida | 1 | 303,900 | 9,500 | 3,900 | 1.28% | 3.13% |

| Florida | 2 | 301,500 | 8,600 | 3,400 | 1.13% | 2.85% |

| Florida | 3 | 277,000 | 8,900 | 3,700 | 1.34% | 3.21% |

| Florida | 4 | 329,900 | 11,600 | 4,700 | 1.42% | 3.52% |

| Florida | 5 | 284,000 | 9,800 | 4,000 | 1.41% | 3.45% |

| Florida | 6 | 283,200 | 10,300 | 4,300 | 1.52% | 3.64% |

| Florida | 7 | 322,500 | 11,100 | 4,500 | 1.40% | 3.44% |

| Florida | 8 | 283,400 | 11,600 | 4,900 | 1.73% | 4.09% |

| Florida | 9 | 317,200 | 9,700 | 3,800 | 1.20% | 3.06% |

| Florida | 10 | 331,500 | 11,600 | 4,700 | 1.42% | 3.50% |

| Florida | 11 | 217,400 | 7,000 | 2,800 | 1.29% | 3.22% |

| Florida | 12 | 283,200 | 9,500 | 3,800 | 1.34% | 3.35% |

| Florida | 13 | 309,200 | 11,800 | 4,600 | 1.49% | 3.82% |

| Florida | 14 | 320,700 | 10,700 | 4,200 | 1.31% | 3.34% |

| Florida | 15 | 304,200 | 11,100 | 4,600 | 1.51% | 3.65% |

| Florida | 16 | 276,100 | 9,300 | 3,700 | 1.34% | 3.37% |

| Florida | 17 | 248,700 | 10,800 | 4,800 | 1.93% | 4.34% |

| Florida | 18 | 284,000 | 9,200 | 3,700 | 1.30% | 3.24% |

| Florida | 19 | 265,200 | 9,100 | 3,700 | 1.40% | 3.43% |

| Florida | 20 | 302,100 | 9,900 | 3,900 | 1.29% | 3.28% |

| Florida | 21 | 316,800 | 9,800 | 3,900 | 1.23% | 3.09% |

| Florida | 22 | 332,000 | 11,000 | 4,300 | 1.30% | 3.31% |

| Florida | 23 | 339,900 | 10,800 | 4,200 | 1.24% | 3.18% |

| Florida | 24 | 293,400 | 8,500 | 3,200 | 1.09% | 2.90% |

| Florida | 25 | 326,000 | 11,500 | 4,400 | 1.35% | 3.53% |

| Florida | 26 | 335,600 | 11,200 | 4,600 | 1.37% | 3.34% |

| Florida | 27 | 313,600 | 10,000 | 3,800 | 1.21% | 3.19% |

| Georgia | 1 | 286,100 | 11,000 | 4,800 | 1.68% | 3.84% |

| Georgia | 2 | 251,200 | 10,400 | 4,300 | 1.71% | 4.14% |

| Georgia | 3 | 285,800 | 12,200 | 4,600 | 1.61% | 4.27% |

| Georgia | 4 | 311,700 | 11,400 | 4,500 | 1.44% | 3.66% |

| Georgia | 5 | 318,100 | 10,900 | 4,300 | 1.35% | 3.43% |

| Georgia | 6 | 361,200 | 14,000 | 5,500 | 1.52% | 3.88% |

| Georgia | 7 | 312,500 | 12,600 | 4,900 | 1.57% | 4.03% |

| Georgia | 8 | 272,700 | 10,600 | 4,300 | 1.58% | 3.89% |

| Georgia | 9 | 284,600 | 12,600 | 5,000 | 1.76% | 4.43% |

| Georgia | 10 | 287,400 | 11,200 | 4,400 | 1.53% | 3.90% |

| Georgia | 11 | 340,900 | 13,800 | 5,500 | 1.61% | 4.05% |

| Georgia | 12 | 278,200 | 11,100 | 4,300 | 1.55% | 3.99% |

| Georgia | 13 | 312,800 | 10,900 | 4,200 | 1.34% | 3.48% |

| Georgia | 14 | 290,700 | 14,800 | 5,400 | 1.86% | 5.09% |

| Hawaii | 1 | 330,100 | 8,700 | 3,200 | 0.97% | 2.64% |

| Hawaii | 2 | 299,400 | 9,500 | 4,000 | 1.34% | 3.17% |

| Idaho | 1 | 329,900 | 14,800 | 6,200 | 1.88% | 4.49% |

| Idaho | 2 | 355,000 | 17,900 | 7,800 | 2.20% | 5.04% |

| Illinois | 1 | 290,200 | 9,900 | 3,700 | 1.27% | 3.41% |

| Illinois | 2 | 278,200 | 11,100 | 4,500 | 1.62% | 3.99% |

| Illinois | 3 | 319,500 | 12,900 | 5,100 | 1.60% | 4.04% |

| Illinois | 4 | 326,600 | 15,200 | 6,000 | 1.84% | 4.65% |

| Illinois | 5 | 397,600 | 15,900 | 6,300 | 1.58% | 4.00% |

| Illinois | 6 | 355,600 | 17,800 | 6,900 | 1.94% | 5.01% |

| Illinois | 7 | 298,500 | 10,800 | 4,300 | 1.44% | 3.62% |

| Illinois | 8 | 366,300 | 17,900 | 7,200 | 1.97% | 4.89% |

| Illinois | 9 | 347,200 | 12,800 | 4,700 | 1.35% | 3.69% |

| Illinois | 10 | 324,800 | 16,300 | 6,500 | 2.00% | 5.02% |

| Illinois | 11 | 347,300 | 15,200 | 5,800 | 1.67% | 4.38% |

| Illinois | 12 | 301,000 | 11,800 | 4,800 | 1.59% | 3.92% |

| Illinois | 13 | 326,600 | 12,800 | 5,400 | 1.65% | 3.92% |

| Illinois | 14 | 351,000 | 17,700 | 7,300 | 2.08% | 5.04% |

| Illinois | 15 | 316,500 | 14,900 | 6,100 | 1.93% | 4.71% |

| Illinois | 16 | 330,800 | 18,100 | 7,700 | 2.33% | 5.47% |

| Illinois | 17 | 311,700 | 18,300 | 7,800 | 2.50% | 5.87% |

| Illinois | 18 | 337,500 | 17,000 | 7,400 | 2.19% | 5.04% |

| Indiana | 1 | 310,600 | 16,500 | 6,800 | 2.19% | 5.31% |

| Indiana | 2 | 317,800 | 20,000 | 7,900 | 2.49% | 6.29% |

| Indiana | 3 | 327,000 | 20,800 | 8,000 | 2.45% | 6.36% |

| Indiana | 4 | 328,500 | 17,600 | 7,200 | 2.19% | 5.36% |

| Indiana | 5 | 357,700 | 14,600 | 5,800 | 1.62% | 4.08% |

| Indiana | 6 | 311,900 | 18,000 | 7,400 | 2.37% | 5.77% |

| Indiana | 7 | 312,200 | 12,600 | 5,000 | 1.60% | 4.04% |

| Indiana | 8 | 329,300 | 16,300 | 6,300 | 1.91% | 4.95% |

| Indiana | 9 | 339,400 | 16,100 | 6,500 | 1.92% | 4.74% |

| Iowa | 1 | 392,300 | 22,700 | 9,700 | 2.47% | 5.79% |

| Iowa | 2 | 373,400 | 20,300 | 8,500 | 2.28% | 5.44% |

| Iowa | 3 | 390,800 | 15,900 | 6,700 | 1.71% | 4.07% |

| Iowa | 4 | 382,300 | 20,800 | 9,100 | 2.38% | 5.44% |

| Kansas | 1 | 345,900 | 17,900 | 7,800 | 2.25% | 5.17% |

| Kansas | 2 | 339,900 | 14,000 | 5,700 | 1.68% | 4.12% |

| Kansas | 3 | 370,300 | 14,100 | 5,600 | 1.51% | 3.81% |

| Kansas | 4 | 332,900 | 21,000 | 9,800 | 2.94% | 6.31% |

| Kentucky | 1 | 284,800 | 13,700 | 5,100 | 1.79% | 4.81% |

| Kentucky | 2 | 317,100 | 15,300 | 5,700 | 1.80% | 4.82% |

| Kentucky | 3 | 333,300 | 14,900 | 5,800 | 1.74% | 4.47% |

| Kentucky | 4 | 333,500 | 14,700 | 5,800 | 1.74% | 4.41% |

| Kentucky | 5 | 234,300 | 8,600 | 3,200 | 1.37% | 3.67% |

| Kentucky | 6 | 335,400 | 15,300 | 6,100 | 1.82% | 4.56% |

| Louisiana | 1 | 354,000 | 12,000 | 4,800 | 1.36% | 3.39% |

| Louisiana | 2 | 329,000 | 10,400 | 4,200 | 1.28% | 3.16% |

| Louisiana | 3 | 328,100 | 13,100 | 5,300 | 1.62% | 3.99% |

| Louisiana | 4 | 311,100 | 11,200 | 4,200 | 1.35% | 3.60% |

| Louisiana | 5 | 283,900 | 10,600 | 4,400 | 1.55% | 3.73% |

| Louisiana | 6 | 367,800 | 12,400 | 4,900 | 1.33% | 3.37% |

