Issue Brief #293

The U.S. Census Bureau released alternative estimates of poverty yesterday that give yet another reminder of the disastrous effect the recession has had on workers and families.

The official poverty measure tells us that 14.3% of Americans are living below the official poverty threshold. Note, however, that this standard has long been criticized for failing to be an adequate measure of deprivation in the United States. The root of the problem is that the current poverty measure is not dynamic: It does not reflect non-cash transfers from the government, like Supplemental Nutrition Assistance (food stamps), housing vouchers, child care subsidies, Medicaid and Medicare, or the Earned Income Tax Credit, nor does it reflect changes in spending patterns, like increasing housing and medical costs, or that these costs might vary by state or region.

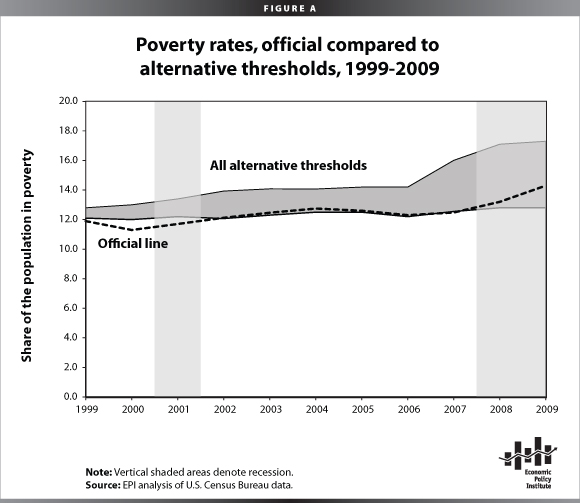

In order to be more dynamic, the Census Bureau offers myriad alternative measures, which can be grouped into two categories: thresholds and income. Threshold refers to the dollar amount under which someone is poor. The official threshold is three times the food budget in 1959 (adjusted for inflation). The alternative thresholds adjust this to reflect increasing out-of-pocket medical expenses, to show the differences in cost of living for various parts of the country (like rural south versus urban northeast), and to show multiple ways in which prices can be inflated over time. Figure A shows the official measure and a range of alternative thresholds. Though the recession has certainly exacerbated the official poverty rate, the threshold measures show that the situation appears even worse.

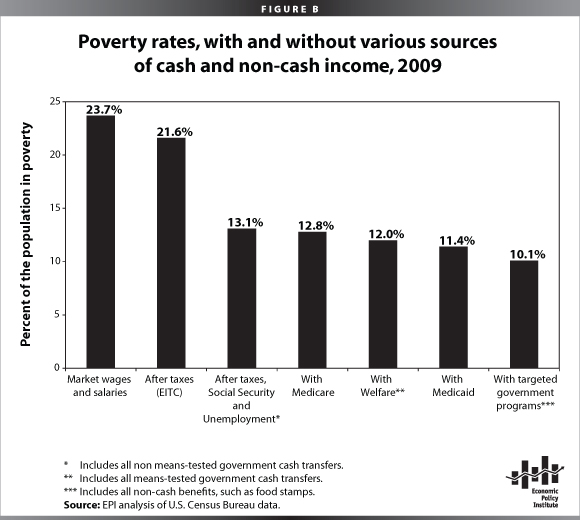

Thresholds, however, are only half the story. Income is a measurement of a person’s earnings and money available to spend. Under the official measure, income is restricted to cash, so that it captures wages and cash transfers, such as Social Security and unemployment insurance. But there are alternative measures of income that allow us to examine poverty after government policy (e.g., food stamps, child care subsidies, etc.). In effect, it shows the ability of the government to mitigate the effect of poverty. While the threshold adjustments indicate why the official measure is outdated and why more people are struggling, the income adjustments demonstrate how effective government policies are in reaching and helping those that we know to be poor and near-poor. As Figure B demonstrates, Social Security is the most important anti-poverty program in the United States.

Taken together, the alternative measures of poverty show how much the recession has increased poverty and how vital government programs and policies are to mitigating those effects.