Ending Currency Manipulation—Just Follow the Money

Growing trade deficits have cost US workers millions of jobs over the past two decades, (these were good jobs in manufacturing industries). Currency manipulation by more than 20 countries, of which China is by far the largest, is the single most important reason why U.S. trade deficits have not decisively reversed. Currency manipulation lowers the value of foreign currencies, relative to the U.S. dollar, which acts like a subsidy to their exports, and a tax on U.S. exports to China and every other country where the U.S. competes with the exports of currency manipulators.

In an era of fiscal austerity, ending global currency manipulation is the best way to reduce trade deficits, create jobs, and rebuild the U.S. economy, as shown in Stop Currency Manipulation and Create Millions of Jobs. Eliminating currency manipulation would reduce the U.S. trade deficit by between $200 billion and $500 billion in three years. This would increase annual U.S. GDP by between $288 billion and $720 billion and create 2.3 million to 5.8 million jobs. About 40 percent of the jobs gained would be in manufacturing.

Ending currency manipulation would not require any government spending – a key political virtue during this time of Congressional gridlock. In fact, it would reduce the federal budget deficit by up to $266 billion dollars per year as the extra economic activity and employment it creates boosts tax revenues and reduces safety net spending. Ending currency manipulation would create jobs in every state, with gains from 8,200 jobs (2.64 percent of total employment) in the District of Columbia to 687,100 jobs (4.18 percent of employment) in California. Ending currency manipulation would likely create jobs in every Congressional District, with gains of up to 24,400 jobs (7.05 percent of employment) in the 17th District in CA.

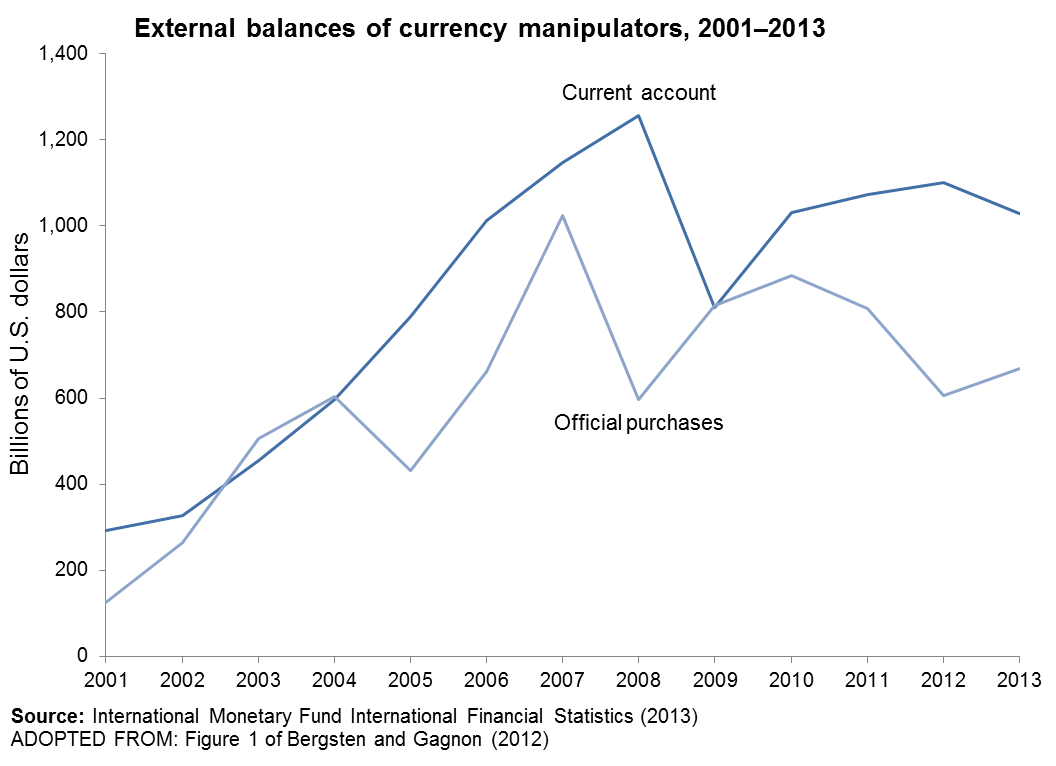

The importance of exchange rate manipulation in driving global trade imbalances is clear. There is a near perfect correlation between official purchases of foreign exchange reserves and the global current account surpluses of currency manipulators, as shown in the Figure below. Joe Gagnon has shown that causation runs from currency manipulation to trade surpluses, and not the other way around.[1] The data shown in this graph exclude asset purchases by government-owned “sovereign wealth funds,”(SWFs) which now control over $6.3 trillion dollars in assets. For example, the China Investment Corporation, one of three Chinese sovereign wealth funds, founded in 2007 with an initial investment of $200 billion, increased to $575 billion in 2013. If asset purchases by SWFs were included, this graph would reveal an even tighter correlation between purchases of foreign exchange and the current account surpluses of currency manipulators.

One important policy insight from this graph and from Gagnon’s research is that policymakers no longer need to estimate the equilibrium value of the yuan or any other manipulated currency; they also do not need to estimate the degree to which they are undervalued (as the Treasury attempts in its semi-annual Reports to Congress on Exchange Rate Policies). The policy linkage goes directly from purchases of Foreign Exchange and other assets by foreign governments to increased trade and current account surpluses. Or, to put it another way, the simple fact that countries purchase huge amounts of foreign assets is proof that exchange rates are out of alignment for moving trade closer to balance. Some have argued that because there has been some non-zero appreciation of the Chinese currency in recent years that this proves the importance of currency manipulation is much attenuated. No, and the proof is that China continues to buy large amounts of U.S. assets, which keeps the appreciation of their currency smaller than it would otherwise have been absent this market distortion.

Thus, for example, dollars have been pouring into China for more than a decade in search of Chinese goods, FDI and financial assets. But for China’s massive capital exports (as reflected in the $4 trillion it has invested in foreign assets since 2000), the value of the yuan would have risen much more rapidly than it has over the past decade. The key to ending currency manipulation is to simply stop or offset purchases of U.S. assets by China and other currency manipulators.

There are a number of steps that Congress and President Obama can take to end currency manipulation, which would reduce our trade deficit and bring millions of manufacturing jobs back to the United States. First, Congress should pass pending legislation (HR 1276 and S 1114) that would allow the Commerce Department to treat currency manipulation as a subsidy in countervailing duty trade cases. In addition, the President and federal agencies already possess the tools needed to end currency manipulation. The Treasury and Federal Reserve administration have the authority needed to offset purchases of foreign assets by foreign governments by engaging in countervailing currency intervention. By taking these steps, the U.S. government could make efforts by foreign governments to manipulate their currencies costly and/or ineffective.

Congress and the President have an opportunity to act now to end currency manipulation, a policy that will create 2.3 to 5.8 million jobs and increase U.S. GDP and reduce the budget deficit at no cost to the government. What better legacy could the president leave behind than a fully employed labor force with a growing and revitalized manufacturing sector? The key is to put an end to foreign purchases of U.S. assets—the markets will take care of the rest.

[1] Gagnon has estimated that a “country’s current account balance increases between 60 and 100 cents for each dollar spent on intervention.”

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.