| Maine | 1 | 340,400 | 13,200 | 5,400 | 1.59% | 3.88% |

| Maine | 2 | 302,700 | 10,800 | 3,900 | 1.29% | 3.57% |

| Maryland | 1 | 342,300 | 12,900 | 5,300 | 1.55% | 3.77% |

| Maryland | 2 | 351,700 | 10,600 | 4,100 | 1.17% | 3.01% |

| Maryland | 3 | 369,500 | 11,200 | 4,600 | 1.24% | 3.03% |

| Maryland | 4 | 384,100 | 11,100 | 4,400 | 1.15% | 2.89% |

| Maryland | 5 | 368,200 | 10,100 | 4,000 | 1.09% | 2.74% |

| Maryland | 6 | 363,200 | 11,700 | 4,700 | 1.29% | 3.22% |

| Maryland | 7 | 315,700 | 9,800 | 3,900 | 1.24% | 3.10% |

| Maryland | 8 | 400,100 | 12,200 | 4,900 | 1.22% | 3.05% |

| Massachusetts | 1 | 341,000 | 13,600 | 5,600 | 1.64% | 3.99% |

| Massachusetts | 2 | 356,500 | 14,800 | 6,000 | 1.68% | 4.15% |

| Massachusetts | 3 | 355,400 | 18,200 | 7,100 | 2.00% | 5.12% |

| Massachusetts | 4 | 374,800 | 15,100 | 5,900 | 1.57% | 4.03% |

| Massachusetts | 5 | 387,400 | 14,800 | 5,700 | 1.47% | 3.82% |

| Massachusetts | 6 | 372,000 | 14,700 | 5,900 | 1.59% | 3.95% |

| Massachusetts | 7 | 369,800 | 11,500 | 4,500 | 1.22% | 3.11% |

| Massachusetts | 8 | 375,600 | 13,600 | 5,300 | 1.41% | 3.62% |

| Massachusetts | 9 | 352,300 | 12,200 | 4,600 | 1.31% | 3.46% |

| Michigan | 1 | 290,200 | 12,600 | 5,200 | 1.79% | 4.34% |

| Michigan | 2 | 315,900 | 17,900 | 7,200 | 2.28% | 5.67% |

| Michigan | 3 | 315,300 | 16,300 | 6,500 | 2.06% | 5.17% |

| Michigan | 4 | 286,300 | 14,200 | 5,700 | 1.99% | 4.96% |

| Michigan | 5 | 264,800 | 11,400 | 4,600 | 1.74% | 4.31% |

| Michigan | 6 | 310,400 | 18,400 | 7,700 | 2.48% | 5.93% |

| Michigan | 7 | 299,100 | 15,500 | 6,200 | 2.07% | 5.18% |

| Michigan | 8 | 330,800 | 15,000 | 5,800 | 1.75% | 4.53% |

| Michigan | 9 | 326,100 | 16,200 | 6,300 | 1.93% | 4.97% |

| Michigan | 10 | 308,700 | 18,100 | 7,400 | 2.40% | 5.86% |

| Michigan | 11 | 342,100 | 17,100 | 6,600 | 1.93% | 5.00% |

| Michigan | 12 | 313,800 | 13,500 | 5,300 | 1.69% | 4.30% |

| Michigan | 13 | 230,700 | 10,300 | 4,000 | 1.73% | 4.46% |

| Michigan | 14 | 257,700 | 10,700 | 4,200 | 1.63% | 4.15% |

| Minnesota | 1 | 348,200 | 18,500 | 7,800 | 2.24% | 5.31% |

| Minnesota | 2 | 358,300 | 17,500 | 6,800 | 1.90% | 4.88% |

| Minnesota | 3 | 353,800 | 19,300 | 7,800 | 2.20% | 5.46% |

| Minnesota | 4 | 336,000 | 14,600 | 5,900 | 1.76% | 4.35% |

| Minnesota | 5 | 352,000 | 15,700 | 6,400 | 1.82% | 4.46% |

| Minnesota | 6 | 348,700 | 17,700 | 7,400 | 2.12% | 5.08% |

| Minnesota | 7 | 328,700 | 19,100 | 8,400 | 2.56% | 5.81% |

| Minnesota | 8 | 303,400 | 12,900 | 5,300 | 1.75% | 4.25% |

| Mississippi | 1 | 305,600 | 13,300 | 4,900 | 1.60% | 4.35% |

| Mississippi | 2 | 266,900 | 11,400 | 4,800 | 1.80% | 4.27% |

| Mississippi | 3 | 303,900 | 11,700 | 4,600 | 1.51% | 3.85% |

| Mississippi | 4 | 304,900 | 11,500 | 4,700 | 1.54% | 3.77% |

| Montana | Statewide | 480,000 | 19,200 | 8,200 | 1.71% | 4.00% |

| Missouri | 1 | 331,500 | 11,900 | 4,600 | 1.39% | 3.59% |

| Missouri | 2 | 378,600 | 17,100 | 7,000 | 1.85% | 4.52% |

| Missouri | 3 | 370,000 | 16,400 | 6,800 | 1.84% | 4.43% |

| Missouri | 4 | 324,900 | 13,000 | 5,300 | 1.63% | 4.00% |

| Missouri | 5 | 345,300 | 13,400 | 5,400 | 1.56% | 3.88% |

| Missouri | 6 | 355,900 | 15,700 | 6,500 | 1.83% | 4.41% |

| Missouri | 7 | 337,400 | 14,900 | 5,900 | 1.75% | 4.42% |

| Missouri | 8 | 298,500 | 14,400 | 5,700 | 1.91% | 4.82% |

| Nebraska | 1 | 321,700 | 14,400 | 6,100 | 1.90% | 4.48% |

| Nebraska | 2 | 316,300 | 11,000 | 4,300 | 1.36% | 3.48% |

| Nebraska | 3 | 305,600 | 18,800 | 8,500 | 2.78% | 6.15% |

| Nevada | 1 | 284,700 | 9,100 | 3,500 | 1.23% | 3.20% |

| Nevada | 2 | 309,400 | 12,300 | 5,100 | 1.65% | 3.98% |

| Nevada | 3 | 336,500 | 10,000 | 3,900 | 1.16% | 2.97% |

| Nevada | 4 | 274,300 | 8,400 | 3,400 | 1.24% | 3.06% |

| New Hampshire | 1 | 352,600 | 15,600 | 6,300 | 1.79% | 4.42% |

| New Hampshire | 2 | 332,200 | 15,700 | 6,400 | 1.93% | 4.73% |

| New Jersey | 1 | 339,200 | 11,900 | 4,600 | 1.36% | 3.51% |

| New Jersey | 2 | 324,400 | 11,100 | 4,500 | 1.39% | 3.42% |

| New Jersey | 3 | 344,200 | 12,000 | 4,900 | 1.42% | 3.49% |

| New Jersey | 4 | 326,400 | 10,300 | 3,900 | 1.19% | 3.16% |

| New Jersey | 5 | 356,100 | 14,600 | 5,600 | 1.57% | 4.10% |

| New Jersey | 6 | 353,600 | 13,000 | 4,700 | 1.33% | 3.68% |

| New Jersey | 7 | 377,100 | 15,900 | 6,300 | 1.67% | 4.22% |

| New Jersey | 8 | 371,000 | 12,700 | 3,900 | 1.05% | 3.42% |

| New Jersey | 9 | 338,500 | 12,400 | 4,500 | 1.33% | 3.66% |

| New Jersey | 10 | 310,700 | 9,600 | 3,500 | 1.13% | 3.09% |

| New Jersey | 11 | 358,800 | 13,900 | 5,400 | 1.51% | 3.87% |

| New Jersey | 12 | 352,400 | 13,500 | 5,500 | 1.56% | 3.83% |

| New Mexico | 1 | 311,900 | 10,600 | 4,400 | 1.41% | 3.40% |

| New Mexico | 2 | 273,100 | 10,500 | 4,400 | 1.61% | 3.84% |

| New Mexico | 3 | 284,800 | 9,700 | 3,700 | 1.30% | 3.41% |

| New York | 1 | 343,300 | 11,400 | 4,500 | 1.31% | 3.32% |

| New York | 2 | 357,800 | 12,600 | 4,800 | 1.34% | 3.52% |

| New York | 3 | 336,700 | 10,100 | 3,700 | 1.10% | 3.00% |

| New York | 4 | 342,500 | 9,600 | 3,600 | 1.05% | 2.80% |

| New York | 5 | 336,200 | 9,300 | 3,200 | 0.95% | 2.77% |

| New York | 6 | 327,000 | 9,100 | 3,000 | 0.92% | 2.78% |

| New York | 7 | 322,200 | 8,600 | 1,900 | 0.59% | 2.67% |

| New York | 8 | 292,700 | 8,000 | 2,700 | 0.92% | 2.73% |

| New York | 9 | 324,900 | 8,900 | 3,100 | 0.95% | 2.74% |

| New York | 10 | 360,300 | 10,300 | 3,600 | 1.00% | 2.86% |

| New York | 11 | 317,500 | 8,400 | 2,700 | 0.85% | 2.65% |

| New York | 12 | 418,800 | 13,000 | 4,400 | 1.05% | 3.10% |

