I. Executive summary

A small but dedicated group of economists, legal theorists, and political thinkers has promoted the argument that little if any labor market regulation is required to ensure the proper level of protection for occupational safety and health (OSH), because workers are fully compensated by higher wages for the risks they face on the job and that markets alone are sufficient to ensure this outcome. In this paper, we argue that such a sanguine perspective is at odds with the history of OSH regulation and the most plausible theories of how labor markets and employment relations actually function. In particular, the imbalance of power between employers and employees and lack of information alone prevent employees from obtaining safe working conditions in market transactions with employers. We also find that the empirical claims purportedly buttressing the free-market view do not stand up to scrutiny, and that the profound shortcomings of OSH performance in the United States, brought to vivid light by the current pandemic, are attributable to too little public intervention in labor markets, not too much.

In the English-speaking world, OSH regulation dates to the Middle Ages. Modern policy frameworks, such as the Occupational Safety and Health Act in the United States, are based on the presumption of employer responsibility, which in turn rests on the recognition that employers generally hold a preponderance of power vis-à-vis their workforce such that public intervention serves a countervailing purpose. Arrayed against this presumption, however, has been the classical liberal view that worker and employer self-interest, embodied in mutually agreed employment contracts, is a sufficient basis for setting wages and working conditions and ought not be overridden by public action—a position we dub the “freedom of contract” view. This position broadly corresponds to the Lochner-era stance of the U.S. Supreme Court and today characterizes a group of economists, led by W. Kip Viscusi, associated with the value-of-statistical-life (VSL) literature.

The theoretical basis for the VSL approach assumes a full-employment labor market in which no worker would willingly exchange their job for another they would be qualified to fill. This situation has little similarity to real world labor markets, which are typically in a state of excess supply (unemployment), where compensation for equally qualified workers varies substantially by industry and employer, and where outcomes are determined not only by initial contracts but also worker and employer performance over time. OSH is one dimension of employer performance.

The problem of ensuring safe and healthy work is not just theoretical. Although workplaces are much less dangerous now than they were 100 years ago, more than 5,000 people died from work-related injuries in the U.S. in 2018. The U.S. Department of Labor’s Bureau of Labor Statistics (BLS) reports that about 3.5 million people sustained injuries at work in that year. However, studies have shown that the BLS substantially underestimates injury incidence, and that the actual number is most likely in the range of 5-10 million. The vast majority of occupational diseases, including cancer, lung diseases, and coronary heart disease, go unreported. A credible estimate, even before the Covid-19 pandemic, is that 26,000 to 72,000 people die annually from occupational diseases.

Many high-risk workers are also poorly paid. For example, the 1.5 million nursing assistants, whose injury rates are over twice the workforce average, have median annual pay that barely exceeds the poverty level for a family of four, and the 2.16 million janitors and cleaners have median annual pay below the poverty level. In addition, temporary and short-term employment is associated with elevated injury rates, even within the same occupation.

There is also growing evidence that workers of color, particularly Black workers, have elevated injury risk because they are overrepresented in relatively hazardous occupations. This is the case even for workers of the same age, education, and sex as their white counterparts. Structural racism is a likely cause of these disparities.

When workers are injured, they incur substantial financial and nonfinancial burdens. Injuries involving a week or more off work lead to average lost earnings of around 20% over at least 10 years following injury. Only between one-half and three-fourths of injured workers eligible for workers’ compensation cash benefits actually receive them. For those who do, less than a fifth of lost wages are replaced.

Many families do not have adequate liquid savings or access to credit. As a result, financial losses caused by occupational injuries and illnesses can lead to difficulty covering everyday expenses, including rent or mortgage payments, car payments, and even food. Latinx and Black workers are much less likely than white workers to have adequate savings to cover these expenses.

Injury impacts stretch beyond the financial. Injured workers experience limitations in household roles, including those as spouse and parent. They suffer post-injury depression and opioid use disorder. They also die at higher rates than their fellow employees from causes including suicide and drug overdose.

The United States stands poorly in international comparisons of work-related fatal injury rates. The U.S. rate is 10% higher than that of its closest rival, Japan, and six times the rate of Great Britain. This difference cannot be explained by differences in industry mix: The U.S. rate for construction is 20% higher, the manufacturing rate 50% higher, and the transportation and storage rate 100% higher than that of the E.U.

This is the real world context of statistical studies claiming to find wages compensating for voluntarily accepted OSH risk. Following Viscusi, such researchers employ regression models in which a worker’s wage, typically its natural logarithm, is a function of the worker’s demographic characteristics (age, education, experience, marital status, gender) and the risk of occupational fatality they face. Using census or similar surveys for nonrisk variables and average fatal accident rates by industry and occupation for risk, these researchers estimate the effect of the risk variable on wages, which they interpret as the money workers are willing to accept in return for a unit increase in risk. This exercise provides the basis for VSL calculations, and it is also used to argue that OSH regulation is unnecessary since workers are already compensated for differences in risk.

This methodology is highly unreliable, however, for a number of reasons:

- It rests on assumptions regarding risk perception and behavior at variance with most research.

- It assumes workers are accurately informed about the risks they face by employers who have an incentive to conceal them.

- It ignores extensive existing regulation of OSH risk and the effects this regulation has on choices made by workers and employers.

- The risk variable, on which the entire empirical strategy depends, is mismeasured: It applies large-group averages to the individual level, and it excludes fatal diseases, which are far more numerous than fatal accidents.

- It suffers from omitted variable bias; in particular, omission of employer- and industry-level variables likely results in very large overestimation of compensation for risk.

- It fails to adequately incorporate the different labor market experiences of men versus women, white workers versus workers of color, and other relevant distinctions.

Given these issues, it is striking that hazardous working conditions are the only job characteristic for which there is a literature claiming to find wage compensation.

While the findings of individual studies have little credibility, the pattern of results across different samples might convey useful information. If so, we note that greater compensation has been found for white, native-born, unionized, and higher-paid workers than for their Black, immigrant, nonunion, and lesser-paid counterparts—suggestive of the role of social and economic power differentials.

The shortcomings of the U.S. OSH system have been laid bare by the novel coronavirus pandemic. Workplaces in meatpacking and other industries have functioned as superspreading venues, and broader surveys reveal widespread worker concern over exposure. Key underlying factors include limited employer protection efforts, the failure of OSHA to assume regulatory responsibility, the inadequacy of occupational disease surveillance, the absence of a social safety net that would permit lower-paid workers to take time off from work if they test positive or have been exposed to identified cases, insufficient coverage by the workers’ compensation system, the lack of hazard pay for workers at greatest risk, and the unequal distribution of risk along lines of race and class. The policy measures needed to protect workers during the pandemic reflect a larger agenda that preceded this episode and will remain after it is over: Raising the bottom end of the labor market to acceptable levels of wages and productivity; revamping labor laws to encourage unionization; rebuilding the occupational and public health infrastructure; taking assertive action to combat discrimination on the basis of race, ethnicity, and immigrant status; and embarking on initiatives to enhance worker voice in the 21st-century economy.

II. Introduction

By early summer of 2020 wildcat strikes or other job actions were underway at over 900 workplaces across the United States, largely over issues of health and safety related to the novel coronavirus (Payday Report 2020). Workers were demanding timely information, protective equipment, and changes in work arrangements to reduce their risk of infection and resorting to collective action to bring the changes about. As the confrontational nature of these events makes clear, employers did not always go along.

