EPI Jobs Picture, February 6th, 2009

Labor market has worst month since recession began

by Heidi Shierholz with research assistance from Tobin Marcus

The January employment report released this morning by the Bureau of Labor Statistics showed that that the economy shed 598,000 jobs and the unemployment rate increased to 7.6% in January, the highest rate in over 16 years. This was the largest decline in 13 consecutive months of job losses, with 1.7 million jobs lost (1.3% of employment) in the last three months alone (the largest such loss in 34 years). By almost every measure available — loss of employment, rise of unemployment, shrinkage of the employment-to-population ratio — this recession is steeper than any in the last 40 years, including the harsh recession of the early 1980s.

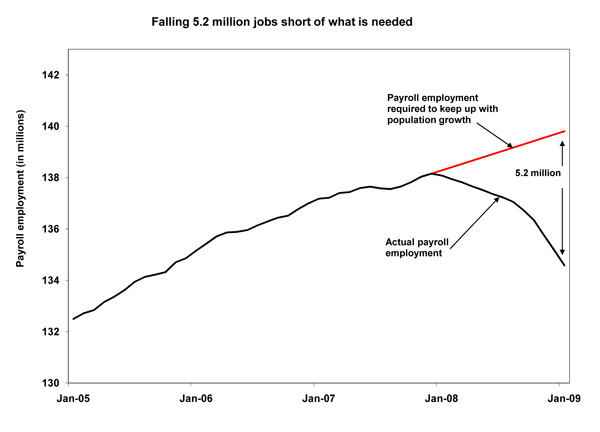

The January decline in payroll jobs (along with a sizeable downward revision of previous month’s estimates) brings the total jobs lost since the recession began in December 2007 to 3.6 million. As sobering as this number sounds, it actually far understates the true gap between how many jobs there are today and how many are needed. Simply to keep up with the ever-expanding population, the economy would have had to have added approximately 127,000 jobs every month over this period — or 1.7 million jobs in the 13 months since the start of the recession. Thus, the loss of 3.6 million jobs since December 2007 actually means the economy is now 5.2 million jobs below where it would need to be to have maintained pre-recession rates of employment for the American workforce. The figure below shows payroll employment over the last four years, and what employment would be today if its growth had kept up with population size.

The unemployment rate rose from 7.2% in December 2008 to 7.6% in January 2009. Since the start of the recession in December 2007, the unemployment rate has increased 2.7 percentage points — the fastest rate increase in the initial 13 months of a recession since the recession of 1957. There are now 11.6 million unemployed American workers, up by over 4 million since the start of the recession.

The employment rate — the percent of the population that is employed — fell 0.5 percentage points to 60.5% in January, a decrease of 2.4 percentage points in the last year and the fastest annual drop in the employment rate in over 54 years. The entire drop in employment rates came from workers younger than 55, as the employment rates of people aged 55 and older have not changed over the last year. The employment rate for men, at 66.1% in January, is its lowest level on record, and the employment rate for women, at 55.3%, is at its lowest level in over 13 years.

There was a jump in underemployment in January (underemployment is a more comprehensive measure of labor market slack than unemployment and includes people working part time who want full time jobs). Underemployment increased from 13.5% in December to 13.9% in January, so that now nearly one in seven workers in this country — an estimated 21.7 million people — is either unemployed or underemployed.

In a labor market where there are nearly four unemployed workers for every job opening, unemployed workers can have an extremely difficult time finding a job and often get stuck in unemployment for long periods. In January, 39.2% of unemployed workers had been jobless for at least 15 weeks, and 22.4% had been jobless for at least six months.

Racial and ethnic minorities continue to experience the largest increases in unemployment. In the first 13 months of this recession, unemployment has increased by 3.7 percentage points for blacks, 3.5 percentage points for Hispanics, and 2.5 percentage points for whites. In January, the unemployment rate was 12.6% for blacks, 9.7% for Hispanics, and 6.9% for whites.

Workers with a high school degree face an unemployment rate of 8.0%, while workers with a college degree face an unemployment rate of 3.8%. While the unemployment rate of college-educated workers is far lower than for workers with fewer years of schooling, it is near their record level of 3.9% set in January 1983.

Most industries are shedding jobs — according to the diffusion index, three-quarters of industries lost jobs in December — evidence of widespread weakness in the labor market. Construction and manufacturing, however, continue to be hit the hardest. Construction lost 111,000 jobs in January, bringing the employment decline since the start of the recession in December 2007 to 10.4% in that sector.

Manufacturing lost 207,000 jobs in January, with fabricated metal products (down 36,700) and motor vehicles and parts (down 31,300) seeing the biggest declines. Since the start of the recession, manufacturing employment has declined by 7.7%

Service employment was also down, as private services (excluding government) shed 285,000 jobs in January, and 1.5% since the start of the recession. Retail trade was down 45,100 in January and 3.7% since the start of the recession. Within retail, there were particularly large losses in motor vehicle and parts dealers (down 14,100 in January and 9.3% since the start of the recession). Employment services also continued to see large losses, shedding 89,000 jobs last month and 20.5% since the start of the recession.

Continuing to buck the negative trends, education and health services generated job growth. Educational services added 32,600 jobs in January, and health care added 19,300 jobs. Education and health services has grown by 4.2% since the start of the recession. Government also added 6,000 jobs in January, though state and local governments experienced losses (down by 6,000 and 3,000, respectively). Since the start of the recession employment in the public sector has grown modestly by 0.8%.

The index of aggregate weekly hours worked fell 0.7% in January and at an 8.8% annual rate over the last four months — an enormous drop in the total number of hours worked and an indication of massive shrinkage in the economy. Average weekly hours worked was 33.3 in January (down from 33.8 in December 2007).

Nominal hourly earnings are rising at a healthy rate, with an increase of 3.9% over the last year. Thus, with inflation slowing significantly, real wages are growing for those workers who keep their jobs. However, the decline in hours worked meant that weekly paychecks saw a smaller nominal increase (2.7% over the last year).

The January employment report is yet one more demonstration of the rapid deterioration in the labor market. The economy is shedding jobs at an alarming rate, and workers who do keep their jobs are seeing their hours cut back. This report highlights the acute need for the immediate passage of a large stimulus package.