See Snapshots archive.

Snapshot for August 29, 2007.

Bush tax changes wreck budget

by Max Sawicky

New projections from the Congressional Budget Office provide the ingredients for two important stories about the nation’s fiscal condition if the Bush tax cuts are extended rather than allowed to expire.

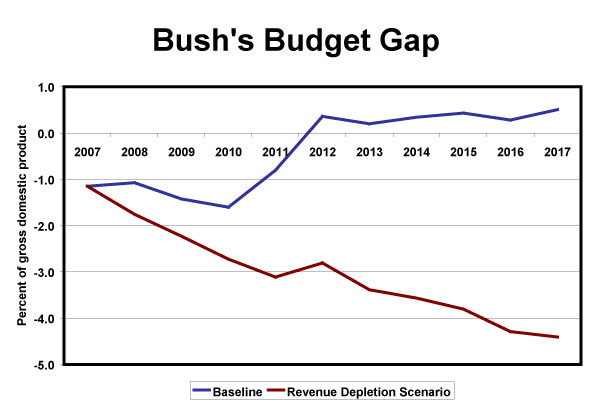

One story involves prospects for balancing the budget. For fiscal years 2007 through 2010, the Bush tax cuts will make balancing the budget impossible in those years. Extending the tax cuts would make matters worse, indefinitely delaying any hope of balanced budgets or generating the surpluses achieved in the late 1990s. More important, under reasonable assumptions, the tax cuts push the deficit to unsustainable levels (in excess of 2% of gross domestic product). The top line of Figure 1 represents the official baseline, founded on assumptions that current law remains unchanged. Those assumptions imply that the tax cuts will expire on schedule. Extending the tax cuts—combined with the likely to be adopted policies of reducing the Alternative Minimum Tax (AMT), renewing long-standing tax breaks (known as “tax extenders”), and allowing discretionary spending to grow at the same rate as the economy—gives rise to the line at the bottom of the chart.

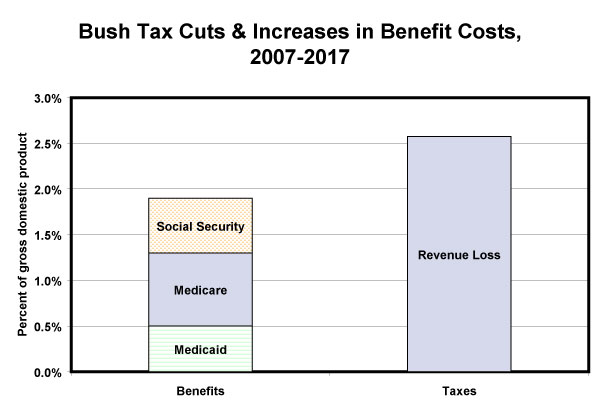

The second story is the imminent collision between the Bush tax cuts and the benefits promised by Social Security, Medicare, and Medicaid. For those planning retirement as early as 2017, most analysts agree that enacting benefit cuts that soon would be grossly unfair to those workers because they would not have enough time to adjust to the benefit reductions. The second chart (Figure 2) shows projected growth in Social Security,* Medicare, and Medicaid spending as a percent of GDP between 2007 and 2017. The second bar shows the cost of Bush tax cuts and related revenue policies in 2017, not including associated interest costs. Growth in “entitlements” is said to be out of control, but the extent of projected growth to 2017 is dwarfed by revenue losses implied by Bush administration policy. Without significant adjustments elsewhere in the budget, benefit costs and revenue shortfalls will have to be reconciled somehow over the next 10 years.

* The revenue needed with respect to Social Security stems from money owed by the federal government to the Trust Fund, which will have to be paid from general revenues (primarily income taxes). Dedicated tax revenues to the Social Security Trust Fund, primarily the payroll tax, keep it solvent for another 30 years or more.