How should we understand such conflicts over health and safety at work? What do they tell us more generally about fairness, efficiency, and the role of inequality and power in employment? This paper examines these questions by reviewing a longstanding debate about occupational safety and health (OSH): Is it an obligation that ought to be assumed by employers, or do competitive markets under a presumption of equal power between employers and employees ensure safe conditions and adequate compensation for any risks that would be too costly to eliminate? As we will see, in modern economics our answer to this question often comes down to whether or not we believe workers are fully compensated for the risks they encounter at work, compensation they might reasonably demand if they could negotiate with employers from a position of approximate equality.

In this paper we will argue:

- The “freedom of contract” view of occupational safety and health fails both theoretically and econometrically. It is based on an inherently implausible view of labor markets and the employment relationship, and it is not supported by the empirical evidence.

- The inadequacy of the free market view is not a secondary matter. Rather, the failure of unregulated markets to ensure adequately safe working conditions and health equity for the workforce has urgent health as well as economic consequences, including those now visible as a result of the ongoing pandemic.

We will begin by briefly reviewing the history of OSH regulation in the English-speaking world, highlighting the changing assumptions on which regulation has been based. This will lead to an examination of modern theoretical perspectives on the employment relationship and its health and safety aspects, and we will contrast the anti-regulatory view held by some economists with alternatives that recognize power imbalances between workers and employers. In the following section we will document the extent and distribution of occupational injury and disease, demonstrating that their impact reflects and exacerbates economic and social inequality. It will be clear from our review of the evidence that, even in a technologically advanced economy like that of the United States, the toll of workplace accidents, illnesses, and deaths remains unacceptably high. After this we will turn to the “value of statistical life” (VSL) literature, which supposedly documents substantial wage compensation for risk, and expose problems in theory, measurement, and methodology. Moreover, we will show that, even on its own terms, this literature presents evidence for the importance of centering workplace inequalities when assessing compensation for risk: More-vulnerable workers (i.e., low-wage, Black, and/or immigrant) not only face greater risk on the job but also receive less compensation for it. In the final section we will return to a discussion of health and safety at work in the age of Covid-19, demonstrating how our analysis is applicable to this extraordinary episode.

One clarification about terminology: In this paper we will use the term freedom of contract to refer to the labor market perspective underlying the presumption that OSH risks are fairly and efficiently negotiated between workers and employers on an equal footing. Strictly speaking, this usage is not quite precise, since freedom of contract is a concept drawn from legal theory and is intrinsically normative, not necessarily descriptive of any particular labor market setting. In practice, however, there is a close correspondence between the legal and economic perspectives. Advocates of freedom of contract generally make the following assumptions about how labor markets work: (1) labor markets are in a more or less continuous equilibrium in which labor supply equals labor demand, (2) all relevant aspects of employment are determined in the initial moment of contractual agreement, (3) there is no regulation of the legal rights and obligations of the employment relationship on either side, (4) social norms and hierarchies are either nonexistent or can be regarded as fixed and are therefore ignorable background influences on individual choice, and (5) in the absence of regulation (or possibly excessive market concentration) the concept of power is inapplicable. In addition, in the context of OSH it is further assumed that risk to life and health is an ordinary consumption good, evaluated on a single dimension (from less to more) and without regard to additional social or psychological considerations. There is no generally accepted term that represents this constellation of assumptions, but, since certain strands of legal and economic thinking align so closely, we have chosen to use the legal designation. Of course, freedom of contract as an idealization applies to the entire range of economic outcomes in which markets play or could play a role, not just the labor outcomes we consider here (Atiyah 1979).

III. Two views of the risk of injury and illness at work

Under English common law dating from the Middle Ages, masters were deemed to be responsible for ensuring that work was acceptably safe for their servants (Henshaw et al. 2007). The underlying philosophy was paternalism, based on the view that masters were more knowledgeable, commanded more resources, and assumed reciprocal obligations because they benefited from their servants’ devotion. Acceptability meant that risks should be no more than typical of such employments, so if disputes made their way to court the relevant evidence consisted of comparisons between the working conditions of this particular master and his peers. Indeed, paternalistic entailments limited the scope of contractual freedom over a wide swath of social and economic life (Atiyah 1979).

Gathering force in the 17th and 18th centuries, however, was a new doctrine, freedom of contract. Under this view, parties are assumed to act in their best interest in the marketplace or, if they don’t, they must be made to suffer the consequences so they will learn to do so in the future. Thus, neither party is to be regarded as having obligations toward the other except insofar as they have agreed to them, and both sides to a contract are free to agree to any terms they choose. The only role of the state is to enforce the terms of such contracts on parties that resist carrying them out. Applied to matters of health and safety at work, this view entailed rejection of the paternalistic view that masters (employers) had inherent obligations to protect servants (workers), relying instead on the judgment both should exercise in pursuing their separate interests. Thus was born the notion of occupational risk as the outcome of a mutual, and presumably optimal, employment agreement (Atiyah 1979).

It is important to recognize that these new terms do not describe an evolution in which one view of OSH was progressively supplanted by another. On the contrary, with changes in the economic role of business, repeated revolutions in technology, and the emerging centrality of the employment relationship in modern life, a version of the older employer responsibility approach to OSH took on new life and became, in one form or another, the dominant understanding by the end of the 19th century (Henshaw et al. 2007). Rather than resting on the paternalism of medieval caste hierarchies, however, the modern view had these elements:

- It recognized that technology had become far more complex and opaque, with serious new dangers best regulated at their source. This meant that businesses had to take worker health and safety into account when devising new methods and products.

- It increasingly viewed the workplace as a sort of society, with workers at least partly in the role of citizens. Thus, the exercise of care by the employer was demanded because it reflected the reciprocity and mutual concern on which industrial cooperation ought to be based.

- It acknowledged the disparity of power between business owners and workers, especially in times of excess labor supply. Indeed, the worst-off workers, those with the least education and fewest outside options aside from their current job, were visibly subjected to barbarous conditions in the absence of social protection (Mill 1871).

For these reasons, the employer responsibility view of OSH freed itself from the ancient noblesse oblige paternalism of the law of masters and servants.

Employer responsibility was codified in the British Factory Acts beginning in 1833, and it crossed the Atlantic after the American Civil War. Massachusetts became the first state to regulate working conditions in 1877, and in the decades that followed nearly every other state followed suit (MacLaury, undated). This is not to say that regulation was sufficient; horrendous conditions could be found in mining, railroads, and meatpacking, as well as manufacturing. The political debate, however, was not over whether some measure of regulation was necessary but where and how much.

Workers often took the initiative to demand responsibility from their employers when the government failed to take action. Along with wages, the call for greater safety on the job was a prime motivator for the unionization drives of the late 19th and early 20th centuries. Eventually labor movement pressure resulted in the Occupational Safety and Health Act of 1970, which created the Occupational Safety and Health Administration (OSHA) and initiated a nationally harmonized system of workplace standards, record-keeping, inspection, and enforcement. It would not be an exaggeration to say that the employer responsibility view of OSH is the law of the land.

A small but dedicated group of economists, legal theorists, and political thinkers, however, resisted this tide.1 They drew on the contract-centered ideal of classical liberalism to argue that government regulation of working conditions was unnecessary, since they were already regulated efficiently by competitive markets. Workers who felt that a particular employer was too inattentive to safety could look for other work more to their taste. Employers, feeling the pressure of worker preferences, would have to invest in better working conditions, offer extra wages or other compensation for the risks they asked workers to undergo, or both. Indeed, labor market agreements drawn up by self-interested individuals aware of their own circumstances and preferences were believed to offer the best form of regulation; government interference could never improve such outcomes and would most likely make them worse.

