A tight labor market and state minimum wage increases boosted low-end wage growth between 2019 and 2023

The labor market recovery from the pandemic recession has been tremendous and low-wage workers have been key recipients of those gains, with dramatically fast real wage growth between 2019 and 2023 as we found in our recent report. These gains were due in part to several large spending bills passed during the pandemic—including the vital American Rescue Plan—which provided relief to workers and their families to help them weather the recession and fed the surge in employment. After losing their jobs in record numbers during the initial shock of the pandemic, low-wage workers found better job opportunities and experienced unusually strong leverage to see fast wage growth as employers scrambled to hire workers in the recovery.

At the same time, 29 states and the District of Columbia raised their minimum wages between 2019 and 2023—either through legislation, ballot referendums, or indexing to inflation. We found that these state minimum wage increases also boosted low-end wage growth: 10th-percentile wages grew about 50% faster in states with minimum wage increases compared with states without any change in their minimum wage (see Figure A). It is also the case that low-wage workers experienced relatively fast wage growth in all states, regardless of changes to their minimum wage.

Wage growth was 50% faster for low-wage workers in states with increases to their minimum wage: Real wage growth at the 10th percentile among states grouped by presence of minimum wage increase, 2019–2023

| Presence of change | 10th percentile |

|---|---|

| No minimum wage change | 7.3% |

| Any minimum wage change | 11.0% |

Notes: Figure C details the list of states in each category. See EPI’s minimum wage tracker for the most current state-level minimum wage information. We exclude workers whose wages were allocated or imputed. The wage allocation model does not include state (Census 2021). This can mute or flatten differences in wages between states.

Source: EPI analysis of the Current Population Survey Outgoing Rotation Group microdata, EPI Current Population Survey Extracts, Version 1.0.48 (2024a), https://microdata.epi.org, and EPI analysis of state minimum wage laws.

States and localities have raised their minimum wages in response to federal inaction

