The following is a summary of strategic communications research done by Quadrant Strategies on behalf of the American Federation of Teachers. Download PDF

Methodology

This research was conducted in two phases:

- 2017: Between February 7th and 13th, we conducted 3,000 online interviews with members of the general population in the United States. The margin of error overall is +/- 1.65% and is larger for subgroups.

- 2018: Between May 2nd and 9th, we conducted 1,000 online interviews with members of the general population in the United States. The margin of error overall is +/- 3.15% and is larger for subgroups.

The big picture

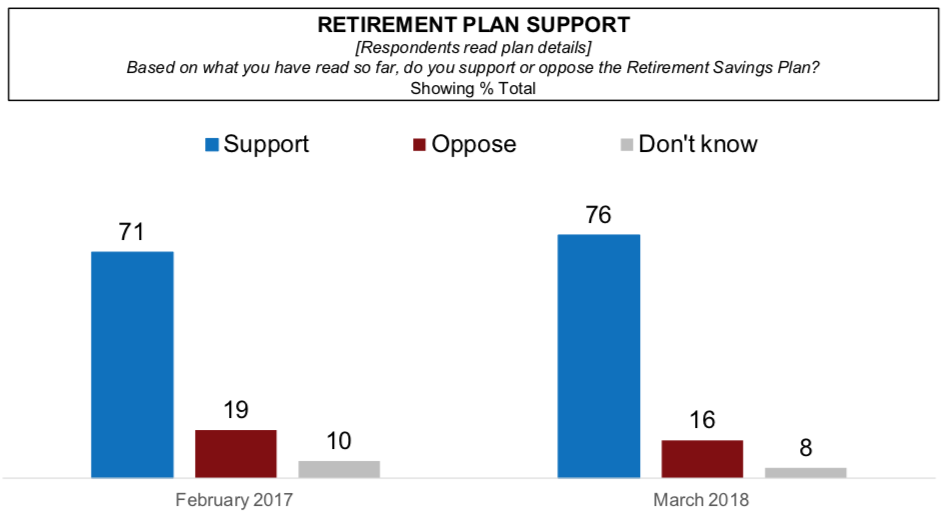

A vast majority of Americans—76%—support the idea of the Retirement Savings Plan.

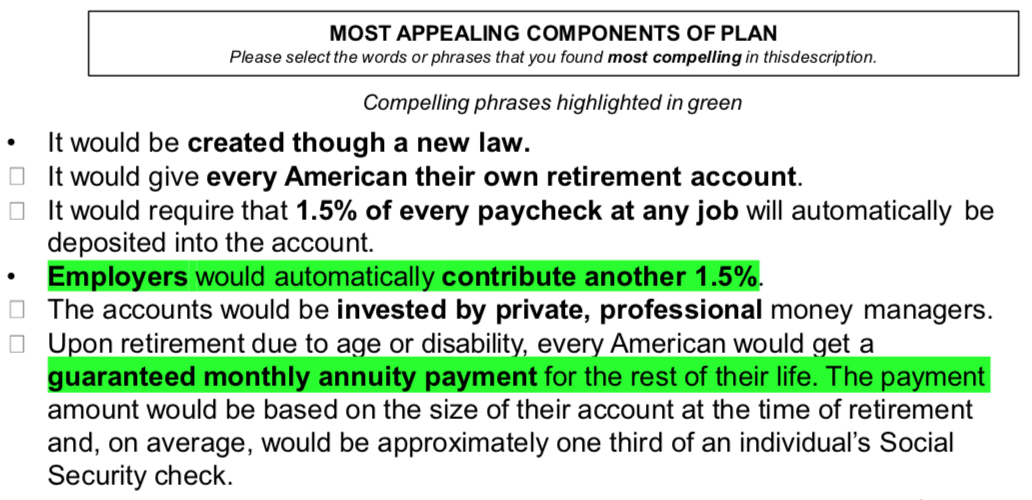

Why? Three key benefits are most appealing:

- 1.5% from each paycheck, matched by employers

- Follows you to every job

- Guaranteed monthly payments in retirement

Key takeaways

Great news: The plan is popular and has momentum

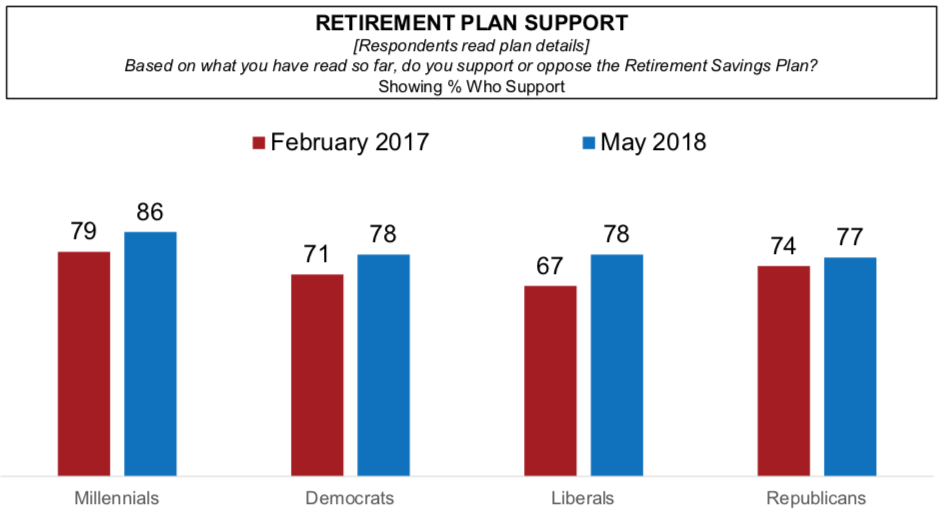

It has become more popular among key groups

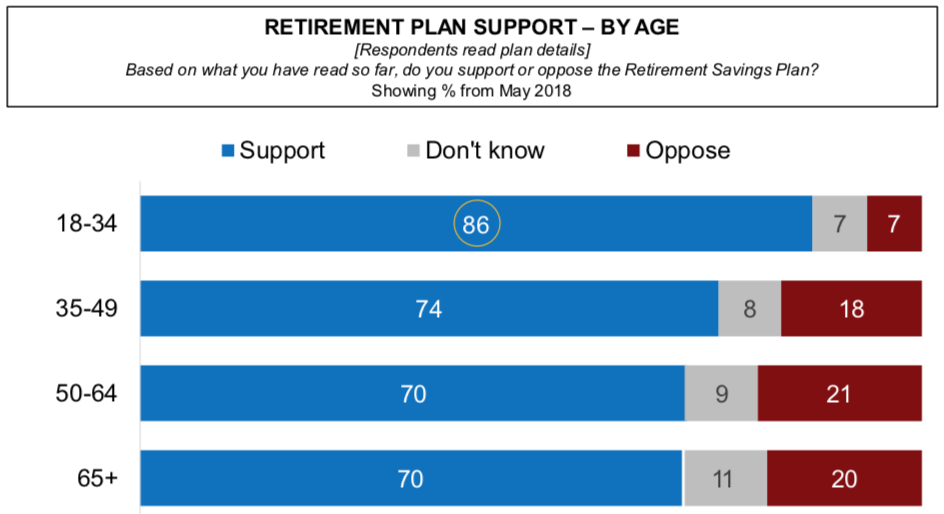

Age is the defining characteristic of support

Why is it popular? People like the details about how it will benefit them personally

Messaging insights

Of the 13 messages we tested, 5 rose to the top…

SIMPLE—SAVINGS: The Retirement Savings Plan makes it easy and painless to save for retirement savings. It automatically adds to your savings as long as you work. The 1.5% saved from every paycheck is matched by your employer and enough to build over time but not too much so that your can’t pay your bills. And nothing changes when you change jobs—your account stays the same and keeps growing. It’s retirement savings made easy.

CONSISTENT—SAVINGS: We can all build savings to live comfortably in retirement. The solution isn’t that everyone has to make more money. It’s contributing to your retirement savings consistently and starting as soon as you can. The Retirement Savings Plan ensures everyone is constantly saving for retirement—from their first paycheck to their last day on the job. And It follows you from job to job, so there are no gaps.

PORTABLE—SAVINGS: The Retirement Savings Plan ensures every American is steadily growing their savings, no matter where they work, and is getting regular benefits for life when they retire. It’s a new social contract that fits the realities of today, because unlike a 401(k), it follows you from job to job.

OTHER COUNTRIES: The Retirement Savings Plan is a tried and tested idea. It worked well in a variety of countries, including Canada, Australia, the Netherlands, New Zealand, Denmark and Chile. Take Australia for example: all Australian workers are now covered by a pension, and there are now nearly 2 trillion Australian dollars in total savings—almost as much as the country’s yearly economic output.

WHAT IT IS/WHAT IT IS NOT: The Retirement Savings Plan is a personal savings plan that relies on individually-owned accounts where you have full control. This is your own money in your own account. It is not another program run by the government or a handout. The government cannot ever get your money. You decide when to retire and convert your savings into lifelong income.

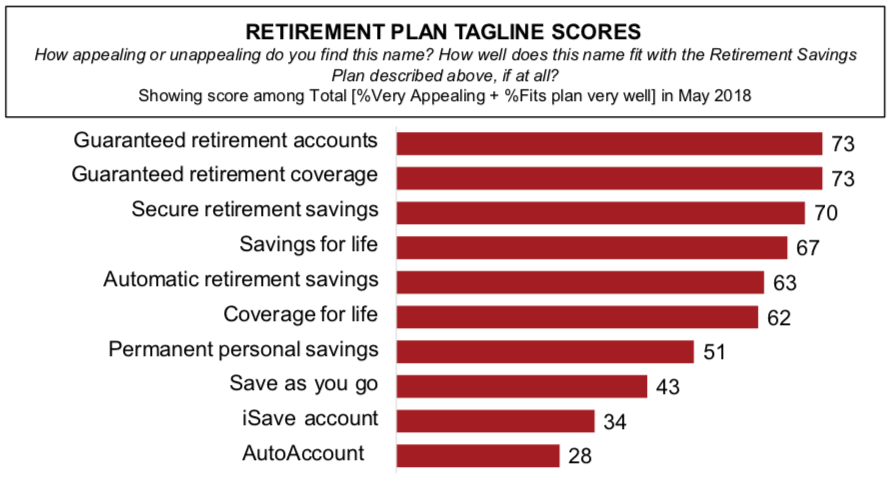

“Guaranteed Retirement Accounts” is a strong name for the plan.

Recommendations

The overarching message

A Guaranteed Retirement Account is your own personal account for life. It’s your money and you control it. You and your employer contribute to your account consistently. And upon retirement you get a guaranteed monthly payment for the rest of your life. This is a tried and tested idea that makes it easy to be covered in retirement.