There is debate among legal scholars over the extent to which such classically liberal ideas were influential in judicial oversight of the emerging regulatory state. In most cases courts upheld the regulation of working conditions, but the most important exception, Lochner v. New York (1905), established a precedent that held for three decades. John Lochner was a baker who challenged New York state regulation of working hours in his industry; state courts upheld the rule, but the U.S. Supreme Court deemed it an infringement on the right of individuals to “purchase and sell labor” (Rosner and Markowitz 2020). Yet even in this ringing assertion of freedom of contract the court was at pains to argue that employer responsibility for safety was unaffected: “To the common understanding the trade of a baker has never been regarded as an unhealthy one” (Justice Peckham, cited in Bale 1988). Regardless, the reversal of the Lochner precedent by the New Deal era court has generally been seen as the end of strict freedom of contract as applied to OSH and related aspects of employment.

It is remarkable, then, that beginning in the 1970s a research project arose in economics to estimate the amount of extra pay received by workers in exchange for bearing greater occupational safety and health risks. The research was based on the assumption that such risks were voluntarily agreed upon by self-interested parties and reflected their corresponding preferences. In other words, these economists assumed a Lochner, freedom-of-contract world and erected an edifice of theory and statistical research on top of it. This approach has proved to be an influential strand of analysis and advocacy, and one of the main purposes of this paper is to scrutinize it in the larger context of what we know about labor, employment relations, and the role of unequal bargaining power.

Here we will briefly summarize the freedom-of-contract approach to OSH that has gained a foothold in economics in order to see how it fits into the long evolution of thinking on this question—or doesn’t. In a later section of the paper we will return to give it much more careful scrutiny.

As presented by its chief advocate, W. Kip Viscusi, over a series of many books and articles, the contract-centered view takes the following forms. To begin with, it is assumed that the national labor market comprises innumerable markets for specific types of labor, each properly modeled as a relationship between supply (workers with particular productivity-related attributes offering their labor) and demand (employers offering pay for particular jobs). Each market clears where supply equals demand, establishing a single level of compensation for all labor of that type.

If there were no compensation except for money wages, a single wage would be paid to each type of worker; economists refer to this as the “law of one price,” which is thought to hold in competitive markets. (There are reasons why such a law might be violated even under conditions of unrestricted competition, but we won’t consider them here.) But now let us also suppose workers care not only about the wages they are paid but also the working conditions they will experience. From the employer’s point of view (in this theory), improvements in these conditions, including OSH, are expensive. Since productivity is assumed to be equal across firms (the result of competition), and all excess or deficient rates of profit will be competed away, all employers appearing as purchasers of labor in a given labor market will pay the same wages-plus-working-conditions expense. In this sense the law of one price remains in effect.

On the worker’s side it is a bit more complicated. Workers care about safety, so any job that is more dangerous than the available alternatives—the ones offered to workers of the same productivity type—has to pay a higher wage, otherwise it would get no takers. Of course, workers differ individually in how they trade off the benefits of income against the costs of risk, so in subjective terms there isn’t a law of one price anymore; a given worker will likely find one job offer more appealing than another, since it better matches that worker’s own subjective tradeoff. Nevertheless, in the new equilibrium of job offers and acceptances, no workers in the equation would willingly exchange their employment for any other offered to workers of their productivity. Any truly better job, one that offered a preferred combination of wages and working conditions, perhaps better in both respects, would be available only to those with more marketable productivity attributes than theirs.

Thus, in the freedom-of-contract world every labor market, comprising workers of the same type, would display a range of wages and working conditions corresponding to different costs of making work safer (employers) and subjective benefits from safety (workers). Riskier jobs would pay more and would be preferred by more risk-tolerant workers. The extra amount of money employers in this hypothetical world must pay to attract a labor force if their jobs are more dangerous is called a compensating wage differential (CWD). It is important to note that the story underlying this term requires that the CWD be fully offsetting; if it isn’t, the job in question won’t be filled. We will see that this backstory plays a critical role in the interpretation given to statistical findings: Economists wedded to the freedom-of-contract view regard any evidence of wage compensation for risk as a measure of the full value placed on safer work that extra wages are needed to replace. Since we are not beholden to this view ourselves, however, we are able to imagine partial compensation for risk—a monetary increment that might be given to workers laboring under more dangerous conditions that nevertheless leaves them worse off than they would have been had those conditions been improved instead.

Returning to the freedom-of-contract story, it’s worth spending a moment to consider how far-reaching the consequences of this set of assumptions must be. First, the level of safety in every single job would be efficient. Employers would make all investments that result in safety improvements that workers value (and are willing to accept correspondingly lower wages for) above the cost of implementing them, and none whose cost exceeds workers’ valuations. Employers with high costs of making jobs safe would offer more dangerous jobs but pay higher wages; workers with a higher tolerance for risk would accept more dangerous work but would be compensated with the additional wages they require. No regulator would be able to make any alteration that would improve the level and allocation of safety at work. Second, all workers who offer labor of the same type would end up at jobs they value at least as highly as any other they might qualify for. Some would get more dangerous jobs and more pay, others less on both counts, but no one would prefer to switch. Regulation would not be needed to protect anyone from anything. Third, by reflecting workers’ subjective valuation of occupational risk, CWDs could be used to estimate a value of statistical life for society in general insofar as workers are representative of the whole population. If the equilibrium CWD is $1,000 for a 1-in-10,000 increase in the risk of death on the job, the VSL would be $1,000 times 10,000 or $10 million. This third property of CWDs has given economists like Viscusi prominence in the world of public policy analysis, and estimates of compensating differentials are factored into regulatory decisions ranging from air pollution to vehicle speed to climate change mitigation.

Despite the publicity given to this strand of modeling, specialists in labor market research have long known that the law of one price for employers and the no-switch condition for workers are routinely violated; workers of similar observable skills doing essentially the same work under comparable conditions are typically paid quite differently, and sometimes those with lower wages also face greater occupational risks. There are better and worse jobs, and much of the modeling and econometric work of the past several decades has been devoted to trying to understand the forces behind these outcomes and what they imply for public policy. The starting point was the work of Richard Lester in the 1940s, such as “Wage Diversity and Its Theoretical Implications” (1946). It was clear that the simple supply-and-demand story could not be an adequate account of how labor markets operate, since competition should enforce equal compensation for equally productive workers.2

In subsequent years many approaches have been put forward. Some depend on dropping the assumption of perfect competition by dividing either firms, workers, or both into more- versus less-favored segments (Dickens and Lang 1993). Since the 1980s, one wage dispersion of interest has been that of inter-industry (and now also intra-industry) wage differentials. Other economists have revolutionized market analysis by looking more carefully into “search theory,” i.e., how workers search for jobs and employers search for workers. Two progenitors of this approach, Christopher Pissarides and Dale Mortensen, were awarded a Nobel Memorial Prize in Economics in 2010 in recognition of the centrality of the approach to modern labor economics, particularly at the macro level.3 In search models, as we will see, it is expected that the law of one price will be violated, a point emphasized in Mortensen (2003). Yet another approach foregrounds bilateral bargaining between employer and worker, either individually or in the context of collective bargaining. This process is referred to as “rent-sharing,” and bargaining models are often grafted onto underlying mechanisms, such as barriers to competition, that give rise to rents themselves. Meanwhile, closer collaboration between economists and management scholars has generated a range of modeling strategies that incorporate more complex and realistic employer choice options. These include “efficiency wage” models (pay for performance and not just showing up) and incorporation of on-the-job training and other investments or practices that use human resources as a basis for competitive advantage.4 Finally, there has been extensive research into the role of racial, gender, and other forms of discrimination in generating unequal outcomes for workers of comparable productivity.5

Nevertheless, despite all these important theoretical insights, a word of caution is in order. For institutional and other reasons we will not consider here, economists working on a particular departure from the freedom-of-contract model typically treat it as the only such departure; its significance is thought to be the difference it alone would make. Thus, we see an array of labor market models in the literature that are at variance with the freedom-of-contract approach only in one respect even though, taken together, they would point to a radically different vision. This strategy is important in practice because it is common for economists to propose policy responses that address only the single “imperfection” they are studying, and these frequently fall short of the scope of commitment embodied in regulatory interventions like OSHA. Without going into detail, we would like to explicitly stipulate a core set of characteristics of the employment relationship that, in combination, remove it decisively from the freedom-of-contract world:

- All employment contracts are necessarily incomplete. Worker and employer performance cannot be fully specified in advance, and thus an ongoing relationship with procedures for designating required, permissible, and prohibited activities is inescapable.