| New York | 13 | 317,200 | 9,400 | 3,300 | 1.04% | 2.96% |

| New York | 14 | 341,800 | 9,600 | 3,200 | 0.94% | 2.81% |

| New York | 15 | 255,900 | 7,500 | 2,600 | 1.02% | 2.93% |

| New York | 16 | 323,600 | 9,800 | 3,600 | 1.11% | 3.03% |

| New York | 17 | 341,400 | 10,100 | 3,600 | 1.05% | 2.96% |

| New York | 18 | 332,100 | 11,500 | 4,500 | 1.36% | 3.46% |

| New York | 19 | 327,300 | 12,200 | 4,900 | 1.50% | 3.73% |

| New York | 20 | 357,600 | 11,200 | 4,500 | 1.26% | 3.13% |

| New York | 21 | 309,200 | 11,100 | 4,100 | 1.33% | 3.59% |

| New York | 22 | 320,200 | 13,900 | 5,800 | 1.81% | 4.34% |

| New York | 23 | 324,600 | 15,100 | 6,100 | 1.88% | 4.65% |

| New York | 24 | 327,300 | 14,100 | 5,800 | 1.77% | 4.31% |

| New York | 25 | 335,400 | 14,200 | 5,700 | 1.70% | 4.23% |

| New York | 26 | 327,700 | 11,900 | 4,700 | 1.43% | 3.63% |

| New York | 27 | 337,800 | 15,500 | 6,400 | 1.89% | 4.59% |

| North Carolina | 1 | 291,800 | 12,900 | 5,300 | 1.82% | 4.42% |

| North Carolina | 2 | 303,800 | 12,600 | 4,200 | 1.38% | 4.15% |

| North Carolina | 3 | 305,600 | 11,100 | 4,700 | 1.54% | 3.63% |

| North Carolina | 4 | 350,900 | 11,800 | 4,600 | 1.31% | 3.36% |

| North Carolina | 5 | 324,500 | 13,900 | 4,900 | 1.51% | 4.28% |

| North Carolina | 6 | 341,800 | 12,900 | 3,900 | 1.14% | 3.77% |

| North Carolina | 7 | 315,400 | 12,300 | 5,000 | 1.59% | 3.90% |

| North Carolina | 8 | 301,700 | 12,400 | 4,100 | 1.36% | 4.11% |

| North Carolina | 9 | 371,400 | 16,300 | 6,300 | 1.70% | 4.39% |

| North Carolina | 10 | 324,000 | 14,800 | 5,400 | 1.67% | 4.57% |

| North Carolina | 11 | 295,400 | 12,400 | 4,700 | 1.59% | 4.20% |

| North Carolina | 12 | 319,800 | 11,800 | 4,400 | 1.38% | 3.69% |

| North Carolina | 13 | 349,900 | 14,900 | 5,900 | 1.69% | 4.26% |

| North Dakota | Statewide | 370,800 | 17,000 | 7,400 | 2.00% | 4.58% |

| Ohio | 1 | 332,300 | 14,700 | 6,000 | 1.81% | 4.42% |

| Ohio | 2 | 323,600 | 14,600 | 6,000 | 1.85% | 4.51% |

| Ohio | 3 | 333,000 | 11,400 | 4,300 | 1.29% | 3.42% |

| Ohio | 4 | 317,900 | 19,700 | 8,000 | 2.52% | 6.20% |

| Ohio | 5 | 334,200 | 18,700 | 7,600 | 2.27% | 5.60% |

| Ohio | 6 | 292,300 | 14,900 | 6,100 | 2.09% | 5.10% |

| Ohio | 7 | 326,800 | 18,800 | 7,500 | 2.29% | 5.75% |

| Ohio | 8 | 328,800 | 19,100 | 8,000 | 2.43% | 5.81% |

| Ohio | 9 | 315,000 | 15,200 | 6,200 | 1.97% | 4.83% |

| Ohio | 10 | 312,800 | 13,500 | 5,400 | 1.73% | 4.32% |

| Ohio | 11 | 275,200 | 11,900 | 4,800 | 1.74% | 4.32% |

| Ohio | 12 | 359,500 | 14,600 | 6,000 | 1.67% | 4.06% |

| Ohio | 13 | 320,400 | 16,000 | 6,200 | 1.94% | 4.99% |

| Ohio | 14 | 349,700 | 19,800 | 8,300 | 2.37% | 5.66% |

| Ohio | 15 | 336,400 | 13,600 | 5,400 | 1.61% | 4.04% |

| Ohio | 16 | 355,600 | 18,200 | 7,400 | 2.08% | 5.12% |

| Oklahoma | 1 | 361,900 | 17,200 | 6,700 | 1.85% | 4.75% |

| Oklahoma | 2 | 290,300 | 13,600 | 5,500 | 1.89% | 4.68% |

| Oklahoma | 3 | 329,900 | 15,200 | 6,300 | 1.91% | 4.61% |

| Oklahoma | 4 | 350,900 | 13,100 | 5,000 | 1.42% | 3.73% |

| Oklahoma | 5 | 348,800 | 12,100 | 4,400 | 1.26% | 3.47% |

| Oregon | 1 | 377,200 | 20,800 | 7,800 | 2.07% | 5.51% |

| Oregon | 2 | 314,200 | 15,500 | 6,500 | 2.07% | 4.93% |

| Oregon | 3 | 383,300 | 15,200 | 5,600 | 1.46% | 3.97% |

| Oregon | 4 | 309,000 | 13,300 | 5,600 | 1.81% | 4.30% |

| Oregon | 5 | 326,700 | 13,900 | 5,900 | 1.81% | 4.25% |

| Pennsylvania | 1 | 273,300 | 9,200 | 3,500 | 1.28% | 3.37% |

| Pennsylvania | 2 | 273,100 | 8,500 | 3,400 | 1.24% | 3.11% |

| Pennsylvania | 3 | 317,700 | 16,700 | 6,800 | 2.14% | 5.26% |

| Pennsylvania | 4 | 342,900 | 15,200 | 6,200 | 1.81% | 4.43% |

| Pennsylvania | 5 | 316,800 | 15,500 | 6,200 | 1.96% | 4.89% |

| Pennsylvania | 6 | 362,300 | 16,500 | 6,700 | 1.85% | 4.55% |

| Pennsylvania | 7 | 339,700 | 15,500 | 6,400 | 1.88% | 4.56% |

| Pennsylvania | 8 | 357,800 | 15,200 | 6,200 | 1.73% | 4.25% |

| Pennsylvania | 9 | 304,800 | 13,500 | 5,200 | 1.71% | 4.43% |

| Pennsylvania | 10 | 312,500 | 13,800 | 5,500 | 1.76% | 4.42% |

| Pennsylvania | 11 | 329,300 | 13,700 | 5,600 | 1.70% | 4.16% |

| Pennsylvania | 12 | 331,900 | 14,900 | 6,000 | 1.81% | 4.49% |

| Pennsylvania | 13 | 339,000 | 13,300 | 5,100 | 1.50% | 3.92% |

| Pennsylvania | 14 | 323,200 | 11,500 | 4,500 | 1.39% | 3.56% |

| Pennsylvania | 15 | 343,800 | 16,000 | 6,500 | 1.89% | 4.65% |

| Pennsylvania | 16 | 327,700 | 15,800 | 6,400 | 1.95% | 4.82% |

| Pennsylvania | 17 | 312,600 | 12,600 | 4,800 | 1.54% | 4.03% |

| Pennsylvania | 18 | 345,000 | 15,800 | 6,400 | 1.86% | 4.58% |

| Rhode Island | 1 | 250,900 | 10,800 | 4,300 | 1.71% | 4.30% |

| Rhode Island | 2 | 260,300 | 9,900 | 4,000 | 1.54% | 3.80% |

| South Carolina | 1 | 299,800 | 11,900 | 4,900 | 1.63% | 3.97% |

| South Carolina | 2 | 305,600 | 12,300 | 5,000 | 1.64% | 4.02% |

| South Carolina | 3 | 264,500 | 14,900 | 5,900 | 2.23% | 5.63% |

| South Carolina | 4 | 301,000 | 14,700 | 5,600 | 1.86% | 4.88% |

| South Carolina | 5 | 275,200 | 13,400 | 5,300 | 1.93% | 4.87% |

| South Carolina | 6 | 253,500 | 10,800 | 4,500 | 1.78% | 4.26% |

| South Carolina | 7 | 269,400 | 11,200 | 4,400 | 1.63% | 4.16% |

| South Dakota | Statewide | 415,600 | 21,100 | 9,200 | 2.21% | 5.08% |

| Tennessee | 1 | 297,600 | 14,100 | 5,700 | 1.92% | 4.74% |

| Tennessee | 2 | 327,200 | 12,300 | 4,800 | 1.47% | 3.76% |

| Tennessee | 3 | 297,000 | 12,900 | 4,700 | 1.58% | 4.34% |

| Tennessee | 4 | 314,500 | 13,900 | 5,100 | 1.62% | 4.42% |

| Tennessee | 5 | 353,400 | 12,500 | 4,900 | 1.39% | 3.54% |

