Despite minute-by-minute dissection of the stock market in the news media, the share of the population owning stock is surprisingly low, even when including shares purchased indirectly through retirement accounts. In 2010, less than half (46.9 percent) of all households had stock holdings, and less than a third (31.1 percent) had stock holdings of $10,000 or more.

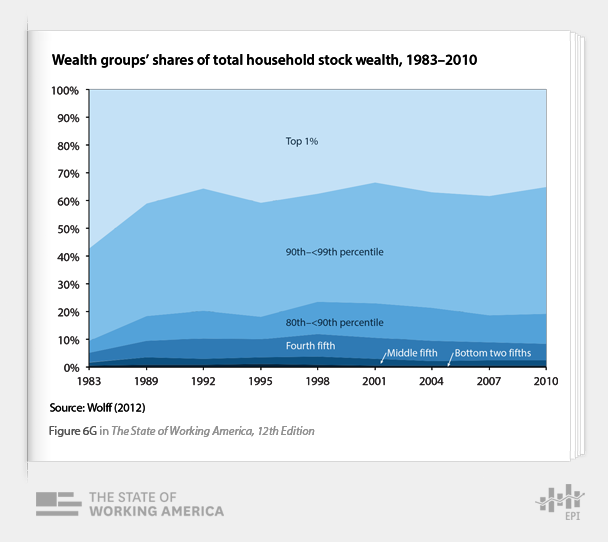

The imbalanced distribution of stock assets has persisted over time, as seen in the figure below from the newly released State of Working America, 12th Edition. The wealthiest 1 percent of households has never held less than one-third of all stock wealth. Since 1989, the top fifth of households consistently held about 90 percent of stock wealth, leaving approximately 10 percent for the bottom four-fifths of households. This figure shows that the vast “democratization of the stock market” since the 1980s—wherein the masses gained significant shares of the market through investment vehicles such as mutual funds, IRAs, and 401(k)s—never actually happened.