- The rights, opportunities, and obligations pertaining to each worker individually depend on those for their co-workers, including those above and below them in the chain of hierarchy. Thus, separate individual agreements (contracts) extending to all terms of the employment relationship are not feasible.

- Because of incomplete contracting, what workers sell is their subordination to the employer. This subordination is bounded, of course, by their freedom to terminate, but it is usually so costly for workers to exercise this option that they often accept substantial depredations and still remain on the job. This is the core power imbalance between worker and employer.6

- In all societies, employment is a legal status with associated rights and responsibilities for both parties. The ability to benefit from the provisions of this status also differs among workers for both legal and socioeconomic reasons, constituting another dimension of power.

- Provision of safe working conditions is largely a matter of ongoing performance and not a once-and-for-all commitment made at the moment of contract. In practice it entails such activities as housekeeping and maintenance, work pacing and scheduling, honest and timely risk communication, and the consideration of health and safety factors in the introduction of new materials and technologies. The determination of safe working conditions is subject to voice as well as exit influences from the workforce (Hirschman 1970).7

- Thus, regulatory systems like OSHA, which contribute to the legal status of employment, are essential. They reduce the effect that differences in power would otherwise have on safety and health outcomes, strengthening the ability of workers to engage in individual (whistleblowing) and collective action, and creating legal and financial incentives for improved employer performance. The necessity of regulation can mostly clearly be seen in its breach, as we will document in our concluding section on the coronavirus pandemic. If an economic model has the property that OSH regulation is generally unnecessary or even harmful, this points to a defect with the model, not regulation.

These foundations of our alternative view of OSH and employment do not negate the role of markets but supplement it. Employer costs and worker preferences do matter in the ways specified in market analysis, but they comprise only part of the story. We prefer to consider the theoretical departures of search theory, behavioral economics, and other branches of modern economics as extensions of an institutionally complex view of the employment relationship, not a stripped-down freedom-of-contract benchmark.

IV. The real world of dangerous work in the United States

A. The overall risk to the working population

In this section, we will summarize information about the extent, severity, and impact of injuries and illnesses related to work. We will see that there are a considerable number of work-related injuries and illnesses in the U.S. and that their financial and health impacts are substantial. We will also see that the impacts of these injuries tend to be unequally distributed, concentrated among lower-wage workers, Black and Latinx workers, and temporary, contracted, and online platform workers. In the United States, we have good information about fatal injuries at work, but we know less about nonfatal injuries. Moreover, we have only very indirect ways of trying to capture the extent of work-related illnesses, which are, by far, the largest category of risk.

1. Fatal injuries

Before 1980, the only source of occupational fatality data in the U.S. was the annual Survey of Injuries and Illnesses (SOII) conducted by the Bureau of Labor Statistics (BLS). In principle, the SOII covers all employers except for agricultural employers with fewer than 10 employees and federal government employees (whose injuries are reported separately). Employers are the only source of information for the SOII, so it depends on their diligence and willingness to report. From 1980 through 1991, the National Institute for Occupational Safety and Health (NIOSH) implemented a new source of occupational fatality data, the National Traumatic Occupational Fatality database (NTOF). The NTOF used death certificates, rather than employer reports, as a source of occupational fatality data. Unlike the SOII, it included all employment, including employees of small employers and the self-employed. It found much higher fatality numbers than reported by the SOII, particularly in the high-risk agriculture and construction sectors (Stout-Weigand 1988; Leigh and Garcia 2000).

Since 1992, U.S. national data about work-related fatalities have been collected by the BLS and published as the Census of Fatal Occupational Injuries (CFOI). The CFOI includes fatal injuries of both employees and independent workers (the self-employed and online platform workers). It is generally acknowledged to be a virtually complete accounting of these deaths and includes worker demographic information, industry, and injury characteristics. Figure A shows that, from 1992 through 2009, the annual number of fatal on-the-job injuries was generally declining, from over 6,000 to a little over 4,500. However, after four years of little change, the number of fatalities rose in 2014-2018. Because the number of people working rose during that period, the fatality rate remained about the same, 35 fatalities per million full-time workers. In 2018, 5,250 workers died from injuries at work. Another way of looking at this is that an American worker died on the job every 100 minutes.

Annual number of fatal occupational injuries, 1992–2018

| Year | Fatal occupational injuries |

|---|---|

| 1992 | 6,217 |

| 1993 | 6,331 |

| 1994 | 6,632 |

| 1995 | 6,275 |

| 1996 | 6,202 |

| 1997 | 6,238 |

| 1998 | 6,055 |

| 1999 | 6,054 |

| 2000 | 5,920 |

| 2001 | 5,915 |

| 2002 | 5,534 |

| 2003 | 5,575 |

| 2004 | 5,764 |

| 2005 | 5,734 |

| 2006 | 5,840 |

| 2007 | 5,657 |

| 2008 | 5,214 |

| 2009 | 4,551 |

| 2010 | 4,690 |

| 2011 | 4,693 |

| 2012 | 4,628 |

| 2013 | 4,585 |

| 2014 | 4,821 |

| 2015 | 4,836 |

| 2016 | 5,190 |

| 2017 | 5147 |

| 2018 | 5250 |

Source: U.S. Department of Labor, Bureau of Labor Statistics (U.S. DOL-BLS 2020b).

2. Nonfatal injuries

Surprisingly, no source provides an accurate count of the number of nonfatal injuries in the U.S. The only national source of information for the number and rate of nonfatal occupational injuries is the BLS’s annual SOII, which reported that 3.5 million work-related injuries and illnesses occurred in the private sector and state and local government in 2018. This translates into 3.1 injuries per 100 full-time workers. However, as noted above, the SOII omits self-employed and online platform workers, somewhere between 8% and 10% of total employment, and it also omits federal employees and workers on small farms. Although it does not omit household employees, their work-related injuries may escape reporting. Even for covered workplaces, researchers, the Government Accountability Office (GAO 2009), and the BLS itself (Ruser 2008) have agreed that it misses many injuries. This under-recording is not random, but is affected by many factors, including industry, occupation, duration of time off work, type of injury, and the state where the injury occurred (Boden, Nestoriak, and Pierce 2010; Boden and Ozonoff 2008; Fan et al. 2006). Also, as noted above, the SOII data are submitted to BLS and OSHA by employers only, a practice that may limit completeness of reporting (Rappin, Wuellner, and Bonauto 2016).

