See Snapshots Archive.

Snapshot for January 26, 2005

Privatization fix for Social Security is worse than doing nothing

In December 2001, a Bush Administration commission introduced three possible plans for privatizing the existing federal Old Age, Survivors, and Disability Insurance (OASDI) program, commonly referred to as Social Security. Plan 2 is the model that Bush Administration officials have consistently favored in public discussions. Contrary to administration rhetoric that action taken now will protect younger workers when they retire, Plan 2 would leave younger workers worse off than if nothing is done.

This plan would cut benefits compared to current law by changing the formula by which they are calculated. Specifically, the Bush-proposed formula would replace the “wage indexing” of benefit levels with “price indexing,” resulting in a large benefit cut that deepens over time. In essence, future adjustments to Social Security payouts would be based on inflation increases rather than earnings increases over time, essentially freezing retirees’ standard of living at whatever point they retire.

Advocates of privatization have claimed that much of this benefit cut would be recouped through the proposal’s other radical change: the creation of private investment accounts financed by siphoning off nearly one-third of workers’ Social Security payroll taxes (in other words, 4.0 of the 12.4 percentage points workers currently pay). Although there are other smaller changes to OASDI proposed in Plan 2, including small subsidies to reduce the harm done to low earners, these would not come close to offsetting the substantial harm done by this proposal.

The nonpartisan Congressional Budget Office (CBO) has analyzed Plan 2 in detail. The CBO calculates the likely share of pre-retirement income—sometimes referred to as the replacement rate—that would prevail under this plan for various types of earners as compared to the current OASDI program. It is important to note that this calculation includes income earned from the proposed private accounts, for various types of earners, as compared to the current OASDI program.

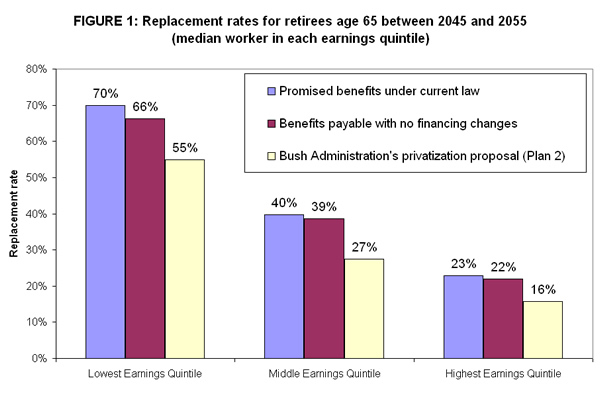

Figure 1 uses this CBO data to show the replacement rates for the median worker who retires at age 65 between 2045 and 2055 in the lowest, middle, and highest earnings quintiles. The figure shows three replacement rates: those promised under current law; those that can actually be paid if no changes are made to the current system (that is, using only a current year’s dedicated Social Security revenues plus the Social Security Trust Fund); and those implied by the Bush Administration’s plan, which includes both Social Security benefits and income earned from private accounts.

As can clearly be seen, the Bush Administration’s plan provides lower replacement rates for all workers relative both to benefits promised in current law (the left bar) and those that could still be paid out even if no changes were made to address the so-called “crisis” (the middle bar). This last comparison is especially important, as privatization advocates’ alarmist rhetoric creates the impression that Social Security is in “crisis,” and that failing to implement radical changes to the system immediately will result in disaster for today’s young workers. The middle bar showing replacement rates that can be funded out of the existing structure of Social Security (current revenues plus the Trust Fund) presents what would happen if absolutely nothing is done to shore up the actuarial shortfall facing Social Security. In essence, these replacement rates represent the full extent of the alleged “crisis” that the Bush Administration purports to address with its Plan 2. In other words, the “crisis” looks a lot better than its proposed fix.

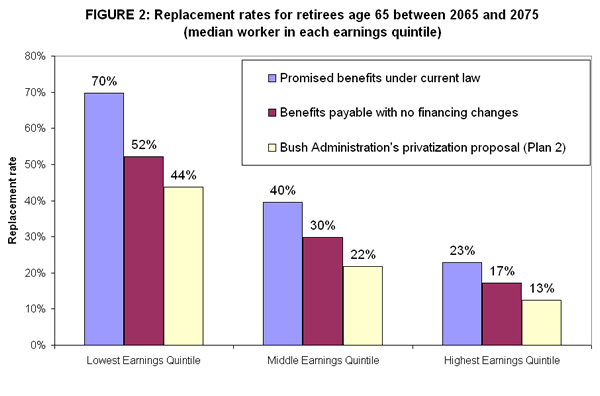

Figure 2 shows the same numbers, but this time examines a worker retiring between 2065 and 2075. The results hold: Plan 2 provides large benefit cuts to all workers when compared to both the benefit levels prescribed by current law and those in the worst-case scenario in which no changes are made at all.

Figures source: Congressional Budget Office (CBO) Long-Term Analysis of Plan 2 of the President’s Commission to Strengthen Social Security. http://www.cbo.gov/showdoc.cfm?index=5666&sequence=0

Today’s Snapshot was written by EPI economist Josh Bivens.