In the summer of 2010, the newly-elected conservative government of the United Kingdom passed and implemented a large austerity budget. This budget was heavily weighted to spending cuts—80 percent of the total consolidation—and included an average 25 percent cut to non-health domestic departmental spending. Tax increases accounted for the remaining 20 percent, including increases in the value-added tax (essentially a sales tax). In total, this fiscal consolidation represented 2.2 percent of GDP. Combined with the previous government’s planned austerity, the overall fiscal consolidation implemented totaled 6.3 percent of GDP.1

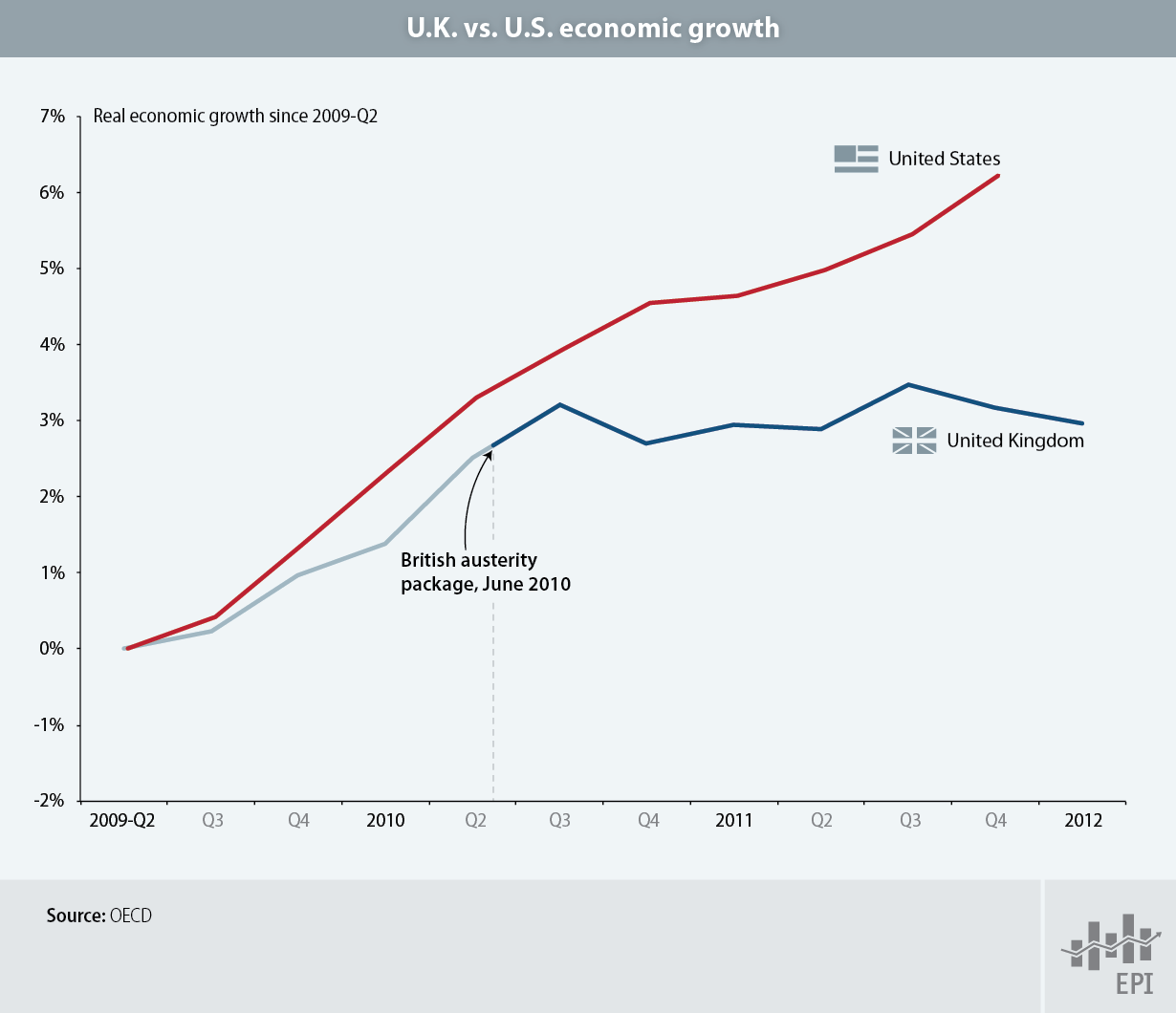

This austerity package caused the British economy to slow significantly. Despite growing at an annualized rate of 4.5 percent in the second quarter of 2010, the recovery completely stalled by the end of that year. Over the last six quarters, the British economy has experienced no real growth; in fact, it has contracted and unemployment has risen. The U.S. economy, meanwhile, has avoided austerity on the massive scale that Britain has adopted, and in the last year-and-a-half has grown consistently (albeit more slowly than what’s needed), adding more than two million jobs.