Injuries are underreported by workers, employers, and medical providers. Reasons for worker underreporting include fear of current and future employer retribution, employer bonuses for zero reported injuries (so-called safety bingo), and lack of understanding about reporting (Azaroff, Levenstein, and Wegman 2002; Frederick and Lessin 2000). Employers may underreport because of the economic incentives to do so (e.g., they wish to reduce workers’ compensation costs); because middle-manager evaluations include only reported, as opposed to actual, injury rates; because some contract bidding takes into account reported injury rates; or because of poor reporting systems and lack of understanding (Rappin, Wuellner, and Bonauto 2016; GAO 2009). Medical providers, who are workers’ compensation gatekeepers in addition to treating injured workers, have indicated that they frequently perceive pressure from employers to downplay injuries and illnesses (GAO 2009). These factors may be particular problems for low-wage and contingent workers, immigrants, and minorities (Castillo 2018; Premji and Krause 2010).

Researchers looking at different states have estimated that, on average, the SOII misses anywhere between 30% and 70% of injuries involving time lost from work (Boden and Ozonoff 2008; Rosenman et al. 2006). If we assume that the SOII misses half of all injuries, then 2018 saw about 7 million work-related injuries, over 6 per 100 full-time workers each year. Employers reported that about one-third of these injuries involved more than a day off work.

3. Occupational disease

Chronic occupational disease deaths are not covered by the CFOI. The SOII covers occupational illnesses in principle, however in practice chronic occupational illnesses are virtually uncounted (Leigh et al. 2000). There are many reasons for this, perhaps the most important of which is that these illnesses often go unrecognized by both workers and their physicians. Some states have programs targeting specific occupational diseases, like lead poisoning, work-related asthma, and pesticide poisoning. The only exception to the considerable undercount of chronic occupational diseases may be for coal workers’ pneumoconiosis, a disease that NIOSH has focused on for decades.

Because no record-keeping adequately captures occupational diseases, estimates of mortality from these causes have relied on epidemiological studies of specific diseases to estimate the fraction attributable to work. These estimates are then combined with overall U.S. mortality from these diseases (Steenland et al. 2003). The authors of an important study in this area estimated that about 49,000 people die annually from occupational illnesses, with a wide range of uncertainty—from 26,000 to 72,000. Even the low estimate of occupational disease deaths is much greater than the number who die from occupational injuries: If we take 5,500 as the annual average of fatal injuries, then occupational illnesses are responsible for roughly five to 13 times as many deaths each year.

The main causes of death from occupational exposures are cancers, noncancer respiratory disease related to dust and chemical exposures, and coronary heart disease, largely related to job strain (high job demands combined with low worker control) (Steenland et al. 2003).

4. Overall risk

In conclusion, except for traumatic fatal injuries, occupational injuries are substantially underreported in the United States. This underreporting varies by many categories, including worker characteristics, occupation, industry, injury severity, and state. Both incidence of and mortality from chronic occupational disease are barely reported at all. Experts can only guess at these risks, so it would seem unlikely that workers would have a reasonable sense of the probability of dying from disease hazards at work.8 One consequence of this lack of information is that workers can’t base their wage demands on the true risk they face on the job, a shortcoming that calls into question estimates of the value of a statistical life predicated on the assumption they can. Our best estimates are that, each year:

- 5,500 people die from work-related injuries.

- Another 49,000 people die from work-related illnesses.

- 7 million people are injured at work every year, and over 2 million of these lose at least a day from work.

- Many people suffer discomfort and disability from work-related illnesses, but we don’t know how many. However, work-related chronic lung and heart diseases can have life-altering consequences that last for decades before they result in premature death.

B. The distribution of risk

Of course, not all jobs are equally risky. Table 1 shows nonfatal injury rates for some high-risk occupations compared with the average for all occupations, and Table 2 shows fatal injury rates. Many of these high-risk jobs have relatively low wages. More generally, groups that have less power, knowledge, or ability to affect workplace hazards and groups that are discriminated against are more likely to be at risk of injury in the workplace.

Selected occupations with high nonfatal injury rates, 2018

| Occupation | Percent of overall average |

|---|---|

| Laborers and freight, stock, and material movers, hand | 318% |

| Heavy and tractor-trailer truck drivers | 322% |

| Janitors and cleaners | 177% |

| Nursing assistants | 327% |

| Maintenance and repair workers, general | 236% |

| Stock clerks and order fillers | 203% |

| Police and sheriff’s patrol officers | 873% |

| Light truck drivers | 311% |

| Construction laborers | 266% |

Source: Authors’ analysis of U.S. Department of Labor Bureau of Labor Statistics data (U.S. DOL-BLS 2020a).

Selected occupations with high fatal injury rates, 2018

| Occupation | Percent of overall average |

|---|---|

| Logging workers | 2800% |

| Fishers and related fishing workers | 2200% |

| Aircraft pilots and flight engineers | 1690% |

| Roofers | 1480% |

| Refuse and recyclable material collectors | 1270% |

| Driver/sales workers and truck drivers | 750% |

| Structural iron and steel workers | 680% |

| Waste management and remediation workers | 610% |

| Landscaping services | 540% |

| Miscellaneous agricultural workers | 520% |

Source: Authors' analysis of U.S. Department of Labor Bureau of Labor Statistics (U.S. DOL-BLS 2020c).

Temporary, contracted, and online platform employment. Temporary agency workers often have higher fatal and nonfatal injury rates than do workers in standard jobs (Foley 2017; Julià et al. 2016; Smith et al. 2010). Similarly, studies of subcontracted employment have shown higher risks than in standard work (Kochan et al. 1994). Low-wage workers also tend to have higher injury rates. One study showed workers in low-income families had higher risk of injury, even accounting for industry and occupation (Dembe, Erickson, and Delbos 2004), another that people earning less than $50,000 per year reported a greater risk of injury than those with higher earnings (Fan et al. 2006).

Temporary and short-term workers, frequently hired through temporary employment agencies, may be particularly vulnerable to workplace safety risks. As noted in an OSHA white paper:

New workers often lack adequate safety training and are likely to be unfamiliar with the specific hazards at their new workplace. As a result, new workers are several times more likely to be injured in the first months on the job than workers employed for longer periods. Consistent with these findings, OSHA has investigated numerous incidents in recent months in which temporary workers were killed on their first days on a job.

Temporary workers are also likely to be newly assigned to unfamiliar workplaces multiple times in any given year and may carry this increased risk as long as they are in the temporary workforce. For employers, there is less financial incentive to invest training resources on temporary employees because shorter tenure will yield a lower return on investment than similar investments for permanent employees.

OSHA has encountered many situations, including some in which temporary workers have been killed, in which employers have chosen to not provide required safety training to temporary workers. And the temporary workers themselves, recognizing the precarious nature of their employment, are less likely to complain to their employers, or to OSHA, about the existence of even serious hazards (OSHA 2015).

Workers in temporary employment relationships are often subject to the same occupational hazards faced by others in the same work environments in standard employment relationships. In addition, these workers are likely to have little control over their work schedules or pace, may be hired only during periods of high demand, and have few social supports in the workplace. They may also have limited training in job tasks, job risks, and prevention of injury or adverse health exposures. They may not have access to personal protective equipment and training in its use. And, in some cases, they may be assigned to the most dangerous jobs (Mehta and Theodore 2006).

ProPublica reporters compared injury rates for jobs held by temporary workers with jobs held by regular employees, accounting for whether the jobs they held were particularly hazardous. For jobs with similar injury risk they found that the odds of injury for temporary workers were almost four times as high as for regular employees (Pierce, Larson, and Grabell 2013).

Short-term and seasonal workers may be more subject to job strain and its adverse health consequences and less likely to benefit from the workplace conditions that may mitigate these effects (Cummings and Kreiss 2008). Job strain can result in both physical and psychological disruption; prolonged job strain leads to increased cardiovascular disease, musculoskeletal disorders, sleep disruption, and psychological problems. Exposure to workplace conditions like job insecurity, low job control, high job demands, and low social support at work may explain a substantial proportion of observed inequality in life span in different demographic groups in the U.S. (Goh, Pfeffer, and Zenios 2015). The growth in temporary, contracted, and online platform employment relationships that results in increased exposure of less-educated and ethnic minorities to harmful workplace practices is likely to result in poorer health.