| Tennessee | 6 | 304,500 | 13,400 | 5,200 | 1.71% | 4.40% |

| Tennessee | 7 | 285,800 | 12,900 | 4,900 | 1.71% | 4.51% |

| Tennessee | 8 | 299,200 | 14,600 | 6,100 | 2.04% | 4.88% |

| Tennessee | 9 | 305,300 | 11,400 | 4,400 | 1.44% | 3.73% |

| Texas | 1 | 297,700 | 12,500 | 5,100 | 1.71% | 4.20% |

| Texas | 2 | 364,600 | 16,100 | 5,600 | 1.54% | 4.42% |

| Texas | 3 | 371,200 | 16,800 | 6,300 | 1.70% | 4.53% |

| Texas | 4 | 299,300 | 12,600 | 5,100 | 1.70% | 4.21% |

| Texas | 5 | 300,800 | 12,000 | 4,800 | 1.60% | 3.99% |

| Texas | 6 | 348,800 | 14,800 | 5,600 | 1.61% | 4.24% |

| Texas | 7 | 376,300 | 16,200 | 5,800 | 1.54% | 4.31% |

| Texas | 8 | 309,200 | 13,600 | 5,300 | 1.71% | 4.40% |

| Texas | 9 | 326,400 | 11,700 | 4,400 | 1.35% | 3.58% |

| Texas | 10 | 342,600 | 14,400 | 5,700 | 1.66% | 4.20% |

| Texas | 11 | 308,800 | 12,800 | 4,700 | 1.52% | 4.15% |

| Texas | 12 | 337,500 | 16,900 | 6,800 | 2.01% | 5.01% |

| Texas | 13 | 309,000 | 13,700 | 5,700 | 1.84% | 4.43% |

| Texas | 14 | 303,300 | 12,900 | 5,600 | 1.85% | 4.25% |

| Texas | 15 | 280,900 | 9,200 | 3,700 | 1.32% | 3.28% |

| Texas | 16 | 281,300 | 8,200 | 2,600 | 0.92% | 2.92% |

| Texas | 17 | 329,300 | 12,400 | 4,700 | 1.43% | 3.77% |

| Texas | 18 | 306,400 | 12,800 | 4,900 | 1.60% | 4.18% |

| Texas | 19 | 310,700 | 12,100 | 4,900 | 1.58% | 3.89% |

| Texas | 20 | 311,400 | 9,600 | 3,700 | 1.19% | 3.08% |

| Texas | 21 | 361,200 | 11,700 | 4,600 | 1.27% | 3.24% |

| Texas | 22 | 352,500 | 14,000 | 5,400 | 1.53% | 3.97% |

| Texas | 23 | 289,700 | 9,800 | 3,500 | 1.21% | 3.38% |

| Texas | 24 | 388,600 | 16,700 | 6,600 | 1.70% | 4.30% |

| Texas | 25 | 302,200 | 12,200 | 4,800 | 1.59% | 4.04% |

| Texas | 26 | 368,300 | 16,400 | 6,500 | 1.76% | 4.45% |

| Texas | 27 | 305,600 | 12,700 | 5,200 | 1.70% | 4.16% |

| Texas | 28 | 266,300 | 9,300 | 3,900 | 1.46% | 3.49% |

| Texas | 29 | 292,900 | 13,000 | 5,200 | 1.78% | 4.44% |

| Texas | 30 | 292,300 | 10,300 | 4,000 | 1.37% | 3.52% |

| Texas | 31 | 323,000 | 12,600 | 4,700 | 1.46% | 3.90% |

| Texas | 32 | 360,900 | 15,700 | 5,900 | 1.63% | 4.35% |

| Texas | 33 | 283,900 | 12,200 | 4,500 | 1.59% | 4.30% |

| Texas | 34 | 242,200 | 8,400 | 3,400 | 1.40% | 3.47% |

| Texas | 35 | 318,200 | 10,100 | 3,900 | 1.23% | 3.17% |

| Texas | 36 | 291,900 | 14,000 | 5,900 | 2.02% | 4.80% |

| Utah | 1 | 312,400 | 13,900 | 5,700 | 1.82% | 4.45% |

| Utah | 2 | 305,700 | 12,200 | 4,800 | 1.57% | 3.99% |

| Utah | 3 | 311,200 | 11,500 | 4,600 | 1.48% | 3.70% |

| Utah | 4 | 331,500 | 14,000 | 5,600 | 1.69% | 4.22% |

| Vermont | Statewide | 327,300 | 13,600 | 5,600 | 1.71% | 4.16% |

| Virginia | 1 | 352,400 | 10,800 | 4,500 | 1.28% | 3.06% |

| Virginia | 2 | 339,800 | 10,800 | 4,400 | 1.29% | 3.18% |

| Virginia | 3 | 320,100 | 10,200 | 4,200 | 1.31% | 3.19% |

| Virginia | 4 | 327,900 | 12,100 | 5,000 | 1.52% | 3.69% |

| Virginia | 5 | 316,100 | 12,000 | 4,600 | 1.46% | 3.80% |

| Virginia | 6 | 339,900 | 13,000 | 5,200 | 1.53% | 3.82% |

| Virginia | 7 | 364,600 | 12,000 | 4,900 | 1.34% | 3.29% |

| Virginia | 8 | 423,700 | 12,100 | 4,800 | 1.13% | 2.86% |

| Virginia | 9 | 298,400 | 13,400 | 5,200 | 1.74% | 4.49% |

| Virginia | 10 | 376,400 | 12,800 | 5,000 | 1.33% | 3.40% |

| Virginia | 11 | 400,900 | 11,900 | 4,800 | 1.20% | 2.97% |

| Washington | 1 | 332,300 | 16,600 | 7,300 | 2.20% | 5.00% |

| Washington | 2 | 318,900 | 15,900 | 7,300 | 2.29% | 4.99% |

| Washington | 3 | 284,500 | 13,100 | 5,300 | 1.86% | 4.60% |

| Washington | 4 | 284,500 | 16,500 | 7,600 | 2.67% | 5.80% |

| Washington | 5 | 291,500 | 11,600 | 4,900 | 1.68% | 3.98% |

| Washington | 6 | 275,500 | 9,600 | 4,000 | 1.45% | 3.48% |

| Washington | 7 | 380,000 | 15,400 | 6,500 | 1.71% | 4.05% |

| Washington | 8 | 318,000 | 16,200 | 7,400 | 2.33% | 5.09% |

| Washington | 9 | 341,400 | 15,800 | 6,900 | 2.02% | 4.63% |

| Washington | 10 | 291,300 | 9,600 | 4,000 | 1.37% | 3.30% |

| West Virginia | 1 | 258,700 | 10,500 | 4,300 | 1.66% | 4.06% |

| West Virginia | 2 | 266,900 | 9,500 | 3,700 | 1.39% | 3.56% |

| West Virginia | 3 | 223,000 | 8,800 | 3,800 | 1.70% | 3.95% |

| Wisconsin | 1 | 342,500 | 19,800 | 8,200 | 2.39% | 5.78% |

| Wisconsin | 2 | 390,000 | 17,500 | 7,300 | 1.87% | 4.49% |

| Wisconsin | 3 | 353,500 | 17,800 | 7,300 | 2.07% | 5.04% |

| Wisconsin | 4 | 308,000 | 14,800 | 5,800 | 1.88% | 4.81% |

| Wisconsin | 5 | 370,600 | 22,500 | 9,300 | 2.51% | 6.07% |

| Wisconsin | 6 | 353,600 | 23,800 | 9,900 | 2.80% | 6.73% |

| Wisconsin | 7 | 338,400 | 19,100 | 7,900 | 2.33% | 5.64% |

| Wisconsin | 8 | 362,800 | 21,200 | 9,000 | 2.48% | 5.84% |

| Wyoming | Statewide | 290,000 | 10,900 | 4,200 | 1.45% | 3.76% |

Source: Scott 2014

Under the high-impact scenario, each of the top 20 districts by jobs created as a share of district employment would gain at least 14,700 jobs and as many as 24,400 jobs (gains representing between 5.79 percent and 8.65 percent of total district employment), as shown in Table 3 at the end of this memorandum. Of the top 20 congressional districts, five are in California; three are in Wisconsin; two each in Indiana, Ohio, and Michigan; and one each in Kansas, Nebraska, Illinois, Minnesota, Washington, and Iowa. Under the high-impact scenario, among all districts, net job gains range from a low of 6,300 jobs in the 34th Congressional District in California to a high of 24,400 jobs in the 17th Congressional District in California.

–The author thanks Josh Bivens and Ross Eisenbrey for comments, and Will Kimball for research assistance.

