EPI’s Jobs Picture for June 4th, 2010

The Bureau of Labor Statistics’ employment report for May does not paint a picture of self-sustained growth in the private sector: absent the census hires and private-sector temp worker hires there was essentially no net job creation. The report showed an increase of 431,000 payroll jobs and an unemployment rate of 9.7%, a 0.2 percentage-point decrease from April’s 9.9%. The vast majority of May’s new jobs (411,000, or 95%) were temporary Census jobs that will disappear over the summer. Adding a mere 41,000 jobs, the private sector saw slower growth than it had in the prior three months, when the average was 146,000 a month. This May’s modest gain in the private sector was a huge improvement over the loss of 334,000 private sector jobs in May 2009, but it is nowhere near a level that will put this country’s 15 million unemployed workers back to work anytime soon.

Furthermore, the shedding of public sector jobs at the state and local level remains an ongoing drag on employment growth. In May, state and local governments shed 22,000 jobs (15,000 at the state level and 7,000 local). Since their peak in August 2008, state and local governments have shed 231,000 jobs (46,000 at the state level and 185,000 local).

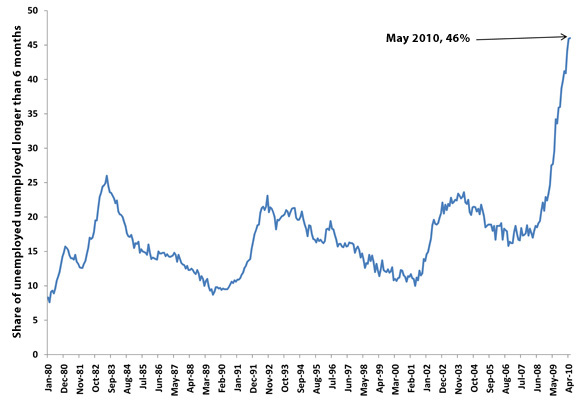

The long-term unemployment situation continued to deteriorate in May, as an additional 47,000 unemployed workers crossed the six-months-unemployed threshold. There are now 6.8 million workers who have been unemployed for longer than six months, which is unsurprising given that there are now well over five unemployed workers per job opening. The median, or typical, unemployment spell was 23.2 weeks (5.4 months), and nearly half (46.0%) of all unemployed workers had been unemployed for over six months, both record highs. The chart below shows the share of the unemployed who have been unemployed for more than six months.

The “underemployment rate” is a more comprehensive measure of labor market slack than the unemployment rate because it includes not just the officially unemployed, but also jobless workers who have given up looking for work and part-time workers who want full-time jobs. That rate declined by half a percentage point but remains at an extremely high 16.6%. The number of involuntary part-timers decreased by 343,000 workers in May, and the number of “marginally attached” workers—the jobless who have given up looking for work—decreased by 251,000. In May, there were a total of 26.0 million workers who were either un- or underemployed.

The length of the average workweek increased slightly in May, from 34.1 to 34.2 hours, and it is up from its low of 33.7 last fall. Improvement in average hours is a good sign, since all else equal, it means larger paychecks for workers. However, at the start of the recession in December 2007, the length of the average workweek in the private sector was 34.7 hours, so there is still a lot of ground to make up. The downside to the continued growth in average hours is that it will be a drag on employment growth: restoring average hours worked by all private-sector workers from 34.2 back to 34.7 would be equivalent to adding 1.6 million new jobs at 34.2 hours per week.

Another ongoing issue is the backlog of “missing workers,” that is, workers who dropped out of (or never entered) the labor force during the downturn. Unlike the past four months, the labor force decreased in May, by 322,000, adding to the backlog. (This is likely just volatility in the household data, rather than a reversal of the trend.) To get an idea of the size of the backlog consider the following—the labor force should have increased by around 3.4 million workers from December 2007 to May 2010, given working-age population growth over this period, but instead it increased by only 524,000. This means that the pool of “missing workers” now numbers around 2.8 million. As these workers enter or re-enter the labor force in search of work, this will contribute to keeping the unemployment rate high.