Also, temporary, contracted, and online platform workers may have less access to health insurance and workers’ compensation benefits (Asfaw 2014; Mehta and Theodore 2006), causing greater financial strain and interfering with recovery from injury or illness. For a more detailed look at these issues, see The Fissured Workplace (Weil 2014) and The Changing Structure of Work: Implications for Workplace Health and Safety in the U.S. (Boden, Spieler, and Wagner 2016).

Workers of color. There is also evidence that workers of color, particularly Black workers, have elevated injury risk. Loomis and Richardson found that Black workers were 30-50% more likely to die from an occupational injury compared to similar white workers (Loomis and Richardson 1998). The disparity in fatal injury risk was primarily accounted for by differences in the underlying hazards of their occupations. Another study indicates that Black men have greater fatality risk than white men working in the same industry. Black agriculture workers’ fatal injury rate is 26.9 per 100,000 workers, compared to 21.2 for whites (CDC/NIOSH 2004). Within the same industry Black and white workers may have very different jobs.

Another study examined six occupations, employing 16% of private-sector workers in the U.S., at high risk of nonfatal work-related injury. The authors found that Latinx, Black non-Latinx, and American Indian/Alaska Native workers were substantially overrepresented in these occupations (Baron et al. 2013). A more recent study found that non-Latinx Black workers and foreign-born Latinx workers were more likely to work in riskier jobs than white workers, leading to higher rates of work-related disability (Seabury et al. 2017). These results held even after accounting for education, age, and sex. Other research has shown increased risk of fatality and injury among immigrant Latinx construction workers (Dong and Platner 2004) and Latinx hotel workers (Buchanan et al. 2010).

Although studies of occupational disease in this context are rare, there is evidence that Black workers have elevated occupational disease risk. For example, a 1971 study found that, among steel workers, coke oven workers had the highest lung cancer mortality (Lloyd 1971). Moreover, Black coke oven workers were largely working on the topside of the coke ovens—hot, dirty work that resulted in heavy exposure to carcinogenic emissions. A more recent study of lung cancer among chromium smelter workers also found Black workers at higher risk (Rosenman and Stanbury 1996).

Some studies did not find increased injury rates among nonwhite workers. One found substantial excess risk of occupational fatalities among Latinx and immigrant workers, but not among Black non-Latinx workers (Marsh et al. 2013). Studies using the National Longitudinal Survey of Youth 1979 did not find higher injury rates among nonwhite workers, but one found longer absences from work (Berdahl and McQuillan 2008; Strong and Zimmerman 2005). However, most of the evidence supports the view that white non-Latinx workers have the lowest risk.

Using another way of looking at relative power, Peter Smith and his colleagues have studied the relationship between injury and worker vulnerability (Smith et al. 2015). Their concept of vulnerability combines potential exposure to hazards with the ability to mitigate those hazards. Mitigation resources include workplace policies and procedures, workers’ awareness of their rights and responsibilities, and workers’ empowerment to protect themselves. Workers who reported being more empowered had much lower injury rates (Lay et al. 2017).

C. The burden of injuries at work

1. Lost earnings

Although there is a history going back to the early 20th century of studies on earnings lost because of injuries at work, researchers have applied modern statistical methods only over the last two decades. Beginning in 1999, a series of studies using workers’ compensation data from California, New Mexico, Oregon, Wisconsin, and Washington has consistently shown that injured workers who received workers’ compensation benefits for lost wages had substantial earnings losses and that these losses persisted for as long as the injured workers were followed. One study focusing on permanent partial disability (PPD) cases in five states estimated that affected workers had lost about 20% of their earnings over a five-year period (Reville et al. 2001). A 2014 study following New Mexico workers for 10 years after injury found average losses of about 20% over the full 10-year period (Seabury et al. 2014). Indeed, all studies have found losses that continue for as long as the study can follow injured workers, and from these studies we conclude that PPD injuries cause a lifetime of substantial lost earnings.

Some studies of lost earnings have also looked at temporary disability (TD) cases, where benefits were paid for time lost from work but not for permanent impairment or disability. The New Mexico study just cited (Seabury et al. 2017) found that in TD cases with one to eight weeks off work workers lost an average of about 10% of earnings averaged over the 10 years after injury. These losses looked like they would continue far into the future, but the workers were followed only for 10 years. Those losing 8 weeks or more lost almost as much on average as those with PPD injuries. A California study found that workers with injuries occurring from 2005 to 2017 who lost at least four days from work lost about 20% of earnings over the two post-injury years (Rennane, Broten, and Dworsky 2020).

A study examining differences in injured workers’ lost earnings by income found that workers in the highest wage quartile had the lowest percentage loss in earnings, while workers in the second quartile had the greatest percentage loss in earnings (Rennane, Broten, and Dworsky 2020). Differences in lost earnings among earnings or racial/ethnic groups have not been well studied.

Workers’ compensation programs only partially cover the earnings losses of injured workers who receive benefits. The extent of this coverage depends both on whether injured workers receive benefits and the proportion of lost wages covered when benefits are paid.

2. Proportion of injured workers receiving workers’ compensation benefits

Studies of the take-up of workers’ compensation benefits have uniformly shown that many injured workers never receive any benefits. Because state systems vary substantially, the proportion of injured workers receiving benefits can vary widely. A six-state study of injuries eligible for cash benefits (lost-time cases) found that workers’ compensation benefits were paid to about 90% of eligible injured workers in two states but to just 50-70% of cases in the other four (Boden and Ozonoff 2008). To be eligible for cash benefits that replace lost earnings, states require that the number of days lost from work exceed the waiting period, which varies between three and seven days. A similar study in Michigan found that 66% of eligible injuries received workers’ compensation benefits (Rosenman et al. 2006). A study of workers’ compensation take-up in 10 states found that, of work-related injuries involving medical treatment or at least one day lost from work, workers’ compensation benefits were received in 47-77% of cases (Bonauto et al. 2010). Presumably all the injuries in this study would have been eligible for workers’ compensation medical benefits, but not necessarily for cash benefits.

Aside from specialized federal compensation programs (the Black Lung Program, the Radiation Exposure Compensation Program, and the Energy Employees Occupational Illness Compensation Program), virtually no chronic occupational disease victims receive compensation. This means that, since occupational illnesses have a far greater incidence than injuries, the bulk of occupational illnesses and injuries go uncompensated.

3. Proportion of lost wages replaced among injured workers receiving workers’ compensation benefits

Several of the studies of lost earnings that used modern statistical methods also calculated the proportion of injury-related lost wages replaced by workers’ compensation cash benefits. The earliest of these studies—the five-state PPD study referenced above—found that workers’ compensation benefits replaced 38-60% of after-tax lost earnings for PPD cases in these states (Reville et al. 2001). (After-tax earnings are used because workers’ compensation benefits are not taxed, while wages are. We note, however, that lost fringe benefits are not considered in this calculation, meaning that the actual income-replacement rate is even lower than what these studies report.) A more recent study in New Mexico, using more complete data, estimated replacement of only 16% of after-tax earnings lost in the 10 years after injury (Seabury et al. 2014). This study also found that workers’ compensation benefits replaced less than 10% of after-tax losses for injuries classified as temporary disability cases. The reason for this somewhat surprising result is that even people receiving less than eight weeks of TD benefits, on average, have losses that continue far into the future.