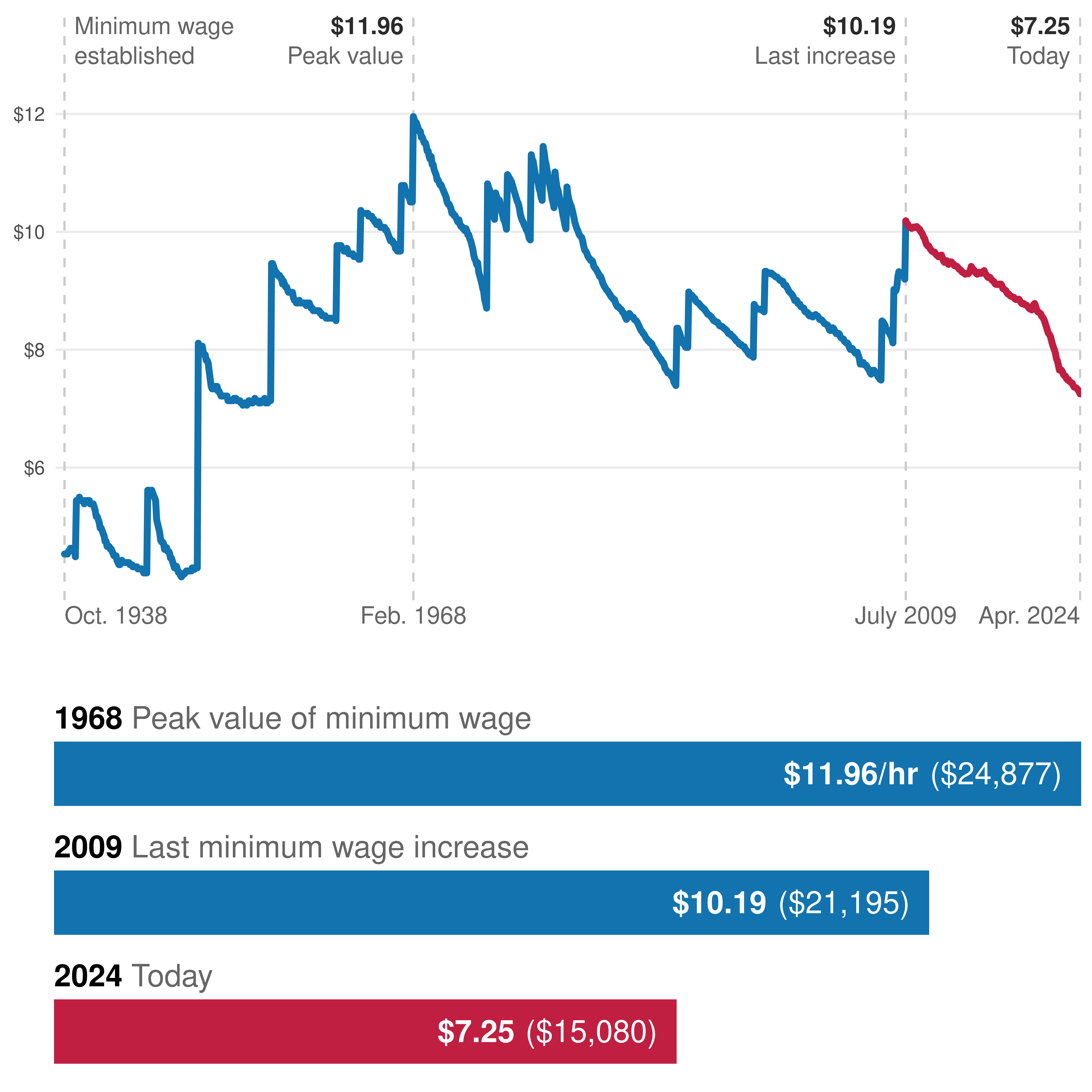

The federal minimum wage has been stuck at $7.25 an hour since 2009 and is now worth less than at any point since February 1956, more than 67 years ago. A worker paid the federal minimum wage earns 29% less in inflation-adjusted terms than a minimum wage worker in July 2009 and 39% less than a minimum wage worker in February 1968, the historical high point of the minimum wage’s value as shown in Figure B.

After the longest period in history without an increase, the federal minimum wage today is worth 29% less than 15 years ago–and 39% less than in 1968: Real value of the minimum wage (adjusted for inflation)

Notes: All values in March 2024 dollars, adjusted using the chained CPI-U since 2000, extended retroactively to the CPI-U-RS (1978-1999), CPI-U-X1 (1967–1977), and CPI-U (1966 and before).

Given the inadequacy of this wage to enable workers and their families to make ends meet, even with full-time hours, it’s not surprising that state policymakers and voters have enacted higher minimum wages than the federal minimum. Figure C shows the 29 states and DC that increased their minimum wage between 2019 and 2023. Thirteen states index their minimum wage to inflation, meaning they make automatic annual increases to the minimum wage based on the change in that year’s cost of living. This has been extremely valuable to low-wage workers in these states during recent years with high levels of inflation. It has meant the value of the minimum wage has roughly kept up with prices of goods and services that low-wage workers need for their livelihoods.

Already this year, ballot measures to raise the minimum wage have been proposed in Alaska, Missouri, Ohio, and Oklahoma. Those initiatives will get decided in the November election. On the legislative side, the Virginia legislature passed a measure to continue the set of increases that started in 2020 to raise the state’s minimum wage to $15 per hour by 2026, but Republican Governor Glenn Youngkin vetoed the measure.

The minimum wage is a crucial labor standard that serves as a valuable wage floor, bolsters the bargaining power of low-wage workers, and narrows wage gaps between workers by gender, race, and ethnicity. Strong labor standards—such as the minimum wage—work hand in hand with tight labor markets to provide faster wage growth for lower-wage workers.