Net U.S. jobs created by eliminating currency manipulation, by state (ranked by jobs gained as a share of total state employment under high-impact scenario)

| Scenario* | ||||||

|---|---|---|---|---|---|---|

| Low impact | High impact | |||||

| Rank | State | State employment (2011 average) | Net jobs created | Jobs created as a share of state employment | Net jobs created | Jobs created as a share of state employment |

| 1 | Wisconsin | 2,819,475 | 64,700 | 2.29% | 156,600 | 5.55% |

| 2 | Indiana | 2,934,500 | 61,000 | 2.08% | 152,600 | 5.20% |

| 3 | Iowa | 1,538,755 | 34,000 | 2.21% | 79,600 | 5.17% |

| 4 | South Dakota | 415,625 | 9,200 | 2.21% | 21,100 | 5.08% |

| 5 | Minnesota | 2,728,880 | 55,900 | 2.05% | 135,300 | 4.96% |

| 6 | Michigan | 4,191,880 | 82,800 | 1.98% | 207,200 | 4.94% |

| 7 | Ohio | 5,213,455 | 103,200 | 1.98% | 254,600 | 4.88% |

| 8 | Kansas | 1,389,040 | 28,900 | 2.08% | 67,000 | 4.82% |

| 9 | Idaho | 684,915 | 13,900 | 2.03% | 32,700 | 4.77% |

| 10 | Nebraska | 943,645 | 19,000 | 2.01% | 44,200 | 4.68% |

| 11 | Oregon | 1,710,335 | 31,300 | 1.83% | 78,600 | 4.60% |

| 12 | North Dakota | 370,830 | 7,400 | 2.00% | 17,000 | 4.58% |

| 13 | New Hampshire | 684,805 | 12,700 | 1.85% | 31,300 | 4.57% |

| 14 | Arkansas | 1,235,755 | 22,500 | 1.82% | 56,300 | 4.56% |

| 15 | South Carolina | 1,968,925 | 35,600 | 1.81% | 89,300 | 4.54% |

| 16 | Washington | 3,118,000 | 61,300 | 1.97% | 140,300 | 4.50% |

| 17 | Illinois | 5,926,850 | 107,500 | 1.81% | 266,400 | 4.49% |

| 18 | Kentucky | 1,838,400 | 31,800 | 1.73% | 82,500 | 4.49% |

| 19 | Connecticut | 1,742,495 | 32,400 | 1.86% | 77,000 | 4.42% |

| 20 | Pennsylvania | 5,853,320 | 101,400 | 1.73% | 253,000 | 4.32% |

| 21 | Alabama | 1,981,095 | 33,000 | 1.67% | 85,000 | 4.29% |

| 22 | Missouri | 2,742,055 | 47,200 | 1.72% | 116,800 | 4.26% |

| 23 | Tennessee | 2,784,460 | 45,800 | 1.64% | 118,100 | 4.24% |

| 24 | Oklahoma | 1,681,760 | 27,900 | 1.66% | 71,100 | 4.23% |

| 25 | California | 16,426,695 | 258,400 | 1.57% | 687,100 | 4.18% |

| 26 | Vermont | 327,300 | 5,600 | 1.71% | 13,600 | 4.16% |

| 27 | Utah | 1,260,805 | 20,800 | 1.65% | 51,600 | 4.09% |

| 28 | Mississippi | 1,181,295 | 18,900 | 1.60% | 47,900 | 4.05% |

| 29 | North Carolina | 4,195,810 | 63,400 | 1.51% | 170,000 | 4.05% |

| 30 | Rhode Island | 511,235 | 8,300 | 1.62% | 20,700 | 4.05% |

| 31 | Texas | 11,455,070 | 179,100 | 1.56% | 460,400 | 4.02% |

| 32 | Montana | 479,990 | 8,200 | 1.71% | 19,200 | 4.00% |

| 33 | Georgia | 4,193,775 | 65,900 | 1.57% | 167,600 | 4.00% |

| 34 | Arizona | 2,687,990 | 43,500 | 1.62% | 105,100 | 3.91% |

| 35 | Massachusetts | 3,284,720 | 50,600 | 1.54% | 128,400 | 3.91% |

| 36 | Delaware | 420,365 | 6,700 | 1.59% | 16,200 | 3.85% |

| 37 | West Virginia | 748,560 | 11,800 | 1.58% | 28,800 | 3.85% |

| 38 | Colorado | 2,492,420 | 38,300 | 1.54% | 95,700 | 3.84% |

| 39 | Wyoming | 289,975 | 4,200 | 1.45% | 10,900 | 3.76% |

| 40 | Maine | 643,105 | 9,300 | 1.45% | 24,000 | 3.73% |

| 41 | New Jersey | 4,152,515 | 57,200 | 1.38% | 150,900 | 3.63% |

| 42 | New Mexico | 869,775 | 12,500 | 1.44% | 30,800 | 3.54% |

| 43 | Louisiana | 1,973,940 | 27,800 | 1.41% | 69,700 | 3.53% |

| 44 | Virginia | 3,860,130 | 52,500 | 1.36% | 131,300 | 3.40% |

| 45 | Florida | 8,101,900 | 110,200 | 1.36% | 274,000 | 3.38% |

| 46 | New York | 8,959,015 | 109,900 | 1.23% | 296,400 | 3.31% |

| 47 | Nevada | 1,204,880 | 16,000 | 1.33% | 39,800 | 3.30% |

| 48 | Maryland | 2,894,565 | 35,800 | 1.24% | 89,400 | 3.09% |

| 49 | Alaska | 344,345 | 3,900 | 1.13% | 10,300 | 2.99% |

| 50 | Hawaii | 629,525 | 7,200 | 1.14% | 18,200 | 2.89% |

| 51 | District of Columbia | 310,605 | 3,300 | 1.06% | 8,200 | 2.64% |

| Total** | 140,399,600 | 2,300,000 | 1.64% | 5,800,000 | 4.13% | |

*The low-impact scenario assumes ending currency manipulation would reduce the trade deficit by $200 billion; the high-impact scenario assumes a $500 billion reduction in the trade deficit. The table shows the hypothetical change in 2015 three years after implementation.

**Total may vary slightly due to rounding.

Net U.S. jobs created by eliminating currency manipulation, by congressional district (ranked by jobs gained as a share of total district employment under high-impact scenario)

| Scenario* | |||||||

|---|---|---|---|---|---|---|---|

| Low impact | High impact | ||||||

| Rank | State | District | District employment (2011 average) | Net jobs created | Jobs created as a share of state employment | Net jobs created | Jobs created as a share of state employment |