Some of these lost earnings may be partially covered by sick pay, private disability insurance, public short-term disability insurance (in some states), unemployment insurance, Social Security Disability Insurance, Supplemental Security Insurance, etc., but the information about this is limited. One study estimated that workers’ compensation cases annually account for about $9 billion in Social Security Disability Insurance benefit payments and about the same amount in Medicare payments (O’Leary et al. 2012).

4. Proportion of medical costs replaced among injured workers receiving workers’ compensation benefits

In principle, workers’ compensation pays all injury-related medical costs for covered injuries. Of course, a substantial number of workers with occupational injuries and almost all workers with chronic occupational diseases do not receive workers’ compensation, so their medical costs are not covered. There is virtually no information about the cost of uncovered injury-related medical expenses, nor is there information about how much of those expenses are covered by general health insurance, Medicaid, Medicare, workers and their families, or other sources.

5. Work-related injuries and financial distress

Many working families live paycheck to paycheck and have little or no savings to fall back on. A 2018 survey asked people whether they could cover an unexpected expense of $400; only 61% said they could cover it with cash, savings, or a credit card paid off by the next statement. A 2017 survey asked people whether they could cover a $2,000 unexpected expense within a month. Over 40% said they could not, even including cash from credit card advances, payday loans, or checking account overdrafts; even greater proportions—54% of Latinxs and 64% of Blacks—gave this response (Stavins 2020). Not surprisingly, the proportion who could not cover the expense fell as incomes rose.

Reductions in income after injury can lead to problems in covering rent or mortgages or car loan payments, increased credit card debt, and general difficulties in making ends meet (Keogh et al. 2000; Morse et al. 1998). Even spending on food declines after injury (Galizzi and Zagorsky 2009). Groups with no or minimal savings are particularly hard hit by occupational injuries and illnesses, with Latinx and Black workers much more likely than white workers to fall into this category. Generally, low-income workers with relatively little savings are more likely to be injured than are other workers (Galizzi and Zagorsky 2009).

6. Other costs

Lost household production. People with work disabilities may not be able to engage fully in household tasks like caring for children, cleaning, or taking out the trash. Several interview studies have shown the considerable extent of these impacts on home life (Imershein, Hill, and Reynolds 1994; Keogh et al. 2000; Strunin and Boden 2004).

Depression and drug and alcohol use disorders. A substantial number of injured workers can’t do the same work or household tasks, lose their jobs, live with intermittent or constant pain, or can’t participate fully in many aspects of family life. There is substantial and growing evidence that these injury effects can lead to depression (Asfaw and Souza 2012; Dersh et al. 2007; Kim 2013) and drug use (Asfaw and Boden 2020). These health consequences have recently been coined “diseases of despair” and have been cited as important reasons for recent declines in U.S. life expectancy (Case and Deaton 2017).

Deaths indirectly caused by workplace injuries. Deaths from suicide and drug overdose, in particular, have been growing in recent years and have become major public health concerns. Moreover, work-related injuries have been shown to increase the risk of dying from both of these causes (Applebaum et al. 2019; Martin et al. 2020).

D. International comparisons

Information from two studies of fatal workplace injury rates in the U.S. and other high-income countries strongly suggests that U.S. rates are higher. The first of these studies compared fatal injury rates among countries around the world. For reasonable comparison, we chose to compare the U.S. with other countries whose 2018 gross domestic product per capita was at least $40,000 (in U.S. dollars). As is evident in Figure B, the U.S. had the highest work-related fatality rate of these countries (Kharel 2016).

Fatal occupational injury rates per 100,000 workers, 2013

| Country | Rate |

|---|---|

| United States | 3.1 |

| France | 2.8 |

| Japan | 2.8 |

| Australia | 2.5 |

| Canada | 2.5 |

| Germany | 2.5 |

| Finland | 2.4 |

| Austria | 2.1 |

| Nertherlands | 1.9 |

| Switzerland | 1.5 |

| Norway | 1.3 |

| Sweden | 0.6 |

| United Kingdom | 0.5 |

Note: Selected countries with gross domestic product per capita in 2018 greater than $40,000.

Source: Ujawi Kharel dissertation, "The Global Epidemic of Occupational Injuries: Counts, Costs, and Compensation" (Kharel 2016).

It is possible that differences in industry composition skewed this comparison. That is, if the U.S. workforce was more concentrated in hazardous industries, one might expect the overall work-related fatality rate to be higher. A second study by Bureau of Labor Statistics economists takes this possibility into account by comparing work-related fatality rates between the U.S. and the European Union by industry sector (Wiatrowski and Janocha 2014). Table 3 shows that U.S. rates are higher than E.U. rates in 11 of 13 industry sectors. Indeed, in three of the four most hazardous sectors U.S. rates are about twice those of the E.U. U.S. rates are lower only in the financial and insurance sectors and the professional, scientific, and technical sectors, the two with the lowest fatality rates. Not only is the overall U.S. fatality rate higher, but disparities between the safest and most hazardous industries are greater than in the E.U.

Fatal injury rates per 100,000 workers in the United States and the European Union, 2010

| Industry | E.U. Rate | U.S. Rate | U.S./E.U. |

|---|---|---|---|

| Agriculture, forestry, and fishing | 9.4 | 18.4 | 200% |

| Manufacturing | 2.2 | 3.3 | 150% |

| Electricity, gas, steam, and air conditioning supply | 2.9 | 4.7 | 160% |

| Water supply; sewerage, waste management, and remediation activities | 6.0 | 12.4 | 210% |

| Construction | 7.9 | 9.6 | 120% |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | 1.4 | 2.0 | 140% |

| Transportation and storage | 6.8 | 13.5 | 200% |

| Accommodation and food service activities | 0.6 | 1.0 | 170% |

| Information and communication | 0.6 | 1.3 | 220% |

| Financial and insurance activities | 0.6 | 0.2 | 30% |

| Real estate activities | 1.0 | 2.0 | 200% |

| Professional, scientific, and technical activities | 0.8 | 0.5 | 60% |

| Administrative and support service activities | 1.8 | 2.5 | 140% |

Source: William J. Wiatrowski and Jill Janocha Monthly Labor Review article, "Comparing Fatal Work Injuries in the United States and the European Union" (Wiatrowski and Janocha 2014).

Because nonfatal injury rates are underreported in the United States, and because we do not know the proportion of injuries reported in other countries, we don’t know how U.S. nonfatal injury rates compare with those of other countries.

V. The value-of-statistical-life literature: What it says, what it gets wrong

The title of Kip Viscusi’s second book, Risk by Choice: Regulating Health and Safety in the Workplace (1983), in which he developed the perspective that has governed the VSL literature ever since, states bluntly its freedom-of-contract assumptions. Without referencing the actual legal, medical, and social history of OSH, it posits an ideal model of how occupational risk would be transacted if the market for labor services were determined solely by self-interested agents whose only concern was to strike the best possible bargain. Employers are assumed to maximize profits, treating both wages and safety as costs of production with no corresponding benefits. Workers are assumed to maximize utility derived positively from both safety and wages. Competition assures that employers all earn the same profit, i.e., zero in economic terms (net of the cost of capital), and workers of a given type all receive the highest level of utility attainable given the jobs they and their peers are offered. The market for each type of labor clears, so no employer faces an unfilled job or worker a spell of unemployment. Employers and employees have equal power to contract or walk away from any bargain.