The minimum wage increased in 29 states and the District of Columbia between 2019 and 2023: States minimum wage increases, 2019–2023

| State | Increase | Percent change key |

|---|---|---|

| Alabama | No increase | 0 |

| Alaska | Minimum wage increase | 1 |

| Arizona | Minimum wage increase | 1 |

| Arkansas | Minimum wage increase | 1 |

| California | Minimum wage increase | 1 |

| Colorado | Minimum wage increase | 1 |

| Connecticut | Minimum wage increase | 1 |

| Delaware | Minimum wage increase | 1 |

| Washington D.C. | Minimum wage increase | 1 |

| Florida | Minimum wage increase | 1 |

| Georgia | No increase | 0 |

| Hawaii | Minimum wage increase | 1 |

| Idaho | No increase | 0 |

| Illinois | Minimum wage increase | 1 |

| Indiana | No increase | 0 |

| Iowa | No increase | 0 |

| Kansas | No increase | 0 |

| Kentucky | No increase | 0 |

| Louisiana | No increase | 0 |

| Maine | Minimum wage increase | 1 |

| Maryland | Minimum wage increase | 1 |

| Massachusetts | Minimum wage increase | 1 |

| Michigan | Minimum wage increase | 1 |

| Minnesota | Minimum wage increase | 1 |

| Mississippi | No increase | 0 |

| Missouri | Minimum wage increase | 1 |

| Montana | Minimum wage increase | 1 |

| Nebraska | Minimum wage increase | 1 |

| Nevada | Minimum wage increase | 1 |

| New Hampshire | No increase | 0 |

| New Jersey | Minimum wage increase | 1 |

| New Mexico | Minimum wage increase | 1 |

| New York | Minimum wage increase | 1 |

| North Carolina | No increase | 0 |

| North Dakota | No increase | 0 |

| Ohio | Minimum wage increase | 1 |

| Oklahoma | No increase | 0 |

| Oregon | Minimum wage increase | 1 |

| Pennsylvania | No increase | 0 |

| Rhode Island | Minimum wage increase | 1 |

| South Carolina | No increase | 0 |

| South Dakota | Minimum wage increase | 1 |

| Tennessee | No increase | 0 |

| Texas | No increase | 0 |

| Utah | No increase | 0 |

| Vermont | Minimum wage increase | 1 |

| Virginia | Minimum wage increase | 1 |

| Washington | Minimum wage increase | 1 |

| West Virginia | No increase | 0 |

| Wisconsin | No increase | 0 |

| Wyoming | No increase | 0 |

Note: These minimum wage categories are based on changes in the nominal value of the minimum wage, not adjusted for inflation. In states with no changes, their minimum wage fell in real terms.

Source: EPI analysis of state minimum wage laws. See EPI’s minimum wage tracker for the most current state-level minimum wage information.

The minimum wage can protect equity gains created by the recovery

An important function of the minimum wage is to create a more equitable wage distribution where the lowest-paid jobs are not too far from middle-income jobs. From 1979 to 2017, the wage gap between the median worker and workers at the 10th percentile grew entirely because of the stagnating value of the federal minimum wage. Since 2019, the wages of low-wage workers have grown more quickly than the median worker, creating a more equitable wage distribution.

Because of occupational segregation and historical discrimination, low-wage workers are disproportionately Black and Hispanic. The rapid wage growth of recent years—as a result of a tight labor market and state minimum wage increases—has narrowed wage gaps between white, Black, and Hispanic workers.

To protect the equity gains created by the recovery, even states that have been raising their minimum wages can do more. States with ballot measures or legislative increases helped their low-wage workers, but inflation cut into the economic security these policies were meant to achieve. Some states are already reacting to this effect. In 2023, New York and Maryland passed new increases in recognition that they needed to either accelerate the scheduled increases or set higher targets in order to protect low-wage workers’ economic security. Without proactive action, when labor market conditions change to be less favorable to workers, the gap between low-wage and middle-income workers will likely grow again.

Even in a period of remarkable wage growth for low-wage workers overall, the minimum wage has still provided powerful support for workers. As the federal minimum wage continues to stagnate, states continue to be the standard bearers of progress on the minimum wage. States have a unique opportunity to protect the gains that low-wage workers achieved during the pandemic recovery by increasing their minimum wages before a change in economic conditions.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.