Age breakdowns in unemployment show that all of the improvement in unemployment in May occurred among workers age 20-24, who saw their unemployment rate decline from 17.2% to 14.7% in May. Workers age 16-19 saw an increase from 25.4% to 26.4%; workers age 25-54 remained unchanged at 8.7%; and workers age 55 and over saw an increase from 7.0% to 7.1%.

Further demographic breakdowns in unemployment show that, while all major groups have experienced substantial increases over this downturn, men, racial and ethnic minorities, and workers with lower levels of schooling continue to get hit particularly hard.

- Unemployment was 15.5% among black workers, 12.4% among Hispanic workers, and 8.8% among white workers (increases of 6.5, 6.1, and 4.4 percentage points, respectively, since the start of the recession).

- Unemployment was 10.5% for men, compared to 8.8% for women (increases of 5.4 and 3.9 percentage points since the start of the recession).

- For workers age 25 and older, unemployment reached 10.9% for high school educated workers and 4.7% for those with a college degree (increases of 6.2 and 2.6 percentage points, respectively, since the start of the recession).

Nominal hourly wages saw a 7 cent increase in May. Nominal hourly wage growth has been slowing since the summer of 2008 and remains low—it grew at a 1.6% annualized rate over the last three months. It grew at 1.9% over the last year, slower than inflation, meaning that real hourly wages have declined over the last year. After falling faster than average hourly wage growth for the first year and a half of the recession, average weekly earnings growth has seen some improvements since last summer, as average hours have improved. Average weekly earnings grew at a 5.3% annualized rate over the last three months.

Temporary help services added 31,000 jobs in May. In other words, just over three-quarters of the 41,000 private sector jobs added in May were temporary help jobs. Furthermore, as mentioned above, 411,000 of the total jobs added in May were temporary Census jobs, meaning there were a total of 442,000 temporary jobs added in May (temporary Census jobs plus jobs in temporary help services). Given that there were a total of 431,000 jobs added, that means there was a net loss of 11,000 permanent jobs in May.

Construction saw a loss of 35,000 jobs, mostly in nonresidential. Retail trade lost 6,600 jobs in May after adding an average of 16,100 per month for the previous three months. Manufacturing, on the other hand, added 29,000 jobs, its fifth straight month of gains, with durable goods manufacturing adding 34,000 and non-durable losing 5,000. Of the 495,000 private-sector jobs that have been added since last December, a quarter of them have been in durable goods manufacturing. Leisure and hospitality added 2,000 jobs in May, after adding an average of 27,000 for the previous three months. Health care added 8,000 jobs in May, after adding an average of 21,200 for the previous three months.

While now adding rather than losing jobs, the labor market remains 7.4 million payroll jobs below where it was at the start of the recession in December 2007. And this number understates the size of the gap in the labor market by failing to take into account the fact that simply to keep up with the growth in the working-age population, the labor market should have added around 3 million jobs since December 2007. This means the labor market is now roughly 10.4 million jobs below what would restore the pre-recession unemployment rate (5.0% in December 2007), and without the 564,000 temporary workers currently on Census payrolls, the gap would be 11 million. To put this all in perspective, consider the following: in the boom of the late 1990s, the fastest y

ear of employment growth was 2.6% in 1998. If we could achieve that same extremely strong level of growth from this point forward, we would still not get down to pre-recession unemployment rates until January 2015.

In sum, this was a disappointing report, and it underlines the weakness of the recovery. Excluding temporary Census hiring, the labor market added 20,000 jobs, not even enough to keep up with the growth in the working-age population. The hole in the labor market is staggering, unemployment remains near 10%, and long-term unemployment continues to break records. The economic case for additional government action to generate employment is clear, and should include aid to the long-term unemployed and fiscal relief for state and local governments.

—Research assistance from Kathryn Edwards and Andrew Green