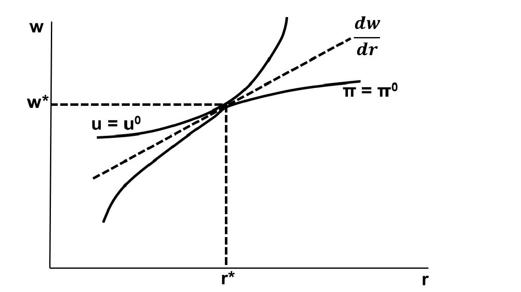

This equilibrium can be depicted in Figure C, where wages are measured on the y-axis and risk on the x-axis.

Here w represents the wage and r the level of risk of death on the job. For a given worker utility function, the curve u = u0 traces combinations of wages and risk that leave combined utility unchanged at the market-clearing utility level u0. The curve incorporates increasing marginal disutility of risk (the curve becomes nearly vertical as a critical level of risk is approached). The other curve, π = π0, traces the corresponding combinations that leave employer profit π unchanged at the competitively determined level of zero. The employer faces increasing marginal costs of reducing risks (diminishing marginal return to safety investments), so the curve becomes steeper as one goes from right to left. Profits and utility are jointly maximized at the tangency indicated by dw/dr, the marginal tradeoff between wages and risk for this particular contracting pair. At market equilibrium for a worker with this productivity (which determines u0) and utility map and for an employer with this cost-of-safety schedule, an equilibrium wage of w* will be established along with an equilibrium risk r*. In a more complete representation of this model there would be many iso-utility curves reflecting different worker attitudes toward money income and risk and many iso-profit curves representing different employer cost-of-safety conditions. More safety conscious workers would sort to be matched with employers with less expensive safety options and vice versa. An upward-sloping contract locus would connect all these individual tangencies.

Here we can see all three properties of compensating wage differentials in a purely contract-centered world:

- The level of risk is perfectly efficient, since the marginal cost of an additional increment of safety is exactly equal to the marginal benefit (in monetary equivalent) it would provide to workers. Safety is neither too low (where improvements inexpensive for the employer to provide would be highly valued by workers) nor too high (where the cost of providing some of the improvements exceeds workers’ valuation of them). Regulation cannot improve this outcome.

- Workers in dangerous jobs would be no better off if they switched jobs with equally productive workers in safer ones. The dangerous jobs pay higher wages so that each worker receives that worker’s u0 in overall compensation. True, with their subjective differences, some workers will end up more satisfied with their work than others, but there is no a priori reason why such differences should have any systematic relationship, positive or negative, to safety.

- The marginal tradeoff between wages and risk, dw/dr, can be employed to calculate the implicit value of life voluntarily chosen by workers at this point in the contract curve. Multiply this incremental equivalent by the number of such increments required to sum to a single statistical life (1 divided by the marginal risk change) and the result is the aggregate money that many such workers would collectively require to reduce expected occupational deaths by one. If workers are viewed as representative of the larger society, this VSL can be applied to any policy change that reduces expected mortality but imposes other costs, e.g., mitigating climate change, reducing toxic emissions from power plants, or, for that matter, regulating risk in the workplace.

Before moving forward, it is important to emphasize that this model begins with the core assumptions of a freedom-of-contract world. Workers care only about their individual well-being, a function of their income and the disutility they experience from occupational risk, and they perform this calculation rationally and consistently, unaffected by social or ethical considerations. Similarly, firms care only about profits, which depend on the wages they pay and the safety investments they make; neither worker commitment nor market reputation plays a role. The labor market is in continuous equilibrium, defined as a state in which supply equals demand and there is no opportunity for any party to improve its outcome by altering the terms it offers to either supply labor or employ it. All relevant outcomes of employment, including actual safety on the job, are determined at the moment employment offers are accepted. Employers and employees have equal bargaining power, a claim increasingly contested by empirical research. There is no regulation of the terms of employment, either by government or collective bargaining agreements; in fact, the legal status of “employment” itself is undefined because none of the questions employment law resolves are at issue. These aren’t claims supported by historical, institutional, or empirical research; they are assumptions made prior to any theoretical or statistical analysis.

On the basis of the preceding model, VSL researchers estimate a wage equation of the following form:

ln wi = α + βXi + γri + εi

where wi is the wage of worker i, α an intercept, Xi a set of control variables for worker i, β a vector of coefficients on these variables, ri the occupational risk faced by worker i, γ the coefficient on this risk, and εi the error term. By incorporating control variables, the intent is to isolate the effect that risk has on wages for equivalent jobs, with the coefficient γ representing the wage effect of a unit change in this risk, which, when multiplied by the level of risk r becomes the compensating wage differential; for instance, if γ = 0.02, average w = $50,000, and average r = 1/10,000 per year, estimated VSL (at these averages) would be [2% of $50,000] x 10,000 = $10,000,000. (These numbers are only for purposes of illustration.) Referring again to Figure C, it is assumed that each worker is of a given productivity type, where this type is a function of attributes like age, gender, experience, education, race, union membership, and marital status. (Note that gender, race, and union membership are routinely interpreted as signaling differences in “productivity.”) Each productivity type applies its utility maps to the same set of wage offers in the competitive market, so including these variables is expected to strip away this potential confounder.

A large number of studies have been conducted along these lines, and most of them find positive coefficients γ on risk, representing wage compensation for more dangerous working conditions. When these marginal tradeoffs are multiplied by the mean change in risk of death, a VSL of several million dollars is typically estimated. Government agencies in the United States and a few other countries have officially adopted these estimates for use in benefit-cost analyses of regulations and public programs, thereby influencing the ability to regulate pollution, workplace safety and health, vehicle speeds, and every other regulatory issue affecting life and health. The VSL also enters into calculations of the “social cost of carbon,” used to justify and calibrate measures to combat climate change (Melillo, Richmond, and Yohe 2014).

The procedure is endorsed by leading lights in the “law and economics” movement, such as Cass Sunstein (e.g., Sunstein 2014), for what they regard as its rational approach to valuing lives. VSL calculations have made their way into introductory economics textbooks as examples of the insight that comes from applying “the economic way of thinking” to problems usually considered fraught or vexing (Mankiw 2014). For many whose only analytical exposure to labor issues occurs in the undergraduate economics classroom or in the use of VSL studies, the freedom-of-contract perspective represents the “economic” approach to OSH.

It is important to recognize, however, that the VSL literature and its underlying analytics are strongly disputed within the economics profession, particularly by those with a deep background in the study of labor markets. For a striking example, consider Labor Economics by Pierre Cahuc, Stéphane Carcillo, and André Zylberberg (2014), which has established itself as the leading graduate textbook in its field. Much of Chapter 5 in the second edition is devoted to disputing the modeling and empirical approach of VSL proponents, which the authors find simplistic and misleading. In the pages that follow we will explain some of these criticisms and add several of our own.

At the theoretical level it should already be clear that the modeling framework used by VSL proponents assumes away nearly all the problems that have preoccupied labor economists in the decades since the pioneering work of Richard Lester and have recently reemerged as central to our understanding of labor market trends. In Figure C, the determination of the slope of the contract curve by the marginal rate of substitution between wages and safety for each corresponding worker embodies the law-of-one-price constraint, but modern labor economics begins by asking why this law doesn’t hold: There is an array of wages paid to workers with similar skills or occupations. The most widely subscribed approach in the discipline today is search theory, in part because it provides a plausible, readily modeled explanation for both wage dispersion and involuntary unemployment. A formal proof that fully compensating wage differentials are a special rather than general case in a search framework was provided by Lang and Majumdar (2004).9 As they demonstrate, a search theoretic version of Figure C would portray many iso-utility and -profit tangencies, and the locus of them could as well be downward as upward sloping—lower wages and greater risk for workers of equivalent potential productivity. With search frictions there is no guarantee that competition will prevent the emergence of good and bad jobs corresponding to safer and more dangerous ones.