Job growth slowed dramatically in November as nonfarm payrolls increased by only 245,000. Holiday hiring didn’t pick up enough to make up for other factors dragging down job growth, and for the fifth month in a row, job gains waned with notable losses in retail hiring on a seasonally adjusted basis. The expiration of vital pandemic unemployment insurance (UI) benefits on December 26 will leave 12 million workers without a safety net, and over 4 million others will have already exhausted their benefits by this cutoff. This spells trouble not only for workers and their families who are desperately trying to keep a roof over their heads and put food on the table—especially with the eviction moratorium also set to expire on December 31—but also for the recovery itself. It didn’t have to be this way. If the suite of UI programs were reinstated and extended through 2021, workers would not lose that valuable safety net and it would spur the creation of 5.1 million more jobs in 2021.

The unemployment rate edged down to 6.7%, but for the “wrong” reasons as 400,000 people left the labor force. The number of workers unemployed 27 weeks or more—the long-term unemployed—shot up to 3.9 million in November. Now, over one-third (36.9%) of the total unemployed are long-term unemployed.

The recovery continues to wane because of the removal of important relief measures as well as the fact that the “easy” gains from workers on temporary layoffs continue to dwindle (temporary layoffs fell by 441,000 in November). Stark disparities remain in the labor market with the Black unemployment rate (10.3%) still higher than the peak of the overall unemployment rate in the Great Recession (10.0%) while white unemployment is now at 5.9%.

Public-sector employment continued to decline for the third month in a row. State and local employment remains 1.3 million jobs below its pre-pandemic level. Most of these losses are in education employment (which is down 1.0 million jobs since February). In addition to reinstating and extending the vital pandemic UI programs and other protections in the CARES Act (e.g. health measures, paid sick leave, eviction moratorium), relief and recovery efforts need to include aid to state and local governments, which face revenue shortfalls and costly forced austerity without federal assistance.

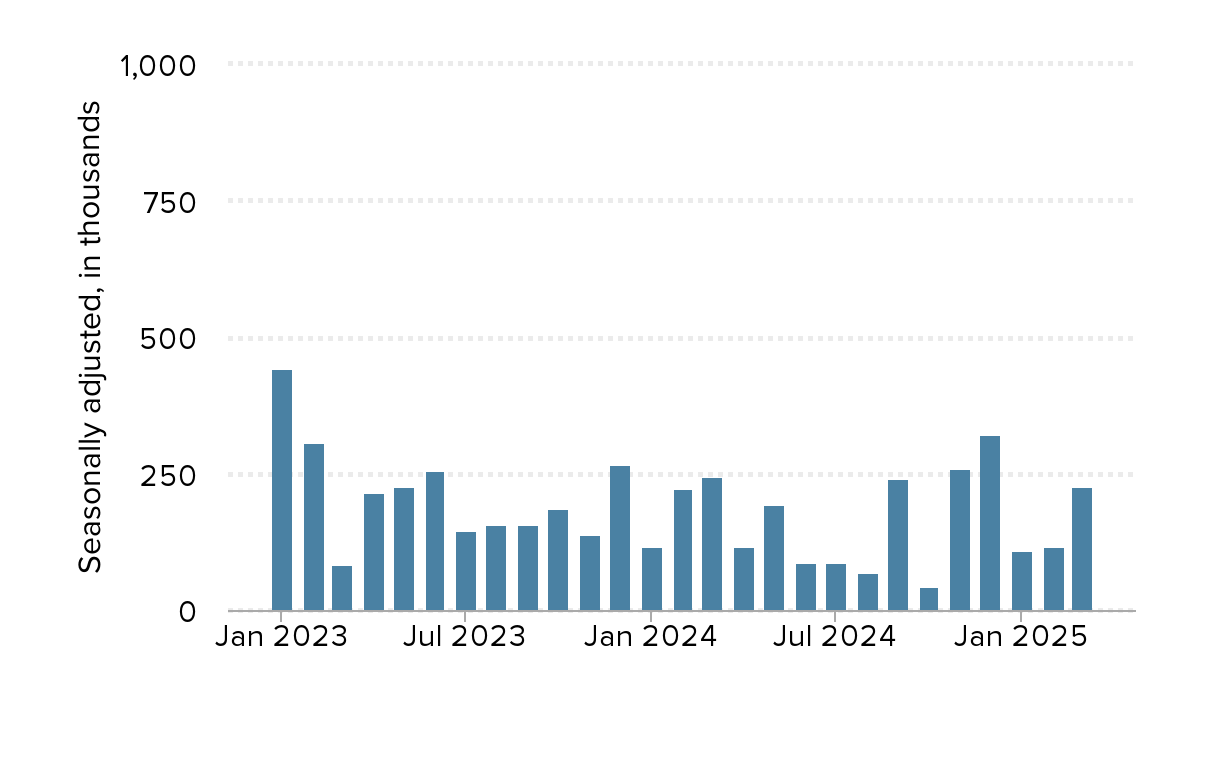

Monthly change in payroll employment, January 2023–April 2025

| Date | Change in Employment |

|---|---|

| Jan-2023 | 444 |

| Feb-2023 | 306 |

| Mar-2023 | 85 |

| Apr-2023 | 216 |

| May-2023 | 227 |

| Jun-2023 | 257 |

| Jul-2023 | 148 |

| Aug-2023 | 157 |

| Sep-2023 | 158 |

| Oct-2023 | 186 |

| Nov-2023 | 141 |

| Dec-2023 | 269 |

| Jan-2024 | 119 |

| Feb-2024 | 222 |

| Mar-2024 | 246 |

| Apr-2024 | 118 |

| May-2024 | 193 |

| Jun-2024 | 87 |

| Jul-2024 | 88 |

| Aug-2024 | 71 |

| Sep-2024 | 240 |

| Oct-2024 | 44 |

| Nov-2024 | 261 |

| Dec-2024 | 323 |

| Jan-2025 | 111 |

| Feb-2025 | 102 |

| Mar-2025 | 185 |

| Apr-2025 | 177 |

Source: EPI analysis of Bureau of Labor Statistics' Current Employment Statistics public data series.