| 1 | California | 21 | 243,800 | 10,100 | 4.1% | 21,100 | 8.7% |

| 2 | California | 17 | 346,100 | 9,300 | 2.7% | 24,400 | 7.0% |

| 3 | Wisconsin | 6 | 353,600 | 9,900 | 2.8% | 23,800 | 6.7% |

| 4 | Indiana | 3 | 327,000 | 8,000 | 2.4% | 20,800 | 6.4% |

| 5 | Kansas | 4 | 332,900 | 9,800 | 2.9% | 21,000 | 6.3% |

| 6 | Indiana | 2 | 317,800 | 7,900 | 2.5% | 20,000 | 6.3% |

| 7 | Ohio | 4 | 317,900 | 8,000 | 2.5% | 19,700 | 6.2% |

| 8 | Nebraska | 3 | 305,600 | 8,500 | 2.8% | 18,800 | 6.2% |

| 9 | Wisconsin | 5 | 370,600 | 9,300 | 2.5% | 22,500 | 6.1% |

| 10 | California | 16 | 244,900 | 6,700 | 2.7% | 14,700 | 6.0% |

| 11 | California | 19 | 324,000 | 7,500 | 2.3% | 19,300 | 6.0% |

| 12 | Michigan | 6 | 310,400 | 7,700 | 2.5% | 18,400 | 5.9% |

| 13 | Illinois | 17 | 311,700 | 7,800 | 2.5% | 18,300 | 5.9% |

| 14 | Michigan | 10 | 308,700 | 7,400 | 2.4% | 18,100 | 5.9% |

| 15 | California | 20 | 302,500 | 8,000 | 2.6% | 17,700 | 5.9% |

| 16 | Wisconsin | 8 | 362,800 | 9,000 | 2.5% | 21,200 | 5.8% |

| 17 | Minnesota | 7 | 328,700 | 8,400 | 2.6% | 19,100 | 5.8% |

| 18 | Ohio | 8 | 328,800 | 8,000 | 2.4% | 19,100 | 5.8% |

| 19 | Washington | 4 | 284,500 | 7,600 | 2.7% | 16,500 | 5.8% |

| 20 | Iowa | 1 | 392,300 | 9,700 | 2.5% | 22,700 | 5.8% |

| 21 | Wisconsin | 1 | 342,500 | 8,200 | 2.4% | 19,800 | 5.8% |

| 22 | California | 18 | 344,500 | 7,700 | 2.2% | 19,900 | 5.8% |

| 23 | Indiana | 6 | 311,900 | 7,400 | 2.4% | 18,000 | 5.8% |

| 24 | Ohio | 7 | 326,800 | 7,500 | 2.3% | 18,800 | 5.8% |

| 25 | Michigan | 2 | 315,900 | 7,200 | 2.3% | 17,900 | 5.7% |

| 26 | Ohio | 14 | 349,700 | 8,300 | 2.4% | 19,800 | 5.7% |

| 27 | Wisconsin | 7 | 338,400 | 7,900 | 2.3% | 19,100 | 5.6% |

| 28 | South Carolina | 3 | 264,500 | 5,900 | 2.2% | 14,900 | 5.6% |

| 29 | Ohio | 5 | 334,200 | 7,600 | 2.3% | 18,700 | 5.6% |

| 30 | Oregon | 1 | 377,200 | 7,800 | 2.1% | 20,800 | 5.5% |

| 31 | California | 26 | 325,900 | 7,700 | 2.4% | 17,900 | 5.5% |

| 32 | Illinois | 16 | 330,800 | 7,700 | 2.3% | 18,100 | 5.5% |

| 33 | Minnesota | 3 | 353,800 | 7,800 | 2.2% | 19,300 | 5.5% |

| 34 | Iowa | 4 | 382,300 | 9,100 | 2.4% | 20,800 | 5.4% |

| 35 | Iowa | 2 | 373,400 | 8,500 | 2.3% | 20,300 | 5.4% |

| 36 | Indiana | 4 | 328,500 | 7,200 | 2.2% | 17,600 | 5.4% |

| 37 | Arkansas | 1 | 277,400 | 6,100 | 2.2% | 14,800 | 5.3% |

| 38 | Minnesota | 1 | 348,200 | 7,800 | 2.2% | 18,500 | 5.3% |

| 39 | Indiana | 1 | 310,600 | 6,800 | 2.2% | 16,500 | 5.3% |

| 40 | Pennsylvania | 3 | 317,700 | 6,800 | 2.1% | 16,700 | 5.3% |

| 41 | Alabama | 4 | 262,900 | 5,200 | 2.0% | 13,700 | 5.2% |

| 42 | Michigan | 7 | 299,100 | 6,200 | 2.1% | 15,500 | 5.2% |

| 43 | Kansas | 1 | 345,900 | 7,800 | 2.3% | 17,900 | 5.2% |

| 44 | Michigan | 3 | 315,300 | 6,500 | 2.1% | 16,300 | 5.2% |

| 45 | Massachusetts | 3 | 355,400 | 7,100 | 2.0% | 18,200 | 5.1% |

| 46 | Ohio | 16 | 355,600 | 7,400 | 2.1% | 18,200 | 5.1% |

| 47 | Ohio | 6 | 292,300 | 6,100 | 2.1% | 14,900 | 5.1% |

| 48 | Washington | 8 | 318,000 | 7,400 | 2.3% | 16,200 | 5.1% |

| 49 | Georgia | 14 | 290,700 | 5,400 | 1.9% | 14,800 | 5.1% |

| 50 | Arkansas | 4 | 295,100 | 6,000 | 2.0% | 15,000 | 5.1% |

| 51 | South Dakota | Statewide | 415,600 | 9,200 | 2.2% | 21,100 | 5.1% |

| 52 | Minnesota | 6 | 348,700 | 7,400 | 2.1% | 17,700 | 5.1% |

| 53 | Illinois | 14 | 351,000 | 7,300 | 2.1% | 17,700 | 5.0% |

| 54 | Idaho | 2 | 355,000 | 7,800 | 2.2% | 17,900 | 5.0% |

| 55 | Illinois | 18 | 337,500 | 7,400 | 2.2% | 17,000 | 5.0% |

| 56 | Wisconsin | 3 | 353,500 | 7,300 | 2.1% | 17,800 | 5.0% |

| 57 | Illinois | 10 | 324,800 | 6,500 | 2.0% | 16,300 | 5.0% |

| 58 | Texas | 12 | 337,500 | 6,800 | 2.0% | 16,900 | 5.0% |

| 59 | Illinois | 6 | 355,600 | 6,900 | 1.9% | 17,800 | 5.0% |

| 60 | Alabama | 5 | 311,900 | 6,400 | 2.1% | 15,600 | 5.0% |

| 61 | Michigan | 11 | 342,100 | 6,600 | 1.9% | 17,100 | 5.0% |

| 62 | Washington | 1 | 332,300 | 7,300 | 2.2% | 16,600 | 5.0% |

| 63 | Ohio | 13 | 320,400 | 6,200 | 1.9% | 16,000 | 5.0% |

| 64 | Washington | 2 | 318,900 | 7,300 | 2.3% | 15,900 | 5.0% |

| 65 | Michigan | 9 | 326,100 | 6,300 | 1.9% | 16,200 | 5.0% |

| 66 | Michigan | 4 | 286,300 | 5,700 | 2.0% | 14,200 | 5.0% |

| 67 | Indiana | 8 | 329,300 | 6,300 | 1.9% | 16,300 | 4.9% |

| 68 | California | 24 | 323,500 | 7,000 | 2.2% | 16,000 | 4.9% |

| 69 | Oregon | 2 | 314,200 | 6,500 | 2.1% | 15,500 | 4.9% |

| 70 | Pennsylvania | 5 | 316,800 | 6,200 | 2.0% | 15,500 | 4.9% |

| 71 | Illinois | 8 | 366,300 | 7,200 | 2.0% | 17,900 | 4.9% |

| 72 | Minnesota | 2 | 358,300 | 6,800 | 1.9% | 17,500 | 4.9% |

| 73 | South Carolina | 4 | 301,000 | 5,600 | 1.9% | 14,700 | 4.9% |

| 74 | Tennessee | 8 | 299,200 | 6,100 | 2.0% | 14,600 | 4.9% |

| 75 | South Carolina | 5 | 275,200 | 5,300 | 1.9% | 13,400 | 4.9% |

| 76 | California | 22 | 289,600 | 6,300 | 2.2% | 14,100 | 4.9% |

| 77 | Ohio | 9 | 315,000 | 6,200 | 2.0% | 15,200 | 4.8% |

| 78 | Kentucky | 2 | 317,100 | 5,700 | 1.8% | 15,300 | 4.8% |

| 79 | Missouri | 8 | 298,500 | 5,700 | 1.9% | 14,400 | 4.8% |

| 80 | Connecticut | 5 | 348,300 | 7,100 | 2.0% | 16,800 | 4.8% |

| 81 | Pennsylvania | 16 | 327,700 | 6,400 | 2.0% | 15,800 | 4.8% |

| 82 | Kentucky | 1 | 284,800 | 5,100 | 1.8% | 13,700 | 4.8% |

| 83 | Wisconsin | 4 | 308,000 | 5,800 | 1.9% | 14,800 | 4.8% |

| 84 | Texas | 36 | 291,900 | 5,900 | 2.0% | 14,000 | 4.8% |

| 85 | Oklahoma | 1 | 361,900 | 6,700 | 1.9% | 17,200 | 4.8% |

| 86 | Indiana | 9 | 339,400 | 6,500 | 1.9% | 16,100 | 4.7% |

| 87 | Tennessee | 1 | 297,600 | 5,700 | 1.9% | 14,100 | 4.7% |

| 88 | California | 50 | 296,200 | 5,900 | 2.0% | 14,000 | 4.7% |

| 89 | New Hampshire | 2 | 332,200 | 6,400 | 1.9% | 15,700 | 4.7% |

| 90 | Illinois | 15 | 316,500 | 6,100 | 1.9% | 14,900 | 4.7% |

| 91 | Oklahoma | 2 | 290,300 | 5,500 | 1.9% | 13,600 | 4.7% |

| 92 | California | 15 | 336,400 | 5,900 | 1.8% | 15,700 | 4.7% |

| 93 | Illinois | 4 | 326,600 | 6,000 | 1.8% | 15,200 | 4.7% |

| 94 | Pennsylvania | 15 | 343,800 | 6,500 | 1.9% | 16,000 | 4.7% |

| 95 | New York | 23 | 324,600 | 6,100 | 1.9% | 15,100 | 4.7% |

| 96 | Colorado | 4 | 344,100 | 6,500 | 1.9% | 16,000 | 4.6% |

| 97 | Arkansas | 3 | 327,000 | 6,000 | 1.8% | 15,200 | 4.6% |

| 98 | California | 46 | 314,400 | 5,100 | 1.6% | 14,600 | 4.6% |

| 99 | Washington | 9 | 341,400 | 6,900 | 2.0% | 15,800 | 4.6% |

| 100 | Oklahoma | 3 | 329,900 | 6,300 | 1.9% | 15,200 | 4.6% |

| 101 | Washington | 3 | 284,500 | 5,300 | 1.9% | 13,100 | 4.6% |

| 102 | New York | 27 | 337,800 | 6,400 | 1.9% | 15,500 | 4.6% |

| 103 | North Dakota | Statewide | 370,800 | 7,400 | 2.0% | 17,000 | 4.6% |

| 104 | Pennsylvania | 18 | 345,000 | 6,400 | 1.9% | 15,800 | 4.6% |

| 105 | North Carolina | 10 | 324,000 | 5,400 | 1.7% | 14,800 | 4.6% |

| 106 | Pennsylvania | 7 | 339,700 | 6,400 | 1.9% | 15,500 | 4.6% |

| 107 | Kentucky | 6 | 335,400 | 6,100 | 1.8% | 15,300 | 4.6% |

| 108 | Connecticut | 2 | 348,600 | 6,900 | 2.0% | 15,900 | 4.6% |

| 109 | Pennsylvania | 6 | 362,300 | 6,700 | 1.8% | 16,500 | 4.6% |

| 110 | California | 45 | 354,400 | 6,400 | 1.8% | 16,100 | 4.5% |

| 111 | California | 48 | 352,600 | 5,900 | 1.7% | 16,000 | 4.5% |

| 112 | Michigan | 8 | 330,800 | 5,800 | 1.8% | 15,000 | 4.5% |

| 113 | California | 25 | 302,700 | 5,700 | 1.9% | 13,700 | 4.5% |

| 114 | Texas | 3 | 371,200 | 6,300 | 1.7% | 16,800 | 4.5% |

| 115 | Missouri | 2 | 378,600 | 7,000 | 1.8% | 17,100 | 4.5% |

| 116 | Tennessee | 7 | 285,800 | 4,900 | 1.7% | 12,900 | 4.5% |

| 117 | Ohio | 2 | 323,600 | 6,000 | 1.9% | 14,600 | 4.5% |

| 118 | Virginia | 9 | 298,400 | 5,200 | 1.7% | 13,400 | 4.5% |

| 119 | Pennsylvania | 12 | 331,900 | 6,000 | 1.8% | 14,900 | 4.5% |

| 120 | Wisconsin | 2 | 390,000 | 7,300 | 1.9% | 17,500 | 4.5% |

| 121 | Idaho | 1 | 329,900 | 6,200 | 1.9% | 14,800 | 4.5% |

| 122 | Nebraska | 1 | 321,700 | 6,100 | 1.9% | 14,400 | 4.5% |

| 123 | Kentucky | 3 | 333,300 | 5,800 | 1.7% | 14,900 | 4.5% |

| 124 | Arizona | 5 | 317,900 | 5,700 | 1.8% | 14,200 | 4.5% |

| 125 | Michigan | 13 | 230,700 | 4,000 | 1.7% | 10,300 | 4.5% |

| 126 | Minnesota | 5 | 352,000 | 6,400 | 1.8% | 15,700 | 4.5% |

| 127 | Texas | 26 | 368,300 | 6,500 | 1.8% | 16,400 | 4.5% |

| 128 | Connecticut | 3 | 352,700 | 6,600 | 1.9% | 15,700 | 4.5% |

| 129 | Utah | 1 | 312,400 | 5,700 | 1.8% | 13,900 | 4.4% |

| 130 | Alabama | 3 | 274,600 | 4,500 | 1.6% | 12,200 | 4.4% |

| 131 | Texas | 29 | 292,900 | 5,200 | 1.8% | 13,000 | 4.4% |

| 132 | Texas | 13 | 309,000 | 5,700 | 1.8% | 13,700 | 4.4% |

| 133 | Pennsylvania | 4 | 342,900 | 6,200 | 1.8% | 15,200 | 4.4% |

| 134 | Missouri | 3 | 370,000 | 6,800 | 1.8% | 16,400 | 4.4% |

| 135 | Pennsylvania | 9 | 304,800 | 5,200 | 1.7% | 13,500 | 4.4% |

| 136 | California | 52 | 350,100 | 6,200 | 1.8% | 15,500 | 4.4% |

| 137 | Georgia | 9 | 284,600 | 5,000 | 1.8% | 12,600 | 4.4% |

| 138 | New Hampshire | 1 | 352,600 | 6,300 | 1.8% | 15,600 | 4.4% |

| 139 | Ohio | 1 | 332,300 | 6,000 | 1.8% | 14,700 | 4.4% |

| 140 | North Carolina | 1 | 291,800 | 5,300 | 1.8% | 12,900 | 4.4% |

| 141 | Tennessee | 4 | 314,500 | 5,100 | 1.6% | 13,900 | 4.4% |

| 142 | Missouri | 7 | 337,400 | 5,900 | 1.7% | 14,900 | 4.4% |

| 143 | Pennsylvania | 10 | 312,500 | 5,500 | 1.8% | 13,800 | 4.4% |

| 144 | Texas | 2 | 364,600 | 5,600 | 1.5% | 16,100 | 4.4% |

| 145 | Missouri | 6 | 355,900 | 6,500 | 1.8% | 15,700 | 4.4% |

| 146 | Kentucky | 4 | 333,500 | 5,800 | 1.7% | 14,700 | 4.4% |

| 147 | California | 10 | 277,200 | 5,300 | 1.9% | 12,200 | 4.4% |

| 148 | Tennessee | 6 | 304,500 | 5,200 | 1.7% | 13,400 | 4.4% |

| 149 | Texas | 8 | 309,200 | 5,300 | 1.7% | 13,600 | 4.4% |

| 150 | North Carolina | 9 | 371,400 | 6,300 | 1.7% | 16,300 | 4.4% |

| 151 | Illinois | 11 | 347,300 | 5,800 | 1.7% | 15,200 | 4.4% |

| 152 | Mississippi | 1 | 305,600 | 4,900 | 1.6% | 13,300 | 4.4% |

| 153 | Texas | 32 | 360,900 | 5,900 | 1.6% | 15,700 | 4.4% |

| 154 | Minnesota | 4 | 336,000 | 5,900 | 1.8% | 14,600 | 4.3% |

| 155 | Tennessee | 3 | 297,000 | 4,700 | 1.6% | 12,900 | 4.3% |

| 156 | Florida | 17 | 248,700 | 4,800 | 1.9% | 10,800 | 4.3% |

| 157 | Michigan | 1 | 290,200 | 5,200 | 1.8% | 12,600 | 4.3% |

| 158 | New York | 22 | 320,200 | 5,800 | 1.8% | 13,900 | 4.3% |

| 159 | Ohio | 11 | 275,200 | 4,800 | 1.7% | 11,900 | 4.3% |

| 160 | Ohio | 10 | 312,800 | 5,400 | 1.7% | 13,500 | 4.3% |

| 161 | New York | 24 | 327,300 | 5,800 | 1.8% | 14,100 | 4.3% |

| 162 | Michigan | 5 | 264,800 | 4,600 | 1.7% | 11,400 | 4.3% |

| 163 | Texas | 7 | 376,300 | 5,800 | 1.5% | 16,200 | 4.3% |

| 164 | Rhode Island | 1 | 250,900 | 4,300 | 1.7% | 10,800 | 4.3% |

| 165 | Oregon | 4 | 309,000 | 5,600 | 1.8% | 13,300 | 4.3% |

| 166 | Michigan | 12 | 313,800 | 5,300 | 1.7% | 13,500 | 4.3% |

| 167 | Texas | 24 | 388,600 | 6,600 | 1.7% | 16,700 | 4.3% |

| 168 | Texas | 33 | 283,900 | 4,500 | 1.6% | 12,200 | 4.3% |

| 169 | Connecticut | 1 | 349,800 | 6,300 | 1.8% | 15,000 | 4.3% |

| 170 | North Carolina | 5 | 324,500 | 4,900 | 1.5% | 13,900 | 4.3% |

| 171 | Mississippi | 2 | 266,900 | 4,800 | 1.8% | 11,400 | 4.3% |

| 172 | Georgia | 3 | 285,800 | 4,600 | 1.6% | 12,200 | 4.3% |

| 173 | California | 23 | 274,100 | 4,700 | 1.7% | 11,700 | 4.3% |

| 174 | South Carolina | 6 | 253,500 | 4,500 | 1.8% | 10,800 | 4.3% |

| 175 | North Carolina | 13 | 349,900 | 5,900 | 1.7% | 14,900 | 4.3% |

| 176 | Oregon | 5 | 326,700 | 5,900 | 1.8% | 13,900 | 4.3% |

| 177 | Texas | 14 | 303,300 | 5,600 | 1.8% | 12,900 | 4.3% |

| 178 | Minnesota | 8 | 303,400 | 5,300 | 1.7% | 12,900 | 4.3% |

| 179 | Pennsylvania | 8 | 357,800 | 6,200 | 1.7% | 15,200 | 4.2% |

| 180 | Texas | 6 | 348,800 | 5,600 | 1.6% | 14,800 | 4.2% |

| 181 | New York | 25 | 335,400 | 5,700 | 1.7% | 14,200 | 4.2% |

| 182 | Utah | 4 | 331,500 | 5,600 | 1.7% | 14,000 | 4.2% |

| 183 | California | 39 | 332,000 | 5,300 | 1.6% | 14,000 | 4.2% |

| 184 | New Jersey | 7 | 377,100 | 6,300 | 1.7% | 15,900 | 4.2% |

| 185 | Texas | 4 | 299,300 | 5,100 | 1.7% | 12,600 | 4.2% |

| 186 | Texas | 10 | 342,600 | 5,700 | 1.7% | 14,400 | 4.2% |

| 187 | Texas | 1 | 297,700 | 5,100 | 1.7% | 12,500 | 4.2% |

| 188 | North Carolina | 11 | 295,400 | 4,700 | 1.6% | 12,400 | 4.2% |

| 189 | Texas | 18 | 306,400 | 4,900 | 1.6% | 12,800 | 4.2% |

| 190 | California | 49 | 299,700 | 4,700 | 1.6% | 12,500 | 4.2% |

| 191 | California | 42 | 307,000 | 5,100 | 1.7% | 12,800 | 4.2% |

| 192 | Pennsylvania | 11 | 329,300 | 5,600 | 1.7% | 13,700 | 4.2% |

| 193 | South Carolina | 7 | 269,400 | 4,400 | 1.6% | 11,200 | 4.2% |

| 194 | Texas | 27 | 305,600 | 5,200 | 1.7% | 12,700 | 4.2% |

| 195 | Vermont | Statewide | 327,300 | 5,600 | 1.7% | 13,600 | 4.2% |

| 196 | Michigan | 14 | 257,700 | 4,200 | 1.6% | 10,700 | 4.2% |

| 197 | Massachusetts | 2 | 356,500 | 6,000 | 1.7% | 14,800 | 4.2% |

| 198 | North Carolina | 2 | 303,800 | 4,200 | 1.4% | 12,600 | 4.1% |

| 199 | Texas | 11 | 308,800 | 4,700 | 1.5% | 12,800 | 4.1% |

| 200 | Georgia | 2 | 251,200 | 4,300 | 1.7% | 10,400 | 4.1% |

| 201 | California | 44 | 270,600 | 3,300 | 1.2% | 11,200 | 4.1% |

| 202 | Colorado | 2 | 384,600 | 6,500 | 1.7% | 15,900 | 4.1% |

| 203 | Kansas | 2 | 339,900 | 5,700 | 1.7% | 14,000 | 4.1% |

| 204 | North Carolina | 8 | 301,700 | 4,100 | 1.4% | 12,400 | 4.1% |

| 205 | California | 35 | 284,800 | 3,900 | 1.4% | 11,700 | 4.1% |

| 206 | New Jersey | 5 | 356,100 | 5,600 | 1.6% | 14,600 | 4.1% |

| 207 | Florida | 8 | 283,400 | 4,900 | 1.7% | 11,600 | 4.1% |

| 208 | Indiana | 5 | 357,700 | 5,800 | 1.6% | 14,600 | 4.1% |

| 209 | Arizona | 9 | 360,300 | 6,100 | 1.7% | 14,700 | 4.1% |

| 210 | California | 5 | 326,800 | 5,500 | 1.7% | 13,300 | 4.1% |

| 211 | Iowa | 3 | 390,800 | 6,700 | 1.7% | 15,900 | 4.1% |

| 212 | California | 43 | 302,800 | 4,400 | 1.5% | 12,300 | 4.1% |

| 213 | Ohio | 12 | 359,500 | 6,000 | 1.7% | 14,600 | 4.1% |

| 214 | West Virginia | 1 | 258,700 | 4,300 | 1.7% | 10,500 | 4.1% |

| 215 | Washington | 7 | 380,000 | 6,500 | 1.7% | 15,400 | 4.1% |

| 216 | California | 32 | 293,800 | 4,000 | 1.4% | 11,900 | 4.1% |

| 217 | California | 29 | 303,700 | 4,400 | 1.4% | 12,300 | 4.1% |

| 218 | Georgia | 11 | 340,900 | 5,500 | 1.6% | 13,800 | 4.0% |

| 219 | Ohio | 15 | 336,400 | 5,400 | 1.6% | 13,600 | 4.0% |

| 220 | Illinois | 3 | 319,500 | 5,100 | 1.6% | 12,900 | 4.0% |

| 221 | Texas | 25 | 302,200 | 4,800 | 1.6% | 12,200 | 4.0% |

| 222 | Indiana | 7 | 312,200 | 5,000 | 1.6% | 12,600 | 4.0% |

| 223 | Georgia | 7 | 312,500 | 4,900 | 1.6% | 12,600 | 4.0% |

| 224 | Pennsylvania | 17 | 312,600 | 4,800 | 1.5% | 12,600 | 4.0% |

| 225 | Massachusetts | 4 | 374,800 | 5,900 | 1.6% | 15,100 | 4.0% |

| 226 | South Carolina | 2 | 305,600 | 5,000 | 1.6% | 12,300 | 4.0% |

| 227 | Missouri | 4 | 324,900 | 5,300 | 1.6% | 13,000 | 4.0% |

| 228 | Montana | Statewide | 480,000 | 8,200 | 1.7% | 19,200 | 4.0% |

| 229 | Illinois | 5 | 397,600 | 6,300 | 1.6% | 15,900 | 4.0% |

| 230 | California | 9 | 275,300 | 4,600 | 1.7% | 11,000 | 4.0% |

| 231 | Connecticut | 4 | 343,000 | 5,500 | 1.6% | 13,700 | 4.0% |

| 232 | Louisiana | 3 | 328,100 | 5,300 | 1.6% | 13,100 | 4.0% |

| 233 | Utah | 2 | 305,700 | 4,800 | 1.6% | 12,200 | 4.0% |

| 234 | Georgia | 12 | 278,200 | 4,300 | 1.5% | 11,100 | 4.0% |

| 235 | Illinois | 2 | 278,200 | 4,500 | 1.6% | 11,100 | 4.0% |

| 236 | Texas | 5 | 300,800 | 4,800 | 1.6% | 12,000 | 4.0% |

| 237 | Massachusetts | 1 | 341,000 | 5,600 | 1.6% | 13,600 | 4.0% |

| 238 | Washington | 5 | 291,500 | 4,900 | 1.7% | 11,600 | 4.0% |

| 239 | Nevada | 2 | 309,400 | 5,100 | 1.6% | 12,300 | 4.0% |

| 240 | Texas | 22 | 352,500 | 5,400 | 1.5% | 14,000 | 4.0% |

| 241 | South Carolina | 1 | 299,800 | 4,900 | 1.6% | 11,900 | 4.0% |

| 242 | Oregon | 3 | 383,300 | 5,600 | 1.5% | 15,200 | 4.0% |

| 243 | Massachusetts | 6 | 372,000 | 5,900 | 1.6% | 14,700 | 4.0% |

| 244 | West Virginia | 3 | 223,000 | 3,800 | 1.7% | 8,800 | 3.9% |

| 245 | Alabama | 2 | 276,900 | 4,200 | 1.5% | 10,900 | 3.9% |

| 246 | Arizona | 7 | 282,300 | 4,400 | 1.6% | 11,100 | 3.9% |

| 247 | Arizona | 3 | 262,200 | 4,300 | 1.6% | 10,300 | 3.9% |

| 248 | Pennsylvania | 13 | 339,000 | 5,100 | 1.5% | 13,300 | 3.9% |

| 249 | Illinois | 12 | 301,000 | 4,800 | 1.6% | 11,800 | 3.9% |

| 250 | Illinois | 13 | 326,600 | 5,400 | 1.7% | 12,800 | 3.9% |

| 251 | Texas | 31 | 323,000 | 4,700 | 1.5% | 12,600 | 3.9% |

| 252 | North Carolina | 7 | 315,400 | 5,000 | 1.6% | 12,300 | 3.9% |

| 253 | California | 33 | 364,200 | 5,200 | 1.4% | 14,200 | 3.9% |

| 254 | California | 41 | 271,900 | 4,100 | 1.5% | 10,600 | 3.9% |

| 255 | Georgia | 10 | 287,400 | 4,400 | 1.5% | 11,200 | 3.9% |

| 256 | Texas | 19 | 310,700 | 4,900 | 1.6% | 12,100 | 3.9% |

| 257 | Arizona | 1 | 264,900 | 4,500 | 1.7% | 10,300 | 3.9% |

| 258 | Georgia | 8 | 272,700 | 4,300 | 1.6% | 10,600 | 3.9% |

| 259 | Missouri | 5 | 345,300 | 5,400 | 1.6% | 13,400 | 3.9% |

| 260 | Maine | 1 | 340,400 | 5,400 | 1.6% | 13,200 | 3.9% |

| 261 | Georgia | 6 | 361,200 | 5,500 | 1.5% | 14,000 | 3.9% |

| 262 | New Jersey | 11 | 358,800 | 5,400 | 1.5% | 13,900 | 3.9% |

| 263 | California | 51 | 258,600 | 4,000 | 1.5% | 10,000 | 3.9% |

| 264 | California | 38 | 313,300 | 4,000 | 1.3% | 12,100 | 3.9% |

| 265 | Delaware | Statewide | 420,400 | 6,700 | 1.6% | 16,200 | 3.9% |

| 266 | California | 36 | 251,900 | 4,100 | 1.6% | 9,700 | 3.9% |

| 267 | Mississippi | 3 | 303,900 | 4,600 | 1.5% | 11,700 | 3.8% |